Tocotrienol Market Size (2024 – 2030)

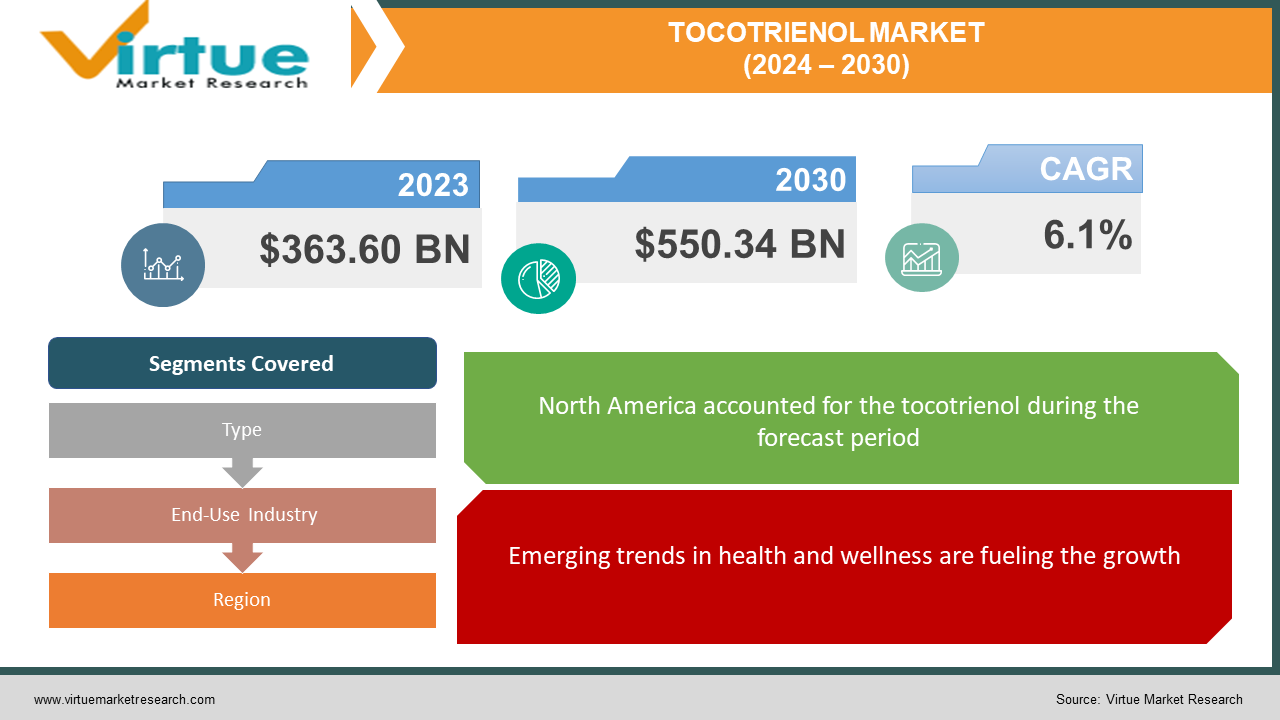

The tocotrienol market was valued at USD 363.60 billion in 2023 and is projected to reach a market size of USD 550.34 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 6.1%.

Tocotrienols are members of the vitamin E family of natural compounds exhibiting strong antioxidant and anti-inflammatory properties. Structurally, they occur in four different analogs: alpha, beta, gamma, and delta tocotrienols. While structurally similar, they offer superior biological activity compared to another vitamin E subgroup called tocopherols. However, research uncovering their unique health merits, especially their abilities to fight chronic diseases, has gained significant momentum only over the last decade. Key science-backed health benefits include improved heart health by lowering LDL cholesterol levels, anti-cancer effects on tumors, bone health benefits preventing osteoporosis, and neuroprotective properties slowing cognitive decline associated with Alzheimer's disease. This growing clinical evidence is driving adoption across the dietary supplement sector. Key strategic priorities for tocotrienol suppliers include expanding product differentiation by unlocking novel health benefits and strengthening the scientific dossier through continued clinical studies. The focus also remains on diversifying downstream applications beyond just dietary supplements, such as functional foods and beverages, cosmeceuticals, animal nutrition, etc., to widen addressable consumer segments. Many players are also actively exploring alternative non-GMO raw material sources, such as rice and wheat bran, to mitigate supply risks and environmental footprint concerns associated with palm crops. The market outlook remains optimistic, backed by widening supply capacities and the continued discovery of additional bioactivity benefits by leading research institutions—factors expected to unlock multi-fold growth over the next decade.

