Global Tile Cutting Tools Market Size (2024-2030)

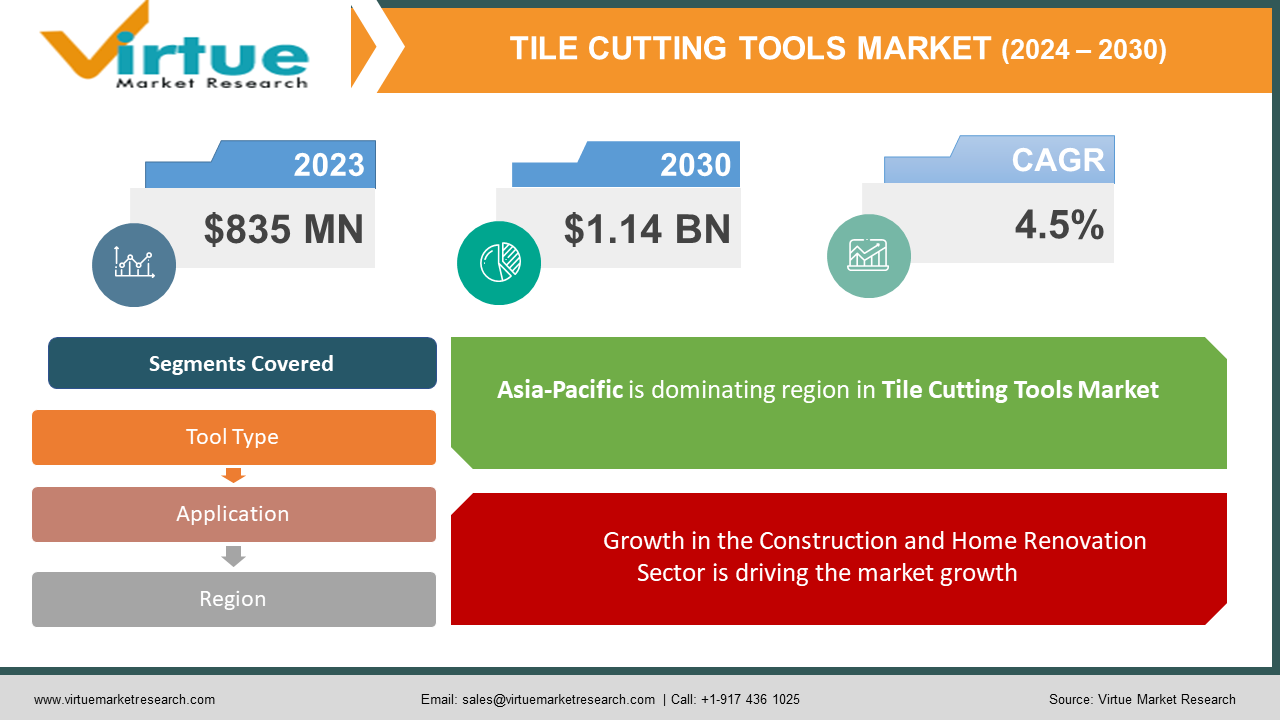

The Global Tile Cutting Tools Market was valued at USD 835 million in 2023 and is expected to reach USD 1.14 billion by 2030, growing at a CAGR of 4.5% from 2024 to 2030.

Tile cutting tools are essential for cutting various types of tiles, including ceramic, porcelain, stone, and glass, used widely in construction and remodeling projects. The market growth is primarily driven by the construction sector's expansion, increasing home renovation activities, and rising demand for aesthetically appealing and durable flooring solutions. Tile cutting tools are increasingly favored for their precision, ease of use, and efficiency in tile installation.

The tile cutting tools market encompasses a range of tools designed to cut ceramic, porcelain, and other types of tiles. These tools are essential for both professional tile installers and DIY enthusiasts. Common types of tile cutting tools include manual tile cutters, electric tile cutters, and tile nippers. Manual tile cutters are suitable for smaller tiles and basic cuts, while electric tile cutters are more powerful and efficient for larger tiles and intricate designs. Tile nippers are used for making small cuts and adjustments. The choice of tile cutting tool depends on factors such as tile material, size, and the complexity of the cutting task. As the construction and renovation industries continue to grow, the demand for efficient and precise tile cutting tools is expected to increase.

Key Market Insights

Manual tile cutters dominate the market due to their ease of use and affordability, especially for small and medium-sized construction projects.

Electric tile cutters are gaining popularity, particularly in large-scale commercial projects where efficiency and precision are key.

Residential renovations account for a significant portion of demand, driven by rising disposable incomes and a growing focus on home aesthetics.

Innovations in tile materials such as thin, large-format, and textured tiles are driving the need for advanced cutting tools.

Asia-Pacific is the largest regional market, supported by rapid urbanization, large-scale infrastructure projects, and rising homeownership rates.

