Textile Dyes and Pigments Market Size (2024 – 2030)

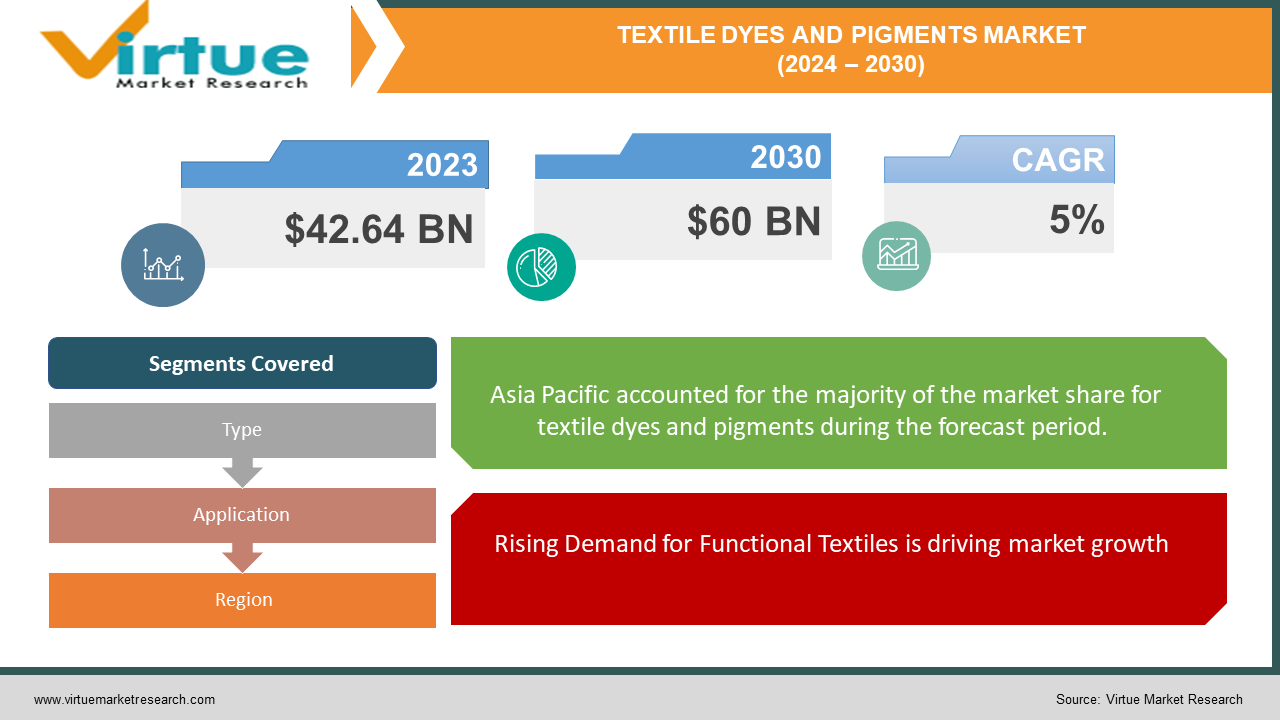

The Global Textile Dyes and Pigments Market was valued at USD 42.64 billion in 2023 and will grow at a CAGR of 5% from 2024 to 2030. The market is expected to reach USD 60 billion by 2030.

The Textile Dyes and Pigments Market caters to the coloring needs of the textile industry. It encompasses dyes that chemically bond with fibers for vibrant colors and pigments that are physically dispersed for specific applications. This market is segmented by dye type (reactive, disperse, etc.) and caters to various applications like apparel, technical textiles for cars and filtration, and home furnishings. Sustainability concerns are driving innovation in eco-friendly dyes, while the rise of digital printing and functional textiles with special properties like water repellency are creating a demand for specialized dyes to meet these evolving needs.

Key Market Insights:

Textiles with special properties like water repellency, UV protection, and fire resistance are gaining traction. This necessitates dyes and pigments specifically designed for such functionality.The ever-growing apparel industry in developing economies like India and China is a major driver for textile dyes and pigments.Technical textiles used in automobiles, healthcare, and filtration require high-performance dyes and pigments, propelling the market growth.Advancements in digital printing techniques are influencing the dyes and pigments used in textile printing.

