Tetrahydrofuran Market Size (2023 – 2030)

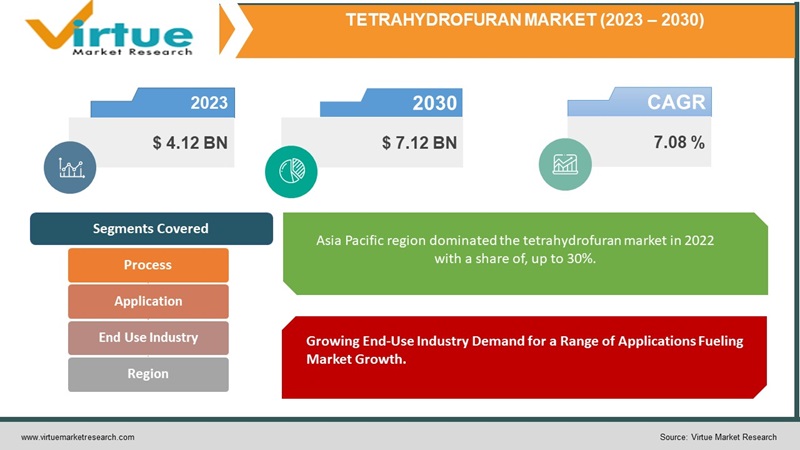

The Global Tetrahydrofuran Market was valued at USD 4.12 billion and is projected to reach a market size of USD 7.12 billion by the end of 2030. Over the outlook period of 2023-2030, the market is anticipated to grow at a CAGR of 7.08%.

The demand, for tetrahydrofuran is on the rise due to its usage in the production of plastics, polyurethane coatings, and rubber products. Tetrahydrofuran is commonly employed as a solvent for small-scale laboratory experiments because it can effectively dissolve a range of compounds and has a relatively low boiling point. These unique characteristics contribute to the growing demand for tetrahydrofuran in industries such, as pharmaceuticals, food packaging, and plastics leading to market growth.

Key Market Insights:

As per the World Paint and Coatings Industry Association (WPCIA), the worldwide revenue generated from the sale of paints and coatings reached USD 180 billion in 2022. It is projected that by 2027 this industry will experience a compound growth rate (CAGR) of 3%.

Tetrahydrofuran finds application, in the pharmaceutical industry for producing cough serum, rifamycin, progesterone, and other hormone-based medicines. It is also used as a reaction medium in the Grignard synthesis process. With India’s pharmaceutical sector contributing 20% of supply by volume and ranking third in terms of production volume the demand, for tetrahydrofuran is expected to rise alongside the expansion of businesses.

According to IQVIA, a company, in the US that specializes in health information technology and clinical research China, which is the second largest spender on pharmaceuticals globally is projected to witness an 8% growth in the segment’s volume over a span of five years. However, the rate of spending will increase by 19%, which is comparatively slower than years but still highlights a commitment to expanding access, to innovative medications.

According to the Government of India, it is projected that the Indian pharmaceutical market will reach a value of USD 130 billion by the year 2030. Additionally, India has been actively supplying products to, more than 200 countries and plans to maintain this trend in the coming years. As of 2021, India holds the position, as the producer of vaccines contributing around 60% to the total vaccine production worldwide. In terms of pharmaceutical manufacturing volume India stands at a place globally.

Tetrahydrofuran Market Drivers:

Growing End-Use Industry Demand for a Range of Applications Fueling Market Growth.

Chemicals have been a subject of interest, for industries for many years. The use of tetrahydrofuran as a solvent in the production of chlorides, vinylidene chloride polymers, and both natural and synthetic resins has opened up opportunities for tetrahydrofuran manufacturers. Tetrahydrofuran plays a role as an intermediate in synthesis. It is utilized in the creation of chemicals such as acid, butadiene acrylic O 2 2 acid, butyrolactone, succinic acid, 1,4 butanediol diacetate, motor fuels, vitamins, hormones, pharmaceuticals, synthetic perfumes organometallic compounds, and insecticides. Additionally, it finds application in the production of polytetramethylene glycol (PTMEG) polyurethane elastomers (PUE) and polymers. In the pharmaceutical sector specifically, tetrahydrofuran is extensively used to synthesize carbetapentane, rifamycin, progesterone, and various hormone-based drugs. The demand for tetrahydrofuran continues to rise due to its usage across industries like pharmaceuticals and packaging sectors—acting as a driving force, behind the growth of the tetrahydrofuran market.