Key Market Insights:

Multiple research studies have demonstrated that tocotrienols exhibit up to 60 times more antioxidant capacity owing to their unique chemical structure. This allows better intracellular uptake compared to tocopherols and enables significantly higher free radical scavenging activity—a mechanism vital for anti-cancer, neuroprotective, and anti-inflammatory effects. Furthermore, specific isomers like delta-tocotrienol also modulate important metabolic pathways that improve blood lipids and bone health—properties not exhibited by common dietary vitamin E sources. This rich scientific dossier highlighting enhanced health effects is enabling supplier messaging focused on targeted wellness benefits and establishing category differentiation versus standard vitamin E ingredients—aspects critical to influencing consumer purchase decisions. Tocotrienols are also gaining adoption within skincare, haircare, and cosmeceutical formulations as their antioxidant properties protect against environmental damage and slow down aging effects related to UV exposure, pigmentation, and wrinkles. Further niche but emerging application avenues exist in pet food and animal feed segments concerning bone health, immunological improvements, and muscle tissue regeneration in livestock. The tocotrienol industry exhibits strong commercial tailwinds linked to the ingredient's superior functionality, expanding use cases beyond supplements into food and cosmetics, and concerted efforts to shift towards responsible sourcing methods for securing long-term ecological sustainability.

Tocotrienol Market Drivers:

Emerging trends in health and wellness are fueling the growth.

The rising interest among individuals in proactively managing health and wellness rather than reactively treating illnesses is providing momentum for the adoption of tocotrienols. Prominent factors enabling this trend include the high costs associated with medical care and medicinal treatments, massive costs arising from health insurance, and a lack of access to healthcare professionals. These economic and structural impediments have propelled individuals to seek affordable prevention and nutrition-centric self-care alternatives by leveraging supplements, nutraceuticals, and functional foods & beverages. Over 63% of urban adults now consume specialized vitamins, omega-3s, probiotics, and plant-based antioxidants as a means of self-care, lowering the risks of chronic health conditions including diabetes, high cholesterol, heart disease, and even cognitive decline. The enthusiasm around preventative self-care also ties strongly into the limitations of traditional curative medical solutions. Pharma products like cancer drugs and painkillers may only address the symptoms of underlying diseases without rectifying the real trigger points or causes. Additionally, overuse of antibiotics has led to drug resistance issues. As consumers become more aware of the merits of developing self-care regimens for combating onset risks and understanding the limitations of medicines, their motivation to integrate solutions like tocotrienols continues to rise. This paradigm shift represents sustained tailwinds benefiting supplier revenue growth for the next decade. Supply-side investments into expanding production capacities, downstream product development, and scientific evidence generation are crucial to tapping into this high-potential segment strategically.

There has been a noticeable shift in consumer preferences away from synthetic additives towards clean-label products containing natural functional ingredients.

The growing consumer shift towards adopting natural, minimally processed ingredients within healthcare products is underpinned by evolving perceptions that tightly interlink health, safety, and responsible sourcing considerations. Market surveys reveal over 86% of consumers associate the term natural with positive sentiments like trust, effectiveness, nutritional density, and safety, prioritizing such clean solutions over food or supplements containing artificial compounds. These attitudes signify deeper changes compared to earlier assumptions that simply categorized natural ingredients as physically sourced from plants or minerals devoid of synthetic chemical interventions. The growing negativity towards artificial preservatives, stabilizers, sweeteners, flavors, and colors, given their associated health risks, is making consumers wary of products listing complex names or E numbers on labels. Compounds like sodium benzoate, BHT, carrageenan, and aspartame have come under heavy scrutiny by researchers regarding long-term toxicity upon accumulation, hormone modulation, and possible carcinogenicity and metabolic disorders. Seeking natural ingredients allows consumers to align personal values like ecological sustainability and social responsibility with their purchase choices. Sourcing botanical extracts ensures reliance on renewable supply chains, like crop harvesting, rather than lab production dependent on non-renewable resources.

Tocotrienol Market Restraints and Challenges:

Although tocotrienols have been shown in studies to operate better than other vitamin E analogs, their concentrated supply and high cost have prevented mass-market products and consumer adoption of tocotrienols.

While the superior functionality of tocotrienols over other vitamin E analogs is scientifically validated, the high costs associated with concentrated supply significantly dampen widespread consumer adoption and incorporation into mass-market products. At present, the affinity purification processes vital for extracting and isolating pure tocotrienol compounds translate into prices nearly 7-8 times higher than common tocopherols. Such premium pricing remains unavoidable presently owing to its dependence on specialty processing technologies. However, it poses severe affordability barriers concerning integration within cheaper functional food categories and dietary supplements targeting economically conscious demographic groups. Consequently, commercialization avenues have become restricted only to niche medical nutrition and high-end anti-aging applications. Market growth also continues to lag in developing countries across Asia, Africa, and Latin America, where low average incomes affect mass adoption. For the industry, the communication challenge involves concisely educating common consumers about how the biochemical activity of tocotrienols translates into targeted health advantages compared to more abundant vitamin E forms procured from widely available plant oils. Educating retailers, distributors, and healthcare practitioners representing the direct touchpoints to reach end-users also constitutes an imperative priority to drive advocacy. Successfully addressing such stakeholders can help position tocotrienols as premium nutraceuticals meriting high uptake. Failure to invest here risks consumers viewing it as a niche, dispensable ingredient amidst an expanding basket of supplement options.

