GLOBAL TIRE RECYCLING MARKET (2024 - 2030)

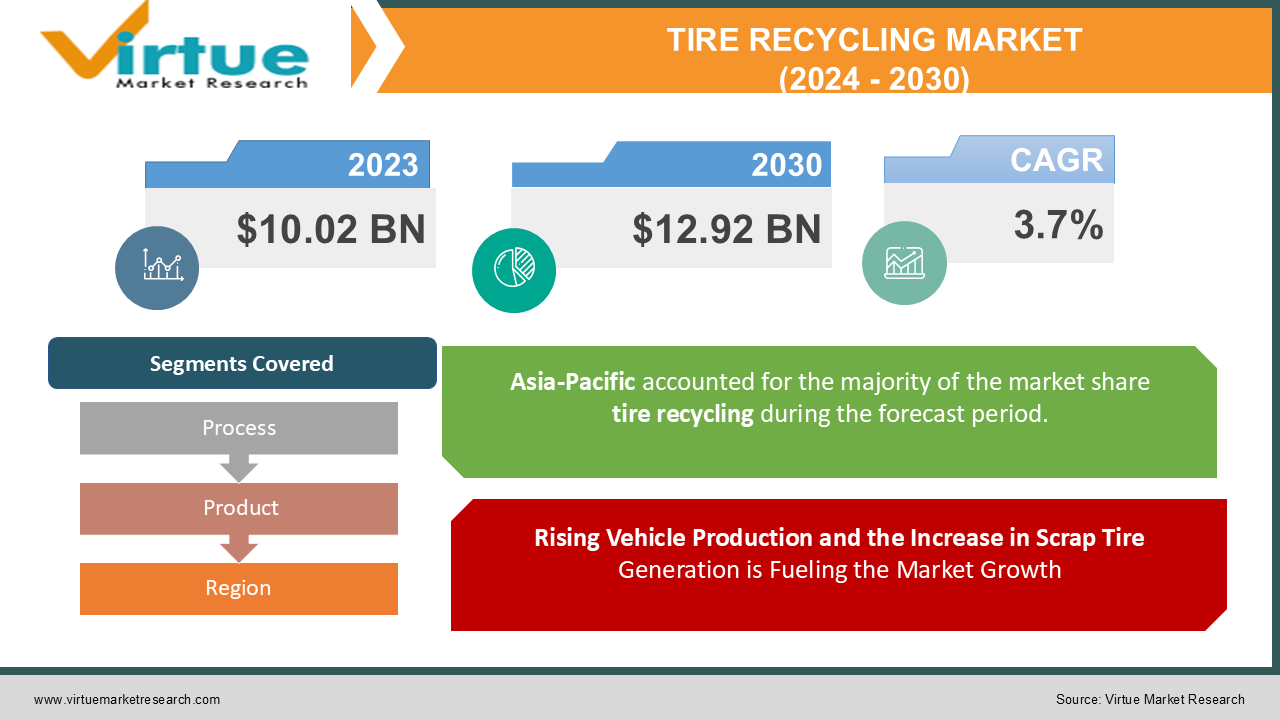

The Global Tire Recycling Market was valued at USD 10.02 Billion and is projected to reach a market size of USD 12.92 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.7%.

The Global Tire Recycling Market is currently experiencing a phase of dynamic expansion, marked by a myriad of factors steering its accelerated growth trajectory. As vehicles approach the end of their lifecycle, the demand for efficient tire disposal solutions rises, making tire recycling pivotal. The market's accelerated growth is fueled by a growing awareness of environmental sustainability and a proactive embrace of circular economy principles. Industries recognizing the significance of waste reduction are driving the soaring demand for recycled tire products, further supported by global government policies offering incentives and enforcing mandatory recycling targets.

Key Market Insights:

- The global tire recycling market is on a robust trajectory, projected to reach a substantial value of USD 14.68 billion by 2030, showcasing a commendable CAGR of 3.7% from 2024 to 2030. This growth is underpinned by escalating vehicle production, a concurrent surge in scrap tire generation, amplified demand for sustainable products, and the enforcement of government regulations favoring tire recycling. Notably, emerging markets in Asia-Pacific and Latin America are poised to lead this expansion, driven by rapid urbanization and heightened vehicle ownership. Concurrently, technological advancements, particularly in pyrolysis and devulcanization, are reshaping the tire recycling landscape, offering more efficient and cost-effective processing methods. These innovations result in the production of superior-quality recycled tire products, such as tire-derived fuel (TDF) and reclaimed rubber, expanding their utility across diverse applications.

