Thermoplastic Bonding Agent Market Size (2024 – 2030)

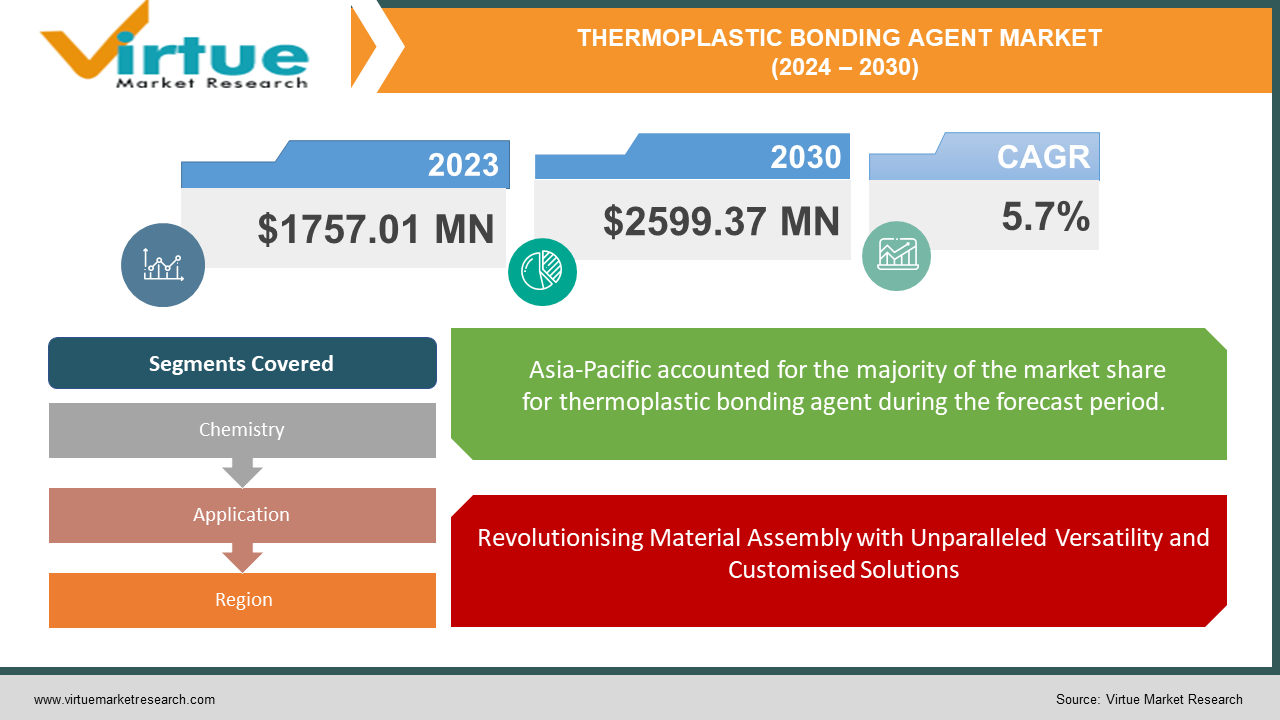

The Global Thermoplastic Bonding Agent Market was valued at USD 1757.01 million in 2023 and is projected to reach a market size of USD 2599.37 million by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.7%.

There are two primary techniques for achieving thermoplastic bonding. adhesives and solvent cements. The way that solvent cement works is that it dissolves the thermoplastics' surface layers, melting them together. The plastic solidifies and makes a strong binding after the solvent evaporates. When attaching comparable thermoplastics, such as ABS to ABS or PVC to PVC, this technique is usually employed. A wider variety of alternatives are available when it comes to adhering to thermoplastics. Super glues, or cyanoacrylates, are a common variety that set quickly but are not resistant to heat or solvents. Although they cure more slowly than superglues, two-part epoxies offer a stronger, more resilient bond with superior resistance to heat and solvents. Hot melt adhesives are appropriate for high-volume applications since they need heat activation to produce a strong bond after cooling.

Key Market Insights:

The market is predicted to increase and reach US$ 2.89 billion by 2032. This demonstrates how thermoplastics are being used more and more, as well as how bonding solutions are required for them.

The automotive and textile industries, which will account for 1.3% of the global vehicle production increase in 2021, are the main drivers of the thermoplastic adhesive films market's development. This implies that the need for bonding agents and the expansion of thermoplastics-using sectors are strongly correlated.

Thermoplastic adhesive films are available in polyester, polyurethane, and polyethylene among other materials. This meets the necessity for joining several thermoplastic kinds.

Due to its increasing industrialization, the Asia Pacific region is predicted to have the greatest development in the thermoplastic adhesive film market, where it currently owns the biggest market share. This suggests that there is an increasing need for thermoplastic bonding solutions worldwide.

