Threonine Market Size (2025 – 2030)

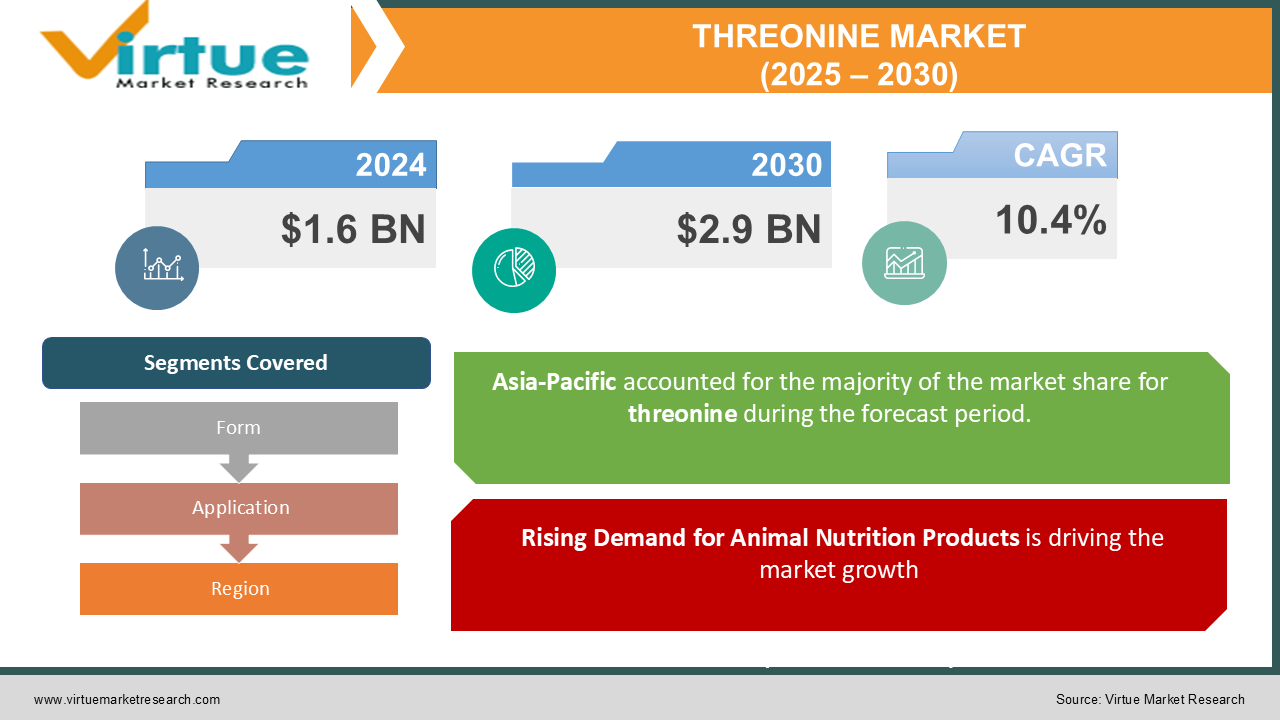

The Global Threonine Market was valued at USD 1.6 billion in 2024 and is projected to reach USD 2.9 billion by 2030, growing at a robust CAGR of 10.4% during the forecast period (2025–2030).

Threonine, an essential amino acid, plays a crucial role in protein synthesis and is widely used across various industries, including animal feed, pharmaceuticals, and food & beverages.

The market is driven by increasing demand for threonine in animal nutrition to improve livestock health and productivity, as well as its growing application in dietary supplements and medical treatments. Advancements in biotechnology and the development of cost-effective production methods are further propelling market growth.

Key Market Insights

-

Animal feed is the largest application segment, accounting for over 65% of the market share in 2024, driven by its role in enhancing livestock growth and immunity.

-

The powder form dominated the market, contributing over 75% of total revenue, owing to its ease of use in feed and food applications.

-

Asia-Pacific is the leading regional market with a 40% share, supported by high livestock production and increasing meat consumption.

-

The rising adoption of sustainable farming practices is boosting the demand for threonine as an alternative to traditional feed additives.

