Timing Devices Market Size (2024 – 2030)

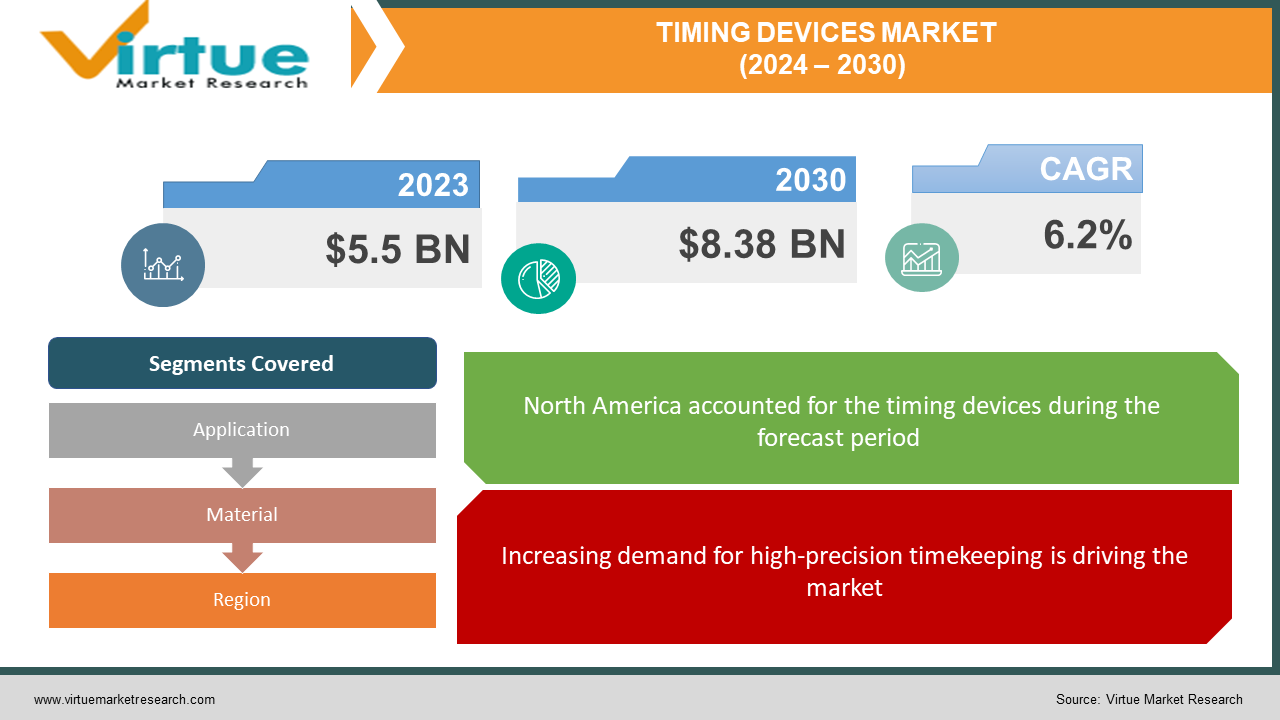

The Global Timing Devices Market was valued at USD 5.5 billion in 2023 and will grow at a CAGR of 6.2% from 2024 to 2030. The market is expected to reach USD 8.38 billion by 2030.

A timing device is an electronic component that generates precise and stable electrical signals to control the timing of various functions in different equipment. They act like the conductor of an orchestra, ensuring everything runs in sync, from enabling accurate data transmission in your phone to controlling engine functions in your car.

