Tire Derived Fuel Market Size (2024 – 2030)

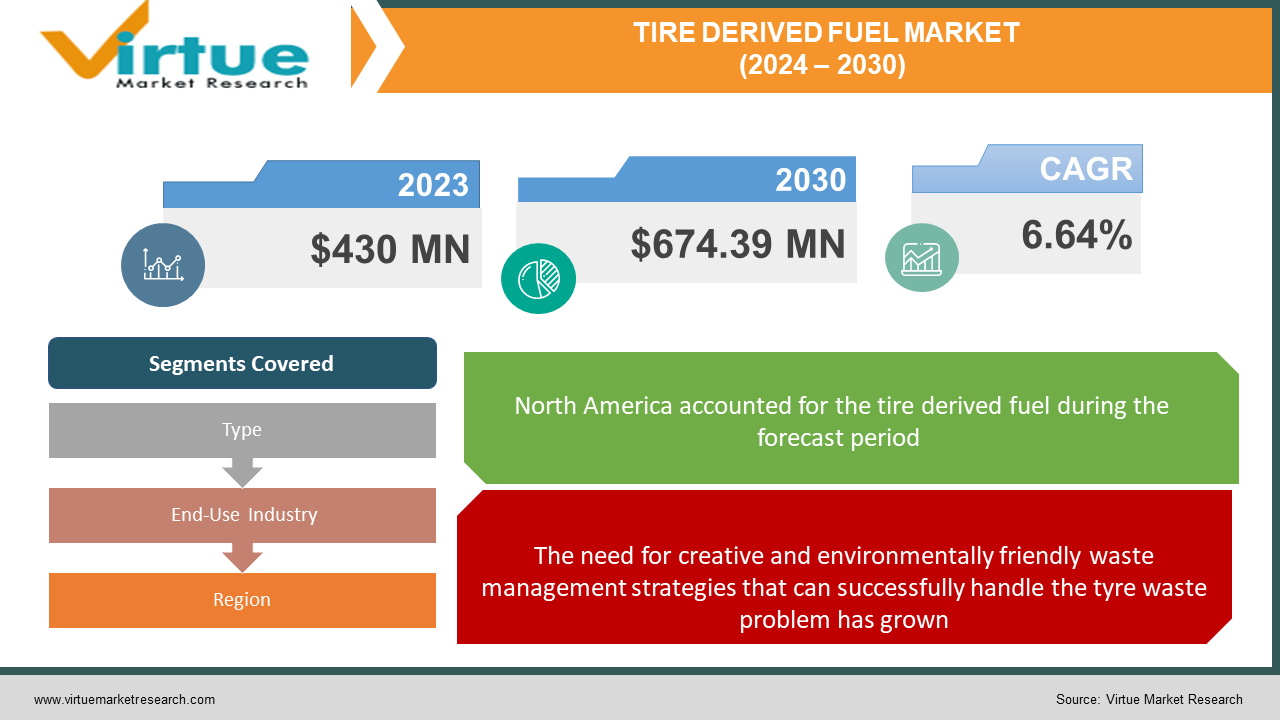

The Tire Derived Fuel Market was valued at USD 430 Million in 2024 and is projected to reach a market size of USD 674.39 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.64%.

The ubiquity of automobiles in the modern world has led to a corresponding problem: billions of tires are discarded annually, posing a major environmental challenge. However, tire-derived fuel (TDF) provides an innovative approach to transform this waste stream into a valuable energy resource. TDF is produced through the processing of scrap tires. These tires can be whole, shredded, or chipped to suit specific industrial uses. High energy content and a composition that allows for cleaner burning than some traditional fuels make TDF an attractive option, especially for industries requiring intense heat. With mounting pressure to address tire waste, TDF offers a solution that reduces landfill dependence and avoids the harmful impacts of improper tire disposal. TDF is a desirable fuel because of the high temperatures and extended residence times in cement kilns, which guarantee full combustion. Furthermore, the ash generated combines with the finished cement product. Due in major part to rapid industrialization and large-scale tyre manufacturing in the Asia Pacific region, the worldwide TDF market is expanding gradually. Due to its early adoption of TDF technology, North America also commands a sizeable portion of the market. The waste tyre supply is subject to fluctuations, and other fuels pose competition. Despite these obstacles, the TDF market exhibits encouraging growth prospects. TDF has the potential to significantly reduce trash, fuel costs, and harmful emissions as the push for sustainable waste management and alternative energy sources grows. TDF has the potential to become a common energy solution in many areas of the global economy with ongoing research and supportive laws.

