Thermoplastic Elastomers Market Size (2024 – 2030)

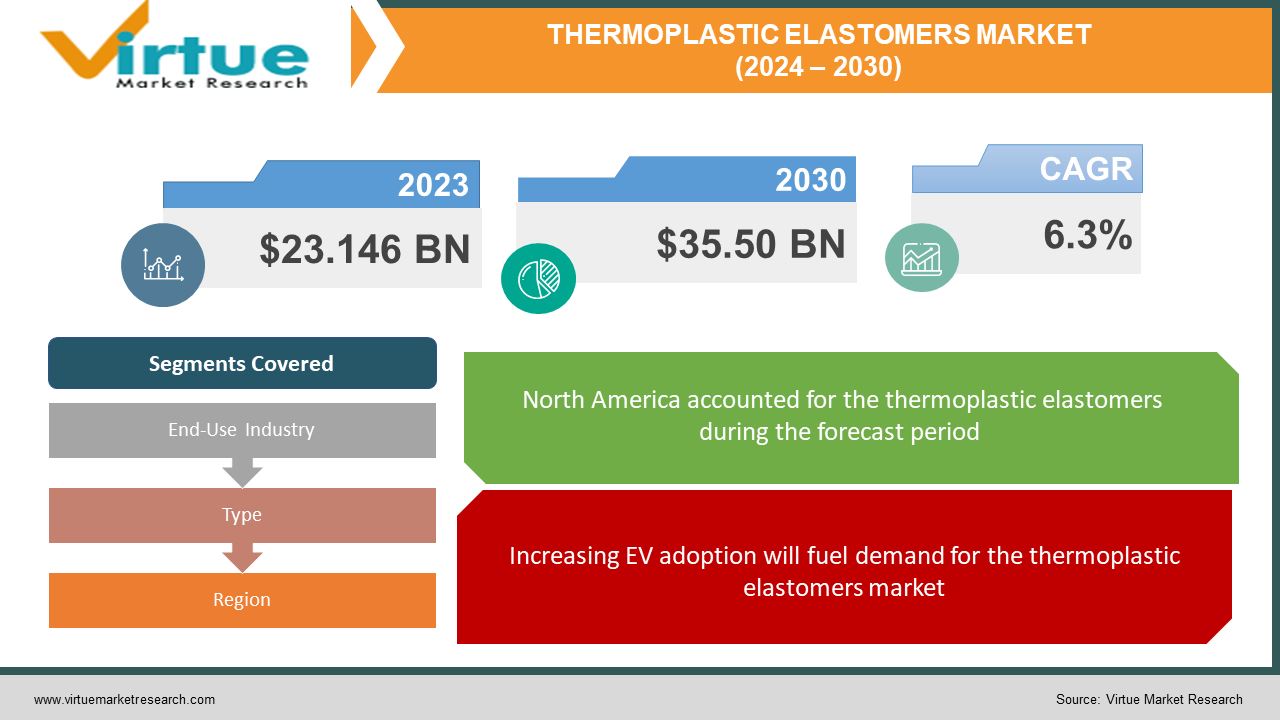

The global thermoplastic elastomers market was valued at USD 23.146 billion and is projected to reach a market size of USD 35.50 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 6.3% between 2024 and 2030.

Growing consumption in a variety of sectors, including consumer products, automotive, industrial, medical, electrical, and electronics, has been a major factor in the expansion of worldwide business in recent years. Throughout the projected period, rising demand for automotive component manufacturing is anticipated to be a key driver of the global industry. Environmental agencies' regulatory action, which aims to reduce carbon emissions by increasing fuel efficiency, has compelled big automakers to use plastics instead of metals and alloys in automotive components. The demand for lightweight, high-performance passenger cars among consumers has been driving plastic innovation in the automobile industry. The use of thermoplastics in the above-described application has increased as a result of these causes. Thermoplastic elastomers (TPEs) are becoming more preferred in terms of application since they have better physical and chemical qualities than thermoset plastics. Throughout the forecast period, a high rate of substitution of TPU and TPO for ethylene propylene diene monomer (EPDM) in building materials is anticipated to support worldwide industry demand. TPEs are special thermoplastics that are environmentally benign and recyclable. They can also be reshaped and remolded, which significantly reduces waste. In terms of physical properties and traits, these provide several additional benefits, including resistance to chemicals, UV light, oxidation, and giving materials a pleasant touch. These characteristics are pushing TPEs to replace rubber and traditional plastic materials in their respective applications. To guarantee the highest level of consumer health and safety, some federal agencies, including the FDA and US Pharmacopoeia, regulate product applications in a variety of end-use sectors. These rules, which offer recommendations for responsible product use, validate the use of TPE in commercial applications. As stated in the Clean Air Act, the U.S. Environmental Protection Agency (EPA) has also established rules and control methods for carbon emissions from different types of automobiles. As a result, there is now a greater need for industrial machinery and vehicles that use thermoplastic elastomer components and are fuel-efficient. It is also anticipated that the rapidly expanding automotive markets will increase demand for thermoplastic elastomers in underbody components, exteriors, sealing systems, and interiors.

