Tomato Processing Machine Market Size (2024 – 2030)

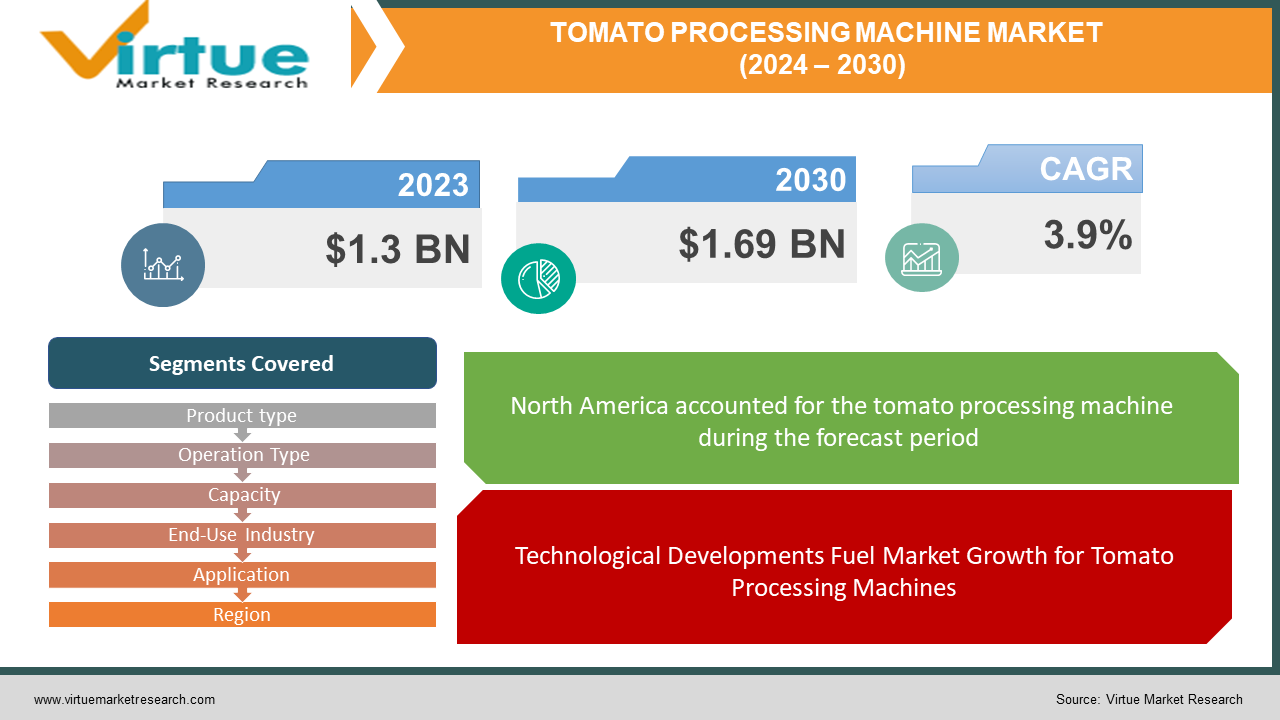

The market for Tomato processing machines at the global level is expanding quickly; it was estimated to be worth 1.3 USD billion in 2023 and is expected to increase to USD 1.69 billion by 2030, with a projected compound annual growth rate (CAGR) of 3.9% from 2024 to 2030.

The global market for tomato processing equipment is expanding significantly due to the food and beverage industry's increasing demand for processed tomato products. Because of consumer preferences for convenience and the growing popularity of tomato-based products like sauces, purees, and juices, the market for tomato processing equipment has experienced a noticeable increase. However, in other regions, problems with high initial and ongoing expenditures may impede market expansion. The market is expected to shift as automation develops, ensuring increased production capabilities and maintaining the overall standard of processed tomato commodities.