The growing Pharmaceutical Sector is contributing to Market Expansion.

The growth of the tetrahydrofuran market is driven by the expansion of the pharmaceutical industry. This growth can be attributed to factors such, as the increasing population, urbanization, rising disposable income, and higher demand for products in regions. Tetrahydrofuran is commonly used in the production of steroids. These steroids serve as reaction mediums in the sector for processes like Grignard syntheses or lithium aluminum hydride reductions. According to data from the European Federation of Pharmaceutical Industries and Associations (EFPIA) between 2014 and 2018 the Brazilian, Chinese, and Indian markets experienced growth rates of 11.4%, 7.3%, and 11.2% respectively compared to a market growth rate of 5.0% for the top five European Union markets and 7.8% for the US market. In line with this trend in 2018 the Australian Government made an investment of $1.3 billion in their Health and Medical Industry Growth Plan to enhance healthcare services within Australia. As a result of these developments within the industry, there will be an increased demand, for pharmaceutical steroids which will consequently drive growth in the tetrahydrofuran market during the forecast period.

Tetrahydrofuran Market Restraints and Challenges:

Tetrahydrofuran is a substance that can catch fire and has the potential to cause cancer. When humans or animals are exposed to tetrahydrofuran it can lead to health risks. It's important to note that THF is highly flammable and when it breaks down due, to heat it releases gases like carbon monoxide and carbon dioxide. If stored for a time in contact, with air it can even form peroxides. If someone is exposed to tetrahydrofuran they may experience dizziness, headaches, and respiratory tract irritation. The chemical is very volatile and flammable so it’s important to store and handle it in an environment where there is limited or no atmospheric oxygen. Additionally, because of its nature, it's crucial to use the contents once the container is opened as they may have a limited shelf life after exposure, to the environment. These factors could potentially impede the growth of the tetrahydrofuran market.

Tetrahydrofuran Market Opportunities:

There is a demand, for tetrahydrofuran (THF) in emerging economies like China and several Asian countries. This demand opens up opportunities for the expansion of the THF market. One of the reasons for this demand is that tetrahydrofuran is commonly used as a solvent in small-scale laboratory experiments. Its ability to dissolve compounds and its relatively low boiling point make it a preferred choice. These qualities are driving the demand for tetrahydrofuran across industries such, as pharmaceuticals, food packaging, and plastics resulting in market growth.

TETRAHYDROFURAN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Process, Application, End Use Industry Regional Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Asia pacific, Europe, South America, Middle East & Africa |

|

Key Companies Profiled |

Honeywell International Inc., Univar Solutions Inc.Ashland Global Holdings Inc., Alfa Aesar, TCI America, Eastman Chemical Company, BASF SE, Oakwood Products, Inc, Mitsubishi Chemical Holding, Toray Industries, Inc |

Tetrahydrofuran Market Segmentation:

Tetrahydrofuran Market Segmentation: By Process

-

Reppe Process

-

Furfural Process

-

Butadiene Chlorination Process

-

Propylene Oxide Process

-

Maleic Anhydride Hydrogenation

-

Dehydration of 1,4-butanediol

-

Others

The segment of the production process known as "reppe" held the majority market share, in tetrahydrofuran production in 2022. This was primarily due to its efficiency, safety measures, and low investment requirements. In the past tetrahydrofuran was produced using the Furfural process, which involved extracting furfural from corn husks as a material. However, this method had limitations as it relied on conditions for supply and could not be consistently reliable. As a result, there was a shift, towards adopting the Reppe process. The reppe process is more favorable compared to other methods because it is entirely synthetic. Unlike its counterpart, it doesn't rely on conditions, for the availability of materials. The reppe process is expected to be used extensively for mass-producing tetrahydrofuran with steps leading to its rapid utilization in the production of tetrahydrofuran, in the foreseeable future.