Manufacturers are focusing on ergonomic design and enhanced safety features to improve user experience and reduce operational risks.

Sustainable practices are becoming increasingly prevalent, with some manufacturers introducing eco-friendly materials and energy-efficient electric tile cutters.

4

Global Tile Cutting Tools Market Drivers

- Growth in the Construction and Home Renovation Sector is driving the market growth

The increasing focus on construction and renovation projects worldwide is a significant driver for the tile cutting tools market. Rising urbanization, population growth, and improving economic conditions have fueled demand for residential and commercial buildings, particularly in emerging markets. This, coupled with the trend of open-concept designs and modern floor plans, has driven demand for aesthetically pleasing and durable tiles, requiring efficient cutting tools. Homeowners are increasingly investing in renovation projects to improve home aesthetics, which further boosts the need for precision tile-cutting tools, especially in kitchens, bathrooms, and other high-traffic areas. - Advancements in Tile Materials is driving the market growth

With the development of new tile materials, such as thin porcelain and large-format tiles, there is a growing need for specialized cutting tools capable of handling various shapes, sizes, and hardness levels. High-strength materials require durable and powerful tile cutters that offer precise cuts without damaging the tile edges. Electric tile cutters, for example, are increasingly popular for such applications, as they can handle tougher materials more efficiently. Innovations in tile designs and materials for various commercial and residential applications continue to expand the market for cutting tools that can adapt to different tile specifications. - Technological Innovations in Tile Cutting Tools is driving the market growth

Technological advancements have brought significant improvements to tile cutting tools, particularly in terms of power, precision, and safety. Modern tile cutters come equipped with laser guides, dust control systems, and safety-enhancing features that increase their appeal for both professional and DIY users. Electric tile cutters are increasingly equipped with water cooling systems to reduce overheating and minimize dust, ensuring a safer work environment. Additionally, compact and ergonomic designs enhance usability, making it easier for workers to handle tools for extended periods without fatigue, contributing to greater adoption across various projects.

Global Tile Cutting Tools Market Challenges and Restraints

- The High Cost of Electric Tile Cutters is restricting the market growth

While electric tile cutters offer precision and efficiency, their high cost can be a deterrent for smaller construction companies and individual users. The price of these tools often includes additional expenses for accessories such as diamond blades, cooling systems, and dust control features, making them a costly investment. The price factor may limit the adoption of electric tile cutters among small businesses and DIY enthusiasts who may instead opt for manual cutters, impacting the overall market growth. Additionally, regular maintenance and replacement of parts in electric cutters can add to operational costs, presenting a restraint on market expansion. - Availability of Low-Cost Alternatives is restricting the market growth

The tile cutting tools market faces competition from low-cost alternatives and traditional methods for tile installation, particularly in emerging economies. Low-cost manual tile cutters, generic brands, or improvised tools are commonly available in local markets, providing options that may be preferred by cost-sensitive users. These alternatives, while less precise, may meet basic requirements in certain projects, impacting the adoption rate of advanced tile cutting tools. Additionally, budget constraints in some regions may push consumers toward these alternatives, hindering the growth potential for branded and premium-quality tile cutters.

Market Opportunities

The rising demand for eco-friendly and ergonomic tile cutting tools presents significant opportunities for manufacturers. Consumers are increasingly concerned about health and safety aspects related to dust and noise exposure, leading to demand for tools with dust collection systems and noise reduction features. Additionally, expansion in emerging markets with high infrastructure investment, such as India, Brazil, and Southeast Asia, provides ample opportunities for market growth, as these regions experience a surge in construction activities. Furthermore, e-commerce and online distribution channels offer manufacturers new avenues to reach customers, particularly DIY enthusiasts and small businesses who may prefer to purchase tools online. The tile cutting tools market presents significant growth opportunities driven by the increasing demand for home renovations and construction activities. The rising popularity of ceramic and porcelain tiles, coupled with the growing trend of DIY home improvement projects, is fueling the market. Additionally, the increasing emphasis on energy efficiency and sustainable building practices is driving the demand for specialized tile cutting tools that can handle eco-friendly materials. Moreover, the emergence of advanced technologies, such as laser cutting and waterjet cutting, is revolutionizing the tile cutting industry, enabling precise and efficient cutting of complex tile designs. As the global construction industry continues to expand, the demand for high-quality and innovative tile cutting tools is expected to surge, creating lucrative opportunities for manufacturers and suppliers.

TILE CUTTING TOOLS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By tool Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Rubi Tools, QEP Co., Inc., Montolit, Bosch Power Tools, and Husqvarna Group., DEWALT, Sigma UK, iQ Power Tools, Raimondi S.p.A., Makita Corporation |

Global Tile Cutting Tools Market Segmentation

Global Tile Cutting Tools Market Segmentation By Tool Type

- Manual Cutters

- Electric Cutters

Manual cutters lead the market, especially among small to medium-scale projects and DIY applications, due to their affordability and ease of use. Electric cutters, while pricier, are gaining traction in larger commercial and industrial applications where high precision and efficiency are required.

