Therapeutic Drug Monitoring Equipment Market Size (2024 – 2030)

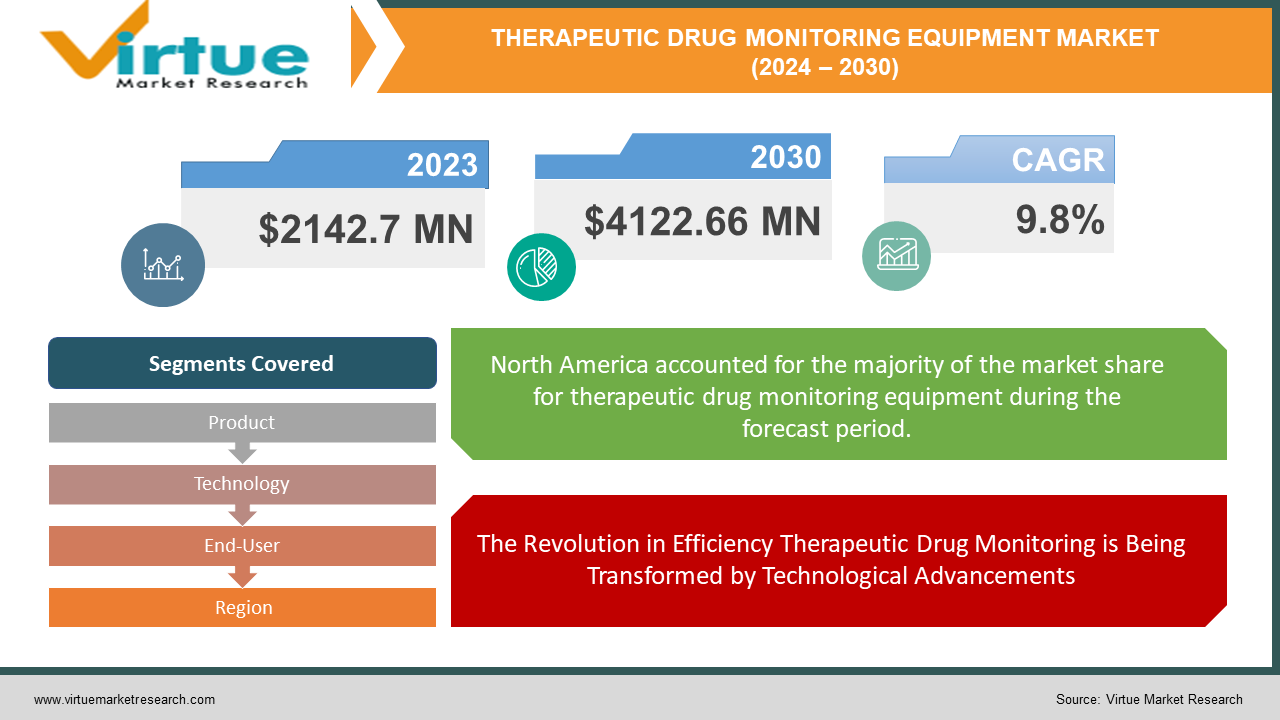

The Global Therapeutic Drug Monitoring Equipment Market was valued at USD 2142.7 million in 2023 and is projected to reach a market size of USD 4122.66 million by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.8%.

Different lab equipment is used for analysis in therapeutic drug monitoring (TDM), depending on the substance under observation. High-performance liquid chromatography (HPLC) may be used to separate and quantify pharmaceuticals and their breakdown products, automated analyzers can run several tests on many samples at once, and mass spectrometers can provide the most accurate identification and quantification of both.

Key Market Insights:

Because chronic diseases like diabetes, cancer, and organ transplants are becoming more common, the global market for TDM equipment is expanding significantly. Around the world, 1.3 billion people deal with chronic illnesses.

Advances like automation, miniaturization, and quicker turnaround times drive the TDM industry, accounting for 35% of market research organizations' global sales. These developments streamline processes, cut expenses, and open the door for TDM technology to be used more widely in a range of healthcare contexts—possibly including at-home testing.