-

Innovations in fermentation technology have reduced production costs, enhancing market accessibility for small-scale industries.

-

The growing popularity of plant-based threonine is a notable trend, catering to the increasing vegan population and clean-label requirements.

-

The pharmaceutical application segment is expected to grow at the fastest CAGR of 12%, driven by its use in protein-based drugs and dietary supplements.

Global Threonine Market Drivers

Rising Demand for Animal Nutrition Products is driving the market growth

Threonine is a critical component of animal feed formulations, contributing to better protein metabolism, enhanced immunity, and improved feed efficiency. With the global increase in meat consumption and the demand for high-quality animal products such as milk and eggs, the adoption of threonine in animal feed is surging.

Livestock farmers are increasingly focusing on improving productivity while maintaining sustainable farming practices. Threonine's ability to reduce nitrogen excretion in animal waste also aligns with environmental goals, further driving its demand in the animal feed industry.

Growing Applications in the Pharmaceutical Industry is driving the market growth

The pharmaceutical sector is witnessing an increased application of threonine in the development of protein-based drugs and dietary supplements. As an essential amino acid, threonine is used to treat liver diseases, digestive disorders, and neurological conditions.

The rising prevalence of chronic diseases, coupled with an increasing focus on personalized medicine, is accelerating the adoption of threonine-based products. Furthermore, ongoing research into the therapeutic benefits of threonine is expected to expand its use in the pharmaceutical sector.

Advancements in Production Technology is driving the market growth

Innovations in fermentation and biotechnological processes have significantly improved the production efficiency of threonine, reducing costs and environmental impact. Leading manufacturers are adopting advanced microbial fermentation techniques to produce high-quality threonine at scale.

The development of bio-based threonine aligns with the global shift towards sustainable and eco-friendly solutions, creating new opportunities for market growth. These advancements also enable manufacturers to cater to the growing demand for threonine in emerging markets.

Global Threonine Market Challenges and Restraints

Fluctuations in Raw Material Prices is restricting the market growth

The production of threonine depends on raw materials such as corn, wheat, and other starch-based crops. Fluctuations in the prices of these commodities, driven by factors like weather conditions, trade policies, and supply chain disruptions, can impact production costs.

Such price volatility poses challenges for manufacturers, particularly small-scale producers, in maintaining profitability and competitiveness. Moreover, rising feedstock prices may lead to increased costs for end-users, potentially restraining market growth.

Stringent Regulatory Frameworks is restricting the market growth

The threonine market is subject to stringent regulations concerning its production, quality, and usage, particularly in the animal feed and pharmaceutical sectors. Compliance with these regulations can increase operational costs for manufacturers.

For example, regulatory bodies such as the European Food Safety Authority (EFSA) and the U.S. Food and Drug Administration (FDA) have strict guidelines for feed additives and dietary supplements, requiring thorough testing and certification processes. Delays in approvals or non-compliance can hinder market growth and product launches.

Market Opportunities

The increasing focus on sustainable agriculture and precision nutrition presents significant opportunities for the threonine market. As livestock farming transitions towards more sustainable practices, the demand for feed additives like threonine, which enhance feed efficiency and reduce environmental impact, is expected to rise.

Emerging economies, particularly in Asia-Pacific and Latin America, are witnessing rapid growth in livestock production, driven by rising meat consumption and economic development. These regions offer untapped potential for threonine manufacturers, especially as governments promote the adoption of modern farming techniques.

Moreover, the rising popularity of plant-based proteins and dietary supplements creates opportunities for threonine in the food and pharmaceutical sectors. Manufacturers focusing on producing plant-derived threonine to cater to vegan and clean-label trends can gain a competitive edge in the market.

THREONINE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

10.4% |

|

Segments Covered |

By Form, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Evonik Industries AG, CJ CheilJedang Corporation, Ajinomoto Co., Inc., Archer Daniels Midland Company, Meihua Holdings Group Co., Ltd., Global Bio-Chem Technology Group Company Limited, NB Group Co., Ltd., Bluestar Adisseo Co., Ltd., Prinova Group LLC, Sunrise Nutrachem Group |

Threonine Market Segmentation - By Form

-

Powder

-

Liquid

The powder form dominated the market with over 75% share in 2024. Its stability, ease of storage, and compatibility with feed and food formulations make it the preferred choice for manufacturers and end-users alike.