Tetrahydrofuran Market Segmentation: By Application

-

Polytetramethylene Ether Glycol (PTMEG)

-

Polyurethane Elastomers

-

Elastic Polymers

-

Solvents

-

Others

The majority of the tetrahydrofuran market, in 2022 was dominated by the polytetramethylene glycol (PTMEG) segment. This is primarily due to the application of tetrahydrofuran in the production of spandex and polyurethane. Polyurethane elastomer finds use in manufacturing seat covers and gear shift knobs while spandex is commonly used in sportswear, fashionable clothing, casual wear, as well as various types of women’s garments like leggings, form-fitting clothes, swimwear athletic wear, and aerobic attire. Furthermore, there has been a rise in health awareness leading to an increase in sports events and fitness activities. This surge has consequently resulted in a demand for sportswear. Therefore the significant utilization of tetrahydrofuran, for manufacturing polytetramethylene ether glycol (PTMEG) is expected to drive the growth of the tetrahydrofuran market during the projected period.

Tetrahydrofuran Market Segmentation: By End-Use Industry

-

Pharmaceutical

-

Sealants & Adhesives

-

Packaging Industry

-

Others

In 2022 the packaging industry accounted for the portion of the tetrahydrofuran market. It is experiencing a growth rate of 7.8% due, to the rising use of tetrahydrofuran as a solvent for chloride and the growing demand for polyvinyl chloride, in the packaging sector. The packaging industry is experiencing a growing demand, for PVC due to its durability, reliability, and lightweight nature. Flexible PVC plays a role in preserving the quality of products like medicines thanks to its barrier properties. Additionally, tetrahydrofuran is widely utilized in manufacturing PVC adhesives and building PVC pipe systems for heating and cooling processes. As the demand for chloride (PVC) continues to rise so does the demand for tetrahydrofuran. All these factors are expected to contribute to the growth of the tetrahydrofuran market, in the future.

Market Segmentation: Regional Analysis:

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia Pacific region dominated the tetrahydrofuran market in 2022 with a share of, up to 30%. This can be attributed to the growing packaging and pharmaceutical sectors in the APAC region. The demand for tetrahydrofuran has been on the rise in the packaging industry for manufacturing chloride well as in the pharmaceutical industry for producing pharmaceutical steroids. As per reports from the Federation of Indian Chambers of Commerce & Industry (FICCI) in 2016, the Indian packaging industry is experiencing growth. Is valued at USD 700 billion worldwide. Additionally, China’s revenue, from packaging materials was projected to surpass $5.2 billion in 2018 accounting for 26 percent of the global packaging materials market. During the forecast period, North America is anticipated to grow the fastest at the highest CAGR of about 7.91% owing to the rapid infrastructure investments and projects in the region.

COVID-19 Impact Analysis on the Global Tetrahydrofuran Market:

The global trade of tetrahydrofuran has been greatly impacted by the outbreak of COVID-19. Many countries have imposed export restrictions, on commodities leading to disruptions in supplies. Moreover, manufacturers of tetrahydrofuran are encountering difficulties such as delays in receiving materials resulting in delayed shipments to customers. Additionally, there has been a decline, in the quality of raw materials and the availability of vessels and blank sailing issues are heavily affecting the orders and growth of the tetrahydrofuran market.

Latest Trends/ Developments:

The supply and demand of Tetrahydrofuran (THF), in regions, depend on the economic conditions that impact the Tetrahydrofuran (THF) market. Additionally, the shift in demand from established markets to emerging ones can be attributed to the growing needs of developing economies. In the years significant capacity expansions have been observed in the market. Key market players are increasing their market share through plant expansions. Introducing products.

In the eight years, expansion strategies have accounted for a portion of overall developments in the market. Tetrahydrofuran (THF) manufacturers are also exploring opportunities to enter markets through ventures and partnerships. BASF for instance has recently established its catalyst manufacturing facility in Asia in China. This facility aims to meet the rising demand for catalysts within the region. These catalysts are components used in chemical production processes, including butanediol-a crucial element, in tetrahydrofuran (THF) manufacturing. The demand, for Tetrahydrofuran (THF), is anticipated to increase in the forecast period due to the growing demand for spandex, in the Asia Pacific region.

