Therapeutic Drug Monitoring Consumables Market Size (2024 – 2030)

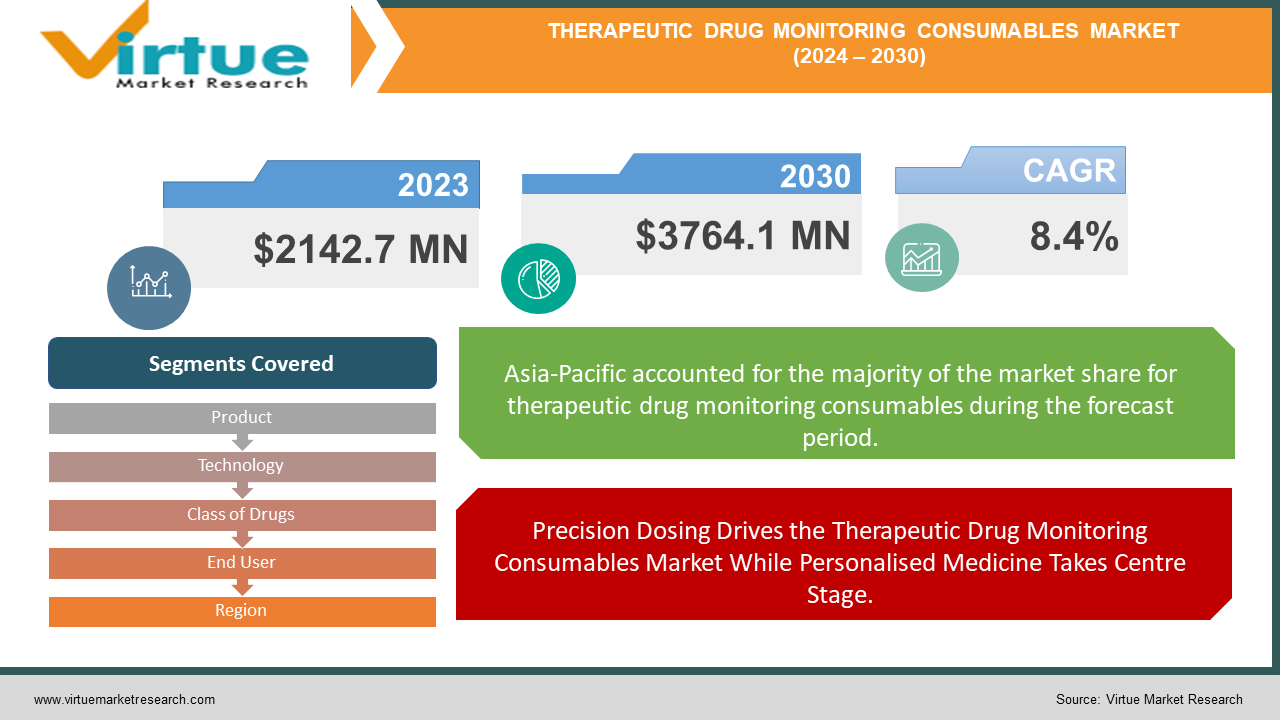

The Global Therapeutic Drug Monitoring Consumables Market was valued at USD 2142.7 million in 2023 and is projected to reach a market size of USD 3764.1 million by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.4%.

The disposable instruments used to take blood samples, prepare them, and measure medication concentrations are known as therapeutic drug monitoring (TDM) consumables. They comprise centrifuge tubes to separate blood components, syringes and needles, transfer pipettes for precise handling, calibration standards and controls for test accuracy, and occasionally even extraction materials for certain medications. To provide a secure and trustworthy assessment of the efficacy of medicine in a patient's bloodstream, all consumables are pyrogen-free and sterile.

Key Market Insights:

Growing at a CAGR of 8.4%, the therapeutic drug monitoring consumables market is expanding. As more tests are carried out, this corresponds to an increasing need for TDM consumables.

A major motivator is the growing emphasis on personalised medicine, which customises care depending on individual circumstances. The demand for the supplies needed to carry out these tests is anticipated to increase as TDM optimises the effectiveness of each patient's medicine.

Close drug monitoring is required due to the increased frequency of chronic conditions such as diabetes, cancer, and organ transplants. The market for TDM consumables expands as the number of patients with these ailments rises to 1.3 billion individuals worldwide who suffer from chronic illnesses.

