Texturized Vegetable Protein Market Size (2024 – 2030)

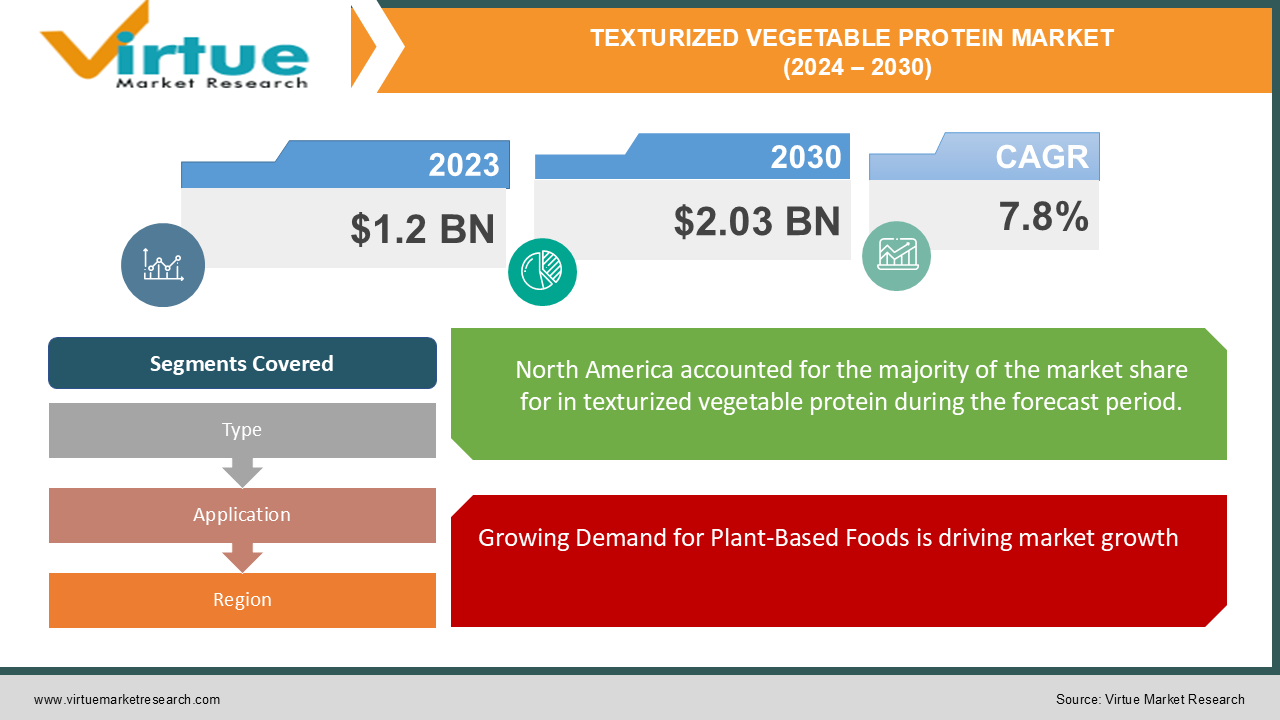

The Global Texturized Vegetable Protein Market was valued at USD 1.2 billion in 2023 and is projected to grow at a CAGR of 7.8% from 2024 to 2030. The market is expected to reach USD 2.03 billion by 2030.

Texturized vegetable protein (TVP) is derived primarily from soy, wheat, or pea proteins and is used as a meat substitute or meat extender in various food applications. It is a key ingredient in the growing plant-based food sector, driven by increasing consumer demand for healthy, sustainable, and ethical food options. The rise in vegetarian and vegan diets, along with heightened awareness about environmental sustainability, has propelled the demand for TVP in global markets.

Key Market Insights:

TVP is extensively used in processed foods such as meat substitutes, ready-to-eat meals, and snacks, capitalizing on the trend of convenient yet healthy food options. Soy-based TVP dominates the market, as soy is a rich source of protein, is cost-effective, and has been widely accepted by consumers and food manufacturers alike.

North America and Europe are leading markets for TVP due to high demand for plant-based food products, while the Asia-Pacific region is rapidly emerging as a key market, driven by changing dietary preferences and increasing disposable incomes.

The market is highly competitive, with key players investing in R&D to develop new product formulations that cater to different tastes, dietary preferences, and nutritional needs. Retail and food service sectors are increasingly incorporating TVP in their product offerings, from plant-based burgers and sausages to protein-rich snacks and ready meals.