Global Thermoplastic Bonding Agent Market Drivers:

Revolutionising Material Assembly with Unparalleled Versatility and Customised Solutions

The capacity of thermoplastic bonding agents to fill the void between various thermoplastic kinds is one of its strongest points. In contrast to conventional techniques that could be restricted to certain materials, thermoplastic bonding agents are available in a variety of formulas. Examples include polyester, polyethylene, and polyurethane; each has advantages of its own. This makes customized bonding solutions possible. Imagine having to firmly attach a flexible, lightweight PVC panel to an inflexible ABS automobile component. It may not be possible to achieve a strong bind between these incompatible materials using conventional methods; instead, a particular formulation of thermoplastic glue can be selected. A completely new degree of design flexibility and usefulness in applications across several sectors is made possible by this material compatibility.

Adopting Bio-Based Adhesives and Eco-Friendly Materials to Promote Sustainability

The world of thermoplastics and the bonding chemicals that hold them together is being impacted by the sustainability movement. Concerns about the environment are driving businesses to concentrate more on creating environmentally friendly products. This relates to the production of thermoplastics derived from biobased or recycled resources. However, sustainability goes beyond that. There is also a green revolution happening to the bonding agents themselves. Traditional, perhaps hazardous solvents and chemicals are being replaced with bio-based adhesives made from renewable resources. The use of eco-friendly materials throughout the bonding process gives items made of thermoplastics a longer and more sustainable lifespan. The market for thermoplastic bonding agents is predicted to increase significantly as a result of this trend towards sustainable solutions, which will appeal to both customers and manufacturers that value the environment. This trend is not merely a feel-good project.

Global Thermoplastic Bonding Agent Market Restraints and Challenges:

There are obstacles in the thermoplastic bonding agent business. The use of some compounds in adhesives is restricted by strict environmental rules, which increases the complexity and cost of research. Variations in the pricing of raw materials can hurt manufacturer earnings and product affordability. Safer substitutes are required because of health concerns regarding some bonding agents. For many situations, traditional joining techniques like welding may be considered easier or less expensive. Lastly, a lack of knowledge may prevent broader adoption, particularly in developing nations. Getting beyond these obstacles will be essential. To fully utilize this adaptable bonding technique, innovation in economical and environmentally friendly formulations is essential, as is promotion and education.

Global Thermoplastic Bonding Agent Market Opportunities:

Thermoplastic bonding agents have a promising future. Technological developments in material science are producing adhesives that are stronger and cure more quickly, leading to new uses. This adaptability reaches new areas such as medical devices, 3D printing with excellent layer adhesion, and lightweight composite construction. Faster bonding procedures are required due to the increase in automation, and thermoplastic agents that work with assembly lines and robots will succeed. Additionally, the emphasis on lightweight materials for electronics, automobiles, and aircraft perfectly complements these bonding agents' advantages. And last, with emerging economies experiencing a rapid industrialization boom, there is a great deal of opportunity to train producers and spread this technology. The thermoplastic bonding agent market has the potential to transform material joining techniques and influence manufacturing trends if it takes advantage of these opportunities.

THERMOPLASTIC BONDING AGENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.7% |

|

Segments Covered |

By Chemistry, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Covestro AG, Fait Plast SpA, HB Fuller Co, Kureha Corp, Pontacol AG, Prochimir Inc, Protechnic SA Adhesive Films Inc, Scapa Group Ltd |

Global Thermoplastic Bonding Agent Market Segmentation: By Chemistry

-

Solvent-Based

-

Hot Melt Adhesives

-

Water-Based Adhesives

-

Reactive Adhesives

The adhesives' chemistry is used to categorize the thermoplastic bonding agent industry. While solvent-based alternatives provide strong welds, their use is dwindling because of environmental issues. Because they cure quickly, hot melt adhesives perform well in high-volume applications. The use of water-based adhesives is growing as an environmentally friendly substitute. Reactive adhesives, such as epoxies, on the other hand, make up the largest and fastest-growing market category. These adhesives provide strong, long-lasting connections that are perfect for demanding applications in a variety of sectors.

Global Thermoplastic Bonding Agent Market Segmentation: By Application

-

Automotive

-

Textiles

-

Electronics

-

Medical Devices

-

Construction

The market for thermoplastic bonding agents serves a range of sectors with different requirements. Textiles require flexible and washable bonding, whereas automotive requires materials that are lightweight and heat resistant. These agents are used in electronics to provide precise bonding with features like conductivity or insulation. Strong bonding is required for composite materials and lightweight building components in construction, while biocompatible and sterile adhesives are essential for medical equipment. The research does not identify a single fastest-growing category; nevertheless, given their substantial dependence on thermoplastics, the automotive and construction industries are plausible possibilities. Application-based segmentation guarantees customized solutions for maximum efficiency in a variety of sectors.

