Transfer Switch Market Size (2025-2030)

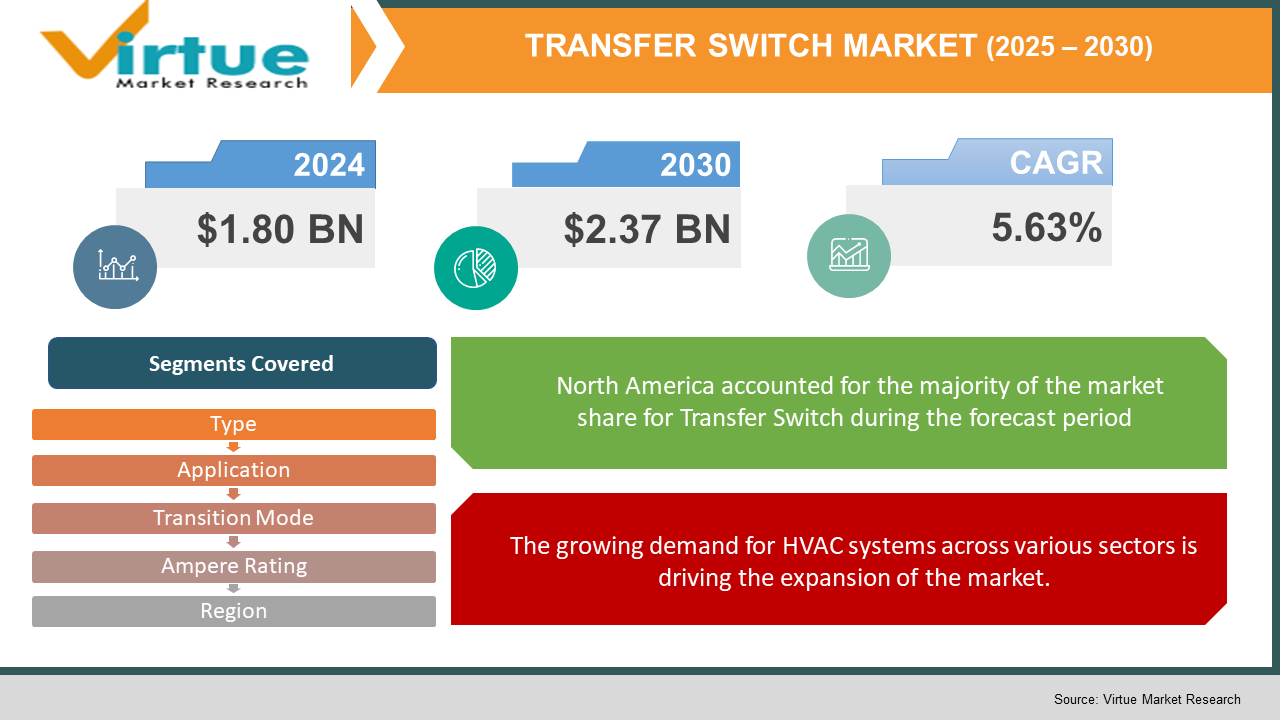

The Transfer Switch Market was valued at USD 1.80 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 2.37 billion by 2030, growing at a CAGR of 5.63%.

Transfer switches serve as a dependable solution for switching essential load connections between primary and backup power sources. An increasing number of organizations are expected to allocate funds to address the costs associated with enhanced safety regulations and the growing demand for energy-efficient systems. The ongoing pandemic has significantly impacted the economy, with widespread disruptions caused by the virus, including temporary closures at key electronics manufacturing hubs. This disruption has led to a shortage of specific raw materials, further affecting the component market. Transfer switches are frequently installed in both residential and commercial settings to ensure safe switching between power sources, preventing power loss during electrical outages.

Key Market Insights:

- The growing trends of urbanization and industrialization have led to an increased demand for a consistent and uninterrupted power supply. Frequent power outages result in significant productivity losses. To mitigate this issue, numerous organizations are installing backup generator systems to ensure a reliable power source.

- All generators require a transfer switch to seamlessly switch power from the utility grid to the backup generator during an outage. This switch is crucial for safely redirecting the power supply from the utility to the backup generator.

- Various institutions, including hospitals, government buildings, commercial centers, and schools, are equipped with generators to guarantee continuous power. Therefore, the transfer switch plays a vital role in ensuring the safe and efficient management of power during outages.

Transfer Switch Market Drivers:

The swift transition from traditional power generation technologies to sustainable energy sources is fueling market expansion.

The market for power generation technologies is undergoing rapid transformation due to the rapid rise of sustainable energy sources such as solar, wind, and hydro. The growing demand for these renewable energy sources has driven the development of innovative methods to efficiently transition from traditional power generation technologies to greener alternatives. The increasing global population and industrialization have contributed to a rise in greenhouse gas emissions. These gases, particularly carbon dioxide, play a significant role in global warming and climate change. Additionally, they contribute to deforestation by hindering plant growth through the disruption of photosynthesis, which in turn reduces oxygen production, lowering atmospheric oxygen levels and altering the planet's climate. This trend is concerning, as human activities and industrial processes are major sources of these emissions. To address this challenge, sustainable energy sources are gaining momentum as an effective solution. The shift toward renewable energy will have a substantial impact on power grids, necessitating seamless integration between traditional and renewable energy generators.