There is a growing tendency towards point-of-care testing, where findings are accessible close to the patient. This calls for the creation of transportable and user-friendly TDM equipment, which might result in a spike in the market for specific TDM consumables that work with these new gadgets.

Global Therapeutic Drug Monitoring Consumables Market Drivers:

Precision Dosing Drives the Therapeutic Drug Monitoring Consumables Market While Personalised Medicine Takes Centre Stage.

One of the main factors driving the expansion of TDM consumables is the emergence of personalised medicine, in which therapies are tailored to each patient's unique biology. Conventional one-size-fits-all drug delivery methods sometimes lead to less-than-ideal results, with some patients not responding effectively or enduring unfavourable side effects. Genetic testing is one approach used in personalised medicine to learn more about a patient's medication metabolism. Then, TDM becomes essential in this procedure. Doctors can make sure patients are receiving the most effective dose while minimising the risk of adverse effects by testing the patient's unique medication levels in their blood. Because of this individualised approach, TDM testing must be performed more often, which means that demand for all single-use disposable goods required to do these tests from specialised centrifuge tubes to blood collection tubes will rise significantly. TDM consumables are predicted to grow in demand along with the continued growth of personalised medicine.

Growing Point-of-Care Testing: Using Specialised Consumables to Transform TDM from Lab-Bound to Bedside Indicators

Point-of-care testing is becoming more prevalent in the therapeutic drug monitoring scene. Because TDM relied on delivering blood samples to central labs, findings were delayed. By bringing the testing procedure closer to the patient, POCT provides a game-changer. Imagine being able to quickly modify pharmaceutical regimens for doctors, with results provided in a matter of minutes. The creation of portable, user-friendly TDM equipment is necessary considering this paradigm change. But to use these new gadgets for their intended purposes, particular consumables are needed. The need for innovative TDM consumables that work with POCT equipment rises as a result. For example, miniaturised blood collection tubes designed for smaller POCT equipment or pre-filled cartridges with reagents may be required. The market for TDM consumables will probably see a rise of specialised, compatible consumables as POCT adoption picks up speed, fuelling this exciting new age of near-patient therapeutic drug monitoring.

Global Therapeutic Drug Monitoring Consumables Market Restraints and Challenges:

There are obstacles in the way of the TDM consumables market's expansion. Exorbitant expenses linked to TDM testing, including as supplies, specialised gear, and laboratory staff, may restrict patient accessibility, particularly in developing nations or for individuals with restricted financial resources. In addition, there are notable variations in the payment rules for TDM testing, and insufficient coverage by insurance or government initiatives may dissuade healthcare institutions from providing these services, so impeding the market. Smaller facilities are further hindered by the requirement for specialised training of lab personnel due to the intricacy of many TDM tests. Lastly, a lack of uniformity in consumables and methods can result in discrepancies and complicate cross-laboratory data comparisons, which can negatively affect TDM's overall efficiency and dependability and, in turn, the consumables market.

Global Therapeutic Drug Monitoring Consumables Market Opportunities:

TDM consumables have a promising future full of prospects. Technological developments in automation and effective testing methods may accelerate results and drastically lower prices, opening up TDM to more people. Manufacturers who put an emphasis on producing high-quality, reasonably priced consumables possibly through advances in material science or, when practical, by looking into multi-use options will be in a strong position. Expanding into developing nations with bettering healthcare infrastructure offers enormous possibilities, and specialised marketing tactics combined with perhaps less expensive consumables could be the secret to success. And last, the growth of point-of-care testing serves as an incubator for new ideas. Producers that can create customised consumables that work with these new gadgets will be leading the way in this revolutionary change in TDM.

THERAPEUTIC DRUG MONITORING CONSUMABLES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.4% |

|

Segments Covered |

By Product, Technology, Class of Drugs, End User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Abbott Laboratories (US) , Alere, Inc. (US) , bioMérieux SA (France) , Bio-Rad Laboratories (US) , Danaher Corporation (US) , Exagen Inc (US), F. Hoffmann-La Roche Ltd (Switzerland) , Sekisui Medical Co., Ltd (Japan) , Siemens Healthineers AG (Germany) , Thermo Fisher Scientific (US) |

Global Therapeutic Drug Monitoring Consumables Market Segmentation: By Product

-

Blood Collection Tubes

-

Syringes and Needles

-

Transfer Pipettes

-

Calibration Standards and Controls

-

Centrifuge Tubes

-

Extraction Supplies

It is harder to identify the TDM consumables product group that is increasing at the highest rate. Essential and in great demand are centrifuge tubes, syringes and needles, and blood collection tubes. Centrifuge tubes and extraction supplies might expand more quickly, though, if automation advances or if certain medications become more popular and need other extraction methods. The easiest way to determine who is currently leading this category would be to do market research or speak with industry professionals.

