Global Toluene Market Size (2023 - 2030)

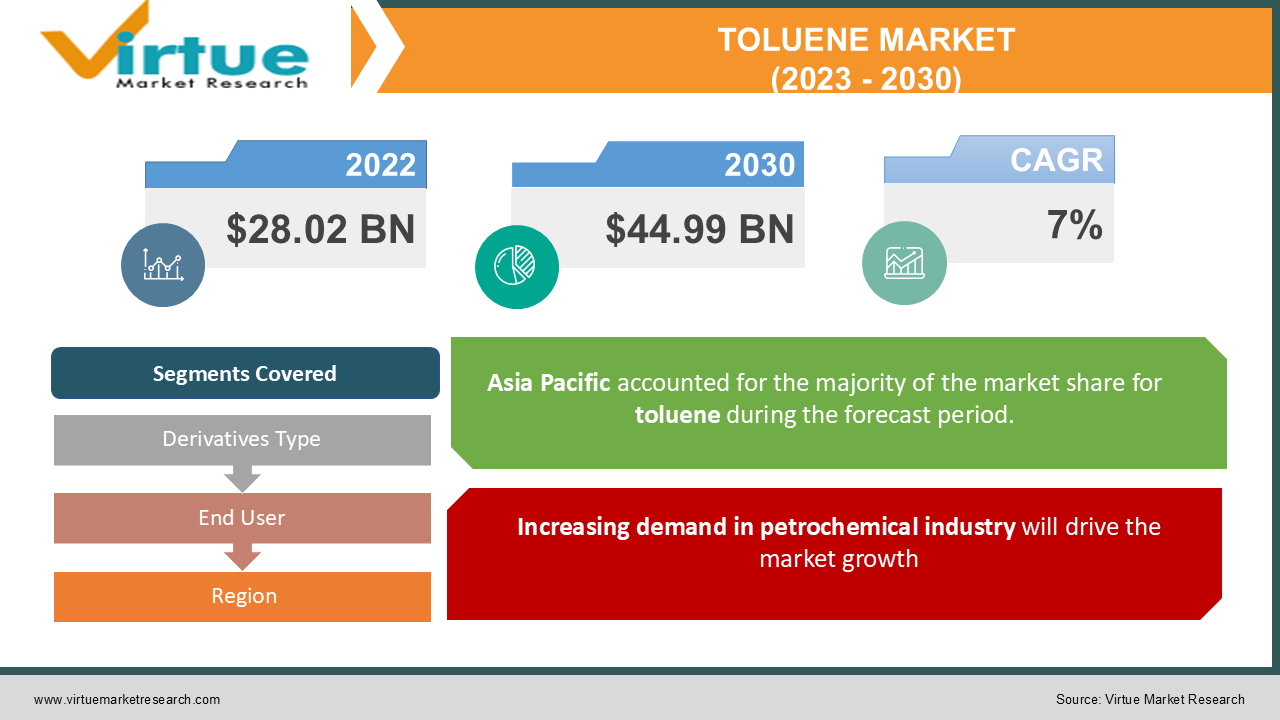

The Global Toluene Market was valued at USD 28.02 billion in 2022 and is projected to reach a market size of USD 44.99 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 7%.

Industry Overview

Toluene is an odourless liquid having a scent that is similar to benzene. It is extremely flammable and irritating to the skin, eyes, lungs, and nose. It is present in crude oil, albeit in very small amounts. It is separated during the catalytic reforming process used to make gasoline, as well as during the production of ethylene or coke from coal. To separate toluene, a distillation or solvent extraction process is used. It is often employed in the production of bulk compounds like benzene and Xylenes. Derivatives like toluene diisocyanate (TDI) are also crucial to industry. The production of flexible polyurethane foams involves the usage of TDI. The production of coatings and elastomers is another use for TDI. Three standard grades of toluene are offered: TDI grade, nitration grade, and commercial grade.