Key Market Insights:

Key market insights show how different critical factors influence the changing global tomato processing machine market landscape. Technological advancements are significant because manufacturers are emphasizing more and more the addition of clever and useful features to processing machinery. The market is seeing a rise in demand for automation as a result of enhanced production capacities and streamlined processes. Growing consumer preferences for a range of tomato-based products, including purees, juices, and sauces, are driving market expansion. Additionally, sustainability and eco-friendliness are gaining popularity, which is leading to developments in processing equipment that uses less energy and is environmentally benign. The food and beverage industry's growth has led to emerging economies making a major contribution to global market expansion. Despite these positive advancements, there are still problems, such as high upfront investment costs and complex upkeep, that impact market dynamics. Overall, innovation, sustainability, and adaptability to shifting consumer demands in the global tomato processing machine market have determined the course of this important company.

Global Tomato Processing Machines Market Drivers:

Changing Efficiency: Technological Developments Fuel Market Growth for Tomato Processing Machines.

The global market for tomato processing equipment is going through a revolutionary period due to rapid technical advancements. Every stage of the processing cycle is becoming more productive because of new advancements in automation and machine design, which enable manufacturers to create more goods at higher quality levels. Automation and intelligent features are becoming increasingly important due to the sector's continuous investment in cutting-edge technology, which enables the market to adjust to the shifting demands of the food and beverage industry.

Satisfying Consumer Needs: Variegated Product Demand Fuels the Growth of the Global Tomato Processing Machine Market.

Global demand for tomato processing equipment is mostly being driven by rising consumer demand for a range of tomato-based goods, such as purees, sauces, and juices. The need to meet the growing demand for processed tomato products and the changing preferences of consumers has prompted manufacturers to expand their manufacturing capacity. This increase in demand serves as a reminder of the vital function processing machines play in both propelling the market's expansion and meeting the diverse and expanding needs of the global food sector.

Greening the Industry: Innovation in Tomato Processing Machines Places Sustainability Front and Centre.

Sustainability is a key element influencing the global market for tomato processing equipment. Manufacturers are prioritising eco-friendly solutions and energy-efficient technologies in response to the growing environmental consciousness. This shift to sustainable methods not only satisfies consumer demand for food processing that is created ethically and environmentally but also meets worldwide environmental goals. The industry's ongoing focus on sustainability is changing the tomato processing machine market moving forward by highlighting moral and environmentally friendly production methods.

Global Tomato Processing Machine Market Restraints and Challenges:

Capital Challenges: Exorbitant Initial Expenses Prevent Tomato Processing Machines from Being Widely Adopted.

One of the biggest challenges facing the global market for tomato processing equipment is high initial investment prices. Sophisticated processing equipment can be expensive to purchase and install, particularly for small and medium-sized organizations. This cost barrier prevents new and efficient tomato processing technologies from entering the market and being adopted, hence limiting their availability. Achieving the highest possible level of benefit from technological developments and ensuring increased industry involvement require climbing this obstacle.

Operational Difficulties: The tomato processing machine sector faces challenges due to maintenance complexity.

The difficulty of maintenance is another major barrier to the tomato processing machine industry. The proper functioning of machines requires specific knowledge and resources as they become more sophisticated and technologically advanced. Downtime for maintenance might result in increased costs and scheduling interruptions. Striking a balance between the demands of maintaining immaculate operational continuity and technological innovation is an ongoing problem for manufacturers.

Managing Diversity: Disparities in Regions and Market Fragmentation present difficulties for tomato processing equipment.

The global market for tomato processing equipment creates challenges with regional variations and market fragmentation. Regionally different laws, customs, and infrastructure provide obstacles to standardization and seamless international business. The difficult task of adapting machinery to a broad range of market requirements falls on manufacturers. Customers have different needs, thus it's important to build flexible, location-specific solutions.

Global Tomato Processing Machine Market Opportunities:

Technology-Driven Effectiveness: Using Automation to Improve Processing.

The incorporation of advanced technologies such as automation and intelligent features presents a significant opportunity for the worldwide tomato processing machine industry. Manufacturers can capitalize on this trend by developing devices that offer fine control over several aspects in addition to increasing processing speed. This technology-driven approach increases overall efficiency, reduces the need for manpower, and positions enterprises at the forefront of innovation in the market.

Global Market Growth: Capitalising on Possibilities in Developing Economies.

