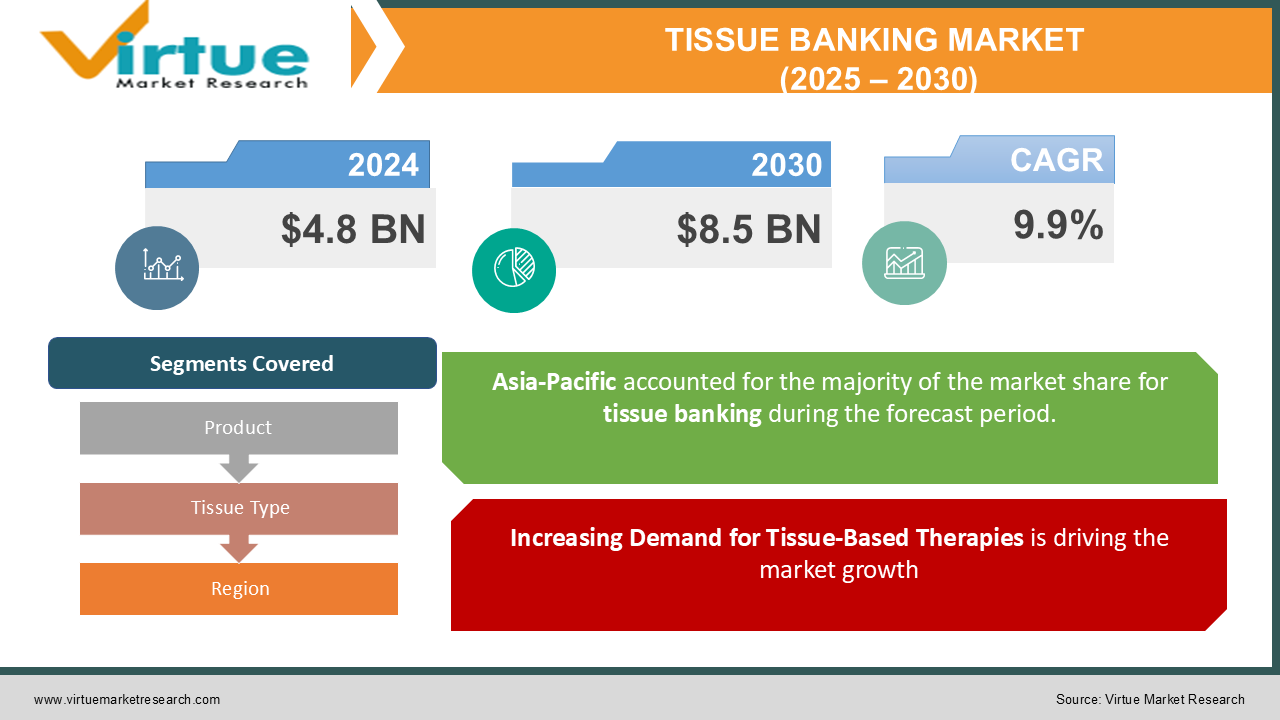

Tissue Banking Market Size (2025–2030)

The Global Tissue Banking Market was valued at USD 4.8 billion in 2024 and is anticipated to reach USD 8.5 billion by 2030, registering a CAGR of 9.9% during the forecast period of 2025–2030.

Tissue banking involves the collection, storage, and distribution of human tissues for medical research, education, and therapeutic purposes, playing a pivotal role in modern healthcare.

The market's growth is driven by increasing demand for tissue-based therapies, advancements in biopreservation technologies, and rising awareness of organ donation. The adoption of tissue banking is further propelled by its applications in regenerative medicine and the treatment of degenerative diseases.

Key Market Insights

-

Equipment holds the largest share in the product segment, accounting for over 40% of the market in 2024, owing to the increasing use of freezers, thawing devices, and monitoring systems.

-

Cardiovascular and bone tissues dominate the tissue type segment, driven by the growing prevalence of cardiovascular diseases and orthopedic conditions.

-

The hospitals segment is the largest end-user category, with more than 50% of the market share, as they play a critical role in tissue transplantation procedures.

-

North America leads the global market, contributing over 35% of the total revenue, followed by Europe, with its robust healthcare infrastructure and advanced research facilities.

-

Asia-Pacific is the fastest-growing region due to increasing healthcare investments and rising awareness of tissue donation.

-

Advancements in cryopreservation and biobanking technologies are transforming the efficiency and safety of tissue storage.

Global Tissue Banking Market Drivers

Increasing Demand for Tissue-Based Therapies is driving the market growth

The rise in chronic conditions and degenerative diseases, such as osteoarthritis, cardiovascular diseases, and corneal disorders, is fueling the demand for tissue-based therapies. Tissue transplantation has emerged as a critical solution for repairing and replacing damaged tissues, enhancing patient outcomes.

The growing need for tissue donation for cosmetic surgeries and burn treatments further drives the market. With the rise in healthcare spending and advancements in medical science, the demand for high-quality preserved tissues continues to escalate.