- In a ground-breaking move, Michelin Group, a stalwart in global tire manufacturing, has unveiled a strategic partnership with Enviro, a prominent tire recycling entity in Europe. This collaborative venture aims to propel Michelin's tire recycling capacity in the region to new heights, with a notable surge of 25%. Central to this initiative is the establishment of a cutting-edge tire recycling facility in France, envisioned to boast an impressive annual capacity of 40,000 tons. This ambitious expansion not only marks a significant stride in environmental sustainability but also aligns seamlessly with Michelin's commitment to fostering a circular economy.

- Governments globally are actively driving tire recycling through strategic regulations and policies, employing a multifaceted approach. This includes the implementation of tax incentives, subsidies, and compulsory recycling targets to incentivize sustainable practices. Concurrently, efforts to standardize tire recycling practices aim to guarantee the uniformity and excellence of recycled tire products. Substantial research and development funding, a collaborative effort between governments and industry organizations, is being directed towards advancing tire recycling technologies, with a focus on enhancing the quality and cost-effectiveness of recycled tire products.

Global Tire Recycling Market Drivers:

Rising Vehicle Production and the Increase in Scrap Tire Generation is Fueling the Market Growth

The perpetual rise in global vehicle production has become a pivotal catalyst, intricately linked to a parallel upswing in the generation of scrap tires. This symbiotic relationship underscores the pressing need for effective waste management strategies as vehicles reach the end of their life cycles or incur irreparable damage. The automotive industry's incessant growth fuels an ever-expanding volume of discarded tires, intensifying the imperative for tire recycling solutions to responsibly address this burgeoning waste stream. As the wheels of vehicle manufacturing continue to turn, the challenge of managing the resultant scrap tire influx becomes increasingly prominent, propelling the tire recycling sector into a central role in sustainable waste management practices.

Navigating Environmental Concerns and Stringent Landfill Restrictions Driving the Market Growth.

As environmental awareness reaches new heights, the tire recycling market stands as a pivotal player in addressing the growing menace of scrap tire disposal. Stringent landfill restrictions, born out of escalating environmental concerns, have significantly altered the landscape of waste management. The inherent environmental hazards associated with landfilled tires, including the potential leaching of harmful chemicals into soil and groundwater, have prompted a critical revaluation of traditional disposal practices. In response, tire recycling emerges as a sustainable and environmentally friendly alternative, aligning with responsible waste management paradigms. The market's response to these concerns underscores its role not only in waste repurposing but also as a guardian of ecological well-being.

Embracing Sustainability: Tire Recycling through the Lens of Circular Economy Principles.

In an era where sustainability reigns supreme, the tire recycling market takes center stage as a beacon of responsible resource management. The global shift towards sustainable practices and the principles of the circular economy has propelled tire recycling into the forefront of environmentally conscious waste solutions. At its core, tire recycling exemplifies the essence of a circular economy by diverting discarded tires from conventional linear disposal methods and transforming them into valuable resources. This approach not only mitigates the environmental impact of tire waste but also aligns with the overarching goal of creating a closed-loop system where materials are continually repurposed. The symbiosis between sustainable practices and circular economy principles positions tire recycling as a transformative force in reshaping the narrative of waste management towards a more regenerative and eco-friendly paradigm.

Global Tire Recycling Market Restraints and Challenges:

Navigating the Complex Terrain of Collection and Transportation Logistics in Tire Recycling.

The process of efficiently collecting and transporting scrap tires from diverse origins, encompassing tire dealerships, auto repair shops, and construction sites, unveils a multifaceted challenge in the tire recycling realm. The dispersed nature of scrap tire generation not only introduces logistical intricacies but also escalates the overall cost dynamics associated with tire recycling initiatives. Establishing a streamlined and cost-effective infrastructure for the collection and transportation of scrap tires emerges as a critical linchpin in ensuring the feasibility and success of tire recycling endeavours. Overcoming these logistical hurdles becomes paramount for fostering a sustainable and economically viable tire recycling ecosystem.

Navigating the Labyrinth of Technological Limitations and Processing Costs in Tire Recycling.

