Tine Seed Drill Market Size (2023-2030)

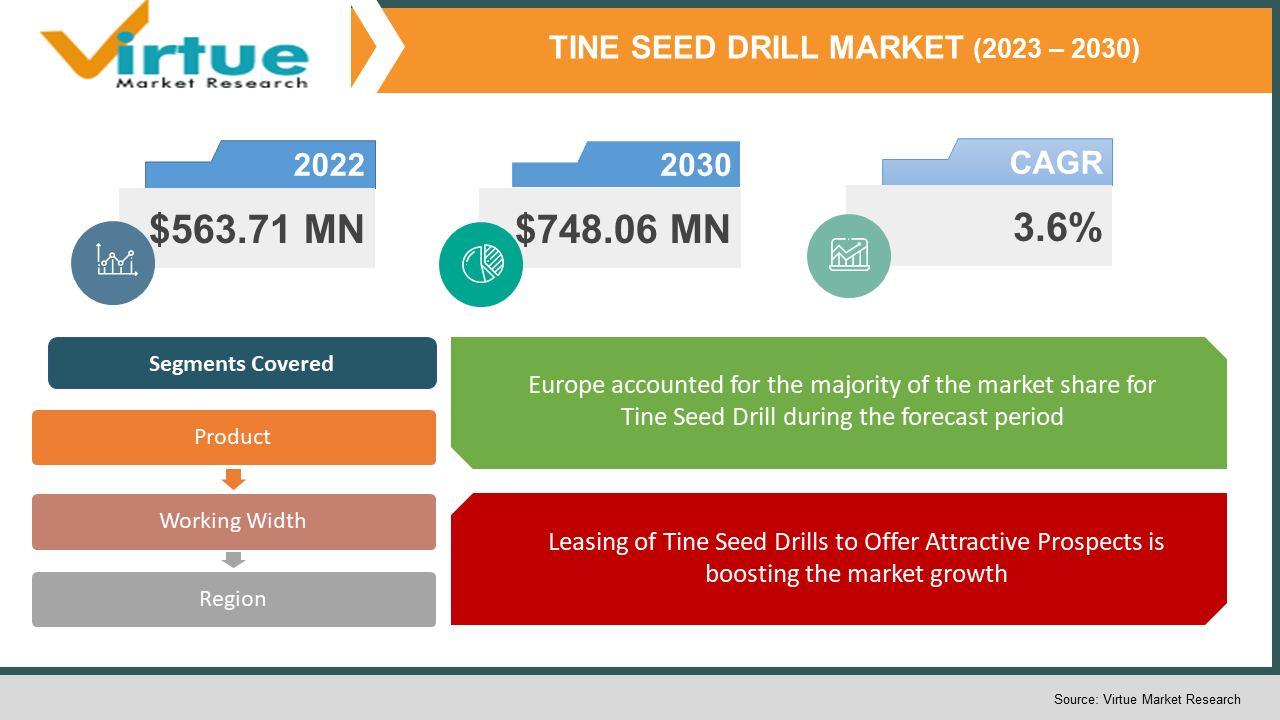

According to the report published by Virtue Market Research in 2022, the Global Tine Seed Drill Market was valued at $563.71 million, and is projected to reach a market size of $748.06 million by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 3.6%.

INDUSTRY OVERVIEW

Farm production is increased by using seed drill machines to sow seeds at a set depth and distance. Birds used to consume the seeds that were tossed after the growing procedure in the past. Additionally, it led to inconsistent seed planting, which had an impact on crop development and left the crop undernourished from a lack of enough sunshine and minerals. The seed drill machines, on the other hand, aid in maintaining regularity and space between seeds, which deters birds from eating them and eventually increases crop productivity. To increase farm production, seed drill machines are mostly utilized for seed plantings in agricultural settings at a specified depth and distance. Crops may develop poorly if seeds are sown unevenly because they won't receive the right nutrients and sunshine. As a large portion of the population migrates to non-farm jobs, resulting in a shortage of available labor, seed drill machines are becoming more and more prevalent. Along with this, the increased use of seed drill machines is being caused by growing knowledge of the advantages of employing seed drills rather than hand sowing. Due to its versatility and ability to manage grass weeds thanks to the introduction of pre-emergent herbicides, which is more common in this market, tine seed drill machines are highly preferred. With a market share of 47.6%, disc seed drill machines are estimated to grow at a 3.1% CAGR during the assessment period. These seed drills work well under ideal circumstances, but when used under less-than-perfect circumstances, they have several drawbacks. Demand is also estimated to be fueled by the growing trend of leasing seed drill equipment, and the market is estimated to grow by 147 BPS during the forecast years of 2023 and 2030.