Key Market Insights:

TPE reduces vehicle weight and density by replacing traditional parts within and outside the vehicle, enabling higher fuel efficiency in automotive applications. Regulatory agencies from different countries have implemented several strict laws to lessen the effects of carbon emissions and greenhouse gases (GHG) on the environment and human health. The need for TPE in external, interior, sealing systems, and under-the-hood components is also expected to increase due to rapidly expanding auto markets. Demand for safe, affordable, lightweight MUV/SUV models with excellent fuel efficiency and a focus on comfort and style is driving an increase in use in the automotive sector. Among the most exciting new technologies that provide chances for increased connectedness, improved productivity, and improved lifestyles are wearable electronics. By enhancing our talents and facilitating communication and interaction with both our surroundings and other people, these gadgets function as an extension of the human body in many respects.

Global Thermoplastic Elastomers Market Drivers:

Increasing EV adoption will fuel demand for the thermoplastic elastomers market.

Thermoplastic elastomers (TPEs) are essential to the automotive industry's shift to sustainability, and as EVs become more commonplace, demand for TPEs is expected to rise dramatically. TPEs are preferred for parts like gaskets, seals, wire insulation, and interior applications in EVs because of their lightweight, impact resilience, and flexibility. TPEs will play a crucial role in meeting the special engineering problems presented by electric vehicles while also helping to enhance energy efficiency and lower emissions, which will fuel the market's significant development as the EV market continues to rise.

Increased attention to energy-efficient structures will power the thermoplastic elastomer industry.

In building and construction applications, thermoplastic elastomers are becoming more and more in demand. Plumbing fixers, siding, flooring, insulation, panels, doors, windows, glass, bathroom units, gratings, railings, and a wide range of structural and ornamental uses are among the many applications for thermoplastic elastomers. In the building and construction industry, thermoplastic elastomers are excellent and affordable substitutes for rival materials, including silicone, natural rubber, latex, and PVC compounds. Furthermore, thermoplastic polyolefins (TPOs) are finding increased applications in the building and construction industries. TPOS is now widely used in newly developed flame-retardant roofing applications. TPO-made roofing membranes are flexible single-ply membranes that combine the best qualities of EPDM and PVC. Long-term weathering resistance, flexibility in freezing temperatures, chemical resistance, tear resistance, puncture resistance, and heat seaming capabilities are all features of TPOs. In terms of environmental friendliness, thermoplastic elastomers are superior to those made of PVC and EPDM. The demand for thermoplastic elastomers in the building and construction sectors is being driven by a shift towards green buildings and an increase in environmental concerns.

Global Thermoplastic Elastomers Market Restraints and Challenges:

Compared to more typical materials like polyethylene, PVC, rubber, and polyurethane, the manufacturing process for thermoplastic epoxy (TPE) is far more complex and demands large investments. To produce TPE, the manufacturing apparatus requires a high degree of technical skill and operates at high temperatures. The cost of TPE has gone up because of large investments and intricate manufacturing procedures. TPE is only used on a small scale and mostly in high-end applications due to its high production costs. Compounding grades, such as polyethylene, polypropylene, acrylonitrile butadiene styrene, and polyurethane, are designed to resemble thermoplastic epoxy (TPE) and are more reasonably priced than TPE. As a result, TPE faces intense rivalry in a few end-use sectors, including electronics, building & construction, and industrial machines. Additionally, the price of TPE is impacted by the rising cost of raw ingredients. The market is filled with various kinds of thermoplastic elastomers. Their prices and performance requirements are different. The profit margin of the applications determines which kind of thermoplastic elastomer is used. The development of additional TPE varieties is being hampered by the new tendency to streamline the intricate process of selecting a particular kind of thermoplastic elastomer. The variety of thermoplastic elastomer varieties available is being decreased by concentrating on particular types and allowing them to fulfill the functions of other thermoplastic elastomers. This circumstance has spurred research efforts to lower the price and improve the adaptability of a particular kind of TPE. In the market for automotive thermoplastic elastomers, TPO is taking the place of TPV. Throughout the projection period, TPO is anticipated to displace PVC and TPU films in automotive applications. Therefore, replacing segments within TPE is a hurdle to the market's overall growth.

