Transactional Email Software Market Size (2023 – 2030)

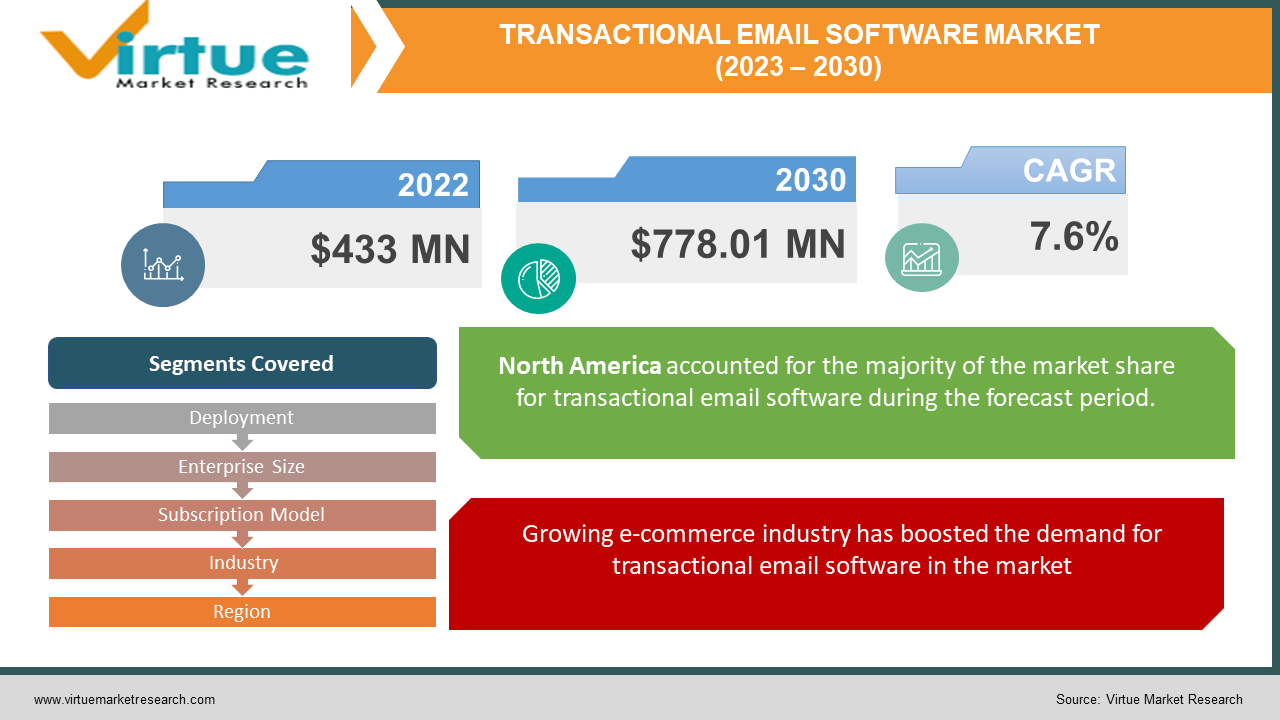

Transactional Email Software Market was valued at USD 433 Million and is projected to reach a market size of USD 778.01 Million by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 7.6%.

Earlier, bulk email method was used to capture the interest of consumers regarding the launch of new products or services, account and booking confirmations, sending manual receipts, and others. However, with the advancements in technology, especially after the increased incorporation of AI in email sending, there is an increase in demand for transactional email software in the market. The software enables companies and organizations send automated emails such as prompt emails, promotional emails, purchase reminder emails, and others to consumers for increasing their engagement with the brand and increasing their market base. Moreover, many companies utilize advanced software with marketing integration tools and personalization services that help in improving customer’s engagement. Furthermore, the market for transactional email software is anticipate to witness a positive growth, as developments in AI and data analytics continue to take place along with the development of omnichannel transactional email services in the market.

Key Market Insights:

According to Experian’s Transactional Email Benchmark report, average revenue generate from per transactional email is 2-5x higher than the standard bulk email.

As per Inner Trends blog, which is a product analytics platform, transactional emails have open rates of about 40-50% and click rates of around 10-20%.