The internationalization of food choices presents a great opportunity for commercial expansion. The rising demand in emerging markets for processed tomato products presents an opportunity for producers. By entering markets strategically, working with local partners, and catering to regional preferences, one can increase market share and revenue growth.

Personalization for Variety of Products: Fitting Machines to Various Requirements.

As consumer preferences for a wide range of tomato-based products continue to shift, there is a potential to build highly customized processing technology. Manufacturers can design equipment that accommodates various tomato kinds and product specifications to meet the specific needs of a wide range of food and beverage applications. This personalisation not only satisfies customer wants but also positions companies as flexible and responsive leaders in their markets.

TOMATO PROCESSING MACHINE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.9% |

|

Segments Covered |

By Product type, Operation Type, Capacity, End-Use Industry, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

CONESA Group, J.G. Bosewell Tomato Company, CFT Group, JBT Corporation, Avure Technologies, Morning Star Company, Food & Biotech Engineers (India) Pvt. ltd, Chumak Company, Navatta Group, FENCO food machinery |

Tomato Processing Machine Market Segmentation: By Product Type

-

Washing & Sorting Machines

-

Crushing & Pulping Machines

-

Concentration & Pasteurization

-

Filling & Packaging Machines

-

Other Auxiliary Equipment (e.g., Peelers, Choppers)

Among the many product types available in the tomato processing machine market, concentration, and pasteurisation machines stand out as being particularly helpful and crucial to the complete processing workflow. These are vital tools for thickening tomato juice and eliminating excess water without sacrificing flavor. Additionally, pasteurization ensures that harmful germs are eliminated, extending the finished product's shelf life. The precision and effectiveness of concentration and pasteurisation devices are crucial in producing high-quality tomato-based goods such as sauces and purees. As consumer demand for processed tomato products rises, the effectiveness of these devices not only ensures product safety but also satisfies market needs for robust and tasty products. Manufacturers who focus on improvements in the technology of pasteurisation and concentration will likely have a significant influence on how the tomato processing machine market develops.

Tomato Processing Machine Market Segmentation: By Operation Type

-

Automatic

-

Semi-Automatic

-

Manual

The optimal type of operation for tomato processing equipment is often determined by the manufacturer's specifications for precision, capacity, and effectiveness. However, automatic machines end up being the most efficient choice for many, particularly in large-scale production circumstances. Automatic tomato processing technology can make manufacturing run more smoothly and efficiently by reducing the amount of manual labor required. Their ability to handle enormous quantities of tomatoes accurately and efficiently for tasks like crushing, sorting, washing, and packaging is very beneficial to industrial-scale operations. Automation not only ensures constant product quality but also reduces personnel expenses and speeds up processes overall. In light of the industry's ongoing movement towards greater productivity and efficiency, manufacturers looking to optimise their operations and meet growing market demands would be well advised to invest in autonomous tomato processing equipment.

Tomato Processing Machine Market Segmentation: By Capacity

-

Small Scale

-

Medium Scale

-

Large Scale

Medium to Large-Scale capacity held the major shares of the global market in the year 2023. Sophisticated tomato processing equipment has been introduced due to the need for large-scale production as well as technological improvements and increased processing efficiency. The market's increasing trajectory is further supported by the globalisation of food preferences and the expanding food industry in emerging economies. Industry leaders are making significant R&D investments to develop innovative and sustainable processing solutions, which raises the overall competitiveness of the global tomato processing machine market.

Tomato Processing Machine Market Segmentation: By End-Use Industry

-

Tomato Processing Companies,

-

Food Service Industry,

-

Retail & Supermarkets,

-

Others (e.g., Small-scale processors, home users)

Regarding the market segmentation of tomato processing equipment based on end-use sectors, the food service industry is a highly significant and evolving sector. Tomato processing equipment made especially for the food service industry meets the specific needs of restaurants, catering services, and other culinary businesses. These machines are useful because they are versatile enough to meet the various menu requirements of restaurants, thanks to their ability to handle varying production levels. In the time-sensitive and fast-paced quick-service and fine-dining food service industries, the effectiveness, speed, and precision of tomato processing equipment are critical in satisfying consumer demand for both fresh and processed tomato products. As customer demands continue to define the culinary landscape, the Food Service Industry's capacity to provide high-quality dishes and enhance operational agility is dependent upon the use of efficient tomato processing machines. It is anticipated that the tomato processing machine market will expand significantly if producers focus on creating innovations that are specially tailored to the needs of this industry.