Key Market Insights:

The Timing Devices Market is experiencing robust growth, driven by several key factors. Rising automation across industries, particularly in manufacturing and healthcare, is fueling demand for precise and reliable timers for controlling various processes. Additionally, the increasing popularity of smart homes and connected devices is creating opportunities for innovative timing solutions like smart plugs and Wi-Fi-enabled timers that offer remote control and integration with smart ecosystems. Furthermore, growing environmental concerns are pushing the adoption of energy-efficient timers for appliances and lighting systems, presenting a lucrative segment within the market. However, the market faces challenges such as intense competition from low-cost alternatives, particularly from overseas manufacturers, and the need for continuous innovation to stay ahead of the curve with rapidly evolving technologies. Overall, the Timing Devices Market is expected to witness continued growth in the coming years, driven by the aforementioned factors, with the increasing demand for smart and connected devices presenting the most promising avenue for expansion.

Global Timing Devices Market Drivers:

Increasing demand for high-precision timekeeping is driving the market

In sectors like telecommunications, aerospace, defense, and scientific research, split-second accuracy is paramount. Precise timing ensures data transmission isn't garbled, navigation systems pinpoint locations flawlessly, and scientific experiments capture phenomena with meticulous detail. For instance, in telecoms, timing ensures data packets arrive in the correct order, preventing corrupted messages or dropped calls. Similarly, GPS relies on precise timing signals from satellites to calculate positions on Earth. In science, from studying the origins of the universe to developing new drugs, experiments hinge on recording events with incredible accuracy, which can only be achieved with perfect timing. This synchronization across various fields is the backbone of modern technology and scientific discovery.

The rising development of self-driving cars is driving the market

The self-driving revolution hinges on the unyielding precision of timing devices. Autonomous vehicles navigate a complex world, making split-second decisions based on a constant stream of data from various sensors like cameras, lidar, and radar. These sensors collect information about the surrounding environment, including the positions and movements of other vehicles, pedestrians, and objects. To interpret this data accurately and react accordingly, the vehicle's control systems require a reliable and highly precise timing reference. Delays, even in milliseconds, can have catastrophic consequences. Imagine a scenario where the car misinterprets the distance to a braking vehicle due to a timing lag, potentially causing a collision.

Furthermore, these timing devices need to be robust and operate effectively under diverse environmental conditions, from scorching deserts to freezing winters. They must be resistant to vibrations, shocks, and electromagnetic interference, as any disruption can compromise the integrity of the timing signal.

Growth in wearable devices is driving the market

The booming popularity of wearable technology, encompassing smartwatches, fitness trackers, and other form factors, has brought a unique challenge to the world of timing devices. These compact devices require a delicate balance between functionality and resource efficiency. Here's where miniaturized and low-power timing components come into play, playing a crucial role in ensuring efficient operation for these wearables. Firstly, the small size of wearables necessitates miniaturized timing components. Traditional timing devices often occupy valuable real estate within a device, leaving less space for other essential components like batteries, sensors, and processing units. Miniaturized components allow designers to pack more functionalities into a smaller form factor, maintaining a sleek and comfortable design for users. Secondly, wearables are often worn for extended periods, making battery life a critical concern. Low-power timing components are crucial in this aspect. Traditional timing devices can be power-hungry, draining the battery quickly. By incorporating low-power components, manufacturers can significantly extend battery life, allowing users to wear their devices for longer durations without needing to constantly recharge. Furthermore, the low-power nature of these components contributes to reduced heat generation. This aspect is particularly important for wearables as they come in close contact with the user's skin. Excessive heat generation can lead to discomfort and potentially even skin irritation. Low-power timing components help maintain optimal operating temperatures, ensuring a comfortable user experience.

Market Opportunities:

The Timing Devices Market presents a multitude of exciting opportunities driven by several key trends. The burgeoning trend of automation across diverse industries, from manufacturing and healthcare to agriculture and construction, is fueling the need for precise and reliable timers to facilitate efficient process control. Additionally, the burgeoning popularity of smart homes and the Internet of Things (IoT) is creating a fertile ground for innovative timing solutions. Smart plugs, Wi-Fi-enabled timers, and voice-controlled devices offer enticing features like remote control, scheduling, and integration with smart ecosystems, catering to the growing demand for convenience and energy efficiency. Furthermore, increasing environmental consciousness is driving the adoption of energy-saving timers for appliances and lighting systems, presenting a lucrative market segment. However, navigating this market also necessitates overcoming challenges like intense competition, particularly from budget-friendly options offered by overseas manufacturers. Maintaining a competitive edge hinges on continuous innovation and staying abreast of rapidly evolving technologies, particularly in the realm of smart and connected devices. By capitalizing on these opportunities and addressing the existing challenges, the Timing Devices Market is poised for sustained growth and holds immense potential for players who can offer innovative, user-centric, and environmentally conscious solutions.

