Tokenization Market Size (2024 – 2030)

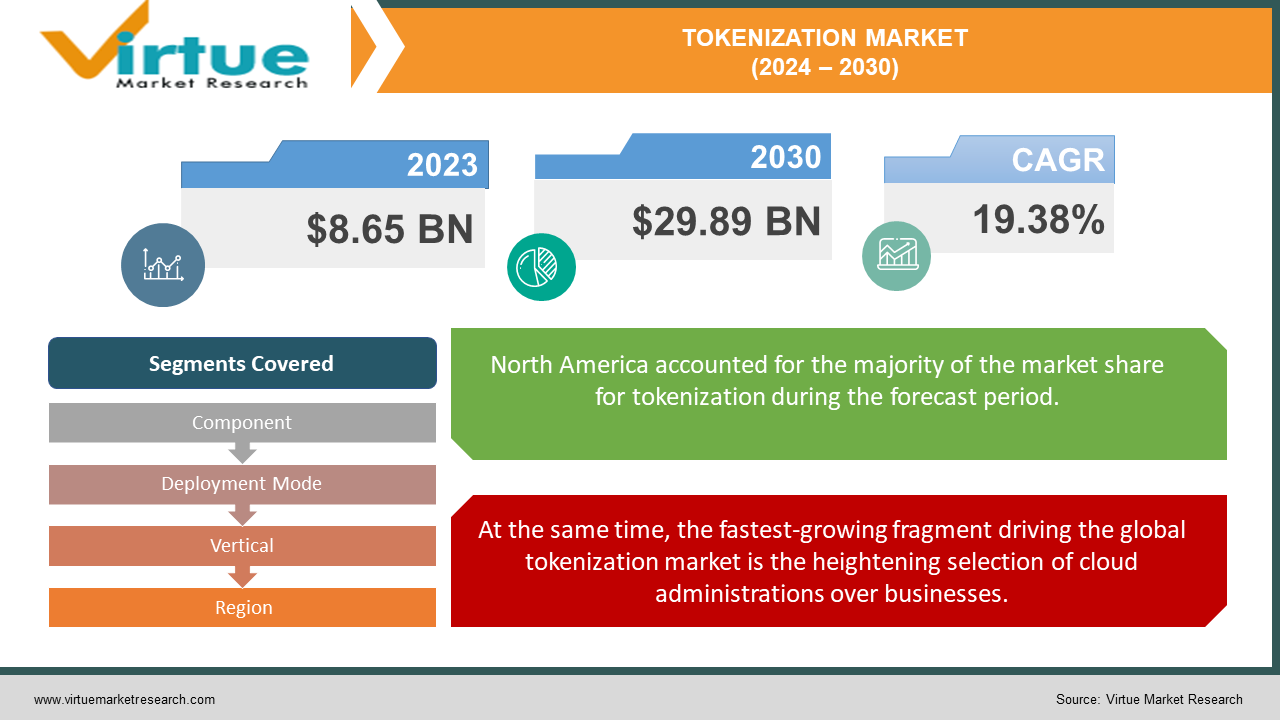

The Global Tokenization Market, valued at USD 8.65 billion in 2023, is projected to achieve a market size of USD 29.89 billion by 2030. This growth trajectory anticipates a compound annual growth rate (CAGR) of 19.38% from 2024 to 2030.

The global tokenization market, characterized as the division including the innovations and administrations that change over delicate information into non-sensitive reciprocals (tokens) that can be utilized in a database or inside framework without bringing it into scope, is encountering vigorous development. Tokenization guarantees compliance with rigid administrative guidelines like PCI-DSS, GDPR, and HIPAA, making it an irreplaceable apparatus for businesses dealing with delicate client data, such as funds, healthcare, and retail. As businesses proceed to emigrate to cloud-based administrations and advanced stages, the basic for shielding delicate data without compromising operational productivity has never been higher. Key players within the advertisement are centering on improving their tokenization administrations with progressed highlights such as real-time preparation, integration capabilities, and bolster for different information designs to cater to differing industry needs. Developments in blockchain and the multiplication of advanced installment strategies assist fuel the request for tokenization arrangements. With the Asia-Pacific locale seeing fast mechanical selection and North America keeping up a solid advertise nearness due to a built-up cybersecurity foundation, the worldwide tokenization showcase is balanced for maintained extension. Thus, businesses are not as it were looking at tokenization as a compliance apparatus but also as a vital approach to building client beliefs and guaranteeing information security in a progressively advanced world.

Key Market Insight:

Smart contracts and blockchain networks embrace tokenization. Ethereum’s ERC-20 tokens paved the way, but newer standards like ERC-721 (NFTs) and ERC-1155 (multi-token standards) redefine the game.

Brick-and-mortar meets blockchain. Real estate tokens democratize property ownership, making it accessible to a wider audience.

