Tissue Engineered Skin Substitutes Market Size (2025 – 2030)

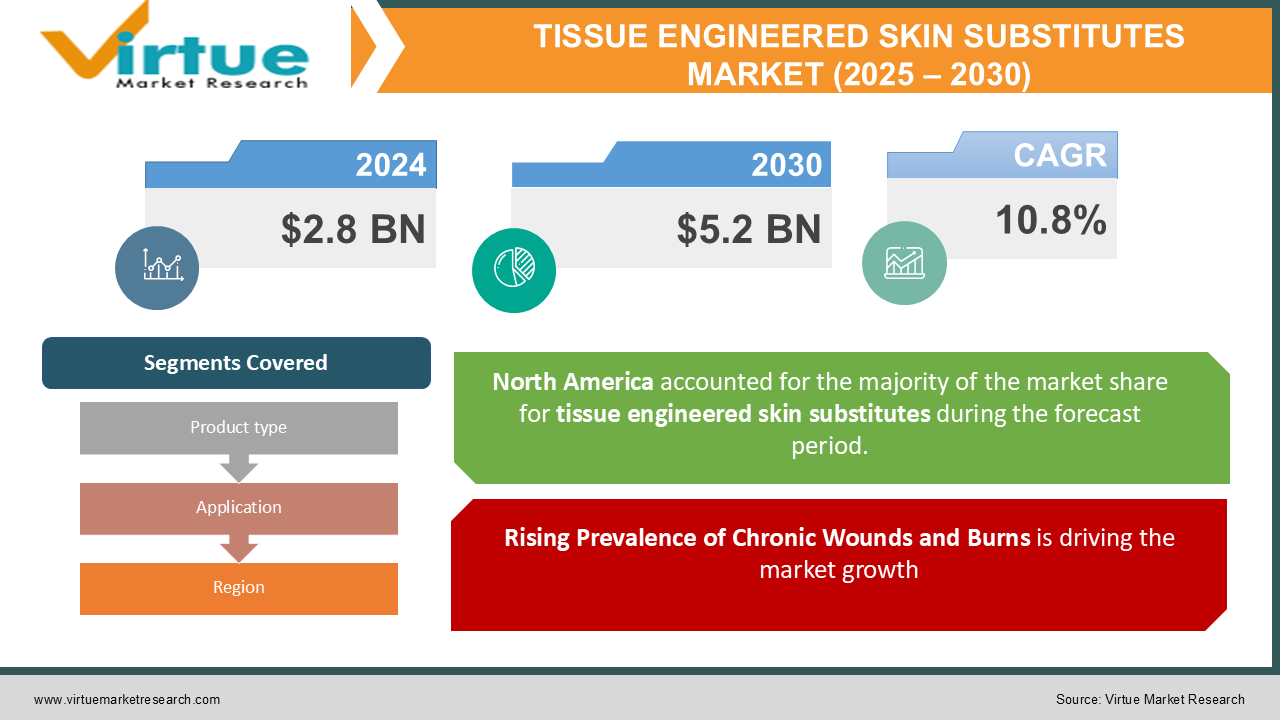

The Global Tissue Engineered Skin Substitutes Market was valued at USD 2.8 billion in 2024 and is projected to reach USD 5.2 billion by 2030, growing at a CAGR of 10.8% during the forecast period (2025–2030).

Tissue-engineered skin substitutes are synthetic or biological materials designed to mimic skin properties, providing effective solutions for wound healing and skin regeneration.

Key factors driving market growth include the rising prevalence of chronic wounds and burn injuries, advancements in tissue engineering technologies, and increasing demand for minimally invasive treatments. Government funding and investments in regenerative medicine further boost the market's growth.

Key Market Insights

-

The cellular skin substitutes segment accounted for over 55% of the market share in 2024, driven by their superior regenerative properties.

-

Chronic wounds dominated the application segment with a 40% revenue share, primarily due to the growing incidence of diabetes and pressure ulcers.

-

North America holds the largest regional market share at 38%, supported by advanced healthcare infrastructure and increasing R&D activities.

-

The rising geriatric population, which is more susceptible to wounds and burns, is a significant growth driver.

-

Innovations in 3D bioprinting technologies are enhancing the development of personalized skin substitutes, improving treatment outcomes.

-

The market is witnessing a shift towards composite skin substitutes that combine acellular and cellular components for better functionality.

-

Emerging markets in Asia-Pacific are expected to grow at the fastest CAGR of 12.2%, driven by increased healthcare spending and awareness.