However, the price of toluene is quite sensitive to changes in the price of crude oil. The supply of toluene is hampered by any irregularities in the production of crude oil. Toluene installation capacity, however, is sufficient to meet and satisfy global demand. Additionally, because to its extreme volatility, it is subject to a number of health and safety laws. As it is frequently included in marker inks, paints, and other readily available products on the market, it is exploited by its usage as a recreational drug in many areas of the world. After prolonged exposures, its toxicity might result in poisoning (toluene poisoning). Toluene poisoning can cause CNS effects such fatigue, hallucinations, ataxia, coma, etc., as well as vomiting, respiratory depression, and other symptoms.

Impact of Covid-19 on the industry

The abrupt COVID-19 epidemic in 2020 had a significant effect on the global toluene market. The national lockdowns enforced by the government authorities in the first half of 2020 had a significant negative impact on a number of downstream industries, enterprises, and other institutions. The global demand for toluene was significantly hampered by the impending worry, and the supply chain was also seriously impacted. Because of the increasing demand for toluene coming from the paint and coatings industries, the market growth following the pandemic showed an upward trajectory.

Market Drivers

Increasing demand in petrochemical industry will drive the market growth

As it is classified as an aromatic compound due to the presence of a benzene ring in its chemical structure, the market is being driven by the rising demand for aromatics in the petrochemical sector to create elastomers, agrochemicals, dyes, etc. Toluene is produced industrially using two different processes. In the first process, it is obtained by pyrolyzing gasoline, which is itself made by splitting naphtha. The second approach involves extracting it from reformate, which is made by massive naphtha cracking as well.

Use of Toluene in benzene and xylene will drive the market growth

Toluene is mostly consumed by other chemicals like benzene and xylene. Benzene, xylene, and its related compounds are created using more than half of the toluene produced worldwide. These compounds are used widely in a variety of sectors, including paints and coatings, chemical production, medicines, mining, construction, and the military. As a result, toluene is in high demand due to its commercial significance and solid foundation in the production of essential chemicals.

Market Restraints

Concerns over the toxicity of the substance will challenge the market growth

Due to constraints on its use due to its high degree of toxicity, toluene demand is anticipated to exhibit a negative trend in various market sectors in the approaching years. Toluene can, however, effectively replace benzene in specific applications due to its lower toxicity when compared to the latter.

TOLUENE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Derivatives Type, End User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Exxon Mobil Corporation (USA), SK Global Corporation Limited (South Korea), Zhenhai Refining and Chemical Company (China), Marathon Petroleum Corporation (USA), PetroChina Company Ltd., Flint Hills Resources LLC (USA), Sinopec Shanghai Petrochemical Co. Ltd. (China), Formosa Chemical & Fibre Corporation (Taiwan), Cepsa (Spain), CNOOC Limited (China), Hengli Petrochemical (Dalian Complex) Co. Ltd. (China), LyondellBasell Industries N.V. (USA) |

This research report on the global toluene market has been segmented and sub-segmented based on, derivative type, end-user, and Geography & region.

Global Toluene Market- By Derivatives Type

-

Benzene and Xylene

-

Solvents

-

Gasoline Additives

-

Toluene Diisocyanate

-

Others (TNT, Benzoic acid, Benzaldehyde)

The toluene market is divided into Benzene and Xylene, Solvents, Gasoline Additives, Toluene Diisocyanate, and Others based on derivative kinds (TNT, Benzoic acid, Benzaldehyde). Due to the rising use of benzene in the textile industry and xylene in the paint & coatings and chemical sectors, the benzene and xylene category will hold the greatest market share of 56.45% in 2021.

Global Toluene Market- By End-User

-

Building and Construction

-

Automotive

-

Oil and Gas

-

Paints and Coatings

-

Pharmaceuticals

-

Others

The market is divided into building and construction, automotive, oil and gas, paints and coatings, medicines, and other categories based on end-use. With a market share of 24.78%, the paints and coatings sector led the pack in the global toluene market and is predicted to continue to do so over the coming years. Due to the numerous planned development projects, the building and construction sector is also anticipated to grow rapidly over the next few years, which will further increase the need for toluene.