Tomato Processing Machine Market Segmentation: By Application

-

By Tomato Paste & Pure Application

-

Ketchup and Sauce Manufacturing

-

Juice and Beverage Production

-

Canned Tomatoes

-

Dried and Powdered Tomato Products

-

Others

The Ketchup and Sauce Manufacturing sector is one of the most important and fruitful industries using tomato processing equipment. These tools are necessary to transform raw tomatoes into delicious and well-liked ketchup and sauces. If the final products have to have the right consistency, texture, and flavor, the equipment in this section needs to run smoothly and precisely. Sauces and ketchup are ubiquitous in homes and the food service industry globally, thus large-scale, efficient production is needed. In this application, it is evident how well tomato processing machines handle the washing, sorting, crushing, and packing processes. Producers who focus on creating innovative technologies for their ketchup and sauce production machinery have the potential to capture a significant portion of the market and meet the growing demand for these versatile and popular tomato-based condiments.

Tomato Processing Machine Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

Within the global market for tomato processing machines, different regions have different distributions of market shares. North America leads the world with a substantial share of 35%, suggesting a robust market for advanced processing technologies in the region's well-established food and beverage industry. With a sizeable market share of 24%, Europe comes in second, mostly as a result of its concentration on technological innovation and the manufacturing of a broad variety of tomato-based items. Growing urbanisation and shifting consumer preferences in the dynamic Asia-Pacific region, which accounts for 26% of the market, are driving demand for efficient tomato processing solutions. South America the Middle East and Africa regions account for 9% and 6% of the market share, respectively. South America's food processing sector is growing, while the Middle East and Africa are also big consumers of sophisticated processing equipment. This distribution illustrates the global nature of the tomato processing machine market because each place contributes differently to the sector's overall health.

COVID-19 Impact Analysis on the Global Tomato Processing Market:

The global tomato processing industry was significantly impacted by the COVID-19 pandemic, which presented both opportunities and challenges. Due to widespread supply chain interruptions, a workforce shortage, and the temporary closure of processing facilities, overall production capacity was reduced. Tight lockdown procedures and real-world challenges made it difficult to move finished items and raw materials, which hindered the seamless functioning of the entire tomato processing chain. Even Nevertheless, when households stocked up on non-perishable items during lockdowns, there was a discernible rise in consumer demand for processed and shelf-stable meals, especially a range of tomato-based goods. A further consequence of the pandemic was that companies in the processing sector likewise embraced automation and technology faster in an attempt to minimise their reliance on human labor and preserve operational resilience. The lessons learned from the epidemic will likely make the tomato processing business more robust, creative, and flexible in the future.

Latest Trends/ Developments:

The dynamic trends and advancements in the worldwide tomato processing machine market are causing a transformation in the industrial environment. The increased emphasis on sustainability as manufacturers employ eco-friendly materials and energy-efficient technologies in response to consumers' growing environmental consciousness is one trend that is worth noting. Automation and smart technologies are developing swiftly. Processing equipment is becoming more intelligent, which allows for the optimisation of manufacturing processes and the meticulous control of many different aspects. Additionally, to meet a variety of product requirements and manufacturing scales, personalisation and flexibility in machine design are becoming increasingly vital.

The industry is exploding with data analytics and digitization, which helps manufacturers increase overall efficiency and decision-making processes. Significant players are also more frequently creating alliances and working together, which encourages innovation and the development of comprehensive solutions. These patterns demonstrate the tomato processing machine industry's adaptability and ongoing change as it responds to shifting consumer needs and international challenges.