According to Epsilon Marketing, 80% of consumers are more likely to do business with companies offering personalized experiences.

According to ZHAW School of Business Marketing Automation report 2021, 72% of e-commerce companies make use of automation for email marketing campaigns.

Transactional Email Software Market Drivers:

Growing e-commerce industry has boosted the demand for transactional email software in the market.

The e-commerce is one of the major users of transactional email software, as they require the software to carry-out multiple email operations. These include using transactional email software for confirming orders placed by the consumers, sending delivery updates such as courier tracking number, expected date of delivery, and others, digital invoices, and others. In addition, many e-commerce platforms use advanced transactional email software to track customer’s purchase patterns and send abandoned cart reminder emails for converting them into potential buyers. Moreover, fashion and beauty companies increasingly use this software to send promotional emails related to new products, provide product recommendations based on customer’s browsing history.

Increasing demand for personalized shopping has boosted the demand for transactional email software in the market.

Customers now-a-days increasingly demand personalized shopping experiences that are more relevant to their taste preferences and offer them convenience. Therefore, companies have altered their marketing strategies by using transactional email software that sends automated emails with the customer’s name in it along with a personalized message, which can help the company increase online engagement of the customer. Moreover, many e-commerce companies offer exclusive access to their products and services by sending loyalty programs and membership emails to induce customers benefit from their exclusive service such as early access to sales, discounts, provide personalized product recommendation base don customer’s previous purchase, and others.

Transactional Email Software Market Restraints and Challenges:

Data privacy issues can decline the demand for transactional email software in the market. Since, this software collects personal information of consumers upon prompting the website or application, it is exposed to data breach and privacy leak issues leading to decline in demand for transactional email software in the market.

Market competition is can deter the growth of transactional email software. Due to rapid expansion of the digital marketing industry, there is an increase in the number of transactional email software providers increasing competition in the market and providing similar kind of services to services to the users, leading to crowding of the market.

Security constraints can decline the demand for transactional email software in the market. Some customers use email blockers that block bulk or spam emails, leading to reduced customer interaction with the brand.

Transactional Email Software Market Opportunities:

The Transactional Email Software Market is witnessing an upward trend in the market due to increased incorporation of AI and machine learning in automating emails and collecting customers’ information for enhanced shopping experience. Moreover, increasing demand for personalized shopping experience by customers have further expanded market opportunities for e-commerce companies in targeting their products to specific set of consumers.

TRANSACTIONAL EMAIL SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

7.6% |

|

Segments Covered |

By Deployment, Enterprise Size, Subscription Model, Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Constant Contact, Zoho, SendPulse, Wildbit, Mailgun, ExpertSender MailChimp, ActiveCampaign, SendGrid, Keap Brevo, Elastic Email, Mailmodo |

Transactional Email Software Market Segmentation: By Deployment

-

Cloud

-

On-Premise

In 2022, based on market segmentation by deployment, cloud segment occupied the highest share of about 27% in the market. Cloud-based transactional email software offers easy accessibility and increased scalability to the users. Moreover, it offers flexibility in terms of accessing the software from any device. Furthermore, cloud-based transactional email software is a cost-effective solution for enterprises, as it offers automatic updates and maintenance of the software without incurring any hardware costs.

On-Premise segment is the fastest-growing during the forecast period. The on-premise transactional email software is a secured and safe solution for companies dealing with confidential information, as the software allow them to have complete control over the data. For instance, financial services companies utilize advanced transactional email software for securing the financial data of the customers on their local servers.

Transactional Email Software Market Segmentation: By Enterprise Size

-

Small and Medium-Sized Enterprises (SMEs)

-

Large Enterprises

In 2022, based on market segmentation by enterprise size, large enterprises occupied the highest share of about 30% in the market. Large enterprises such as e-commerce companies, beauty and apparel companies, tech and healthcare companies increasingly use transactional email software for sending bulk emails for lead generation purposes. Moreover, they use transactional email software with smart integration tools such as marketing and email automation tools that enable them to capture potential buyers’ interest for their products and services.