COVID-19 IMPACT ON THE TINE SEED DRILL MARKET

Due to lockdowns, travel restrictions, and company lockdowns, the COVID-19 problem is having an impact on the economics and industries of many different nations. Serious disruptions in the global materials business are occurring, including workplace closures and interruptions in the supply chain. China is one of the most hit nations and a major centre for manufacturing and the supply of raw materials to many different sectors. Manufacturing, delivery schedules, and sales of various materials are all being hampered by the lockdown of several industries and facilities in China. Many businesses warned of potential delays in product shipments and declines in future sales of their goods. All of these things are predicted to hurt the worldwide market for tine seed drill machines.

MARKET DRIVERS:

Incrementing Agricultural Production to Support the Growth in Demand for Tine Seed Drill Machines

One of the most important economic sectors is agriculture, which boosts food security while also increasing global GDP. Over the course of the assessment period, the global push to boost agricultural output to sustain the growing population will drive market expansion for tine seed drill machines. The world population will reach a peak of 9.7 billion people by 2064, predicts a study financed by the Global Burden of Disease study and published by The Lancet in 2020. Therefore, the agricultural output must be increased through increased productivity to provide food security for this enormous population. This will need the use of tine seed drill machines, and their demand is anticipated to increase by 27% over the projected period.

Leasing of Tine Seed Drills to Offer Attractive Prospects is boosting the market growth

Due to the increased popularity of renting seed drill equipment among farm owners, new rental companies are opening up to meet the market's expanding demand. Due to the deteriorating notion of equipment ownership, the leasing of tine seed drills is anticipated to gain traction in the future. Additionally, leasing reduces operational expenses, opening up appealing possibilities and chances in the market for tine seed drill machines across the world. The market is estimated to increase by 1.1X between 2023 and 2030 as a result of this trend.

MARKET RESTRAINTS:

The covid-19 outbreak negatively impedes the market growth.The closures of various factories and plants hurt delivery times, global supply chains, production, and material sales, which is further estimated to slow the growth of the tine seed drills market over the forecast period. Additionally, the rise in fuel prices may provide additional obstacles to market expansion for seed drills shortly.This research report on the Tine Seed Drill Market has been segmented and sub-segmented based on Product, By Working Width and By Region.

TINE SEED DRILL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

3.6% |

|

Segments Covered |

By Product,Working Width, Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AGCO CORPORATION, CNH INDUSTRIAL, DEERE & COMPANY,MAHINDRA TRACTORS, ACMASRL, AGRIMERIN AGRICULTURAL MACHINERY, AGRISEM INTERNATIONAL, AMAZONEN-WERKE H. DREYER GMBH & CO. KG, APV - TECHNISCHEPRODUKTE GMBH |

TINE SEED DRILL MARKET – BY PRODUCT

• Mechanical Seed Drills

• Pneumatic Seed Drills

• Combination Seed Drills

• Manual Seed Drills

Based on the product. the Tine seed drill machines market is segmented into mechanical seed drills, pneumatic seed drills, combination seed drills, and manual seed drills. Mechanical seed drill machines now have a 41.2% market share and are anticipated to grow at a 4.1% CAGR during the forecast period. The lower cost of mechanical seed drill machines in comparison to pneumatic seed drills and combination seed drills is what is responsible for this segment's higher growth. Furthermore, they are especially well suited for small- and medium-sized farms, making accurate seeding and uniform field emergence possible. The market shares of pneumatic and combination seed drill machines are 27.6% and 25.9%, respectively, and are estimated to grow at corresponding CAGRs of 3.5% and 3.3% from 2023 to 2030. Due to growing knowledge of the advantages offered by both seed drills, demand for both of these varieties is projected to increase. The demand for pneumatic and combination seed drill devices among end users is projected to increase over the next few years as a result of their numerous features and numerous advantages.