Threonine Market Segmentation - By Application

-

Animal Feed

-

Pharmaceuticals

-

Food & Beverages

-

Others

The animal feed segment leads the market, accounting for over 65% of total revenue. Threonine’s role in enhancing livestock growth, immunity, and productivity makes it an essential additive in feed formulations.

Threonine Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Asia-Pacific is the largest regional market, holding a 40% share in 2024. The region's dominance is attributed to its significant livestock population, rising meat consumption, and increasing adoption of modern farming practices. Countries like China, India, and Indonesia are driving demand for threonine due to their growing agricultural and pharmaceutical industries. Additionally, government initiatives to promote sustainable livestock farming are further supporting market growth in the region.

COVID-19 Impact Analysis

The COVID-19 pandemic had a mixed impact on the threonine market. On one hand, disruptions in supply chains and reduced production capacity temporarily hindered market growth. On the other hand, the increasing focus on health and nutrition during the pandemic drove demand for threonine in dietary supplements and pharmaceuticals. The animal feed segment experienced steady growth as livestock farming continued to operate during the pandemic to meet food supply demands. However, the market faced challenges such as logistical constraints and fluctuating raw material prices. In the post-pandemic period, the threonine market is expected to witness accelerated growth as industries recover and prioritize sustainability and health-focused solutions.

Latest Trends/Developments

The threonine market is witnessing several advancements, including the adoption of bio-based production methods and the rising popularity of plant-derived threonine. These developments align with global sustainability goals and consumer preferences for clean-label products. The integration of AI and IoT technologies in livestock farming is another notable trend, enabling precision nutrition and driving demand for high-quality feed additives like threonine. Additionally, collaborations between manufacturers and research institutions are leading to the development of innovative threonine-based products for pharmaceutical and dietary applications.

Key Players

-

Evonik Industries AG

-

CJ CheilJedang Corporation

-

Ajinomoto Co., Inc.

-

Archer Daniels Midland Company

-

Meihua Holdings Group Co., Ltd.

-

Global Bio-Chem Technology Group Company Limited

-

NB Group Co., Ltd.

-

Bluestar Adisseo Co., Ltd.

-

Prinova Group LLC

-

Sunrise Nutrachem Group

Chapter 1. Threonine Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Threonine Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Threonine Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Threonine Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Threonine Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Threonine Market – By Form

6.1 Introduction/Key Findings

6.2 Powder

6.3 Liquid

6.4 Y-O-Y Growth trend Analysis By Form

6.5 Absolute $ Opportunity Analysis By Form, 2025-2030

Chapter 7. Threonine Market – By Application

7.1 Introduction/Key Findings

7.2 Animal Feed

7.3 Pharmaceuticals

7.4 Food & Beverages

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Threonine Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Form

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Form

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Form

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Form

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Form

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Threonine Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Evonik Industries AG

9.2 CJ CheilJedang Corporation

9.3 Ajinomoto Co., Inc.

9.4 Archer Daniels Midland Company

9.5 Meihua Holdings Group Co., Ltd.

9.6 Global Bio-Chem Technology Group Company Limited

9.7 NB Group Co., Ltd.

9.8 Bluestar Adisseo Co., Ltd.

9.9 Prinova Group LLC

9.10 Sunrise Nutrachem Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 1.6 billion in 2024 and is projected to reach USD 2.9 billion by 2030, growing at a CAGR of 10.4%.

Key drivers include rising demand for animal nutrition, growing applications in the pharmaceutical industry, and advancements in production technology.

Segments include Form (Powder, Liquid) and Application (Animal Feed, Pharmaceuticals, Food & Beverages, Others).

Asia-Pacific dominates the market with a 40% share, driven by its large livestock population and increasing meat consumption.

Major players include Evonik Industries, CJ CheilJedang, Ajinomoto Co., and Archer Daniels Midland Company.