Key Market Insights:

In many applications, TDF offers a significant cost advantage over traditional fuels. This is especially attractive for industries with high energy demands, such as cement manufacturing and power generation. By switching to TDF, these businesses can reduce operational expenses and improve their bottom line. While TDF promotes waste reduction and can have a lower emission profile than some fossil fuels, careful consideration is needed for its environmental impact. Proper combustion technology and emissions control systems are essential to minimize pollution risks associated with TDF use. Rigorous environmental regulations play a significant role in ensuring TDF's responsible deployment. The steady supply of waste tyres is essential to the TDF market. The production of TDF can be impacted by variations in feedstock contamination or tyre disposal rates. The industry is creating plans to increase tyre collection networks and enhance quality control procedures in order to handle feedstock unpredictability. The Asia Pacific region is a key hub for the TDF market due to its sizable and expanding industrial sectors and enormous production of waste tyres.

Tire Derived Fuel Market Drivers:

The need for creative and environmentally friendly waste management strategies that can successfully handle the tyre waste problem has grown.

The environmental conscience of the world is awakening, and waste management practices are under increasing scrutiny. Traditional methods of disposing of used tires, like stockpiling and landfilling, are demonstrably unsustainable. Stockpiles pose fire hazards and attract disease-carrying pests while landfilling tires take up valuable space and can lead to environmental contamination due to their slow biodegradability and potential leaching of harmful compounds. TDF offers a compelling alternative. By transforming used tires into a fuel source, several key benefits emerge. Every ton of TDF used displaces a ton of coal or other traditional fuel sources, reducing landfill burden and extending their lifespan. TDF creates a valuable energy resource from a waste product, embodying the principles of a circular economy. Instead of ending up in landfills, used tires are given a "second life" as fuel. Utilizing TDF as fuel can potentially lower greenhouse gas emissions compared to coal, particularly when considering the environmental costs of mining and transporting coal. Ensuring proper combustion and emission control measures is crucial to minimize potential air pollution concerns. Upgrading facilities to handle TDF may require upfront investment, although the long-term economic and environmental benefits can be substantial.

Another significant driver propelling the tire-derived fuel market is the array of economic advantages associated with its utilization.

Managing tire waste incurs expenses from transportation and storage to potentially paying for landfill space. TDF shifts the paradigm, transforming waste disposal costs into potential revenue streams. Industries utilizing TDF can often lower their energy bills compared to traditional fuels, particularly if there are incentives or subsidies in place for renewable energy sources. This makes TDF compelling for energy-intensive sectors. Investing in TDF infrastructure isn't just about the environment; it generates employment. Tire collection, processing plants, and logistics provide jobs and economic activity in the regions where they operate. Reducing reliance on imported fossil fuels can insulate industries and even nations from price volatility and supply chain disruptions. TDF, as a locally sourced alternative, improves resilience. Industries that embrace TDF may position themselves as environmentally conscious businesses. This can appeal to consumers and even investors, giving them a competitive edge in a sustainability-focused market. Government incentives, whether direct financial support or favorable tax treatment for TDF use, further sweeten the deal. These incentives encourage investment and make it easier for industries to adopt TDF for its economic benefits.

Tire Derived Fuel Market Restraints and Challenges:

While using TDF has several benefits, such as assisting in the sustainable management of waste and possibly lowering dependency on non-renewable energy sources, some stakeholders are worried about possible emissions from burning TDF.