The tire recycling landscape grapples with a significant challenge rooted in technological limitations and the ensuing processing costs. Innovative recycling technologies, such as pyrolysis and devulcanization, while offering promising solutions, present a dual challenge. The capital-intensive nature of these technologies, coupled with their substantial energy requirements, gives rise to heightened processing costs. This financial burden casts a shadow over the overall profitability of tire recycling operations, posing a formidable hurdle to the widespread adoption of advanced recycling methodologies. Addressing these technological constraints and exploring avenues to mitigate processing costs are imperative for unlocking the full potential of tire recycling, ensuring its economic viability and long-term sustainability.

Ensuring Quality Excellence and Consistency in Recycled Tire Products.

A nuanced challenge within the tire recycling domain revolves around maintaining stringent quality control standards and ensuring consistency in the products derived from recycled tires. The inherent variability in the composition and quality of scrap tires introduces a layer of complexity, requiring vigilant oversight to guarantee the uniformity and reliability of recycled materials. Achieving consistent quality is pivotal not only for meeting industry standards but also for instilling confidence in end-users. The tire recycling sector faces the imperative of implementing robust quality control measures and standardization processes to overcome these challenges. Addressing these intricacies is essential for bolstering market acceptance and expanding the diverse applications of recycled tire products.

Global Tire Recycling Market Opportunities:

Pioneering Progress: Unleashing the Potential through the Development of Advanced Recycling Technologies in the Tire Recycling Landscape.

The tire recycling market stands at the precipice of transformation, poised for unprecedented growth driven by the ongoing development of advanced recycling technologies. At the forefront of this evolution are ground-breaking processes like pyrolysis and devulcanization, holding the promise to revolutionize the tire recycling paradigm. These advanced technologies not only present avenues to enhance the quality of recycled tire products but also offer pathways to improve operational efficiency and cost-effectiveness. The ongoing commitment to research and development in these areas becomes a cornerstone, with strategic investments serving as catalysts for innovation. As tire recyclers embrace and implement these cutting-edge technologies, the industry is primed to elevate its capabilities, establish competitive advantages, and chart a course toward a more sustainable and economically viable future.

Diversification Horizons: Unlocking Growth through the Expansion into New Application Areas in the Tire Recycling Landscape.

Beyond traditional applications such as asphalt pavements and tire-derived fuel, the tire recycling market is on the brink of a paradigm shift through the exploration of new and diverse application areas. Recycled tire products, versatile and adaptive, hold untapped potential in realms such as construction materials, rubberized products, agricultural applications, and even the consumer goods sector. The strategic pursuit of these innovative application areas represents an unparalleled opportunity for the market to broaden its scope and impact. By actively venturing into new territories, the tire recycling industry can not only cater to evolving market demands but also foster sustainability through the creation of value-added products. This expansion strategy is poised to redefine the market landscape, unlocking hitherto unexplored growth avenues and propelling the tire recycling sector into a more diversified and dynamic future.

Forging Alliances: Catalyzing Progress through Collaborative Engagement among Stakeholders in the Tire Recycling Arena.

In the complex and interconnected world of tire recycling, the pathway to progress is illuminated by collaborative efforts among key stakeholders. This collaborative spirit transcends traditional boundaries and encompasses tire manufacturers, recyclers, policymakers, and consumers alike. Through unified engagement, stakeholders can create a supportive ecosystem that nurtures the tire recycling industry. Knowledge sharing becomes a cornerstone, fostering the exchange of insights and best practices. Standardization of processes emerges as a collective goal, ensuring consistency and reliability across the tire recycling spectrum. Moreover, collaborative efforts contribute to the formulation of effective policies, acting as a catalyst for the widespread adoption of tire recycling practices. As stakeholders join forces, they not only fortify the foundations of the tire recycling market but also pave the way for a sustainable future where the circular economy principles thrive, and recycled tire products become integral to a greener and more responsible world.

GLOBAL TIRE RECYCLING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.7 % |

|

Segments Covered |

By Process, Product and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Liberty Tire Recycling LLC, Genan Holding A/S, Scandinavian Enviro Systems AB, Rethink Tires, Champlin Tire Recycling Lakin Tire, Miami Tire Recycling Company New River Tire Recycling, reRubber, Entech Inc., Continental AG, Michelin Group S.A. |

Global Tire Recycling Market Segmentation:

Market Segmentation: By Process:

- Mechanical recycling

- Pyrolysis

- Devulcanization

Within the intricate framework of the global tire recycling market, mechanical recycling emerges as the largest and most established segment. Its ascendancy is underpinned by both maturity and widespread adoption across diverse industrial landscapes. The proven efficacy of mechanical recycling in reclaiming valuable materials from discarded tires underscores its significance. This method, characterized by its efficiency and well-established practices, not only mitigates environmental concerns but also represents a stalwart contributor to the circular economy. As industries prioritize sustainable practices, mechanical recycling stands tall as the cornerstone of tire recycling, playing a pivotal role in reshaping the fate of discarded tires.