Global Toluene Market- By Geography & Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

The toluene market is divided into five geographic regions: North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa. Due to strong consumption in nations like China, South Korea, India, Taiwan, and Japan, the Asia-Pacific region now controls the majority of the world's toluene market. Rapid growth and globalisation have fuelled the market's significant industrial demand. Due to rising demand for toluene downstream products, emerging nations like China and India are anticipated to dominate the market throughout the forecast period. The import demand in China has been restrained, nevertheless, by the US-China trade conflict. The market's growth throughout the anticipated time may be hampered by further escalation of the trade dispute.

Although there is a consistent demand in the area, imports from Asia have reduced the profit margins of local producers. Global trade and regulatory changes may have an effect on market expansion in the near future. Due to rising crude oil costs and production problems in the region, toluene prices in the Europe region were high. Over the course of the projection, the regional market may be impacted by changes in trade policy after the BREXIT agreement. The recent expansion of the regional market has been hampered by the political and economic unrest in the region of Latin America. The market, however, is anticipated to continue to grow as these circumstances improve. Toluene is mostly produced in the Middle East and Africa, where there are several manufacturing facilities.

Global Toluene Market- By Companies

1. Exxon Mobil Corporation (USA)

2. SK Global Corporation Limited (South Korea)

3. Zhenhai Refining and Chemical Company (China)

4. Marathon Petroleum Corporation (USA)

5. PetroChina Company Ltd.

6. Flint Hills Resources LLC (USA)

7. Sinopec Shanghai Petrochemical Co. Ltd. (China)

8. Formosa Chemical & Fibre Corporation (Taiwan)

9. Cepsa (Spain)

10. CNOOC Limited (China)

11. Hengli Petrochemical (Dalian Complex) Co. Ltd. (China)

12. LyondellBasell Industries N.V. (USA)

NOTABLE HAPPENINGS IN THE GLOBAL TOLUENE MARKET IN THE RECENT PAST:

-

Business Expansion: - In 2021, PPG stated that its US$13 million investment in its paint and coatings plant in Jiading, China, has been completed. The facility now boasts eight new powder coating production lines and an enlarged powder coatings technology centre, both of which are intended to strengthen PPG's R&D capabilities. The plant's capacity will probably grow by more than 8,000 tonnes annually as a result of the expansion.

-

Government Investment: - In 2021, The Department of Chemicals and Petrochemicals in India received INR 233.14 crore (USD 32.2 million) from the government in the Union Budget 2021–22. To increase domestic manufacturing and exports, the Indian government is thinking of implementing a production-linked incentive (PLI) plan in the chemical industry. As a result, the country's toluene market is anticipated to grow.

- Merger & Acquisition: - In 2019, Sinopec-SK Manufacturers of petrochemicals and related goods Wuhan Petrochemical Co. and SINOPEC have reached an agreement to purchase the SINOPEC-owned Wuhan refinery, which produces 25 different chemicals including gasoline, toluene, jet aircraft fuel, etc. The transaction is thought to be worth USD 1.9 billion.

Chapter 1. TOLUENE MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. TOLUENE MARKET– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-110 Impact Analysis

2.3.1. Impact during 2023 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. TOLUENE MARKET– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. TOLUENE MARKET- Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. TOLUENE MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. TOLUENE MARKET– By Derivative Type

6.1. Toluene Market

6.2. Toluene Disocynates

6.3. Gasoline Additives

6.4. Others

Chapter 7. TOLUENE MARKET– By Application

7.1. Drugs

7.2. Blending

7.3. Cosmetic Nail Products

7.4. Others

Chapter 8. TOLUENE MARKET– By Production Process

8.1. Reformate Processes

8.2. Pygas Processes

8.3. Coke/coal Processes

8.4. Styrene Processes

Chapter 9. TOLUENE MARKET– By Region

9.1. North America

9.2. Europe

9.3. The Asia Pacific

9.4. Latin America

9.5. Middle-East and Africa

Chapter 10. TOLUENE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. Company 1

10.2. Company 2

10.3. Company 3

10.4. Company 4

10.5. Company 5

10.6. Company 6

10.7. Company 7

10.8. Company 8

10.9. Company 9

10.10. Company 10

Download Sample

Choose License Type

2500

4250

5250

6900