The Asia-Pacific region is expected to witness the highest growth rate during the forecast period, owing to the rapid digitization of economies such as China and India.

SecureKey Technologies: This Canadian gem has emerged as a beacon of trust in the tokenization landscape. With a robust portfolio spanning financial services, healthcare, and government sectors, SecureKey holds its ground. Their innovative Verified. My platform, powered by tokenization, simplifies identity verification while safeguarding user privacy.

Gemalto (Thales): A European juggernaut, Gemalto (now part of Thales) orchestrates a symphony of secure tokens. Their SafeNet Trusted Access solution dances across industries, ensuring seamless access management. Gemalto’s global footprint and commitment to cutting-edge security make it a formidable contender.

Global Tokenization Market Drivers:

Most noteworthy among the portions inside the global tokenization market is the expanding rate of information breaches, impelling a surge in requests for vigorous security arrangements.

With cyber dangers advancing in complexity and recurrence, businesses are hooking with the basics to brace their protections against potential breaches. Tokenization develops as a cutting-edge defense instrument, advertising a proactive approach to information security by rendering touchy data garbled and in this way, viably upsetting noxious get to endeavors. In addition, rigid administrative systems like GDPR and CCPA order comprehensive information assurance measures, making tokenization a crucial instrument for compliance. By minimizing the scope of touchy information uncovered to breaches, tokenization not as it were mitigates the chance of administrative punishments but also shields the priceless belief and notoriety of businesses within the eyes of their clients.

At the same time, the fastest-growing fragment driving the global tokenization market is the heightening selection of cloud administrations over businesses.

As organizations progressively move their operations and information to cloud situations, the requirement for vigorous security measures becomes fundamental. Tokenization addresses the interesting security challenges posed by cloud computing by decoupling delicate information from identifiable data, hence moderating the chance of unauthorized get to and information breaches. Besides, tokenization encourages compliance with exacting information security controls in cloud situations by minimizing the scope of touchy information subject to administrative investigation. As businesses look to use the adaptability and cost-efficiency of cloud computing while keeping up information security and compliance, the request for tokenization arrangements is balanced for exponential development, driving advancement and advertise extension within the advancing scene of cybersecurity.

Challenges in the Global Tokenization Market:

Regulatory compliance and data privacy concerns present significant challenges to the adoption of tokenization solutions.

Each nation or locale regularly has its possess set of controls, such as the GDPR in Europe and CCPA in California, which direct how individual information must be taken care of and ensured. The tokenization market faces noteworthy challenges due to shifting administrative scenes and exacting information protection laws over distinctive districts. Furthermore, the complexity of guaranteeing that tokenization arrangements adjust with all important legitimate necessities can lead to delays in usage and expanded operational costs. Compliance with these differing and advancing controls requires considerable assets and ceaseless overhauls of tokenization frameworks, making a boundary for both existing and modern advertising participants.

The integration complexity with legacy systems poses a significant challenge for organizations looking to implement modern tokenization technologies.

Numerous organizations still depend on bequest frameworks that were not planned to bolster cutting-edge tokenization advances. Coordination of tokenization arrangements with these obsolete foundations can be challenging and expensive. This frequently includes noteworthy re-engineering of existing forms and frameworks to oblige tokenization, which can disturb commerce operations. Besides, the need for standardization in tokenization strategies can assist in complicated integration endeavors, leading to irregularities and potential security vulnerabilities. The significant venture required in terms of both time and cash to overcome these integration obstacles acts as an obstruction for organizations considering the appropriation of tokenization arrangements.

Opportunities in the Global Tokenization Market:

One compelling showcase opportunity inside the global tokenization market lies within the burgeoning fintech segment. Tokenization, by supplanting touchy information with special distinguishing proof images or tokens, offers a strong arrangement to improve exchange security and diminish extortion chance. As monetary innovation proceeds to advance, the requirement for secure, productive, and user-friendly installment arrangements becomes fundamental. With customers progressively receiving contactless installments and computerized managing an account, fintech companies are in a prime position to use tokenization. This technology's integration into portable installment stages, blockchain-based money-related administrations, and advanced wallets present a critical development road. Subsequently, fintech firms contributing to tokenization can pick up a competitive edge by giving secure, inventive monetary items that meet the advancing requests of a carefully adroit client base. This not as it were guarantees upgraded security for clients but also builds belief, driving higher appropriation rates.

TOKENIZATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

19.38% |

|

Segments Covered |

By Component, Deployment Mode, Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Visa, Mastercard, American Express, Fiserv, Inc., OpenText Corporation, TrustCommerce, Thales, TokenEx, Inc., Entrust Corporation, FIS, CipherCloud, Futurex, Symantec Hewlett Packard Enterprises, Protegrity |

Global Tokenization Market Segmentation: By Component

-

Hardware

-

Software

-

Services

The highest and fastest-growing segment inside the worldwide tokenization market is services, speaking to a worldview move within the way businesses approach information security and value-based judgment. Concurrently, computer program arrangements, serving as the computerized spine of tokenization systems, keep up a significant advertise share. With a faithful center on giving custom-fitted mastery and continuous bolster, the administration's section develops as the foundation of fruitful tokenization activities. Its exponential development direction underscores the expanding request for specialized counseling, integration, and overseen administrations, as endeavors explore the complexities of advanced change. In the interim, equipment components, comprising the physical foundation basic for secure exchanges, illustrate relentless development, underlining their foundational part in guaranteeing vigorous information security measures. Their flexibility and flexibility resounds with organizations over differing businesses, driving critical appropriation rates and cultivating consistent information tokenization forms. As businesses prioritize versatility and nimbleness in an ever-evolving advanced scene, a comprehensive approach to joining equipment, computer programs, and administrations remains paramount in tackling the total potential of tokenization advances.

Global Tokenization Market Segmentation: By Deployment Mode

-

On-Premises

-

Cloud

The highest market share within the global tokenization market has a place in the cloud deployment section, reflecting the broad appropriation of cloud-based arrangements over businesses. In addition, its consistent integration with existing frameworks and administrations advance improves its offer, driving significant advertising income. At the same time, the fastest-growing segment within this space is additionally cloud sending, impelled by components such as advanced change activities and raising cybersecurity concerns. With a compound yearly development rate (CAGR) outperforming that of on-premises arrangement, the cloud fragment develops as a frontrunner in development, reshaping the worldwide tokenization scene and proclaiming a modern period of secure, spry information administration. With its adaptability, adaptability, and cost-effectiveness, cloud arrangement offers organizations the deftness and availability required to explore a progressively advanced scene. As businesses prioritize effectiveness and adaptability, the request for cloud-based tokenization arrangements surges, checking a worldview move within the showcase elements.

Global Tokenization Market Segmentation: By Vertical

-

Banking, Financial Services, and Insurance (BFSI)

-

Retail and e-commerce

-

Healthcare and Life Sciences

-

Government and Public Sector

-

IT and Telecommunications

The global tokenization market unfurls an energetic account, with its highest market share and fastest-growing segment focalizing within the bustling domain of retail and eCommerce. Here, in the midst of the computerized passageways and virtual checkout counters, tokenization develops as a foundation of belief, invigorating exchanges and defending client information with unparalleled adequacy. With a commanding advertise share surpassing 35%, this portion stands tall as the reference point of selection, moved by the tenacious surge in online shopping exercises around the world. At the same time, the keeping money, money-related administrations, and protections (BFSI) segment developed as the veritable juggernauts of development, displaying a surprising compound yearly development rate (CAGR) of 12.5% over the estimated period. Grasping tokenization intensely, these budgetary powerhouses invigorate their computerized posts, guaranteeing the holiness of exchanges and compliance with rigid administrative systems. Over the healthcare, government, and IT domains, tokenization weaves a common string of versatility and development, defending touchy information, reinforcing national security systems, and impelling advanced change activities forward. In this embroidered artwork of verticals, each fragment finds its one-of-a-kind beat, fueled by the objectives of security, compliance, and proficiency in a progressively interconnected world.

Global Tokenization Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

Highest among the regions, North America claims a commanding share of approximately 40% in the global tokenization market, propelled by its steadfast adoption of digitized processes across industries. Within North America, the United States emerges as the fastest-growing segment, fueled by its dynamic financial services sector and relentless technological advancements. Meanwhile, Europe closely follows, accounting for around 30% of the market, buoyed by stalwart leaders like the United Kingdom, Germany, and France, which prioritize stringent data protection regulations. In the Asia-Pacific region, comprising approximately 20% of the market, countries such as China, India, and Japan drive significant growth with their burgeoning digital payments and e-commerce sectors. Despite contributing smaller shares, South America and the Middle East & Africa regions are not to be overlooked, as countries like Brazil and the UAE gradually embrace tokenization solutions, laying the groundwork for promising future expansions.