Global Textile Dyes and Pigments Market Drivers:

Rising Demand for Functional Textiles is driving market growth:

The textile industry is experiencing a surge in demand for fabrics with specialized functionalities. Consumers are increasingly seeking out clothes and gear that offer water repellency for outdoor adventures, UV protection for sun safety, and fire resistance for safety applications. This trend is driving innovation in the textile dyes and pigments market. Traditional dyes may not perform well on these high-tech fabrics, so manufacturers are developing specialty dyes and pigments that can withstand the elements, resist fading under UV rays, and maintain their color integrity even when incorporated into fire-retardant treatments. This focus on functional dyes ensures vibrant colors and long-lasting performance without compromising the special properties of the fabric. As the demand for functional textiles continues to rise, the textile dyes and pigments market will play a crucial role in bridging the gap between aesthetics and functionality.

Growing Apparel Industry is driving market growth:

The booming apparel industry in developing economies like India and China is a significant engine fueling the growth of the textile dyes and pigments market. These regions boast large and rapidly growing populations with a rising disposable income. This translates into a surging demand for new clothing, creating a ripple effect throughout the textile supply chain. As these countries become major apparel manufacturing hubs, they require vast quantities of dyes and pigments to color the fabrics feeding the global fashion frenzy. Moreover, the growing middle class in these regions is increasingly fashion-conscious, seeking trendy and diverse clothing options. This translates into a demand for a wider variety of colors and finishes, further pushing the need for a broader spectrum of dyes and pigments. Additionally, the trend toward fast fashion, characterized by frequent style updates and lower prices, requires efficient and cost-effective dyeing processes. This, in turn, fuels the demand for high-quality, fast-acting dyes that can meet the rapid production cycles of fast fashion brands. Therefore, the continued growth of the apparel industry in developing economies like India and China will undoubtedly be a major driver for the global textile dyes and pigments market for the foreseeable future.

Technical Textiles Boom is driving market growth:

Beyond the world of clothing, technical textiles are quietly revolutionizing various industries, and their growth is a major boon for the textile dyes and pigments market. These high-tech fabrics, used in automobiles, healthcare, and filtration applications, demand exceptional performance from the dyes and pigments coloring them. In automobiles, for instance, dyes need to withstand harsh weather conditions, resist fading from prolonged sun exposure, and maintain color vibrancy despite constant wear and tear. Similarly, medical textiles require dyes that can endure repeated sterilization cycles without compromising color integrity or releasing harmful chemicals that could endanger patients. Filtration applications, on the other hand, necessitate pigments with exceptional durability to ensure the filter media retains its effectiveness over extended use. To meet these demanding requirements, the textile dyes and pigments market is witnessing the development of innovative solutions. These include dyes with superior lightfastness, heat resistance, and chemical compatibility, ensuring the colors don't bleed or degrade under demanding conditions. Additionally, the rise of eco-friendly alternatives is crucial for applications like filtration, where dyes cannot leach harmful chemicals that could contaminate filtered substances. This continuous push for high-performance and sustainable dyes and pigments will undoubtedly propel the market forward as the demand for advanced technical textiles continues to surge across various industries.

Global Textile Dyes and Pigments Market challenges and restraints:

Stringent Environmental Regulations are a significant hurdle for Textile Dyes and Pigments:

Traditional textile dyes and pigments cast a long shadow on the environment. Many contain harmful chemicals like heavy metals, carcinogens, and endocrine disruptors. Growing awareness of this issue has led to stricter regulations around the use of these substances. This compels manufacturers to develop eco-friendly alternatives, but this shift isn't without hurdles. Sustainable dyes often require more complex production processes and may be pricier to develop and manufacture compared to their conventional counterparts. However, the bigger concern lies in the wastewater generated during the dyeing process. These effluents, laden with toxic chemicals and dyes, can significantly pollute waterways if not treated properly. The treatment process itself adds another layer of complexity and cost. Therefore, stricter regulations and the environmental impact of traditional dyes are pushing the industry towards innovation, but navigating the challenges of cost-effective and eco-friendly production remains a significant hurdle.

Shifting Consumer Preferences is throwing a curveball at the Textile Dyes and Pigments market:

The growing movement towards sustainable fashion is putting a spotlight on natural dyes. Consumers are actively seeking out clothing colored with organic pigments derived from plants, insects, or minerals. This shift is driven by a desire for eco-friendly clothing and concerns about the health risks potentially associated with synthetic dyes. However, natural dyes come with their own set of challenges. While natural dyes offer a softer, more muted color palette, they often lack the vibrancy and colorfastness of synthetics. Natural dyes may fade more quickly under sunlight or washing, requiring reapplication or limiting the range of achievable colors. Furthermore, large-scale production of natural dyes can be resource-intensive. Extracting colorants from plants can require significant amounts of water and land, potentially negating some of the environmental benefits. Additionally, the natural dyeing process itself can be more complex and time-consuming compared to synthetic dyes, impacting production costs. Despite these challenges, the demand for natural dyes is likely to persist as research continues to improve their colorfastness and production efficiency.