TIMING DEVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Application, Material, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Seiko Epson Corporation, Nihon Dempa Kogyo Co., Ltd., TXC Corporation, Kyocera Corporation, Rakon Limited, Renesas Electronics Corporation, Infineon Technologies AG, Microchip Technology Inc, Texas Instruments, Abracon |

Timing Devices Market Segmentation - by Application

-

Consumer Electronics

-

Telecommunications and Networking

-

Automotive

-

Military and Defense

-

Medical and Healthcare

The global timing devices market caters to a diverse range of applications. Consumer electronics, encompassing smartphones, tablets, and TVs, currently holds the largest share due to the sheer volume of devices produced. However, other sectors like telecommunications rely on precise timing for data transmission, while automotive applications utilize them for engine control, safety systems, and infotainment. Military and defense sectors require high-precision timing for critical systems like radar and communication. Additionally, timing devices play a vital role in industrial automation and monitoring processes, and are crucial components in medical equipment like pacemakers and infusion pumps. This widespread application across various industries underscores the critical role timing devices play in modern technology and its continued growth.

Timing Devices Market Segmentation - By Material

-

Crystal

-

Ceramic

-

Silicon

Timing devices come in three primary materials, each with its advantages and trade-offs. Traditionally, crystal has been the dominant choice, offering exceptional precision and stability, crucial for applications like telecommunications and military equipment. However, its bulky size and higher cost make it less suitable for miniaturized devices. Ceramic presents a cost-effective alternative, boasting good temperature stability for various applications. However, it may not match the precision of the crystal in all scenarios. The rising star is silicon, gaining popularity due to its ability to be miniaturized and integrated seamlessly with other electronic components. This makes it ideal for the ever-shrinking consumer electronics and wearables market, where size and cost are key factors. While silicon may not yet surpass crystal in raw precision, its continual advancements and integration capabilities are making it an increasingly attractive option for a wider range of applications.

Timing Devices Market Segmentation - Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The global timing devices market is geographically divided into four main regions. North America currently holds the largest market share due to the presence of major manufacturers and a high demand for advanced timing devices, particularly in sectors like telecommunications, aerospace, and defense. Asia Pacific is projected to witness the fastest growth in the coming years. This is driven by the region's booming consumer electronics industry, a growing automotive sector, and expanding industrial automation. The increasing demand for smartphones, wearables, and other electronics, coupled with government initiatives to support domestic electronics manufacturing, is fueling this growth. Europe, on the other hand, has a mature market with a strong presence of established players. While growth here might not be as rapid as in Asia Pacific, the region is still expected to see steady progress due to continued demand for high-precision timing devices in various applications. Finally, the Rest of the World, which includes Latin America, the Middle East, and Africa, is expected to experience moderate growth. While these regions offer potential due to their developing economies and increasing adoption of technology, factors like limited infrastructure and lower purchasing power are likely to hinder their growth compared to the other regions.