Precise medication monitoring is in high demand due to the increased emphasis on personalized medicine, which involves creating treatment programs that are specific to each patient. Revenue from the worldwide market research sector is expected to increase from $130 billion in 2023 to $140 billion in 2024. Furthermore, faster TDM findings can be obtained closer to the patient, perhaps at clinics or even at home, thanks to the growing popularity of point-of-care testing. The creation of portable and user-friendly TDM equipment is required by this trend.

The TDM equipment business has challenges despite its potential, including costly upfront equipment costs, restricted insurance reimbursement, and a lack of uniform lab standards.

Global Therapeutic Drug Monitoring Equipment Market Drivers:

Increasing Rates of Chronic Disease Motivate the Need for Therapeutic Drug Monitoring Equipment to Provide Long-Term Care That Is Safe and Effective

Globally, the burden of chronic disease is growing, with diseases including diabetes, cancer, and those needing organ transplants becoming more common. This increase results in a population that is becoming more and more reliant on long-term medicine to treat their ailments. This is where devices for therapeutic drug monitoring (TDM) are useful. TDM technology allows medical personnel to accurately monitor a patient's systemic levels of these drugs, ensuring the safety and efficacy of therapy. It enables them to determine if the medicine is doing as intended within the therapeutic range or whether dose changes are necessary to maximize the patient's response to the treatment. To minimize potential problems from under or over-medication, regular monitoring is essential for the management of chronic diseases and ultimately improves patient outcomes.

The Revolution in Efficiency Therapeutic Drug Monitoring is Being Transformed by Technological Advancements

Exciting technological breakthroughs are driving a revolution in the therapeutic drug monitoring (TDM) environment. Automation is a major area of advancement. TDM analysis repetitive operations are becoming more and more automated, which streamlines laboratory workflows and frees up crucial time for medical practitioners. This reduces the possibility of human mistakes during testing and increases efficiency. Again, miniaturization is revolutionary. TDM technology is getting more compact and smaller, which makes it simpler to incorporate into different healthcare environments—even ones with limited space. This makes TDM more accessible to patients in clinics or maybe even at home thanks to point-of-care testing. Another significant development is faster turnaround times. Healthcare professionals may obtain TDM data sooner with faster analysis, which enables them to optimize patient care by making appropriate medication modifications. Automation, miniaturization, and quicker turnaround times are three innovations that together are making TDM more user-friendly, efficient, and economical. This creates opportunities for TDM equipment to be used in a wider variety of healthcare settings, which will eventually help a greater number of patients.

Global Therapeutic Drug Monitoring Equipment Market Restraints and Challenges:

The market for therapeutic drug monitoring (TDM) devices is encouraging, but obstacles prevent it from expanding unchecked. Hospitals and laboratories have difficulties due to the high initial expenditures of advanced technology, particularly in settings with limited resources. Moreover, insufficient insurance coverage for TDM testing deters medical professionals from using this technique. Another challenge is standardization, as inconsistent techniques throughout laboratories result in inconsistent testing and result interpretation, which lowers overall efficacy. The intricacy of TDM assays in and of itself poses a difficulty, necessitating skilled staff and particular knowledge that could be scarce in some healthcare environments. Ultimately, it might be challenging to integrate TDM data with electronic health records, which can impede the efficient exchange of information and jeopardize patient care. In order to guarantee the broader acceptance of TDM equipment and its function in personalized medicine, it is imperative to address these constraints.

Global Therapeutic Drug Monitoring Equipment Market Opportunities:

Opportunities abound in the market for Therapeutic Drug Monitoring (TDM) equipment due to a convergence of trends. Precise drug monitoring is required due to the increased emphasis on personalized medicine, where therapies are customized for each patient, which drives a strong demand for TDM technology. Additionally, as chronic illnesses become more common, there is an increasing need for attentive drug control, which TDM technology successfully meets. Automation, downsizing, and quicker response times are examples of how technology is improving TDM's efficiency and economy, which is opening the door to its widespread use. The growing popularity of point-of-care testing, which enables faster results closer to the patient, calls for the creation of portable and user-friendly TDM equipment. Finally, favorable government policies and rising healthcare professionals' knowledge of TDM's advantages are driving market expansion. By taking advantage of these chances, producers of TDM equipment may greatly enhance patient care and meet the changing needs of the healthcare industry.

THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.8% |

|

Segments Covered |

By Product, Technology, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Abbott Laboratories (US), ARK Diagnostics Inc. (US), bioMérieux SA (France), Bio-Rad Laboratories Inc. (US), Danaher Corporation (US), Exagen Inc. (US), F. Hoffmann-La Roche AG (Switzerland), Siemens Healthineers (Germany), Thermo Fisher Scientific Inc. (US) |

Global Therapeutic Drug Monitoring Equipment Market Segmentation: By Product

-

Consumables

-

Equipment

The Equipment category is the real growth driver in the Therapeutic Drug Monitoring equipment market, even if consumables like reagents are necessary for TDM tests. The robust equipment used in TDM analysis is housed in this section. It includes sophisticated detectors for accurate drug detection and automated analyzers for high-volume testing. With tools like mass spectrometers and HPLC, the emphasis on technical developments is driving the TDM equipment industry.

Global Therapeutic Drug Monitoring Equipment Market Segmentation: By Technology

-

Immunoassays

-

Chromatographic Techniques

-

Mass Spectrometry

When it comes to the analysis techniques employed, the market for Therapeutic Drug Monitoring (TDM) equipment is engaged in an exciting technical competition. Although not the fastest growing market, immunoassays, the conventional approach utilizing antibodies, nonetheless occupy a large proportion. Chromatographic techniques provide a more in-depth study, although their growth may be slower. Mass spectrometry is the true leader, offering the most accurate drug identification and quantification. Since mass spectrometry offers the most precise image of a patient's medication levels, its rise is indicative of the healthcare industry's rising emphasis on accuracy in TDM.

Global Therapeutic Drug Monitoring Equipment Market Segmentation: By End-User

-

Hospital Labs

-

Private Labs

Healthcare institutions are the target market for Therapeutic Drug Monitoring (TDM) equipment. Due to their established infrastructure for performing TDM testing, hospital laboratories now possess the biggest market share and are in a dominant position. The real competitors, though, are private labs, which are expanding at the quickest rate. A greater spectrum of patients can be reached by private laboratories providing these services, especially as outpatient care grows and TDM use increases. Hospital laboratories could still hold sway in the TDM equipment market for the time being, but the commercial lab sector is a vibrant and quickly expanding competitor.

Global Therapeutic Drug Monitoring Equipment Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Because of well-established industry players and a strong emphasis on personalized treatment, North America now holds the top spot. Asia Pacific, on the other hand, is the rising star because of its vast population, economic growth, and increased need for TDM. Europe has a thriving industry that might expand more based on how important healthcare expenditure is in each nation. The Middle East and Africa now have the smallest percentage of the market but might rise in the future owing to rising regional tensions and increased spending in some governments (albeit this would be particular to the naval TDM segment). South America's market is predicted to develop at a modest rate.

COVID-19 Impact Analysis on the Global Therapeutic Drug Monitoring Equipment Market:

The COVID-19 pandemic had a complex impact on the market for therapeutic drug monitoring (TDM) devices. The first obstacle came from broken international supply chains, which would have led to short-term delays and shortages of equipment. Furthermore, there may have been a brief pause in the adoption and usage of TDM technology for non-critical cases due to the healthcare system's heavy concentration on the epidemic. Long-term prospects, nevertheless, seem promising. The pandemic highlighted the value of careful patient monitoring and personalized medication in critical care, which might result in a long-term increase of TDM equipment for treating critically sick patients after COVID-19. In addition, the pandemic's telemedicine growth offers intriguing prospects. Future market expansion may be supported by the integration of TDM equipment with remote patient monitoring systems, which might provide patients in need of TDM with increased flexibility and convenience.