Global Tile Cutting Tools Market Segmentation By Application

- Residential

- Commercial

- Industrial

The residential segment is the dominant application, driven by home improvement and renovation projects. As homeowners seek to modernize their interiors, particularly kitchens and bathrooms, there is a sustained demand for precise and reliable tile-cutting tools in this sector.

Global Tile Cutting Tools Market Regional Segmentation

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Asia-Pacific leads the global tile cutting tools market due to rapid urbanization, population growth, and the booming construction industry in countries like China, India, and Indonesia. Rising middle-class incomes and government investments in infrastructure projects are key factors supporting the region’s dominance.

COVID-19 Impact Analysis on the Global Tile Cutting Tools Market

The COVID-19 pandemic initially disrupted the tile cutting tools market due to supply chain interruptions and construction halts. However, as lockdown restrictions eased, the market rebounded, particularly in the residential sector, where home renovation projects surged. The pandemic-induced shift toward DIY projects contributed to an increase in demand for manual tile cutters, especially through online channels. As the construction industry recovered, commercial and industrial applications resumed, with growing demand for electric tile cutters in large-scale projects. The post-pandemic period is expected to see steady growth, driven by ongoing infrastructure projects and rising consumer interest in home improvement.

Latest Trends/Developments

The market is witnessing increased adoption of digital and laser-guided tile cutting tools, enhancing cutting precision and reducing waste. Additionally, manufacturers are introducing cordless and battery-powered electric cutters, providing greater flexibility and mobility on job sites. Another significant trend is the focus on ergonomic designs and dust management systems, as health-conscious consumers prioritize tools that offer a safer and cleaner work environment. Smart and connected tools are also emerging, with features that allow users to monitor tool performance and maintenance needs, improving efficiency in professional settings. The tile cutting tools market is witnessing significant advancements and trends. One of the key developments is the increasing adoption of laser cutting technology, which offers precise and efficient cutting of complex tile designs. Additionally, waterjet cutting technology is gaining traction, enabling the cutting of intricate patterns and shapes. Manufacturers are focusing on developing ergonomic and user-friendly tools to reduce operator fatigue and improve productivity. Moreover, the integration of smart features, such as Bluetooth connectivity and digital displays, is enhancing the functionality and convenience of tile cutting tools. As the construction industry continues to evolve, the demand for innovative and high-performance tile cutting tools is expected to drive further growth and development in this market.

Key Players

- Rubi Tools

- QEP Co., Inc.

- Montolit

- Bosch Power Tools

- Husqvarna Group

- DEWALT

- Sigma UK

- iQ Power Tools

- Raimondi S.p.A.

- Makita Corporation

Chapter 1. GLOBAL TILE CUTTING TOOLS MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL TILE CUTTING TOOLS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL TILE CUTTING TOOLS MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL TILE CUTTING TOOLS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL TILE CUTTING TOOLS MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL TILE CUTTING TOOLS MARKET– BY Tool Type

6.1. Introduction/Key Findings

6.2. Manual Cutters

6.3. Electric Cutters

6.4. Y-O-Y Growth trend Analysis By Tool Type

6.5. Absolute $ Opportunity Analysis By Tool Type, 2024-2030

Chapter 7. GLOBAL TILE CUTTING TOOLS MARKET– BY APPLICATION

7.1. Introduction/Key Findings

7.2. Residential

7.3. Commercial

7.4. Industrial

7.5. Y-O-Y Growth trend Analysis By APPLICATION

7.6. Absolute $ Opportunity Analysis By APPLICATION , 2024-2030

Chapter 8. GLOBAL TILE CUTTING TOOLS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application

8.2.3. By Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application

8.3.3. By Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application

8.4.3. By Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application

8.5.3. By Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL TILE CUTTING TOOLS MARKET – Company Profiles – (Overview, Product Type s Portfolio, Financials, Strategies & Development

9.1. Rubi Tools

9.2. QEP Co., Inc.

9.3. Montolit

9.4. Bosch Power Tools

9.5. Husqvarna Group

9.6. DEWALT

9.7. Sigma UK

9.8. iQ Power Tools

9.9. Raimondi S.p.A.

9.10. Makita Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 835 million in 2023 and is projected to reach USD 1.14 billion by 2030, growing at a CAGR of 4.5%.

Key drivers include the growth in the construction and home renovation sector, advancements in tile materials, and technological innovations in cutting tools.

The market is segmented by tool type (manual cutters, electric cutters) and application (residential, commercial, industrial).

Asia-Pacific leads the market due to rapid urbanization and a booming construction industry, especially in countries like China and India

Major players include Rubi Tools, QEP Co., Inc., Montolit, Bosch Power Tools, and Husqvarna Group.