Tocotrienol Market Opportunities:

While dietary supplements represent the dominant application area for tocotrienol compounds, significant untapped commercial potential exists across pharmaceutical drug development and medical nutrition categories. Leveraging their established antioxidant and anti-inflammatory mechanisms, tocotrienol derivatives are being actively researched by biopharmaceutical companies for the development of novel drug candidates. Recent preclinical and limited human studies have demonstrated promising results for tocotrienol formulations to aid in the prevention and supportive treatment of conditions like non-alcoholic fatty liver disease (NAFLD), rheumatoid arthritis, gastric cancers, and metabolic disorders including diabetes. The ability to modulate specific genetic pathways regulating lipid homeostasis, angiogenesis, and immune responses opens possibilities within these high-value therapeutic segments. Tocotrienols as antioxidant actives are starting to gain traction within the rapidly growing nutricosmetics category, focused on dietary topical supplements for skin health. The ability to quench free radicals and prevent photoaging from UV radiation and environmental pollutants makes tocotrienol-infused formulations increasingly attractive for cosmetic brands seeking high-performance ingredients with scientific backing. While palm continues to dominate as the primary source for commercial tocotrienol extraction, efforts are underway to establish alternative plant sources, ensuring long-term, sustainable supply chain resiliency. Promising initiatives include isolating tocotrienols from annatto, olive deodorizer distillates, and rice bran oil extracts. These could open economics by enabling application extensions into functional foods like spreads, breakfast cereals, and baked goods formulated with tocotrienol-enriched oils. The vast growth headroom available from therapeutics, cosmetics, and newer application segments beyond just supplements represents strong commercial opportunities that can sustain exponential industry expansion over this decade.

TOCOTRIENOL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Type, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, American River Nutrition, ExcelVite Inc., BTSA Biotechnologías Aplicadas SA , Archer Daniels Midland Company, Cayman Chemical, SourceOne Global Partners |

Tocotrienol Market Segmentation: By Type

-

Alpha Tocotrienol

-

Gamma Tocotrienol

-

Delta Tocotrienol

-

Beta Tocotrienol

Alpha-tocotrienol, characterized by unsaturated side chains, currently commands the largest segment, accounting for around 40% of the overall tocotrienol market revenues in 2023. This isomeric form exhibits potent neuroprotective, antioxidant, and anti-inflammatory properties beneficial for brain and cognitive health. Its metabolic pathways also demonstrate positive effects against hypercholesterolemia by reducing circulating LDL cholesterol levels. The gamma-tocotrienol isomer represents the fastest-growing type. The molecule's highly potent antioxidant capacity to neutralize reactive oxygen species (ROS) combined with proven anti-cancer effects, particularly for breast, prostate, and gastric tumors, is responsible for its widespread adoption.

Tocotrienol Market Segmentation: By End-Use Industry

-

Dietary Supplements

-

Cosmetics

-

Pharmaceuticals

-

Others

The dietary supplement sector is the largest grower in the tocotrienol market. This dominance stems from the increasing consumer focus on health and wellness and a growing understanding of the protective benefits of antioxidants. Tocotrienols are marketed for their potential to support cardiovascular health, cognitive function, skin health, and overall well-being. The pharmaceutical segment is the fastest-growing. They are employed as therapeutic agents and in a variety of pharmaceutical applications, including as drug delivery systems. They are good candidates for the creation of novel pharmacological formulations because of their anti-inflammatory and antioxidant qualities. Tocotrienols are excipients or active pharmaceutical ingredients (APIs) that can be utilized in pharmaceutical formulations. They can improve the stability and bioavailability of medications as excipients.

Tocotrienol Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the largest growing market. The United States, being the largest consumer economy in North America, uses tocotrienols extensively in dietary supplements. Rising consumer spending on nutritional and preventive health products will continue to favor demand growth for tocotrienols. Asia-Pacific is the fastest-growing region owing to its large population base, rising incomes, increasing health awareness, and governmental support for nutraceuticals. The markets of China, Japan, and India specifically are poised for robust growth in demand. Europe is the third-largest market for tocotrienols presently, contributing to over 20% of the total revenue in 2023. European countries like Germany, the United Kingdom, and France utilize these compounds primarily as ingredients in supplements and functional foods.