The growing demand for HVAC systems across various sectors is driving the expansion of the market.

The demand for heating, ventilation, and air conditioning (HVAC) systems is increasing across the industrial, commercial, and residential sectors. These networks are essential for regulating temperature, ventilation, and humidity within buildings. As the construction of new buildings rises, so does the need for HVAC systems. The growing global temperatures are prompting organizations to make significant investments in these systems. Furthermore, as urban populations continue to grow, the need for HVAC systems has become even more pronounced, with their installation becoming common in hospitals, schools, and various public spaces. The demand for transfer switch systems has also risen, as these devices are critical in managing the power supply to HVAC systems, which are increasingly vital in maintaining optimal environmental conditions.

Transfer Switch Market Restraints and Challenges:

Stringent regulatory requirements are limiting the growth of the market.

The growth of the transfer switch market is primarily constrained by the impact of regulatory requirements on the design of Automated Transfer Switches (ATS). Every ATS product introduced must undergo testing and certification by Underwriters Laboratories (UL), a process that is both costly and time-consuming. Several regulatory bodies, including international and regional electrical commissions, oversee the transfer switch market. Manufacturers are required to develop various designs to meet specific country standards, as well as technical and manufacturing regulations. In accordance with UL 1008, each automatic transfer switch must have specific short circuit withstand and close-on ratings (WCR). The WCR (wire circuit breaker rating) varies depending on factors such as voltage levels, switch frame sizes, bypass configurations, pole numbers, and overcurrent protection for transfer switches. As a result, automatic transfer switches must be selected carefully based on the Wiring Rules outlined in UL 1008. These complex requirements contribute to the challenges hindering market growth.

Transfer Switch Market Opportunities:

The growing adoption of micro-grids presents significant opportunities for market growth.

Microgrids are compact electrical grids that can operate independently or complement the primary grid of a home or business. Typically powered by renewable energy sources such as solar, wind, and hydro turbines, microgrids offer a cost-effective and sustainable solution, especially in densely populated areas. According to the World Bank, around 1.2 billion people will require access to electricity by 2030 to achieve universal energy access. To meet this goal, a combination of main grid expansion, mini-grids, and off-grid solar solutions will be necessary. Historically, a major challenge in deploying microgrids has been the need for a connection to the primary grid. However, demand for microgrids has grown in recent years. One potential solution is the implementation of a "break button," which would allow for disconnection from the grid when required. This trend has created new opportunities for transfer switches, which enable microgrids to seamlessly connect and disconnect from the main grid as needed.

TRANSFER SWITCH MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.63% |

|

Segments Covered |

By Type, application, transition mode, amphere rating, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Siemens, Socomec Regal Beloit, Eaton, Kohler Co., General Electric , Eltek Power Systems, Generac Power System Russelectric, Schneider Electric |

Transfer Switch Market Segmentation:

Transfer Switch Market Segmentation By Type:

- Automatic

- Manual

The automatic segment holds the largest market share and is projected to experience growth during the forecast period. An automatic transfer switch (ATS) is an electrical device that switches the load between the utility source and an alternate power source. It operates by detecting a fault or issue with the primary source and automatically transferring the load to the secondary source. ATS is widely used in commercial and industrial buildings and plays a critical role in power distribution systems. The growth of this segment is primarily driven by the increasing demand for automated technology in the industrial sector.

The manual segment ranks second in market size. A Manual Transfer Switch (MTS) is an electrical device that facilitates the transfer of power from the utility grid to a backup source, typically a generator. MTS are used to maintain services during power outages and are often installed alongside backup generators. These switches are positioned in locations where there is a high concentration of equipment that requires power, ensuring that the equipment remains safe during outages. The benefits of MTS in providing reliable power continuity drive the growth of this segment.

Transfer Switch Market Segmentation By Application:

- Industrial

- Commercial

- Residential

The residential segment holds the largest market share and is expected to grow during the forecast period. Efficient home electrical systems serve two key purposes: ensuring the safety of the electrical system and providing a reliable power supply to various areas of the house. Achieving these goals requires selecting the appropriate transfer switch. A transfer switch enables the swift switching of power flow between circuits, ensuring continuous operation during power interruptions. These essential features drive the growth of the market for transfer switches in residential applications.

Transfer Switch Market Segmentation By Transition Mode:

- Open

- Closed

- Delayed

- Soft Load Transition

Closed transition automatic transfer switches (ATS) hold the largest market share and are anticipated to experience the highest growth during the forecast period. These systems utilize a "make before break" feature, which is enabled by advanced electrical technology. This design minimizes or eliminates the temporary power interruption, or "stutter," that open transition systems can occasionally cause, by allowing a brief overlap between the utility power and the generator/backup source. These capabilities contribute significantly to the growth of the market for closed transition transfer switches.