Although TDF has several benefits, such as helping with sustainable waste management and possibly lowering dependency on non-renewable energy sources, some stakeholders are worried about the possible emissions that could result from burning TDF. The main source of these worries is the belief that burning Tyres could cause the release of hazardous materials into the atmosphere, including Sulphur dioxide, heavy metals, and particulate matter. It is important to acknowledge that the TDF industry has made tremendous progress in resolving these difficulties through enhanced processing methods and stringent monitoring and compliance procedures, even though these worries are legitimate and should be treated carefully. Steel belts, fibers, and other impurities are eliminated from scrap tires using specialized machinery and techniques, guaranteeing that the final TDF product satisfies strict quality requirements and reduces the possibility of dangerous emissions. The logistical and operational issues related to the handling, storage, and transportation of TDF represent another significant obstacle for the market for TDF. TDF is a large, irregularly shaped substance that presents storage and transportation issues, in contrast to conventional fossil fuels. The safe and effective handling of TDF may necessitate specialized infrastructure and equipment, which could raise the overall operating costs for facilities using this fuel source. Furthermore, the logistical and financial sustainability of the TDF supply chain may be impacted by the accessibility and closeness of scrap Tyre suppliers to TDF processing plants. There may be insufficient or geographically distant supplies of scrap tyres in some areas, which would raise transportation expenses and therefore lower the economic viability of TDF as an alternative fuel source. Moreover, the implementation of TDF can necessitate infrastructure and equipment improvements or adjustments at current facilities, which can be quite expensive. This initial capital cost may serve as a deterrent to the wider use of TDF as an alternative fuel source, especially for smaller or resource-constrained businesses.

Tire Derived Fuel Market Opportunities:

While TDF has gained significant traction in sectors like cement production and pulp and paper mills, there's untapped potential for its adoption across a broader industrial landscape. Industries requiring high heat or possessing suitable combustion systems, such as steel production or certain types of chemical manufacturing, could represent new frontiers for TDF usage. This expansion requires targeted research, demonstrating the technical and economic feasibility of TDF in these sectors, along with adaptation of combustion technologies where necessary. Currently, TDF is often viewed primarily as a solution to tire waste. However, a significant opportunity lies in shifting this perception towards viewing TDF as a valuable energy resource. Scrap tires contain not only a high energy content but also elements like steel and other potentially recoverable materials. Developing integrated tire recycling processes focused on maximizing resource extraction can create additional revenue streams for the industry and further enhance its sustainability profile. Global movements towards sustainability, decarbonization, and combating climate change are increasingly at the forefront of both corporate agendas and government policies.

TIRE DERIVED FUEL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.64% |

|

Segments Covered |

By Type, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Liberty Tire Recycling, Lakin Tire, Ragn-Sells Group, ResourceCo, Globarket Tire Recycling, Emanuel Tire |

Tire Derived Fuel Market Segmentation: By Type

-

Shredded Tires

-

Tire-Derived Aggregate (TDA)

-

Crumb Rubber

-

Tire-Derived Fuel Pellets

Shredded Tires: Shredded tires, also known as tire shreds or chips, are one of the most commonly used forms of TDF. These are produced by shredding scrap tires into irregularly shaped pieces ranging from 2 to 8 inches in size. Shredded tires account for a significant share of the TDF Market, estimated to be around 45-50%. This type of TDF is widely used in cement kilns and boilers due to its high calorific value and consistent energy content. Tire-Derived Aggregate (TDA): Tire-Derived Aggregate (TDA) is a form of TDF where scrap tires are shredded into smaller, more uniform pieces, typically ranging from 0.5 to 2 inches in size. TDA is often used as a lightweight fill material in civil engineering projects, such as road construction, landfill liners, and drainage applications. Although its use as a fuel source is limited, TDA holds a smaller share of the overall TDF Market, estimated to be around 10-15%. Crumb Rubber: Crumb rubber is a finely ground form of TDF, produced by further processing shredded tires into smaller particles ranging from 1/4 inch to a fine powder-like consistency. Crumb rubber finds applications in various industries, including rubber manufacturing, asphalt modification, and sports surfaces. While crumb rubber has limited direct use as a fuel source, it represents a smaller portion of the TDF Market, estimated to be around 5-10%. Tire-Derived Fuel Pellets: Tire-Derived Fuel Pellets, or TDF pellets, are a relatively new and innovative form of TDF. These pellets are manufactured by compressing and compacting shredded tire material into uniform, densified cylindrical shapes. TDF pellets offer several advantages, including improved handling, transportation, and storage characteristics, as well as consistent energy content and combustion properties. Despite being a relatively new product, TDF pellets are gaining traction and are expected to be one of the fastest-growing segments of the TDF Market, with an estimated share of around 15-20%.