Global Texturized Vegetable Protein Market Drivers:

Growing Demand for Plant-Based Foods is driving market growth: The rising consumer shift towards plant-based diets is one of the primary drivers of the texturized vegetable protein (TVP) market. The plant-based food industry has experienced unprecedented growth in recent years, driven by health concerns, environmental sustainability, and ethical considerations regarding animal welfare. TVP, derived from plant proteins like soy and wheat, is a versatile ingredient that mimics the texture of meat, making it an ideal substitute for vegetarians, vegans, and flexitarians. With increasing awareness of the health benefits of plant-based diets, such as lower cholesterol and reduced risk of heart disease, TVP is becoming a staple in many households. Additionally, the sustainability factor is key, as producing TVP has a significantly lower environmental impact in terms of land and water use compared to animal-based meat products.

Increasing Health Awareness and Nutritional Benefits is driving market growth: Health-conscious consumers are increasingly seeking high-protein, low-fat alternatives to traditional meat products. TVP is particularly appealing because it provides a complete protein profile, especially soy-based variants, which contain all essential amino acids. With rising concerns about the negative health effects of excessive meat consumption, including heart disease, obesity, and certain cancers, more consumers are turning to TVP as a healthier protein source. The nutritional benefits of TVP, such as high protein content, low fat, and no cholesterol, align well with the growing trend of clean-label, plant-based foods. Moreover, TVP is a good source of dietary fiber, vitamins, and minerals, further boosting its appeal as a nutritious alternative in various food applications, from snacks to meal replacements.

Sustainability and Environmental Impact is driving market growth: Environmental sustainability is a critical factor driving the demand for texturized vegetable protein. Traditional livestock farming is resource-intensive and has a significant environmental footprint, contributing to deforestation, water depletion, and greenhouse gas emissions. As awareness about climate change and environmental degradation grows, consumers and companies alike are seeking sustainable food alternatives. TVP, as a plant-based product, uses fewer natural resources and has a lower carbon footprint than meat production, making it an environmentally friendly option. Major food companies are increasingly investing in sustainable practices, and incorporating plant-based ingredients like TVP into their products aligns with their sustainability goals. This trend is expected to fuel the growth of the TVP market as more consumers prioritize eco-friendly food choices.

Global Texturized Vegetable Protein Market Challenges and Restraints:

Taste and Texture Barriers is restricting market growth: While TVP has come a long way in terms of mimicking the taste and texture of traditional meat products, there are still challenges to overcome in this area. Many consumers, particularly those who are used to eating meat, may find the taste or texture of TVP-based products less appealing or somewhat different from the meat they are accustomed to. The food industry continues to work on improving the sensory qualities of TVP products through advancements in texturization technology, flavor development, and product innovation. However, achieving perfect meat-like qualities remains a challenge, and consumer acceptance of TVP as a true meat alternative is still a hurdle for some demographic segments. Companies must invest in R&D to refine their TVP offerings and meet the evolving expectations of consumers seeking a close meat substitute.

Allergen Concerns and Limited Consumer Base are restricting market growth: One of the main limitations of the TVP market is its reliance on soy and wheat as primary raw materials, both of which are common allergens. Consumers with soy or gluten allergies must avoid many TVP products, limiting the overall market potential. As the demand for allergen-free products grows, manufacturers must diversify their protein sources, using pea protein or other novel plant proteins, to cater to a broader consumer base. Additionally, the market for TVP is still primarily centered in regions with a high acceptance of plant-based diets, such as North America and Europe. Expanding the market into regions where meat consumption is deeply ingrained in the culture, like parts of Asia or Latin America, may take longer due to different dietary habits and preferences.

Market Opportunities:

The Global Texturized Vegetable Protein Market presents considerable opportunities for growth, especially in regions where plant-based eating habits are on the rise. With increasing awareness about the environmental and health impacts of meat consumption, TVP offers a sustainable, protein-rich alternative that fits well with the clean-eating movement. The versatility of TVP, which can be incorporated into a wide range of food products, from snacks to meals, opens up significant possibilities for food manufacturers to innovate and cater to diverse consumer preferences. In developing regions where food security is a concern, TVP could provide an affordable, nutritious, and environmentally friendly source of protein, offering a solution to malnutrition and protein deficiency. Additionally, as technology improves, the taste and texture of TVP will become more meat-like, attracting even more consumers, particularly flexitarians and meat-reducers, who are seeking to incorporate more plant-based proteins into their diet without sacrificing taste or texture. The rise of e-commerce and direct-to-consumer food brands also provides opportunities for TVP producers to reach new markets and consumers with innovative and tailored product offerings.