Small and medium-sized enterprises segment is the fastest-growing segment during the forecast period. SMEs such as the emerging start-ups, tech businesses, and others use free version of transactional email software for reaching out to customers by sending promotional emails about the launch of their new products and services. In addition, the software offered detailed insights to SMEs regarding the customers engagement with their email platform, potential clicks on discounts or product launches email, and others that can help them optimize their marketing strategies.

Transactional Email Software Market Segmentation: By Subscription Model

-

Pay-as-you-go model

-

Freemium

-

Premium

In 2022, based on market segmentation by subscription model, premium occupied the highest share of about 35% in the market. Premium-based transactional email software is widely used by large enterprises who are engaged with bulk email process for promoting their business products, engaging with customers, tracking and updating about product delivery to customer, and others. Moreover, they utilize transactional email software with advanced features, which is not accessible to free users such as enhanced efficiency, email suggestions, custom email templates, advanced analytics tool for optimizing email marketing software, automation tools, and others.

Freemium segment is the fastest-growing segment during the forecast period. Freemium-based transactional email software are increasingly used by start-ups and small businesses with limited budget. Moreover, freemium software has limited features and usage facilities and require user to pay a fee to gain access to specific features plan. Furthermore, freemium transactional email software offers access to limited email templates and basic email automation tool that allow small businesses to send emails to limited number of people for converting them into customers.

Transactional Email Software Market Segmentation: By Industry

-

E-commerce

-

Financial Services

-

Education

-

Government

-

Healthcare

-

Hospitality

-

Others

In 2022, based on market segmentation by industry, e-commerce occupied the highest share of about 38% in the market. E-commerce companies or platforms are the major users of transactional email software, as they require it to send promotional emails about new products, sales, discounts, offers, provide product delivery information such as dispatch and shipping information, and others. Moreover, they use premium and advanced transactional email software that offers analytics about customer engagement with their website, track their purchase history, and browsing history to recommend better products and induce their purchase decisions. In addition, e-commerce companies send automated reminder emails to customers with abandoned carts for increasing their engagement with the brand and convert them into potential buyer by offering discounts.

Hospitality segment is the fastest-growing segment during the forecast period. Hospitality sector require transactional emails software for collecting customer’s personal information by sending automated prompt emails for booking requests and confirmation. Moreover, the software enables restaurants and hotels update customers regarding their reservation, provide booking updates such as time and venue, check-in and check-out information, and others. Additionally, this software enables hotels and resorts collect customer feedback for their services by sending feedback email forms for their reviews that can help them to optimize their business operations.

Transactional Email Software Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle-East & Africa

In 2022, based on market segmentation by region, North America occupied the highest share of about 42% in the market. The growing trends in digital marketing, fast booming e-commerce industry, and continuous advancements in automation technologies has boosted the demand for transactional email software in the region.

Asia-Pacific achieves fastest-growth during the forecast period. Rapid digitization, which further expanded the e-commerce industry in countries such as India, China, Japan, and others, and increasing trends in mobile-first technology, which induced transactional email software companies develop mobile-responsive user interface for customers has boosted the demand for transactional email software in the region.

COVID-19 Impact Analysis on the Transactional Email Software Market

The pandemic had a positive impact on the transactional email software market. Due to increase in digitization during the pandemic, people spent most of their time on online platforms, which induced companies increase their online market presence and use transactional emails software for capturing customer’s attention in the market. E-commerce companies emerged as a leader during the pandemic, as people preferred online shopping of essential items due to social distancing norms. Moreover, not only companies but government and regulatory bodies too, made use of this software for alerting and providing information regarding virus outbreak, potential vaccine centers, lockdown measures, and others.

Latest Developments:

- In November 2020, Zoho launched TranMail service for users that enable them to automated emails such as order confirmations, OTP emails, and others that is time-sensitive contain crucial information about the customer. Moreover, the service offers affordable and flexible payment plan for all sizes of business.