TINE SEED DRILL MARKET - BY WORKING WIDTH

-

Below 2 m Seed Drill Machines

-

2-3 m Seed Drill Machines

-

3-4 m Seed Drill Machines

-

4-5 m Seed Drill Machines

-

Above 5 m Seed Drill Machines

Based on the working width, the Tine seed drill market is segmented into Below 2 m Seed Drill Machines, 2-3 m Seed Drill Machines, 3-4 m Seed Drill Machines, 4-5 m Seed Drill Machines and Above 5 m Seed Drill Machines. The demand for seed drill machines with operating widths between 3 and 4 meters and under 2 meters continues to be the strongest. Over USD 126 Mn in sales was generated by seed drill machines with a 3–4 m operating width in 2022.

TINE SEED DRILL MARKET - BY REGION

-

North America

-

Europe

-

The Asia Pacific

-

Latin America

-

The Middle East

-

Africa

By region, the Tine Seed Drill Market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa. The market for seed drill machines in Europe holds 24.3% of the worldwide market share and is anticipated to grow at a 3.6% CAGR from 2023 to 2030. The agriculture industry in Europe is very productive and distinguished by extremely intense production. In the upcoming years, demand for and expansion of tine seed drill machines will be supported by the region's increasing automation of agriculture. The Asia Pacific, excluding Japan, continues to witness rapid growth in the need for seed drill machines (APEJ). Since a sizable portion of the population relies on agriculture for a living, China and India have a particularly high demand for these products. Due to the need for farm owners to adjust to shifts in the workforce's availability, the agricultural sectors of both China and India are transforming. Over ten years, estimates show that more than 10 million agricultural labourers in India switched to employment outside the agriculture industry. Farm owners are investing in farm gear and equipment because of the workforce shortage. In China, where the adoption of tine seed drill machines has been constant over the past ten years, the situation is not noticeably different.

TINE SEED DRILL MARKET - BY COMPANIES

Some of the major players operating in the Tine Seed Drill Market include:

-

AGCO CORPORATION

-

CNH INDUSTRIAL

-

DEERE & COMPANY

-

MAHINDRA TRACTORS

-

ACMASRL

-

AGRIMERIN AGRICULTURAL MACHINERY

-

AGRISEM INTERNATIONAL

-

AMAZONEN-WERKE H. DREYER GMBH & CO. KG

-

APV - TECHNISCHEPRODUKTE GMBH

NOTABLE HAPPENING IN THE TINE SEED DRILL MARKET

-

PRODUCT LAUNCH- In the Farm Equipment Sector, Mahindra & Mahindra announced the release of new potato planting equipment in 2020. (FES). It is being developed in conjunction with Dewulf, the business's partner in Europe. With a high level of singulation ensured by this planter, the yield and quality are probably to increase.

-

AWARDS- In 2022, Deere and Company received eight 2022 AE50 prizes for improvements in tractors, planters, liquid fertiliser systems, cotton harvesters, etc. that improved agricultural productivity.

Chapter 1. TINE SEED DRILL MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. TINE SEED DRILL MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – DemandChapte

chapter 3. TINE SEED DRILL MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. TINE SEED DRILL MARKET -Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. TINE SEED DRILL MARKET -Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6 TINE SEED DRILL MARKET – BY PRODUCT

6.1 Mechanical Seed Drills

6.2 Pneumatic Seed Drills

6.3 Combination Seed Drills

6.4 Manual Seed Drills

Chapter 7 TINE SEED DRILL MARKET - BY WORKING WIDTH

7.1 Below 2 m Seed Drill Machines

7.2 2-3 m Seed Drill Machines

7.3 3-4 m Seed Drill Machines

7.4 4-5 m Seed Drill Machines

7.5 Above 5 m Seed Drill Machines

Chapter 8 TINE SEED DRILL MARKET - BY REGION

8.1 North America

8.2 Europe

8.3 The Asia Pacific

8.4 Latin America

8.5 The Middle East

8.6 Africa

Chapter 9 TINE SEED DRILL MARKET - BY COMPANIES

9.1 AGCO CORPORATION

9.2 CNH INDUSTRIAL

9.3 DEERE & COMPANY

9.4 MAHINDRA TRACTORS

9.5 ACMASRL

9.5.1 AGRIMERIN AGRICULTURAL MACHINERY

9.5.2 AGRISEM INTERNATIONAL

9.5.3 AMAZONEN-WERKE H. DREYER GMBH & CO. KG

9.5.4 APV - TECHNISCHEPRODUKTE GMBH

Download Sample

Choose License Type

2500

4250

5250

6900