Overcapacity in Dye Production is a growing nightmare for Textile Dyes and Pigments:

A looming shadow over the textile dyes and pigments market is the issue of global oversupply. Production capacity, particularly in certain regions, has outpaced actual demand for dyes and pigments. This glut of products creates intense competition among manufacturers, driving down prices to stay afloat. While lower prices might seem beneficial short term for consumers, it squeezes profit margins for manufacturers. This financial strain can stifle innovation in developing new and sustainable dyes. Additionally, oversupply can lead to price fluctuations, making it difficult for businesses to plan production costs and budgets effectively. To navigate this challenge, the industry needs to find ways to better synchronize production capacity with actual textile industry demands. This might involve production adjustments, exploring new markets for dyes and pigments, or even collaborative efforts among manufacturers to avoid flooding the market.

Market Opportunities:

The Textile Dyes and Pigments Market presents a multitude of exciting opportunities for companies that can adapt and innovate. The burgeoning demand for functional textiles with special properties like water repellency, UV protection, and fire resistance is creating a niche for specialty dyes and pigments that can withstand these demanding applications. This opens doors for manufacturers who can develop dyes that bond well with these high-tech fabrics and maintain color integrity. Furthermore, the booming apparel industry in developing economies like India and China presents a vast and rapidly growing market for textile dyes. As these regions become apparel manufacturing hubs, catering to a fashion-conscious middle class with a desire for diverse clothing options, there's a surge in demand for a wider variety of dyes and pigments. Additionally, the trend towards fast fashion necessitates dyes that can meet the rapid production cycles, creating opportunities for high-quality, fast-acting dyes. Beyond apparel, the increasing use of technical textiles in automobiles, healthcare, and filtration is another promising avenue. These applications require exceptional performance from dyes and pigments, pushing the market towards dyes with superior lightfastness, heat resistance, and chemical compatibility. However, the key to capitalizing on these opportunities lies in navigating the challenges as well. Sustainability is a growing concern, and developing eco-friendly dyes that are cost-effective and can compete with traditional options is crucial. Similarly, the demand for natural dyes presents an opportunity, but research is needed to improve their colorfastness and production efficiency to make them a more viable large-scale alternative. Overall, the Textile Dyes and Pigments Market offers a dynamic landscape for companies that can innovate, adapt to stricter environmental regulations, and cater to the evolving demands of the textile industry across various sectors.

TEXTILE DYES AND PIGMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE (Germany), Huntsman International LLC (USA), Clariant International Ltd (Switzerland), DIC Corporation (Japan), Kronos Worldwide Inc. (USA), Lanxess AG (Germany), Atul Ltd (India), Kiri Industries Ltd (India), Archroma Management (Switzerland), Zhejiang Longsheng Group Co. Ltd (China) |

Textile Dyes and Pigments Market Segmentation - By Type

-

Dyes

-

Pigments

Dyes are the clear leader in the Textile Dyes and Pigments Market. They dominate due to their ability to form strong chemical bonds with various fibers like cotton, nylon, and polyester, resulting in vibrant and long-lasting colors. Pigments, while used in textiles, play a more niche role. They are typically insoluble particles that provide color but don't bond with the fibers. This can make them less colorfast and more suited for specific applications where dyes aren't ideal.

Textile Dyes and Pigments Market Segmentation - By Application

-

Textiles

-

Apparel

Apparel is the most prominent sector for Textile Dyes and Pigments within the overall textile industry. It consumes a significant portion of dyes and pigments due to the vast demand for clothing in diverse colors and styles. This includes everything from everyday wear to high-fashion garments. While technical textiles for automobiles, filtration, and other applications are a growing segment, their demand for dyes and pigments is currently dwarfed by the sheer volume of clothing produced globally.