Key Players:

-

Constant Contact

-

Zoho

-

SendPulse

-

Wildbit

-

Mailgun

-

ExpertSender

-

MailChimp

-

ActiveCampaign

-

SendGrid

-

Keap

-

Brevo

-

Elastic Email

-

Mailmodo

Chapter 1. Transactional Email Software Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Transactional Email Software Market – Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Transactional Email Software Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Transactional Email Software Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Transactional Email Software Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Transactional Email Software Market – By Enterprise Size

6.1 Introduction/Key Findings

6.2 Small and Medium-Sized Enterprises (SMEs)

6.3 Large Enterprises

6.4 Y-O-Y Growth trend Analysis By Enterprise Size

6.5 Absolute $ Opportunity Analysis By Enterprise Size, 2023-2030

Chapter 7. Transactional Email Software Market – By Deployment Mode

7.1 Introduction/Key Findings

7.2 On-premise

7.3 Cloud

7.4 Y-O-Y Growth trend Analysis By Deployment Mode

7.5 Absolute $ Opportunity Analysis By Deployment Mode, 2023-2030

Chapter 8. Transactional Email Software Market – By Subscription Model

8.1 Introduction/Key Findings

8.2 Pay-as-you-go model

8.3 Freemium

8.4 Premium

8.5 Y-O-Y Growth trend Analysis By Subscription Model

8.6 Absolute $ Opportunity Analysis By Subscription Model, 2023-2030

Chapter 9. Transactional Email Software Market – By Industry

9.1 Introduction/Key Findings

9.2 E-commerce

9.3 Financial Services

9.4 Education

9.5 Government

9.6 Healthcare

9.7 Hospitality

9.8 Others

9.9 Y-O-Y Growth trend Analysis By Industry

9.10 Absolute $ Opportunity Analysis By Industry, 2023-2030

Chapter 10. Transactional Email Software Market , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Enterprise Size

10.1.2.1 By Industry

10.1.3 By Subscription Model

10.2 By Deployment Mode

10.2.1 Countries & Segments - Market Attractiveness Analysis

10.3 Europe

10.3.1 By Country

10.3.1.1 U.K

10.3.1.2 Germany

10.3.1.3 France

10.3.1.4 Italy

10.3.1.5 Spain

10.3.1.6 Rest of Europe

10.3.2 By Enterprise Size

10.3.3 By Deployment Mode

10.3.4 By Subscription Model

10.3.5 By Industry

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 Asia Pacific

10.4.1 By Country

10.4.1.1 China

10.4.1.2 Japan

10.4.1.3 South Korea

10.4.1.4 India

10.4.1.5 Australia & New Zealand

10.4.1.6 Rest of Asia-Pacific

10.4.2 By Enterprise Size

10.4.3 By Deployment Mode

10.4.4 By Subscription Model

10.4.5 By Industry

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 South America

10.5.1 By Country

10.5.1.1 Brazil

10.5.1.2 Argentina

10.5.1.3 Colombia

10.5.1.4 Chile

10.5.1.5 Rest of South America

10.5.2 By Enterprise Size

10.5.3 By Deployment Mode

10.5.4 By Subscription Model

10.5.5 By Industry

10.5.6 Countries & Segments - Market Attractiveness Analysis

10.6 Middle East & Africa

10.6.1 By Country

10.6.1.1 United Arab Emirates (UAE)

10.6.1.2 Saudi Arabia

10.6.1.3 Qatar

10.6.1.4 Israel

10.6.1.5 South Africa

10.6.1.6 Nigeria

10.6.1.7 Kenya

10.6.1.8 Egypt

10.6.1.9 Rest of MEA

10.6.2 By Enterprise Size

10.6.3 By Deployment Mode

10.6.4 By Subscription Model

10.6.5 By Industry

10.6.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Transactional Email Software Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Constant Contact

11.2 Zoho

11.3 SendPulse

11.4 Wildbit

11.5 Mailgun

11.6 ExpertSender

11.7 MailChimp

11.8 ActiveCampaign

11.9 SendGrid

11.10 Keap

11.11 Brevo

11.12 Elastic Email

11.13 Mailmodo

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Transactional Email Software Market was valued at USD 433 Million and is projected to reach a market size of USD 778.01 Million by the end of 2030.

Growing e-commerce industry and Increasing demand for personalized shopping are the market drivers of the Transactional Email Software market.

Cloud and On-Premise, are the segments under the Transactional Email Software Market by deployment.

North America is the most dominant region for the Transactional Email Software Market.

Asia-Pacific is the fastest growing region in the Transactional Email Software Market.