While mechanical recycling holds the mantle, the tire recycling landscape is experiencing a seismic shift driven by innovation, with pyrolysis and devulcanization emerging as the fastest-growing segments. The forecast period anticipates a surge in the adoption of these advanced processes, propelled by their inherent potential to generate higher-value products and substantially curtail environmental impacts. Pyrolysis, through its transformative thermal decomposition, and devulcanization, with its capacity to rejuvenate vulcanized rubber, represents the cutting edge of tire recycling. This trajectory signifies not just a shift in scale but a fundamental evolution towards processes that promise enhanced value creation and a more sustainable approach to managing end-of-life tires.

Market Segmentation: By Product

- Tire-derived fuel (TDF)

- Crumb rubber

- Refurbished tires

- Other recycled tire products

At the forefront of the global tire recycling market stands Tire-derived fuel (TDF), commanding the largest segment. Its dominance is rooted in the compelling attributes of high energy density, making it a formidable alternative, and its inherent potential to diminish reliance on conventional fossil fuels. TDF, with its efficient utilization of discarded tires, not only addresses environmental concerns but also aligns with the broader agenda of reducing the carbon footprint. As industries seek sustainable energy solutions, TDF emerges as a reliable and impactful contributor, solidifying its position as the foremost segment in the tire recycling landscape.

In the dynamic evolution of tire recycling, refurbished tires emerge as the fastest-growing segment, poised for accelerated expansion during the forecast period. This momentum is fueled by a confluence of factors, prominently the strides in re-treading technologies that enhance the viability and quality of refurbished tires. Additionally, a surging demand for sustainable alternatives amplifies the growth trajectory of this segment. Consumers, driven by environmental consciousness, increasingly opt for refurbished tires, creating a shift in market dynamics. The forecasted surge in demand underlines the industry's responsiveness to advancing technologies and a growing market appetite for eco-friendly alternatives, positioning refurbished tires as a key driver in the future landscape of tire recycling.

Market Segmentation: By Region:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In the dynamic landscape of tire recycling, Asia-Pacific emerges as an unrivaled leader, solidifying its status as the largest market segment with an impressive market share of 45%. This commanding presence is not merely a statistical triumph but is emblematic of the region's substantial contributions to the global tire recycling paradigm. Propelled by robust initiatives, continual technological advancements, and a growing commitment to sustainable practices, Asia-Pacific stands at the forefront of shaping the trajectory of tire recycling on a global scale.

Beyond its sheer size, Asia-Pacific stakes its claim as the fastest-growing market segment, maintaining an equally substantial market share of 45%. This rapid ascent underscores a dynamic and evolving market landscape, fueled by the confluence of factors such as escalating industrialization, a heightened environmental consciousness, and a proactive adoption of tire recycling solutions. Asia-Pacific's dual distinction, both in size and growth, not only signifies its current dominance but positions the region as a pivotal force steering the future of tire recycling.

COVID-19 Impact Analysis on the Global Tire Recycling Market:

The onset of the COVID-19 pandemic brought forth a series of challenges for the global tire recycling market. Disruptions reverberated through the supply chain, causing impediments to the seamless flow of scrap tires and essential raw materials to recycling facilities. This tumultuous environment not only resulted in shortages of recycled tire products but also inflicted heightened operational costs upon tire recycling companies. Concurrently, a reduction in demand for recycled tire products unfolded as various industries, including construction and automotive manufacturing, grappled with slowdowns and shutdowns. The consequent decline in demand cast a shadow on the profitability of tire recycling enterprises. Compounding these challenges, labor shortages further hampered production capacity, impeding the ability of tire recycling companies to meet market demands.

While the pandemic cast a shadow of adversity, it also catalyzed positive shifts within the tire recycling landscape. The heightened awareness of environmental sustainability, amplified by the pandemic's global impact, holds the promise of fostering increased demand for recycled tire products in the long term. The crisis acted as a catalyst for a deeper embrace of circular economy principles, emphasizing resource recovery and waste reduction. In alignment with these principles, the tire recycling industry stands poised for a potential resurgence. Government initiatives worldwide, recognizing the importance of sustainable industries, have offered financial and regulatory support. This backing not only aids in the recovery of tire recycling companies but also propels the industry toward further innovation and expansion, paving the way for a more resilient and sustainable future.