Global Thermoplastic Elastomers Market Opportunities:

Vegetable oils and fatty acids are examples of sustainable resources used to make biobased TPE. It provides qualities that are on par with or greater than those of typical TPE, primarily for the sporting goods, electronics, and footwear industries. TPE made from biobased materials is more biodegradable and uses fewer non-renewable resources during production. For industry participants, ongoing innovation and biobased TPE commercialization are opening up new avenues. Additionally, a lot of synthetic TPE producers are now concentrating on creating environmentally beneficial and sustainable products. For example, biobased TPU is produced by BASF and Lubrizol for use in the textile, automotive, footwear, and industrial sectors. Biobased TPU is made from a variety of biopolymers, including castor oil, palm oil, polyhydroxy butyrate (PHB), polylactide (PLA), and corn and wheat starches. Because diisocyanates and polyols are expensive raw materials, newly developed biobased TPU offers an advantage over conventional TPU in terms of characteristics. For manufacturers, R&D is opening up opportunities for the production of biobased TPUs.

THERMOPLASTIC ELASTOMERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.3% |

|

Segments Covered |

By End-Use Industry, Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

LG Chemicals, Huntsman Corporation, Dynasol Elastomers LLC, Bayer MaterialScience LLC, China Petroleum & Chemical Corporation (Sinopec), Evonik Industries, Kraton Polymers, LLC, Avient Corporation, Teknor APEX Company, EMS Group, LCY Chemical Corporation |

Global Thermoplastic Elastomers Market Segmentation: By End-Use Industry

-

Automotive

-

Footwear

-

Medical

-

Building and Construction

-

Electrical & Electronics

Automotive is the largest end-user by market share in 2023. The use of TPE in automotive applications has skyrocketed due to the widespread use of electronic and electrical equipment, including safety belt tensioners, passenger airbags, electric motor housings for windows and seats, and more. Under-the-hood components are also finding use for recently developed grades with improved hydrolytic stability. Additionally, being molded are other automotive applications, including plugs, connections, and housing components, that have to withstand the industry's increasingly demanding standards. Advances in mold design, enhanced computer simulation, more robotics, and a better knowledge of flow behavior in molds have all helped polyester resins produce massive, molded parts more economically and efficiently. The fastest-growing end market for thermoplastic elastomers is the medical sector. TPEs' biocompatibility, flexibility, and sterilizing properties have led to an increase in their use in medical equipment, gadgets, and packaging. Medical-grade gloves, tubing, syringe components, seals, and gaskets are just a few of the uses for them.

Global Thermoplastic Elastomers Market Segmentation: By Type

-

Styrene Block Copolymers

-

Thermoplastic Polyurethanes

-

Thermoplastic Polyolefins

-

Copolyester Ether Elastomers

-

Thermoplastic Vulcanizates

Styrene block copolymers are the largest category. SBCs are used as a base polymer for TPE compounds called thermoplastic strategic elastomers (TPS). Growing use in automobile systems and under-the-hood applications is anticipated to be a key driver of TPE consumption worldwide. Because of its ability to insulate both sound and heat, TPE is becoming more and more popular in the building industry. Furthermore, industry growth is expected to be aided by the spike in industrialization that is occurring in different countries. The industry has recently seen significant growth due to rapid industrialization and the ensuing demand for plastics, synthetic lubricants, and other industrial uses. The United States' quick industrialization helped the sector expand. Thermoplastic vulcanizates are the fastest-growing segment. Their capacity to recycle and repurpose trash and scraps from production is the reason for these aspects.