Key Players:

-

CONESA Group

-

J.G. Bosewell Tomato Company

-

CFT Group

-

JBT Corporation

-

Avure Technologies

-

Morning Star Company

-

Food & Biotech Engineers (India) Pvt. ltd

-

Chumak Company

-

Navatta Group

-

FENCO food machinery

Chapter 1. Tomato Processing Machine Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Tomato Processing Machine Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Tomato Processing Machine Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Tomato Processing Machine Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Tomato Processing Machine Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Tomato Processing Machine Market – By Product Type

6.1 Introduction/Key Findings

6.2 Washing & Sorting Machines

6.3 Crushing & Pulping Machines

6.4 Concentration & Pasteurization

6.5 Filling & Packaging Machines

6.6 Other Auxiliary Equipment (e.g., Peelers, Choppers)

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Tomato Processing Machine Market – By Operation Type

7.1 Introduction/Key Findings

7.2 Automatic

7.3 Semi-Automatic

7.4 Manual

7.5 Y-O-Y Growth trend Analysis By Operation Type

7.6 Absolute $ Opportunity Analysis By Operation Type , 2024-2030

Chapter 8. Tomato Processing Machine Market – By End-User Industry

8.1 Introduction/Key Findings

8.2 Tomato Processing Companies,

8.3 Food Service Industry,

8.4 Retail & Supermarkets,

8.5 Others (e.g., Small-scale processors, home users)

8.6 Y-O-Y Growth trend Analysis By End-User Industry

8.7 Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 9. Tomato Processing Machine Market – By Capacity

9.1 Introduction/Key Findings

9.2 Automatic

9.3 Semi-Automatic

9.4 Manual

9.5 Y-O-Y Growth trend Analysis By Capacity

9.6 Absolute $ Opportunity Analysis By Capacity, 2024-2030

Chapter 10. Tomato Processing Machine Market – By Application

10.1 Introduction/Key Findings

10.2 By Tomato Paste & Pure Application

10.3 Ketchup and Sauce Manufacturing

10.4 Juice and Beverage Production

10.5 Canned Tomatoes

10.6 Dried and Powdered Tomato Products

10.7 Others

10.8 Y-O-Y Growth trend Analysis By Application

10.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 11. Tomato Processing Machine Market , By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Product Type

11.1.2.1 By Operation Type

11.1.3 By End-User Industry

11.1.4 By Texture

11.1.5 By Application

11.1.6 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Product Type

11.2.3 By Operation Type

11.2.4 By End-User Industry

11.2.5 By Capacity

11.2.6 By Texture

11.2.7 By Application

11.2.8 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Product Type

11.3.3 By Operation Type

11.3.4 By End-User Industry

11.3.5 By Capacity

11.3.6 By Texture

11.3.7 By Application

11.3.8 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Product Type

11.4.3 By Operation Type

11.4.4 By End-User Industry

11.4.5 By Capacity

11.4.6 By Texture

11.4.7 By Application

11.4.8 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Product Type

11.5.3 By Operation Type

11.5.4 By End-User Industry

11.5.5 By Capacity

11.5.6 By Texture

11.5.7 By Application

11.5.8 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Tomato Processing Machine Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 CONESA Group

12.2 J.G. Bosewell Tomato Company

12.3 CFT Group

12.4 JBT Corporation

12.5 Avure Technologies

12.6 Morning Star Company

12.7 Food & Biotech Engineers (India) Pvt. ltd

12.8 Chumak Company

12.9 Navatta Group

12.10 FENCO food machinery

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global demand for tomato processing equipment is predicted to reach USD 1.69 billion by 2030, growing at a compound annual growth rate (CAGR) of 3.9% between 2024 and 2030. In 2023, the market was valued at USD 1.3 billion.

The emphasis on efficiency and sustainability, along with the growth in processed food consumption, are the main factors driving the global market for processing equipment.

The primary challenges confronting the worldwide tomato processing machine market are high initial investment costs, challenging maintenance, and market fragmentation.

In 2023, North America held the largest share of the Global Tomato Processing Market.

The major players are J.G. Bosewell Tomato Company, CONESA Group, CFT Group, JBT Corporation, Avure Technologies, Morning Star Company, Food & Biotech Engineers (India) Pvt. Ltd, Chumak Company, Navatta Group, and FENCO food machinery.