Transfer Switch Market Segmentation By Ampere Rating:

- 0-300A

- 301-800A

- 801-1600A

- 1601A-4000A

The 301A-800A segments hold the largest market share and are projected to experience the highest growth during the forecast period. This segment’s dominance is attributed to the growing adoption of transfer switch transition modes in malls and other retail sectors, where reliable power supply is critical.

Transfer Switch Market Segmentation- by region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

North America holds the largest market share and is expected to experience growth during the forecast period. The demand for transfer switches in North America is primarily driven by the increasing need for the refurbishment of electric grid networks. The necessity to switch power between circuits is becoming more critical, especially with the deteriorating infrastructure in the region and growing awareness of these issues. As a result, the demand for transfer switches has been steadily rising.

The Asia-Pacific region is the fastest-growing market for transfer switches. The integration of large-scale renewable energy reforms has significantly boosted the demand for transfer switches, as countries like China and India recognize the importance of a stable power supply to support their economies. A recent Memorandum of Understanding (MoU) between the International Renewable Energy Agency (IRENA) and the China State Grid Corporation (SGCC) aims to enhance grid infrastructure, improve system flexibility, and promote sector coupling in China.

This collaboration includes IRENA’s Clean Energy Corridor, focusing on improving grid flexibility, accelerating solar power grid development, and reducing carbon emissions in urban energy systems.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has had a significant impact on both consumers and the global economy. The outbreak led to the temporary shutdown of electronics manufacturing hubs, disrupting the supply chain and causing shortages of materials, components, and finished goods. This disruption in business continuity has resulted in considerable negative effects on revenue and shareholder returns, leading to anticipated financial challenges in the transfer switch market.

Latest Trends/ Developments:

August 2022 - ABB announced the acquisition of Siemens' low voltage NEMA motor business. This acquisition is aimed at enhancing ABB's product offerings, strengthening its supply chain relationships, and improving support for its North American customer base.

March 2022 - Russelectric, a Siemens Business, introduced its Paralleling System, designed to ensure that essential loads remain uninterrupted when switching between power sources at airports. The system also supports peak shaving and utility-sponsored load curtailment initiatives. Additionally, the Paralleling System provides airports with enhanced resiliency, power continuity, and security.

Key Players:

These are top 10 players in the Transfer Switch Market :-

- Siemens

- Socomec

- Regal Beloit

- Eaton

- Kohler Co.

- General Electric

- Eltek Power Systems

- Generac Power System

- Russelectric

- Schneider Electric

Chapter 1. Transfer Switch Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. Global Transfer Switch Market– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Transfer Switch Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Transfer Switch Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Transfer Switch Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Transfer Switch Market– By Type

6.1 Introduction/Key Findings

6.2 Automatic

6.3 Manual

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. Global Transfer Switch Market– By Application

7.1 Introduction/Key Findings

7.2 Industrial

7.3 Commercial

7.4 Residential

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. Global Transfer Switch Market– By Transition Mode

8.1 Introduction/Key Findings

8.2 Open

8.3 Closed

8.4 Delayed

8.5 Soft Load Transition

8.6 Y-O-Y Growth trend Analysis Transition Mode

8.7 Absolute $ Opportunity Analysis Transition Mode , 2025-2030

Chapter 9. Global Transfer Switch Market– By Ampere Rating

9.1 Introduction/Key Findings

9.2 0-300A

9.3 301-800A

9.4 801-1600A

9.5 1601A-4000A

9.6 Y-O-Y Growth trend Analysis Ampere Rating

9.7 Absolute $ Opportunity Analysis Ampere Rating , 2025-2030

Chapter 10. Transfer Switch Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Type

10.1.3. By Ampere Rating

10.1.4. By Application

10.1.5. Transition Mode

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Type

10.2.3. By Transition Mode

10.2.4. By Ampere Rating

10.2.5. Application

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Type

10.3.3. By Ampere Rating

10.3.4. By Transition Mode

10.3.5. Application

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By Type

10.4.3. By Transition Mode

10.4.4. By Ampere Rating

10.4.5. Application

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Type

10.5.3. By Transition Mode

10.5.4. By Ampere Rating

10.5.5. Application

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Transfer Switch Market– Company Profiles – (Overview, Service Type Portfolio, Financials, Strategies & Developments)

11.1 Siemens

11.2 Socomec

11.3 Regal Beloit

11.4 Eaton

11.5 Kohler Co.

11.6 General Electric

11.7 Eltek Power Systems

11.8 Generac Power System

11.9 Russelectric

11.10 Schneider Electric

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The growing trends of urbanization and industrialization have led to an increased demand for a consistent and uninterrupted power supply. Frequent power outages result in significant productivity losses.

The top players operating in the Transfer Switch Market are - Siemens, Socomec and Regal Beloit.

The COVID-19 pandemic has had a significant impact on both consumers and the global economy. The outbreak led to the temporary shutdown of electronics manufacturing hubs, disrupting the supply chain and causing shortages of materials, components, and finished goods.

One potential solution is the implementation of a "break button," which would allow for disconnection from the grid when required. This trend has created new opportunities for transfer switches, which enable microgrids to seamlessly connect and disconnect from the main grid as needed.

Asia-Pacific is the fastest-growing region in the Transfer Switch Market.