COVID-19 Impact Analysis on the Tocotrienol Market:

The onset of the COVID-19 pandemic caused shockwaves across industries globally, and the tocotrienol market was no exception. Government-imposed lockdowns and mobility restrictions heavily impacted market demand during the initial months. However, the long-term impact has created certain opportunities across the consumer base and applications. In the initial few months when nationwide lockdowns were implemented, supply chains were heavily disrupted. Raw material procurement, manufacturing activities, and cross-border trade faced limitations. This slowed down production as well as new launches of tocotrienol products like dietary supplements. At the same time, consumer demand also dropped due to economic uncertainty and a priority shift toward essentials. These factors collectively led the global tocotrienol market revenue to decline by 5–6%. Asia-Pacific countries like India and China imposed strict lockdowns, stalling production and exports of ingredients like tocotrienols. North America and Europe also recorded declines owing to supply chain bottlenecks and muted demand for nutraceuticals. Asia-Pacific's overall dominant share in the tocotrienol market slipped slightly because of these conditions. The consumer's focus on health and preventive care was diverted amid income losses and stress over the pandemic. However, in 2022 and going ahead, the demand outlook seems positive for tocotrienols globally. Health consciousness regarding self-care is rising remarkably after witnessing the repercussions of COVID-19. Consumers are now inclined towards supplements and foods that provide immunity-strengthening benefits along with other protective properties.

Latest Trends/ Developments:

The tocotrienol market is witnessing several impactful trends that are shaping its growth trajectory. Some of the notable ones include rising demand for delta-tocotrienols, shifting consumer preferences, increasing research on efficacy, and widening applications across sectors like cosmetics. Delta-tocotrienols are emerging as one of the popular variant forms of tocotrienols being adopted in dietary supplements and functional foods. Although research is still in the early stages, delta-tocotrienols are known to demonstrate higher antioxidant potency compared to the more common alpha and gamma variants. Studies have indicated their benefits in areas like cholesterol reduction, neuroprotection, anti-cancer effects, and bone health. Their unique molecular structure makes them more bioavailable as well. Leading supplement brands have already launched products containing delta-tocotrienols owing to rising consumer interest. The application of delta form is therefore poised to expand rapidly over the coming years. In terms of end-user preferences, a visible shift is being witnessed towards vegetarian capsules and gummies instead of soft gels. The main driver of this trend is the growing vegan and vegetarian consumer base across North America, Asia-Pacific, and European countries that prefer plant-based formulations. Manufacturers are responding by increasing delta-variant production capacities and launching innovative product formats to capitalize on these trends.

Key Players:

-

BASF SE

-

American River Nutrition

-

ExcelVite Inc.

-

BTSA Biotechnologías Aplicadas SA

-

Archer Daniels Midland Company

-

Cayman Chemical

-

SourceOne Global Partners

Chapter 1. Tocotrienol Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Tocotrienol Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Tocotrienol Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Tocotrienol Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Tocotrienol Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Tocotrienol Market – By End-use Industry

6.1 Introduction/Key Findings

6.2 Dietary Supplements

6.3 Cosmetics

6.4 Pharmaceuticals

6.5 Others

6.6 Y-O-Y Growth trend Analysis By End-use Industry

6.7 Absolute $ Opportunity Analysis By End-use Industry , 2024-2030

Chapter 7. Tocotrienol Market – By Type

7.1 Introduction/Key Findings

7.2 Alpha Tocotrienol

7.3 Gamma Tocotrienol

7.4 Delta Tocotrienol

7.5 Beta Tocotrienol

7.6 Y-O-Y Growth trend Analysis By Type

7.7 Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 8. Tocotrienol Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By End-use Industry

8.1.3 By Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By End-use Industry

8.2.3 By Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By End-use Industry

8.3.3 By Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By End-use Industry

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By End-use Industry

8.5.3 By Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Tocotrienol Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 American River Nutrition

9.3 ExcelVite Inc.

9.4 BTSA Biotechnologías Aplicadas SA

9.5 Archer Daniels Midland Company

9.6 Cayman Chemical

9.7 SourceOne Global Partners

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Emerging trends in health and wellness and a shift in consumer preferences towards clean-label products are the main market drivers.

Isolating and purifying tocotrienols from natural sources, like palm oil or rice bran, can be a complex and expensive process. Advanced technologies are needed, contributing to higher final product costs.

BASF SE, American River Nutrition, ExcelVite Inc., BTSA Biotechnologías Aplicadas SA, Archer Daniels Midland Company, and Cayman Chemical are the major players.

North America currently holds the largest market share.

Asia-Pacific exhibits the fastest growth.