Global Therapeutic Drug Monitoring Consumables Market Segmentation: By Technology

-

Immunoassay Consumables

-

Chromatography & Mass Spectrometry Consumables

According to technology, immunoassay consumables now control the TDM consumables industry. Their adaptability, low cost, and ease of use make them perfect for tracking a variety of medications in different labs. Chromatography and mass spectrometry consumables, on the other hand, are expected to expand as more precise drug level measurements are required for personalised treatment due to their higher accuracy and capacity to handle complicated drug analysis.

Global Therapeutic Drug Monitoring Consumables Market Segmentation: By Class of Drugs

-

Antiepileptic Drugs (AEDs)

-

Antiarrhythmic Drugs

-

Immunosuppressant Drugs

-

Other Drug Classes

AED and antiarrhythmic monitoring consumables are in great demand due to common disorders like epilepsy and cardiac arrhythmias, but the fastest-growing market is more fluid. There may be brief increases in demand for certain specific TDM consumables due to breakthrough treatments or personalised medicine strategies for particular medication classes. Keeping up with news on developments in personalised medicine and breakthroughs in different therapeutic areas can help you keep aware about how this segmentation is changing.

Global Therapeutic Drug Monitoring Consumables Market Segmentation: By End User

-

Hospital Laboratories

-

Commercial & Private Laboratories

-

Research and Academic Institutes

Hospital laboratories dominate the end-user TDM consumables market because of their sophisticated facilities and large patient volumes that need monitoring. Nonetheless, as patients look for easy alternatives outside of hospital settings and knowledge of TDM rises, commercial and private laboratories are expected to witness rapid development. They are anticipated to become a significant force in the TDM consumables market going forward due to their increasing demand.

Global Therapeutic Drug Monitoring Consumables Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Due to a few variables coming together, the Asia-Pacific region is expected to lead the TDM consumables market. An increasing number of older people with chronic conditions may now more easily access TDM services because to investments in healthcare infrastructure fuelled by rapid economic development. Furthermore, Asia-Pacific's growing understanding of personalised medicine fosters a favourable environment for TDM's function in maximising the efficacy of medicines, helping this region to lead the global market growth for TDM consumables.

COVID-19 Impact Analysis on the Global Therapeutic Drug Monitoring Consumables Market:

The COVID-19 pandemic has both positive and negative effects on the market for TDM consumables. On the one hand, possible shortages of TDM consumables resulted from worldwide interruptions in manufacture and travel caused by lockdowns and restrictions. The demand for specific consumables was impacted by the brief drop in ordinary TDM procedures, which was probably driven by the healthcare system giving priority to COVID-19 patients. Delays in non-emergency medical care and elective surgery may have further decreased the necessity for TDM in some regions. The pandemic, however, also brought with it certain opportunities. An increase in the demand for TDM consumables was probably caused by a surge in monitoring medications used to treat COVID-19 patients. It's possible that a greater emphasis on critical care highlighted the importance of TDM for seriously sick patients who need careful drug monitoring.

Recent Trends and Developments in the Global Therapeutic Drug Monitoring Consumables Market:

There is a current innovation boom in the global market for therapeutic drug monitoring consumables. Automation is transforming workflows through simplified procedures and automated solutions that enable faster, more economical testing. This results in an increase in the need for consumables that are compatible. Affordability is also a top priority for manufacturers, who leverage advances in material science to create high-quality, reasonably priced consumables or, when practical, investigate multi-use solutions. The explosion of point-of-care testing (POCT) is another fascinating development. POCT allows for speedier findings and medication modifications by bringing TDM testing closer to the patient. This opens up a market for cutting-edge, customised TDM consumables that work with these portable instruments, such as miniature blood collection tubes or pre-filled reagent cartridges. Lastly, emerging nations with better infrastructure for healthcare are the market's focus. Producing this exciting new market niche is forcing manufacturers to adjust their approaches and maybe even provide less expensive consumables.