Latest Trends/Developments:

In the dynamic landscape of tire recycling, a wave of technological advancements is reshaping traditional paradigms, ushering in an era of enhanced efficiency and diversified applications. The forefront of this transformation is marked by the ascendance of pyrolysis and devulcanization technologies, heralded as more efficient and cost-effective alternatives to conventional mechanical recycling methods. These cutting-edge processes not only signify a quantum leap in recycling capabilities but also yield higher-quality products, including tire-derived fuel (TDF) and reclaimed rubber.

A pivotal development in tire recycling comes in the form of smart tire recycling systems, where innovation converges with artificial intelligence. These systems, intricately designed to optimize the sorting and separation of tire components, herald a new era of operational efficiency and waste reduction. By leveraging sensors and machine learning algorithms, smart tire recycling systems transcend conventional methods, precisely identifying and classifying diverse tire materials.

In tandem with these strides, tire recycling researchers are at the vanguard of exploring emerging technologies that promise to redefine the landscape. Among these, microwave-assisted pyrolysis and solvolytic processes emerge as frontrunners. These cutting-edge methodologies hold the potential to further elevate the quality and efficiency of recycled tire products.

Key Players:

- Liberty Tire Recycling LLC

- Genan Holding A/S

- Scandinavian Enviro Systems AB

- Rethink Tires

- Champlin Tire Recycling

- Lakin Tire

- Miami Tire Recycling Company

- New River Tire Recycling

- reRubber

- Entech Inc.

- Continental AG

- Michelin Group S.A.

A cadre of pioneering companies, including Liberty Tire Recycling, Genan Holding, and Scandinavian Enviro Systems, stands at the forefront of the global tire recycling industry, championing innovation and sustainability. With operations spanning North America, Europe, and Asia, these leaders utilize cutting-edge technologies, such as pyrolysis and devulcanization, to produce high-quality recycled tire products like crumb rubber and tire-derived fuel. Committed to a circular economy, they are reshaping tire waste management, reducing environmental impact, and creating a sustainable future where discarded tires find new life as valuable resources.

Chapter 1. GLOBAL TIRE RECYCLING MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL TIRE RECYCLING MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL TIRE RECYCLING MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL TIRE RECYCLING MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL TIRE RECYCLING MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL TIRE RECYCLING MARKET – By Process

6.1. Mechanical recycling

6.2. Pyrolysis

6.3. Devulcanization

Chapter 7. GLOBAL TIRE RECYCLING MARKET – By Product

7.1. Tire-derived fuel (TDF)

7.2. Crumb rubber

7.3. Refurbished tires

7.4. Other recycled tire products

Chapter 8. GLOBAL TIRE RECYCLING MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Process

8.1.3. By Product

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Process

8.2.3. By Product

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Process

8.3.3. By Product

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Process

8.4.3. By Product

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Process

8.5.3. By Product

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL TIRE RECYCLING MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Liberty Tire Recycling LLC

9.2. Genan Holding A/S

9.3. Scandinavian Enviro Systems AB

9.4. Rethink Tires

9.5. Champlin Tire Recycling

9.6. Lakin Tire

9.7. Miami Tire Recycling Company

9.8. New River Tire Recycling

9.9. reRubber

9.10. Entech Inc.

9.11. Continental AG

9.12. Michelin Group S.A.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Tire Recycling Market was valued at USD 10.02 Billion and is projected to reach a market size of USD 12.92 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.7%.

Liberty Tire Recycling LLC, Genan Holding A/S, Scandinavian Enviro Systems AB, Rethink Tires, Champlin Tire Recycling, Lakin Tire, Miami Tire Recycling Company, New River Tire Recycling, reRubber, Entech Inc., Continental AG, Michelin Group S.A.

Asia-Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2030).

In 2023, the Asia-Pacific accounts for the biggest market share in the Tire Recycling Market.

The Global Tire Recycling Market is propelled by rising vehicle production, generating more scrap tires, and environmental concerns, prompting the adoption of sustainable practices like tire recycling to mitigate environmental impact. The focus on circular economy principles enhances the demand for recycled tire products, driving market growth.