Textile Dyes and Pigments Market Segmentation - Regional Analysis

-

Asia-Pacific

-

North America

-

Europe

-

South America

-

Middle East and Africa

The clear leader in the Textile Dyes and Pigments Market is currently Asia Pacific (APAC). This region boasts a whopping 50-60% share of the global market. The dominance is fueled by the presence of textile and apparel manufacturing giants like China and India. These countries not only produce a massive amount of clothing but also cater to a rapidly growing middle class with a rising demand for diverse and colorful clothing. This translates to a constant need for a wide variety of dyes and pigments.

COVID-19 Impact Analysis on the Global Textile Dyes and Pigments Market

The COVID-19 pandemic delivered a blow to the Global Textile Dyes and Pigments Market. Lockdowns and travel restrictions disrupted supply chains, leading to shortages of dyes and pigments due to limited production and import-export activities. This impacted textile manufacturing, particularly in apparel production, as demand for clothing plummeted. Additionally, social distancing measures and a shift towards a work-from-home culture led to decreased demand for formal wear, further affecting dye consumption. However, the market witnessed some positive shifts. The surge in demand for personal protective equipment (PPE) like masks and gowns created a need for specialized dyes. Additionally, the rise of home hygiene practices fueled demand for dyes used in carpets and home textiles. Overall, the pandemic's impact was mixed. While the textile industry's slowdown impacted dye consumption, there were pockets of growth in specific areas. As the global economy recovers, the Textile Dyes and Pigments Market is expected to bounce back, but its long-term trajectory will depend on the continued growth of technical textiles and the industry's ability to adapt to a post-pandemic world.

Latest trends/Developments

The Textile Dyes and Pigments Market is buzzing with innovation driven by sustainability concerns and evolving textile applications. A key trend is the development of eco-friendly dyes derived from natural sources or utilizing cleaner production processes. These dyes offer reduced environmental impact compared to traditional options. Additionally, research on improving the colorfastness and production efficiency of natural dyes is ongoing to make them more viable for large-scale use. Another trend is the rise of digital printing techniques in textiles. This necessitates dyes specifically formulated for inkjet printers, offering vibrant colors and precise application. Furthermore, the growing demand for functional textiles with special properties like water repellency, UV protection, and fire resistance is pushing the development of specialty dyes that can withstand these demanding applications. Finally, there's a growing focus on resource efficiency. Manufacturers are exploring ways to optimize dye usage and minimize water consumption during the dyeing process, contributing to a more sustainable textile industry.

Key Players:

-

BASF SE (Germany)

-

Huntsman International LLC (USA)

-

Clariant International Ltd (Switzerland)

-

DIC Corporation (Japan)

-

Kronos Worldwide Inc. (USA)

-

Lanxess AG (Germany)

-

Atul Ltd (India)

-

Kiri Industries Ltd (India)

-

Archroma Management (Switzerland)

-

Zhejiang Longsheng Group Co. Ltd (China)

Chapter 1. Textile Dyes and Pigments Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Textile Dyes and Pigments Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Textile Dyes and Pigments Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Textile Dyes and Pigments Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Textile Dyes and Pigments Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Textile Dyes and Pigments Market – By Application

6.1 Introduction/Key Findings

6.2 Textiles

6.3 Apparel

6.4 Y-O-Y Growth trend Analysis By Application

6.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Textile Dyes and Pigments Market – By Type

7.1 Introduction/Key Findings

7.2 Dyes

7.3 Pigments

7.4 Y-O-Y Growth trend Analysis By Type

7.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Textile Dyes and Pigments Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Textile Dyes and Pigments Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF SE (Germany)

9.2 Huntsman International LLC (USA)

9.3 Clariant International Ltd (Switzerland)

9.4 DIC Corporation (Japan)

9.5 Kronos Worldwide Inc. (USA)

9.6 Lanxess AG (Germany)

9.7 Atul Ltd (India)

9.8 Kiri Industries Ltd (India)

9.9 Archroma Management (Switzerland)

9.10 Zhejiang Longsheng Group Co. Ltd (China)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Textile Dyes and Pigments Market was valued at USD 42.64 billion in 2023 and will grow at a CAGR of 5% from 2024 to 2030. The market is expected to reach USD 60 billion by 2030.

Rising Demand for Functional Textiles, Growing Apparel Industry, Technical Textiles Boom These are the reasons that are driving the market.

Based on Application it is divided into two segments – Textiles, and Apparel.

Asia is the most dominant region for the luxury vehicle Market.

BASF SE (Germany), Huntsman International LLC (USA), Clariant International Ltd (Switzerland), DIC Corporation (Japan), Kronos Worldwide Inc. (USA).