Advancements in Biopreservation and Cryopreservation Technologies is driving the market growth

Innovations in biopreservation technologies, such as advanced cryopreservation methods, have significantly improved the storage and viability of tissues. The integration of AI and IoT in tissue banking equipment has enhanced monitoring and preservation accuracy, reducing wastage and improving outcomes.

For instance, temperature-controlled systems with real-time monitoring capabilities are ensuring the safety and efficacy of stored tissues. These advancements are making tissue banking more reliable, boosting its adoption in healthcare and research.

Rising Awareness of Organ and Tissue Donation is driving the market growth

Government and non-governmental organizations are actively promoting awareness of organ and tissue donation through campaigns and initiatives. Public education efforts highlighting the life-saving potential of tissue donation are leading to an increase in donor registrations globally.

For example, campaigns like Donate Life America and World Organ Donation Day emphasize the importance of donation, driving public participation. This growing awareness is positively impacting the tissue banking market, increasing the availability of tissues for transplantation and research.

Global Tissue Banking Market Challenges and Restraints

High Costs of Equipment and Storage is restricting the market growth

The cost of tissue banking equipment, such as cryopreservation systems, freezers, and monitoring devices, is a significant barrier for small and medium-sized facilities. Additionally, maintaining optimal storage conditions for tissue preservation requires substantial operational expenditure.

In developing regions, the lack of funding and infrastructure further hampers the establishment of tissue banks. Despite technological advancements, cost-related challenges remain a key restraint, limiting the market's growth potential.

Ethical and Legal Concerns is restricting the market growth

Tissue banking is subject to stringent ethical guidelines and legal frameworks to ensure donor consent and tissue traceability. Variability in regulations across countries creates challenges for global tissue banking operations.

Ethical concerns related to donor rights and the commercialization of human tissues can impact public perception and participation. Ensuring compliance with regulatory standards while maintaining operational efficiency is a persistent challenge for market participants.

Market Opportunities

The tissue banking market presents significant opportunities for growth, particularly in the field of regenerative medicine. Tissues preserved in banks serve as critical resources for developing regenerative therapies, including stem cell-based treatments for degenerative diseases. As regenerative medicine gains traction globally, the demand for high-quality tissue samples is expected to rise.

Additionally, advancements in tissue engineering are opening new avenues for tissue banking. Researchers are exploring methods to create synthetic tissues and organs, further enhancing the scope of tissue banking applications. Collaborations between tissue banks and research institutes are likely to drive innovation, creating opportunities for market expansion.

Emerging markets, particularly in Asia-Pacific and Latin America, offer untapped potential due to rising healthcare investments and improving awareness of tissue donation. Manufacturers focusing on affordable and scalable tissue banking solutions are well-positioned to capture market share in these regions.

TISSUE BANKING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9.9% |

|

Segments Covered |

By Product, Tissue Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Thermo Fisher Scientific, Inc., Brooks Automation, Inc., BioLife Solutions, Inc., Avantor, Inc., PHC Corporation, Taylor-Wharton International LLC, Boekel Scientific, Chart Industries, Inc., Merck KGaA,Eppendorf AG |

Tissue Banking Market Segmentation - By Product

-

Equipment

-

Consumables

-

Media

Equipment leads the product segment due to its essential role in maintaining the viability of tissues during storage and transportation.

Tissue Banking Market Segmentation - By Tissue Type

-

Cardiovascular Tissues

-

Bone Tissues

-

Corneal Tissues

-

Skin Tissues

-

Others

Cardiovascular tissues, including heart valves, blood vessels, and heart patches, dominate the tissue type segment, driven by their extensive use in cardiac surgeries and vascular grafting procedures. Heart valve replacements are a common treatment for valvular heart disease, a condition that affects millions of people worldwide. These procedures often involve the implantation of tissue valves, such as aortic and mitral valves, to restore normal blood flow through the heart. Similarly, vascular grafts are used to bypass blocked or narrowed arteries, improving blood circulation to vital organs. These grafts can be sourced from human donors or manufactured using synthetic materials. The increasing prevalence of cardiovascular diseases, coupled with advancements in surgical techniques and tissue engineering, has fueled the demand for cardiovascular tissues. Additionally, the growing geriatric population, which is more susceptible to heart disease, further contributes to the dominance of this segment. As the healthcare industry continues to prioritize the treatment of cardiovascular diseases, the demand for high-quality cardiovascular tissues is expected to remain strong, driving the growth of the tissue banking industry.

Tissue Banking Market Segmentation - By End-User

-

Hospitals

-

Research Institutes

-

Tissue Banks

-

Others

Hospitals are the primary end-users of tissue grafts and transplants, accounting for a significant share of the market. These institutions possess the necessary infrastructure, specialized surgical teams, and advanced medical equipment to perform complex procedures like organ transplantation, bone grafting, and skin grafting. Hospitals often have dedicated transplant centers that coordinate the entire process, from donor identification and organ procurement to recipient selection and post-operative care. Additionally, hospitals are at the forefront of medical research and clinical trials, facilitating the development and adoption of innovative tissue engineering techniques and regenerative medicine therapies. This allows them to offer cutting-edge treatments and improve patient outcomes. Furthermore, hospitals play a crucial role in educating and training healthcare professionals in tissue transplantation and related procedures, ensuring a skilled workforce to meet the growing demand for these services. As the field of tissue transplantation continues to advance, hospitals will remain the primary end-user segment, driving the growth of the tissue banking industry.