Impact of COVID-19 on the Global Tokenization Market:

The COVID-19 widespread has significantly affected the global tokenization market, serving as a critical catalyst for its quickened development. This move highlighted the basic requirement for improved cybersecurity measures to ensure touchy data, driving the selection of tokenization advances. As the world hooked on the challenges of social removing and further work, businesses and shoppers alike turned to advanced arrangements at an exceptional rate. The surge in online exchanges, fueled by the e-commerce boom amid lockdowns, advance underscored the need for secure installment handling, moving tokenization to the cutting edge of advanced security methodologies. This far-reaching selection was encouraged by headways in cloud computing and the developing dependence on advanced stages, which gave the fundamental framework for tokenization sending. In addition, businesses such as healthcare, back, and retail, which experienced expanded cyber dangers in the midst of the widespread, utilized tokenization to defend understanding of information, money-related exchanges, and client data. Subsequently, the showcase has seen a vigorous extension, with companies contributing intensely to tokenization arrangements to guarantee compliance with rigid information security controls and to invigorate their resistance against advanced cyberattacks. The widespread, in this manner, not as it were quickened the tokenization market's development but too for all time reshaped the scene of advanced security, inserting tokenization profoundly into the texture of the worldwide computerized foundation. As the world moves to a post-pandemic time, the dependence on advanced biological systems set up amid the emergency is anticipated to hold on, setting tokenization's part as a foundation of cutting-edge cybersecurity and information protection.

Global Tokenization Market Key Players:

-

Visa

-

Mastercard

-

American Express

-

Fiserv, Inc.

-

OpenText Corporation

-

TrustCommerce

-

Thales

-

TokenEx, Inc.

-

Entrust Corporation

-

FIS

-

CipherCloud

-

Futurex

-

Symantec

-

Hewlett Packard Enterprises

-

Protegrity

Recent Developments:

-

In January 2024: Visa acquired Verifi, a leading provider of payment protection and tokenization services. This acquisition is set to bolster Visa's fraud prevention capabilities by incorporating Verifi's robust tokenization solutions into its existing suite of services.

-

In December 2023: Thales Group completed the acquisition of Gemalto, a digital security company, for $5.4 billion. This strategic move is intended to expand Thales' portfolio in the digital security space, particularly in tokenization and encryption services.

-

In April 2024: CipherCloud launched its new tokenization platform, CipherSecure, which promises enhanced security for cloud-based applications. CipherSecure utilizes advanced algorithms to tokenize sensitive data, ensuring compliance with stringent data protection regulations.

-

In March 2024: IBM and Mastercard announced a strategic partnership aimed at enhancing data security for financial transactions. This collaboration focuses on integrating IBM's advanced tokenization technology with Mastercard's payment processing infrastructure to provide end-to-end security solutions for global transactions.

Chapter 1. Tokenization Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Tokenization Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Tokenization Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Tokenization Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Tokenization Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Tokenization Market – By Component

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Software

6.4 Services

6.5 Y-O-Y Growth trend Analysis By Component

6.6 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Tokenization Market – By Deployment Mode

7.1 Introduction/Key Findings

7.2 On-Premises

7.3 Cloud

7.4 Y-O-Y Growth trend Analysis By Deployment Mode

7.5 Absolute $ Opportunity Analysis By Deployment Mode, 2024-2030

Chapter 8. Tokenization Market – By Vertical

8.1 Introduction/Key Findings

8.2 Banking, Financial Services, and Insurance (BFSI)

8.3 Retail and e-commerce

8.4 Healthcare and Life Sciences

8.5 Government and Public Sector

8.6 IT and Telecommunications

8.7 Y-O-Y Growth trend Analysis By Vertical

8.8 Absolute $ Opportunity Analysis By Vertical, 2024-2030

Chapter 9. Tokenization Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Component

9.1.3 By Deployment Mode

9.1.4 By By Vertical

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Component

9.2.3 By Deployment Mode

9.2.4 By Vertical

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Component

9.3.3 By Deployment Mode

9.3.4 By Vertical

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Component

9.4.3 By Deployment Mode

9.4.4 By Vertical

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Component

9.5.3 By Deployment Mode

9.5.4 By Vertical

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Tokenization Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Visa

10.2 Mastercard

10.3 American Express

10.4 Fiserv, Inc.

10.5 OpenText Corporation

10.6 TrustCommerce

10.7 Thales

10.8 TokenEx, Inc.

10.9 Entrust Corporation

10.10 FIS

10.11 CipherCloud

10.12 Futurex

10.13 Symantec

10.14 Hewlett Packard Enterprises

10.15 Protegrity

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Tokenization Market was estimated to be worth USD 8.65 billion in 2023 and is projected to reach a value of USD 29.89 billion by the end of 2030, growing at a fast CAGR of 19.38 % during the forecast period 2024-2030.

The Segments under the Global Tokenization Market by component are Hardware, software, and services.

Some of the top industry players in the Digital Forensics Market are Visa, Mastercard, American Express, Fiserv, Inc., OpenText Corporation, TrustCommerce, Thales, TokenEx, Inc., Entrust Corporation, FIS, CipherCloud, Futurex, Symantec, Hewlett Packard Enterprises, Protegrity.

The Global Tokenization Market is segmented based on Component, Deployment Mode, Vertical, and region.

The Retail and e-commerce sector is the most common vertical of the Global Tokenization Market.