Tire Derived Fuel Market Segmentation: By End-Use Industry

-

Cement Industry

-

Power Generation

-

Pulp and Paper Mills

-

Industrial Boilers

-

Other End-Users

Cement Industry: One of the biggest and most important end markets for TDF is the cement industry. Significant amounts of energy are needed in cement kilns to reach the high temperatures required for the production process. For cement producers, TDF presents an alluring substitute fuel source since it offers a steady and dependable energy source and supports environmentally friendly waste management techniques. An estimated 40–45% of the global TDF market is accounted for by the cement sector. Power Generation: Another significant end-user of TDF is the power generation sector. TDF can replace a portion of the fuel used by power plants, especially those that burn coal or other fossil fuels, to lessen their dependency on non-renewable energy sources and their carbon footprint. TDF is utilised in circulating fluidized bed combustion, TDF-fired power plants, cofiring in boilers, and other power production applications. Reportedly, the power-generating industry accounts for 25–30% of the total TDF market share. Pulp & Paper Mills: TDF has been included by the pulp and paper sector as an additional fuel source for their operations. Significant amounts of energy are needed in pulp and paper mills for operations including steam generating, heating, and drying. TDF supports the industry's initiatives to lessen its environmental impact by providing a cost-effective and environmentally friendly substitute for conventional fossil fuels. The pulp and paper sector, projected to account for 10–15% of the total TDF market, is a smaller but still expanding segment. Industrial Boilers: Another end-user market for TDF is industrial boilers, which are utilised in a variety of manufacturing operations. By using TDF as an additional fuel source in their boilers, businesses in the chemical, pharmaceutical, and food processing industries can lessen their dependency on conventional fossil fuels and save their overall energy expenses. Estimated to be between 5 and 10% of the total TDF market, the industrial boiler category has a small proportion. Other End-Users: Other end-user sectors have also expressed interest in TDF due to its adaptability. These include the steel and mining industries, where TDF can be employed in mineral processing operations and as an additional fuel source in steel-making processes. Furthermore, TDF may be used as an alternative fuel in smaller-scale applications like boilers used in businesses and institutions. Together, these "other" end customers make up a lesser share of the TDF market—between five and ten percent, according to estimates.

Tire Derived Fuel Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

With an estimated 35–40% of the worldwide TDF market, the North American area dominates the market. In the TDF Market, North America—more specifically, the US and Canada—is one of the most important regions. These nations' well-established infrastructure and laws facilitate the use of TDF in a variety of industries, such as pulp & paper, cement, and power generation. Europe is thought to hold a significant 25–30% portion of the worldwide market. Europe is a major player in the TDF Market since it was a pioneer in adopting circular economy ideas and sustainable energy solutions. Favorable laws and incentives have been put in place by nations including Germany, the UK, and Italy to encourage the use of TDF in a variety of industrial applications. Approximately 20–25% of the global TDF market is accounted for by the Asia-Pacific region. Because of the growing need for sustainable waste management solutions and the rising need for energy, the Asia-Pacific area is turning into a fast-expanding market for TDF. Recognizing TDF's potential, nations like China, South Korea, and Japan are making significant investments in infrastructure and legislative frameworks to encourage its adoption. Countries in Latin America, including Brazil, Mexico, and Argentina, have expressed interest in using TDF as a waste management and sustainable energy source. The Middle East and Africa region has comparatively lower TDF adoption rates because of several variables, such as the quantity of traditional fossil fuel supplies, lack of infrastructure, and regulatory impediments

COVID-19 Impact Analysis on the Tire Derived Fuel Market:

Lockdowns and economic uncertainty led to decreased production in key TDF-using industries like cement and power generation. This directly reduced the demand for TDF. Disruptions in the waste management sector, along with workforce restrictions, hindered the collection and processing of scrap tires – the lifeblood of TDF production. This led to potential supply shortages and price fluctuations. Companies understandably focused on immediate concerns related to worker safety and navigating the unprecedented business environment created by the pandemic. The pandemic, while disruptive, brought environmental concerns to the forefront of many businesses' strategies. TDF, with its waste-to-resource approach, offered an attractive waste management and energy solution. As cement manufacturers, power generators, and other TDF users adapted to the 'new normal,' demand for TDF recovered, driven by the continuous need for reliable and affordable fuel. Waste management and TDF production facilities implemented safety measures and optimized their logistics to maintain a steady supply of tires, ensuring the market could meet recovering demand. The COVID-19 pandemic highlighted both the vulnerabilities and the potential of the TDF market. The importance of robust supply chains, adaptable industries, and the pursuit of sustainable solutions – all of which TDF embodies – have become even more apparent. The challenges faced during the pandemic are likely to spur innovation and long-term strategies for the market to better weather future disruptions.

Latest Trends/ Developments:

Research focuses on improving tire preprocessing techniques to remove contaminants, resulting in TDF with lower emissions when burned. This addresses potential environmental concerns and opens TDF up to more stringent applications. Development of combustion systems designed specifically for TDF use. These optimize fuel utilization, boosting energy efficiency and reducing pollutants. Exploring the potential of TDF in waste-to-energy plants, where it can be combined with other waste streams to generate electricity and heat. Research into incorporating TDF (often ground into smaller fractions) into building materials like asphalt or concrete mixes. This innovative approach further taps into TDF's potential within a circular economy. An increasing number of governments are implementing policies that incentivize the use of alternative fuels and promote responsible tire disposal. This is a major driver for the TDF market. The potential inclusion of TDF in carbon trading schemes could create new revenue streams for TDF producers and further incentivize its adoption. The emergence of online platforms connecting scrap tire suppliers with TDF producers can streamline transactions and improve supply chain efficiency.

Key Players:

-

Liberty Tire Recycling

-

Lakin Tire

-

Ragn-Sells Group

-

ResourceCo

-

Globarket Tire Recycling

-

Emanuel Tire

Chapter 1. Tire Derived Fuel Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Tire Derived Fuel Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Tire Derived Fuel Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Tire Derived Fuel Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Tire Derived Fuel Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Tire Derived Fuel Market – By Type

6.1 Introduction/Key Findings

6.2 Shredded Tires

6.3 Tire-Derived Aggregate (TDA)

6.4 Crumb Rubber

6.5 Tire-Derived Fuel Pellets

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Tire Derived Fuel Market – By End-Use Industry

7.1 Introduction/Key Findings

7.2 Cement Industry

7.3 Power Generation

7.4 Pulp and Paper Mills

7.5 Industrial Boilers

7.6 Other End-Users

7.7 Y-O-Y Growth trend Analysis By End-Use Industry

7.8 Absolute $ Opportunity Analysis By End-Use Industry , 2024-2030

Chapter 8. Tire Derived Fuel Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By End-Use Industry

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By End-Use Industry

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By End-Use Industry

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By End-Use Industry

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By End-Use Industry

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Tire Derived Fuel Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 Liberty Tire Recycling

9.2 Lakin Tire

9.3 Ragn-Sells Group

9.4 ResourceCo

9.5 Globarket Tire Recycling

9.6 Emanuel Tire

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Billions of tires are discarded annually, posing environmental hazards like landfill overflow and fire risks. TDF offers a solution by diverting tires from traditional disposal methods.

Although TDF can reduce reliance on some fossil fuels, careful attention must be paid to the emissions generated during its combustion. The release of certain pollutants like heavy metals or particulate matter is a concern.

Liberty Tire Recycling, Lakin Tire, Ragn-Sells Group, ResourceCo, Globarket Tire Recycling, Emanuel Tire.

North America currently holds the largest market share, estimated at around 40%.

The Asia Pacific exhibits the fastest growth, driven by its increasing population, and expanding economy.