Global Tissue Engineered Skin Substitutes Market Drivers

Rising Prevalence of Chronic Wounds and Burns is driving the market growth

The global rise in chronic wounds, including diabetic ulcers, venous leg ulcers, and pressure ulcers, is a primary driver for tissue-engineered skin substitutes. According to the International Diabetes Federation, approximately 10.5% of the global adult population is affected by diabetes, which often leads to non-healing wounds.

Burn injuries, particularly in developing countries, also contribute to the increasing demand for skin substitutes. Tissue-engineered products provide a viable solution by accelerating the wound healing process, reducing complications, and improving patient outcomes.

Technological Advancements in Tissue Engineering is driving the market growth

The integration of advanced technologies such as 3D bioprinting, nanotechnology, and bioactive materials has revolutionized the development of tissue-engineered skin substitutes. These technologies enable the creation of customized products that closely mimic natural skin properties, ensuring better integration and healing.

For instance, 3D bioprinted skin models are being used for patient-specific treatments, offering improved functionality and reduced rejection rates. Such innovations are expected to drive market growth significantly.

Increasing Demand for Minimally Invasive Treatments is driving the market growth

Minimally invasive procedures are gaining popularity due to their reduced recovery time, lower risk of complications, and better patient compliance. Tissue-engineered skin substitutes offer a less invasive alternative to traditional skin grafts, making them a preferred choice for wound management. The growing focus on improving patient quality of life and reducing healthcare costs further supports the adoption of these advanced products.

Global Tissue Engineered Skin Substitutes Market Challenges and Restraints

High Cost of Products and Limited Accessibility is restricting the market growth

The high cost of tissue-engineered skin substitutes, coupled with limited reimbursement policies in certain regions, poses a significant challenge to market growth. For example, advanced cellular substitutes can cost upwards of USD 1,000 per application, making them inaccessible to patients in low- and middle-income countries.

This financial barrier, along with the need for specialized training for their application, limits widespread adoption, especially in resource-constrained settings.

Complex Regulatory Approval Processes is restricting the market growth

The stringent regulatory frameworks governing the approval of tissue-engineered products can delay market entry and increase developmental costs. Regulatory bodies such as the U.S. FDA and EMA require extensive preclinical and clinical data to ensure product safety and efficacy. These challenges can deter small and medium-sized companies from investing in the development of innovative products, affecting market dynamics.

Market Opportunities

The growing focus on personalized medicine and regenerative therapies presents immense opportunities for the tissue-engineered skin substitutes market. The increasing adoption of 3D bioprinting to create patient-specific skin substitutes tailored to individual needs is a significant trend. Moreover, government initiatives and funding for research in regenerative medicine are accelerating innovation. For instance, the U.S. Department of Defense has invested heavily in projects focused on advanced skin substitute technologies to treat burn injuries in military personnel. Emerging economies in Asia-Pacific and Latin America also offer untapped growth potential. Rising healthcare awareness, increasing disposable incomes, and government investments in healthcare infrastructure are driving demand for advanced wound care solutions in these regions. The development of composite and hybrid skin substitutes that integrate cellular and acellular components is another promising avenue, as these products offer improved functionality and broader application.

TISSUE ENGINEERED SKIN SUBSTITUTES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

10.8% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Integra LifeSciences Corporation, Smith & Nephew PLC, Organogenesis Holdings Inc., Mölnlycke Health Care AB, Vericel Corporation, Acelity L.P. Inc. (3M), Advanced Tissue, PolarityTE, Inc., MiMedx Group, Inc., Stratatech Corporation (A Mallinckrodt Company) |

Tissue Engineered Skin Substitutes Market Segmentation - By Product Type

-

Acellular Skin Substitutes

-

Cellular Skin Substitutes

Cellular skin substitutes, characterized by the presence of living cells such as fibroblasts and keratinocytes, have emerged as the dominant segment in the tissue-engineered skin substitutes market, capturing over 55% of the market share in 2024. This significant market dominance can be attributed to their inherent ability to actively promote tissue regeneration and wound healing. Unlike acellular substitutes, which primarily provide a supportive scaffold, cellular substitutes actively participate in the wound healing process. The incorporated cells secrete growth factors, cytokines, and extracellular matrix components, which stimulate the proliferation and migration of host cells, accelerate tissue repair, and ultimately enhance wound closure. This superior regenerative capacity of cellular skin substitutes makes them highly effective in treating complex and chronic wounds, leading to improved patient outcomes and reduced healing times, thereby solidifying their position as the leading segment in the tissue-engineered skin substitutes market.