TEXTURIZED VEGETABLE PROTEIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.8% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland (ADM), Cargill, Roquette Frères, DuPont, Kerry Group, Puris Foods, Sotexpro, Ingredion Incorporated, AGT Food and Ingredients, CHS Inc. |

Texturized Vegetable Protein Market Segmentation: By Type

-

Soy Protein

-

Wheat Protein

-

Pea Protein

-

Others

Soy protein dominates the TVP market due to its high protein content, affordability, and widespread consumer acceptance. It is the most commonly used base for TVP products, making it the most dominant segment in the product category.

Texturized Vegetable Protein Market Segmentation: By Application

-

Meat Substitutes

-

Meat Extenders

-

Ready Meals

-

Snacks

-

Others

Meat substitutes dominate the application segment, as the growing popularity of vegetarian and vegan diets drives demand for products that closely mimic the texture and taste of traditional meat.

Texturized Vegetable Protein Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is expected to dominate the global texturized vegetable protein market due to the strong demand for plant-based foods, a well-established consumer base for meat alternatives, and significant investment in food innovation. The presence of key players and the rapid adoption of new plant-based products further solidify North America’s position as the leading market.

COVID-19 Impact Analysis on the Texturized Vegetable Protein Market:

The COVID-19 pandemic had a mixed impact on the texturized vegetable protein market. On the positive side, the pandemic accelerated consumer interest in healthy, immune-boosting foods, and plant-based diets were seen as a means of promoting overall wellness. The disruptions in traditional meat supply chains during the pandemic also led consumers to explore meat alternatives like TVP. However, the pandemic caused challenges such as supply chain disruptions, particularly in sourcing raw materials like soy and pea protein, and delays in product development and launches due to lockdown measures. Despite these challenges, the long-term outlook for the TVP market remains positive as consumers continue to prioritize health and sustainability in their food choices.

Latest Trends/Developments:

Several trends are shaping the future of the texturized vegetable protein market. First, innovations in food technology are driving the development of new TVP products with improved taste, texture, and nutritional profiles, making them more competitive with traditional meat products. Second, the use of alternative protein sources, such as pea protein, is growing, as consumers seek allergen-free options. Additionally, hybrid products that combine plant-based proteins like TVP with traditional meat are emerging as a way to attract flexitarians who want to reduce their meat consumption without eliminating it entirely. Another key trend is the rise of private-label plant-based foods, with supermarkets and retailers launching their own lines of TVP-based products to meet growing consumer demand. Furthermore, increased investment in sustainability and clean-label initiatives by food companies is driving the development of environmentally friendly and minimally processed TVP products, aligning with consumer preferences for transparent and ethical food sourcing.

Key Players:

-

Archer Daniels Midland (ADM)

-

Cargill

-

Roquette Frères

-

DuPont

-

Kerry Group

-

Puris Foods

-

Sotexpro

-

Ingredion Incorporated

-

AGT Food and Ingredients

-

CHS Inc.

Chapter 1. Texturized Vegetable Protein Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Texturized Vegetable Protein Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Texturized Vegetable Protein Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Texturized Vegetable Protein Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Texturized Vegetable Protein Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Texturized Vegetable Protein Market – By Type

6.1 Introduction/Key Findings

6.2 Soy Protein

6.3 Wheat Protein

6.4 Pea Protein

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Texturized Vegetable Protein Market – By Application

7.1 Introduction/Key Findings

7.2 Meat Substitutes

7.3 Meat Extenders

7.4 Ready Meals

7.5 Snacks

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Texturized Vegetable Protein Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Texturized Vegetable Protein Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Archer Daniels Midland (ADM)

9.2 Cargill

9.3 Roquette Frères

9.4 DuPont

9.5 Kerry Group

9.6 Puris Foods

9.7 Sotexpro

9.8 Ingredion Incorporated

9.9 AGT Food and Ingredients

9.10 CHS Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Texturized Vegetable Protein Market was valued at USD 1.2 billion in 2023 and is expected to reach USD 2.03 billion by 2030, growing at a CAGR of 7.8% from 2024 to 2030.

Key drivers include the growing demand for plant-based foods, increasing health awareness, and the sustainability benefits of using plant-based protein over traditional meat production.

The market is segmented by product ( Soy Protein, Wheat Protein, Pea Protein, and Others), and by application ( Meat Substitutes, Meat Extenders, Ready Meals, Snacks, and Others).

North America is the dominant region due to the high demand for plant-based foods, a well-established market for meat alternatives, and significant investment in food innovation

Leading players include Archer Daniels Midland (ADM), Cargill, Roquette Frères, DuPont, Kerry Group, and Puris Foods.