Key Players:

-

Abbott Laboratories (US)

-

Alere, Inc. (US)

-

bioMérieux SA (France)

-

Bio-Rad Laboratories (US)

-

Danaher Corporation (US)

-

Exagen Inc (US)

-

F. Hoffmann-La Roche Ltd (Switzerland)

-

Sekisui Medical Co., Ltd (Japan)

-

Siemens Healthineers AG (Germany)

-

Thermo Fisher Scientific (US)

Chapter 1. Therapeutic Drug Monitoring Consumables Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Therapeutic Drug Monitoring Consumables Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Therapeutic Drug Monitoring Consumables Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Therapeutic Drug Monitoring Consumables Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Therapeutic Drug Monitoring Consumables Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Therapeutic Drug Monitoring Consumables Market – By Product

6.1 Introduction/Key Findings

6.2 Blood Collection Tubes

6.3 Syringes and Needles

6.4 Transfer Pipettes

6.5 Calibration Standards and Controls

6.6 Centrifuge Tubes

6.7 Extraction Supplies

6.8 Y-O-Y Growth trend Analysis By Product

6.9 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Therapeutic Drug Monitoring Consumables Market – By Technology

7.1 Introduction/Key Findings

7.2 Immunoassay Consumables

7.3 Chromatography & Mass Spectrometry Consumables

7.4 Y-O-Y Growth trend Analysis By Technology

7.5 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Therapeutic Drug Monitoring Consumables Market – By Class of Drugs

8.1 Introduction/Key Findings

8.2 Antiepileptic Drugs (AEDs)

8.3 Antiarrhythmic Drugs

8.4 Immunosuppressant Drugs

8.5 Other Drug Classes

8.6 Y-O-Y Growth trend Analysis By Class of Drugs

8.7 Absolute $ Opportunity Analysis By Class of Drugs, 2024-2030

Chapter 9. Therapeutic Drug Monitoring Consumables Market – By End-User

9.1 Introduction/Key Findings

9.2 Hospital Laboratories

9.3 Commercial & Private Laboratories

9.4 Research and Academic Institutes

9.5 Y-O-Y Growth trend Analysis By End-User

9.6 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 10. Therapeutic Drug Monitoring Consumables Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Product

10.1.2.1 By TechnologyApplication

10.1.3 By Class of Drugs

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Product

10.2.3 By TechnologyApplication

10.2.4 By Class of Drugs

10.2.5 By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Product

10.3.3 By TechnologyApplication

10.3.4 By Class of Drugs

10.3.5 By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Product

10.4.3 By TechnologyApplication

10.4.4 By Class of Drugs

10.4.5 By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Product

10.5.3 By TechnologyApplication

10.5.4 By Class of Drugs

10.5.5 By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Therapeutic Drug Monitoring Consumables Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Abbott Laboratories (US)

11.2 Alere, Inc. (US)

11.3 bioMérieux SA (France)

11.4 Bio-Rad Laboratories (US)

11.5 Danaher Corporation (US)

11.6 Exagen Inc (US)

11.7 F. Hoffmann-La Roche Ltd (Switzerland)

11.8 Sekisui Medical Co., Ltd (Japan)

11.9 Siemens Healthineers AG (Germany)

11.10 Thermo Fisher Scientific (US)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Therapeutic Drug Monitoring Consumables Market size is valued at USD 2142.7 million in 2023.

The worldwide Global Therapeutic Drug Monitoring Consumables Market growth is estimated to be 8.4 % from 2024 to 2030.

Global Therapeutic Drug Monitoring Consumables Market segmentation covered in the report is By Product (Blood Collection Tubes, Syringes and Needles, Transfer Pipettes, Calibration Standards and Controls, Centrifuge Tubes, Extraction Supplies); By Technology (Immunoassay Consumables, Chromatography & Mass Spectrometry Consumables); By Class of Drugs (Antiepileptic Drugs (AEDs), Antiarrhythmic Drugs, Immunosuppressant Drugs, Other Drug Classes); By End User (Hospital Laboratories, Commercial & Private Laboratories, Research and Academic Institutes) and by region.

Automation advances, affordable consumables, market development into emerging nations, and the growth of point-of-care testing with suitable consumables are anticipated to propel the future of TDM consumables.

The COVID-19 epidemic probably had a complicated effect on the TDM consumables industry. Although the demand for the monitoring medications used to treat COVID-19 patients may have grown, supply chain interruptions and resource reallocations may have resulted in brief shortages of TDM consumables.