COVID-19 Impact Analysis on the Global Timing Devices Market

The COVID-19 pandemic caused a ripple effect throughout the Global Timing Devices Market, presenting both challenges and unexpected opportunities. Initial disruptions were significant, with lockdowns and supply chain disruptions impacting production and distribution. The decline in demand from key end-user industries like automotive and consumer electronics due to production slowdowns further hampered market growth. However, the pandemic also accelerated the growth of certain segments. The surge in remote work and online learning activities fueled demand for electronics like laptops and tablets, which in turn, increased the need for timing devices in these devices. Additionally, the rise in focus on hygiene and health awareness led to a growth in demand for timers in medical equipment and sanitization solutions. The increased adoption of smart home technologies for remote monitoring and control of appliances and lights during lockdowns also presented a positive opportunity for the market. As the global economy recovers, the market is expected to return to its pre-pandemic growth trajectory, with a potential long-term benefit from the increased focus on automation and healthcare solutions. However, navigating the post-pandemic landscape requires considering lingering supply chain uncertainties and potential cost fluctuations. Overall, the COVID-19 pandemic's impact on the Timing Devices Market was a mixed bag, presenting both temporary setbacks and opportunities for growth in specific segments.

Latest trends/Developments

The Global Timing Devices Market is witnessing a surge in innovation and advancements, driven by the ever-increasing demand for high-precision, miniaturized, and energy-efficient timing solutions. One prominent trend is the miniaturization of timing devices, particularly oscillators, and crystals, which cater to the growing demand for compact and portable electronic devices like smartphones and wearables. Additionally, the **rise of Quantum Clocks is revolutionizing the market by offering unparalleled accuracy through the utilization of atomic properties. This opens doors for novel applications in fields like telecommunications, navigation systems, and scientific research. Furthermore, the integration of timing devices with Artificial Intelligence (AI) is gaining traction, enabling features like predictive maintenance and self-calibration, enhancing device performance and reliability. The market is also witnessing a growing focus on environmentally friendly solutions, with manufacturers developing low-power consumption timing devices and exploring the use of sustainable materials in their production. In conclusion, the Global Timing Devices Market is undergoing a period of exciting advancements, with miniaturization, quantum technology, AI integration, and sustainability shaping the future of this dynamic industry.

Key Players:

-

Seiko Epson Corporation

-

Nihon Dempa Kogyo Co., Ltd.

-

TXC Corporation

-

Kyocera Corporation

-

Rakon Limited

-

Renesas Electronics Corporation

-

Infineon Technologies AG

-

Microchip Technology Inc.

-

Texas Instruments

-

Abracon

Chapter 1. Timing Devices Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Timing Devices Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Timing Devices Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Timing Devices Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Timing Devices Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Timing Devices Market – By Application

6.1 Introduction/Key Findings

6.2 Consumer Electronics

6.3 Telecommunications and Networking

6.4 Automotive

6.5 Military and Defense

6.6 Medical and Healthcare

6.7 Y-O-Y Growth trend Analysis By Application

6.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Timing Devices Market – By Material

7.1 Introduction/Key Findings

7.2 Crystal

7.3 Ceramic

7.4 Silicon

7.5 Y-O-Y Growth trend Analysis By Material

7.6 Absolute $ Opportunity Analysis By Material, 2024-2030

Chapter 8. Timing Devices Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Material

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Material

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Material

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Material

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Material

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Timing Devices Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 Seiko Epson Corporation

9.2 Nihon Dempa Kogyo Co., Ltd.

9.3 TXC Corporation

9.4 Kyocera Corporation

9.5 Rakon Limited

9.6 Renesas Electronics Corporation

9.7 Infineon Technologies AG

9.8 Microchip Technology Inc.

9.9 Texas Instruments

9.10 Abracon

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Timing Devices Market was valued at USD 5.5 billion in 2023 and will grow at a CAGR of 6.2% from 2024 to 2030. The market is expected to reach USD 8.38 billion by 2030.

Increasing demand for high-precision timekeeping and growth in wearable devices are the reasons that are driving the market

Based on end-user it is divided into five segments – Consumer Electronics, Telecommunications, and Networking, Automotive, Military and Defense, Medical, and Healthcare

North America is the most dominant region for the Timing Devices Market.

Seiko Epson Corporation, Nihon Dempa Kogyo Co., Ltd., TXC Corporation