Global Thermoplastic Bonding Agent Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The regional differences are shown when the thermoplastic bonding agent market is segmented by geography. While Asia Pacific is now leading and growing at the highest rate due to its expanding industries and infrastructural development, North America is a mature market. Europe places a higher priority on sustainability and progress than South America, which has challenges but also has promise. Finally, a rising market with significant potential is found in the Middle East and Africa. Manufacturers may target areas depending on growth, economic conditions, and acceptance of new technologies thanks to this regional segmentation.

COVID-19 Impact Analysis on the Global Thermoplastic Bonding Agent Market:

The market for thermoplastic bonding agents did not suffer entirely from the COVID-19 outbreak. Of course, there were production snares, supply chain interruptions, and lackluster demand from sectors such as the automobile-building industry. However, the emphasis on cleanliness could have increased these chemicals' use in medical equipment. The surge in e-commerce increased demand for packaging materials that might be dependent on it. Additionally, industries like electronics for remote work and medical gadgets saw development, which may have contributed to an increase in the need for bonding agents. In general, the market appears to be rebounding; however, the long-term effects will depend on things like the economy picking up, new uses for these bonding agents, and the increasing automation of the process, which will need quicker bonding solutions.

Recent Trends and Developments in the Global Thermoplastic Bonding Agent Market:

Innovation is booming in the thermoplastic bonding agent industry worldwide. One of the main motivators is sustainability since old solvent-based adhesives are being replaced by bio-based adhesives made from maize or soy. Another major development is automation, which necessitates fast curing and reliable bonding agents for manufacturing lines and robots. Improvements in material science are producing stronger adhesives, cures more quickly, have better heat resistance, and even have self-healing capabilities! Beyond their typical applications, these next-generation technologies are finding usage in medical devices, 3D printing with improved bonding, and lightweight construction. Ultimately, as developing countries experience rapid industrialization, there is an increasing emphasis on training producers about these adaptable bonding agents. This will facilitate their wider use and lead to a revolutionary approach to material assembly.

Key Players:

-

Covestro AG

-

Fait Plast SpA

-

HB Fuller Co

-

Kureha Corp

-

Pontacol AG

-

Prochimir Inc

-

Protechnic SA Adhesive Films Inc

-

Scapa Group Ltd

Chapter 1. Thermoplastic Bonding Agent Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Thermoplastic Bonding Agent Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Thermoplastic Bonding Agent Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Thermoplastic Bonding Agent Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Thermoplastic Bonding Agent Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Thermoplastic Bonding Agent Market – By Chemistry

6.1 Introduction/Key Findings

6.2 Solvent-Based

6.3 Hot Melt Adhesives

6.4 Water-Based Adhesives

6.5 Reactive Adhesives

6.6 Y-O-Y Growth trend Analysis By Chemistry

6.7 Absolute $ Opportunity Analysis By Chemistry, 2024-2030

Chapter 7. Thermoplastic Bonding Agent Market – By Application

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Textiles

7.4 Electronics

7.5 Medical Devices

7.6 Construction

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Thermoplastic Bonding Agent Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Chemistry

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Chemistry

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Chemistry

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Chemistry

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Chemistry

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Thermoplastic Bonding Agent Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Covestro AG

9.2 Fait Plast SpA

9.3 HB Fuller Co

9.4 Kureha Corp

9.5 Pontacol AG

9.6 Prochimir Inc

9.7 Protechnic SA Adhesive Films Inc

9.8 Scapa Group Ltd

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Thermoplastic Bonding Agent Market size is valued at USD 1757.01 million in 2023.

The worldwide Global Thermoplastic Bonding Agent Market growth is estimated to be 5.7% from 2024 to 2030.

Global Thermoplastic Bonding Agent Market segmentation covered in the report is By Chemistry (Solvent-Based, Hot Melt Adhesives, Water-Based Adhesives, Reactive Adhesives); By Application (Automotive, Textiles, Electronics, Medical Devices, Construction), and by region.

It is anticipated that developments in bio-based and sustainable adhesives, growing automation and Industry 4.0 integration, and the creation of next-generation bonding agents with improved qualities will propel the thermoplastic bonding agent market's future expansion. Investigating cutting-edge uses in 3D printing, medical gadgets, and lightweight buildings will open intriguing new possibilities.

There was a mixed effect of the COVID-19 epidemic on the thermoplastic bonding agent business. Production and supply chain difficulties at first led to delays. Nonetheless, the industry is recovering, and there may have been an increase in demand for e-commerce packaging and hygiene-focused applications (medical equipment).