Tissue Engineered Skin Substitutes Market Segmentation - By Application

-

Chronic Wounds

-

Burns

-

Surgical Wounds

-

Others

The chronic wounds segment holds the largest market share in the wound care market, accounting for approximately 40% of the total. This significant share is primarily driven by the rising prevalence of chronic diseases such as diabetes, which significantly increases the risk of developing non-healing wounds like diabetic foot ulcers. Other conditions associated with chronic wounds include venous insufficiency, pressure ulcers, and peripheral arterial disease. The increasing aging population, coupled with the growing incidence of these chronic conditions, is further fueling the demand for effective wound care solutions, thereby driving the growth of the chronic wounds segment.

Tissue Engineered Skin Substitutes Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America dominates the global market with a 38% share, supported by well-established healthcare infrastructure, a high prevalence of chronic wounds, and significant R&D investments in tissue engineering. The U.S. leads the regional market, driven by the presence of major industry players and strong government support for regenerative medicine research. Canada also contributes to regional growth with its focus on advanced wound care solutions.

COVID-19 Impact Analysis

The COVID-19 pandemic significantly impacted the global tissue-engineered skin substitutes market, disrupting supply chains and delaying elective surgeries. However, the increased focus on healthcare and hygiene accelerated the adoption of advanced wound care products in critical care settings. Post-pandemic, the market is expected to witness robust growth as healthcare systems recover and investments in regenerative medicine increase. The demand for tissue-engineered solutions is likely to rise further, driven by the growing emphasis on improving healthcare outcomes and reducing hospital stays.

Latest Trends/Developments

The field of tissue-engineered skin substitutes is witnessing significant advancements. 3D bioprinting technology is revolutionizing the creation of customized skin substitutes, enabling the production of more personalized and effective treatments with improved outcomes and reduced rejection rates. A notable trend is the shift towards composite substitutes that combine acellular and cellular components, enhancing their functionality and mimicking the complex structure of native skin. Rising healthcare investments and increased awareness in emerging markets like Asia-Pacific and Latin America are driving demand for advanced wound care solutions. Furthermore, the industry is increasingly focused on sustainability, prioritizing eco-friendly manufacturing processes and the use of biodegradable materials. Finally, the clinical applications of tissue-engineered skin substitutes are expanding beyond wound healing to include cosmetic surgeries and reconstructive procedures, demonstrating the versatility and growing potential of this innovative technology.

Key Players

-

Integra LifeSciences Corporation

-

Smith & Nephew PLC

-

Organogenesis Holdings Inc.

-

Mölnlycke Health Care AB

-

Vericel Corporation

-

Acelity L.P. Inc. (3M)

-

Advanced Tissue

-

PolarityTE, Inc.

-

MiMedx Group, Inc.

-

Stratatech Corporation (A Mallinckrodt Company)

Chapter 1. Tissue Engineered Skin Substitutes Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Tissue Engineered Skin Substitutes Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Tissue Engineered Skin Substitutes Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Tissue Engineered Skin Substitutes Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Tissue Engineered Skin Substitutes Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Tissue Engineered Skin Substitutes Market – By Product Type

6.1 Introduction/Key Findings

6.2 Acellular Skin Substitutes

6.3 Cellular Skin Substitutes

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 7. Tissue Engineered Skin Substitutes Market – By Application

7.1 Introduction/Key Findings

7.2 Chronic Wounds

7.3 Burns

7.4 Surgical Wounds

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Tissue Engineered Skin Substitutes Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Tissue Engineered Skin Substitutes Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Integra LifeSciences Corporation

9.2 Smith & Nephew PLC

9.3 Organogenesis Holdings Inc.

9.4 Mölnlycke Health Care AB

9.5 Vericel Corporation

9.6 Acelity L.P. Inc. (3M)

9.7 Advanced Tissue

9.8 PolarityTE, Inc.

9.9 MiMedx Group, Inc.

9.10 Stratatech Corporation (A Mallinckrodt Company)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 2.8 billion in 2024 and is projected to reach USD 5.2 billion by 2030, growing at a CAGR of 10.8%.

Key drivers include the rising prevalence of chronic wounds and burns, technological advancements in tissue engineering, and increasing demand for minimally invasive treatments.

Segments include Product Type (Acellular, Cellular) and Application (Chronic Wounds, Burns, Surgical Wounds, Others).

North America dominates the market with a 38% share, driven by advanced healthcare infrastructure and significant R&D investments.

Major players include Integra LifeSciences Corporation, Smith & Nephew PLC, Organogenesis Holdings Inc., and Vericel Corporation.