Tissue Banking Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America leads the global tissue banking market, with the United States contributing the largest share. The region's dominance is attributed to its well-established healthcare infrastructure, high awareness of tissue donation, and extensive research activities.

Asia-Pacific is emerging as the fastest-growing region, driven by improving healthcare access, increasing organ donation rates, and government support for biobanking initiatives. Countries like China, India, and Japan are witnessing significant growth, supported by rising investments in medical infrastructure and research.

COVID-19 Impact Analysis

The COVID-19 pandemic had a dual impact on the tissue banking market. While elective procedures, including tissue transplantation, were postponed during the initial stages of the pandemic, the demand for biobanking increased as researchers sought tissues for studying the virus's impact. The pandemic highlighted the importance of tissue preservation for research and therapeutic purposes. Tissue banks played a crucial role in supporting COVID-19-related studies, creating a positive long-term impact on the market. Additionally, the increased focus on healthcare infrastructure development during the pandemic is expected to drive market growth in the coming years.

Latest Trends/Developments

Advanced monitoring systems leveraging AI and IoT technologies are revolutionizing tissue preservation and traceability. By employing sensors, data analytics, and machine learning algorithms, these systems enable real-time monitoring of critical parameters such as temperature, humidity, and oxygen levels, ensuring optimal tissue viability and preventing deterioration. Additionally, IoT-enabled devices facilitate automated data collection and analysis, streamlining operations and enhancing quality control. The establishment of large-scale biobanks is supporting research in regenerative medicine and personalized healthcare. These repositories store a diverse range of biological materials, including tissues, cells, and DNA samples, providing valuable resources for scientific investigations. Biobanks play a crucial role in advancing our understanding of diseases, identifying genetic markers, and developing innovative therapies. By facilitating collaborative research and enabling the sharing of biological materials, biobanks accelerate scientific discovery and contribute to the development of personalized medicine. Tissue banks are adopting eco-friendly practices to reduce their environmental footprint, such as energy-efficient storage systems, waste reduction initiatives, and sustainable packaging materials. By minimizing energy consumption, optimizing resource utilization, and implementing environmentally responsible practices, tissue banks can contribute to a more sustainable future. Additionally, some tissue banks are exploring innovative technologies, such as cryopreservation using environmentally friendly cryogens, to further reduce their environmental impact.

Key Players

-

Thermo Fisher Scientific, Inc.

-

Brooks Automation, Inc.

-

BioLife Solutions, Inc.

-

Avantor, Inc.

-

PHC Corporation

-

Taylor-Wharton International LLC

-

Boekel Scientific

-

Chart Industries, Inc.

-

Merck KGaA

-

Eppendorf AG

Chapter 1. Tissue Banking Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Tissue Banking Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Tissue Banking Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Tissue Banking Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Tissue Banking Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Tissue Banking Market – By Product

6.1 Introduction/Key Findings

6.2 Equipment

6.3 Consumables

6.4 Media

6.5 Y-O-Y Growth trend Analysis By Product

6.6 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Tissue Banking Market – By Tissue Type

7.1 Introduction/Key Findings

7.2 Cardiovascular Tissues

7.3 Bone Tissues

7.4 Corneal Tissues

7.5 Skin Tissues

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Tissue Type

7.8 Absolute $ Opportunity Analysis By Tissue Type, 2024-2030

Chapter 8. Tissue Banking Market – By End-User

8.1 Introduction/Key Findings

8.2 Hospitals

8.3 Research Institutes

8.4 Tissue Banks

8.5 Others

8.6 Y-O-Y Growth trend Analysis By End-User

8.7 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Tissue Banking Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By Tissue Type

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By Tissue Type

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By Tissue Type

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By Tissue Type

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By Tissue Type

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Tissue Banking Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Thermo Fisher Scientific, Inc.

10.2 Brooks Automation, Inc.

10.3 BioLife Solutions, Inc.

10.4 Avantor, Inc.

10.5 PHC Corporation

10.6 Taylor-Wharton International LLC

10.7 Boekel Scientific

10.8 Chart Industries, Inc.

10.9 Merck KGaA

10.10 Eppendorf AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 4.8 billion in 2024 and is projected to reach USD 8.5 billion by 2030, growing at a CAGR of 9.9%.

Key drivers include the increasing demand for tissue-based therapies, advancements in biopreservation technologies, and rising awareness of organ and tissue donation.

Segments include Product (Equipment, Consumables, Media), Tissue Type (Cardiovascular, Bone, Corneal, Skin, Others), and End-User (Hospitals, Research Institutes, Tissue Banks, Others).

North America dominates with over 35% of the market share, supported by advanced healthcare infrastructure and a high prevalence of tissue transplantation procedures.

Leading players include Thermo Fisher Scientific, Inc., Brooks Automation, Inc., BioLife Solutions, Inc., and others.