Recent Trends and Developments in the Global Therapeutic Drug Monitoring Equipment Market:

The market for therapeutic drug monitoring (TDM) devices is booming with new ideas. Precise medication monitoring is becoming more and more necessary as personalized medicine—where therapies are customized to meet the needs of each patient—gains traction. Here's where TDM gear does well. Technological developments in automation and miniaturization are facilitating the seamless integration of TDM testing into personalized medicine initiatives by making it faster, simpler, and more accessible. The very terrain of technology itself is changing. Medical personnel may free up significant time by implementing automation to optimize procedures. In addition to having the potential to lower costs, miniaturization and quicker turnaround times open the door for broader TDM implementation, especially in point-of-care settings nearer to patients. The development of portable and user-friendly TDM equipment is being further propelled by the increasing prevalence of point-of-care testing. Anticipating forward, the possible incorporation of Artificial Intelligence (AI) shows possibilities for evaluating intricate TDM data and supporting medical practitioners in making knowledgeable drug administration choices. Last but not least, growing acceptance of TDM's advantages and laws that encourage use are driving market expansion by establishing a foundation for broader adoption. Essentially, these developments are turning the market for TDM equipment into an effective instrument for better patient care and personalized treatment.

Key Players:

-

Abbott Laboratories (US)

-

ARK Diagnostics Inc. (US)

-

bioMérieux SA (France)

-

Bio-Rad Laboratories Inc. (US)

-

Danaher Corporation (US)

-

Exagen Inc. (US)

-

F. Hoffmann-La Roche AG (Switzerland)

-

Siemens Healthineers (Germany)

-

Thermo Fisher Scientific Inc. (US)

Chapter 1. Therapeutic Drug Monitoring Equipment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Therapeutic Drug Monitoring Equipment Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Therapeutic Drug Monitoring Equipment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Therapeutic Drug Monitoring Equipment Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Therapeutic Drug Monitoring Equipment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Therapeutic Drug Monitoring Equipment Market – By Product

6.1 Introduction/Key Findings

6.2 Consumables

6.3 Equipment

6.4 Y-O-Y Growth trend Analysis By Product

6.5 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Therapeutic Drug Monitoring Equipment Market – By Technology

7.1 Introduction/Key Findings

7.2 Immunoassays

7.3 Chromatographic Techniques

7.4 Mass Spectrometry

7.5 Y-O-Y Growth trend Analysis By Technology

7.6 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Therapeutic Drug Monitoring Equipment Market – By End-User

8.1 Introduction/Key Findings

8.2 Hospital Labs

8.3 Private Labs

8.4 Y-O-Y Growth trend Analysis By End-User

8.5 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Therapeutic Drug Monitoring Equipment Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By Technology

9.1.4 By By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By Technology

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By Technology

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By Technology

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By Technology

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Therapeutic Drug Monitoring Equipment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Abbott Laboratories (US)

10.2 ARK Diagnostics Inc. (US)

10.3 bioMérieux SA (France)

10.4 Bio-Rad Laboratories Inc. (US)

10.5 Danaher Corporation (US)

10.6 Exagen Inc. (US)

10.7 F. Hoffmann-La Roche AG (Switzerland)

10.8 Siemens Healthineers (Germany)

10.9 Thermo Fisher Scientific Inc. (US)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Therapeutic Drug Monitoring Equipment Market size is valued at USD 2142.7 million in 2023.

The worldwide Global Therapeutic Drug Monitoring Equipment Market growth is estimated to be 9.8% from 2024 to 2030.

The Global Navy Integrated Bridge Systems Market is segmented By Product (Consumables, Equipment); By Technology (Immunoassays, Chromatographic Techniques, Mass Spectrometry); By End-User (Hospital Labs, Private Labs), and by region.

The development of user-friendly point-of-care testing equipment and the incorporation of AI for improved decision-making skills are anticipated to drive expansion in the global therapeutic drug monitoring equipment market.

The market for therapeutic drug monitoring equipment was probably impacted by the COVID-19 epidemic in a variety of ways. Temporary delays may have resulted from disruptions in healthcare resource allocation and supply networks. Long-term growth, meanwhile, could have been fueled by the pandemic's emphasis on personalized treatment and critical care.