Global Thermoplastic Elastomers Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America has the largest market share in 2023. Plastics are widely used in the North American market, especially in the automotive, electronics, packaging, and construction industries. Materials like TPE are widely used because they are easy to mold and versatile; car makers especially want to use them because they are inexpensive to produce. Being a significant source of crude oil, Canada helps fuel the expansion of the plastics industry by producing petrochemical-derived polymers like TPE. The availability of raw materials and low production costs help Mexico's growing automobile industry remain competitive in international markets. Asia-Pacific is the fastest-growing region. Asia-Pacific's manufacturing boom is led by China and India, which is driving up demand for TPE across a range of industries. The growing manufacturing sector will increase the need for TPE compounds in the automotive, industrial machinery, packaging, and electrical and electronics industries. Europe is still a sizable market despite macroenvironmental difficulties, with Eastern Europe exhibiting potential in both industry and consumption. With the help of growing end-use sectors, emerging economies in Central and South America, the Middle East, and Africa are growing quickly. TPE is still extensively used in a variety of medical devices and equipment. The demand for TPE goods is fueled by MEA's dominance in crude oil production, with OPEC nations playing a crucial role in the dynamics of the world oil market.

COVID-19 Impact Analysis on the Global Thermoplastic Elastomers Market:

The market for thermoplastic elastomers experienced a downturn in demand for their downstream derivatives. Global economic development was significantly impacted by the coronavirus outbreak, which the World Health Organization has classified as a pandemic. The World Trade Organization (WTO) predicted that the economic effects of COVID-19 would cause a 15%–34% decline in global trade volumes. The majority of nations have released guidelines for working from home; therefore, the pandemic is having an impact on a variety of businesses, including electronics, construction, and the automobile sector.

Latest Trends/ Developments:

In January 2023, to lessen the carbon footprint connected with their 3D printing materials—more specifically, bio-based high-performance Rilsan polyamide 11 and Pebax elastomers—Arkema SA and Engie SA joined forces to acquire 300 GWh/year of renewable biomethane in France.

In January 2022, Arkema SA invested in its Serquigny plant in France, increasing its worldwide manufacturing capacity of Pebax Elastomer by 25%.

In July 2022, in North America, Asahi Kasei Corporation expanded its portfolio of specialty chemically-coupled glass fiber-reinforced polypropylenes with the introduction of the Soform series, a newly designed resin

Key players:

-

LG Chemicals

-

Huntsman Corporation

-

Dynasol Elastomers LLC

-

Bayer MaterialScience LLC

-

China Petroleum & Chemical Corporation (Sinopec)

-

Evonik Industries

-

Kraton Polymers, LLC

-

Avient Corporation

-

Teknor APEX Company

-

EMS Group

-

LCY Chemical Corporation

Chapter 1. Thermoplastic Elastomers Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Thermoplastic Elastomers Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Thermoplastic Elastomers Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Thermoplastic Elastomers Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Thermoplastic Elastomers Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Thermoplastic Elastomers Market – By End-Use Industry

6.1 Introduction/Key Findings

6.2 Automotive

6.3 Footwear

6.4 Medical

6.5 Building and Construction

6.6 Electrical & Electronics

6.7 Y-O-Y Growth trend Analysis By End-Use Industry

6.8 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 7. Thermoplastic Elastomers Market – By Type

7.1 Introduction/Key Findings

7.2 Styrene Block Copolymers

7.3 Thermoplastic Polyurethanes

7.4 Thermoplastic Polyolefins

7.5 Copolyester Ether Elastomers

7.6 Thermoplastic Vulcanizates

7.7 Y-O-Y Growth trend Analysis By Type

7.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Thermoplastic Elastomers Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By End-Use Industry

8.1.3 By Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By End-Use Industry

8.2.3 By Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By End-Use Industry

8.3.3 By Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By End-Use Industry

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By End-Use Industry-

8.5.3 By Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Thermoplastic Elastomers Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 LG Chemicals

9.2 Huntsman Corporation

9.3 Dynasol Elastomers LLC

9.4 Bayer MaterialScience LLC

9.5 China Petroleum & Chemical Corporation (Sinopec)

9.6 Evonik Industries

9.7 Kraton Polymers, LLC

9.8 Avient Corporation

9.9 Teknor APEX Company

9.10 EMS Group

9.11 LCY Chemical Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Based on end-user, type, and region, the Global Thermoplastic Elastomers Market report's segments are covered.

In the global thermoplastic elastomers market, North America is anticipated to hold the largest share.

The global thermoplastic elastomers market is predicted to reach a value of USD 35.50 billion by 2030.

The global thermoplastic elastomers market is expected to grow between 2024 and 2030.

In 2023, the global thermoplastic elastomers market was estimated to be worth USD 23.146 billion.