In times there have been some advancements, in the market particularly in the form of bio-based Tetrahydrofuran (THF). A notable player in this space is BASF, WHO introduced a PolyTetrahydrofuran product to the market back in 2015. These kinds of developments are anticipated to drive the demand, for Tetrahydrofuran (THF) in the future.

Key Players:

-

Honeywell International Inc.

-

Univar Solutions Inc.

-

Ashland Global Holdings Inc.

-

Alfa Aesar

-

TCI America

-

Eastman Chemical Company

-

BASF SE

-

Oakwood Products, Inc

-

Mitsubishi Chemical Holdings

-

Toray Industries, Inc

Lubrizol 3D Printing Solutions recently made an announcement, about the release of ESTANE 3D TPU M88A Thermoplastic Polyurethane (TPU) on November 14, 2022. This particular grade of TPU is specific. Certified for use with the HP Jet Fusion 5200 series, a printing option widely recognized for its suitability in production applications. The ESTANE 3D M88A material is both flexible and exceptionally strong making it perfect, for printing geometries, lattice structures, and manufacturing items.

Chapter 1. Tetrahydrofuran Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Tetrahydrofuran Market – Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Tetrahydrofuran Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Tetrahydrofuran Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Tetrahydrofuran Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Tetrahydrofuran Market – By Process

6.1 Reppe Process

6.2 Furfural Process

6.3 Butadiene Chlorination Process

6.4 Propylene Oxide Process

6.5 Maleic Anhydride Hydrogenation

6.6 Dehydration of 1,4-butanediol

6.7 Others

Chapter 7. Tetrahydrofuran Market – By Application

7.1 Polytetramethylene Ether Glycol (PTMEG)

7.2 Polyurethane Elastomers

7.3 Elastic Polymers

7.4 Solvents

Chapter 8. Tetrahydrofuran Market – By End Use Industry

8.1 Pharmaceutical

8.2 Sealants & Adhesives

8.3 Packaging Industry

8.4 Others

Chapter 9. Tetrahydrofuran Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Technology

9.1.2.1 By Application

9.1. 3 By Process

9.1.4 By Application

9.1.5 By End Use Industry

9.1.6 By Regional Analysis

9.1.7 Countries & Segments - Market Attractiveness Analysis

9.2 Asia Pacific

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Process

9.2.3 By Application

9.2.4 By End Use Industry

9.2.5 By Regional Analysis

9.2.6 Countries & Segments - Market Attractiveness Analysis

9.3 Europe

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Process

9.3.3 By Application

9.3.4 By End Use Industry

9.3.5 By Regional Analysis

9.3.6 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Process

9.4.3 By Application

9.4.4 By End Use Industry

9.4.5 By Regional Analysis

9.4.6 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Process

9.5.3 By Application

9.5.4 By End Use Industry

9.5.5 By Regional Analysis

9.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Tetrahydrofuran Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Honeywell International Inc.

10.2 Univar Solutions Inc.

10.3 Ashland Global Holdings Inc.

10.4 Alfa Aesar

10.5 TCI America

10.6 Eastman Chemical Company

10.7 BASF SE

10.8 Oakwood Products, Inc

10.9 Mitsubishi Chemical Holdings

10.10 Toray Industries, Inc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Tetrahydrofuran Market was valued at USD 4.12 billion and is projected to reach a market size of USD 7.12 billion by the end of 2030.

Growing End-Use Industry Demand for a Range of Applications, Growing Pharmaceutical Sector.

Based on Application, the Global Tetrahydrofuran Market is segmented into Polytetramethylene Ether Glycol (PTMEG), Polyurethane Elastomers, Elastic Polymers, Solvents, Others

Asia Pacific is the most dominant region for the Global Tetrahydrofuran Market.

Honeywell International Inc., Univar Solutions Inc., Ashland Global Holdings Inc., Alfa Aesar, TCI America, and Eastman Chemical Company are the key players operating in the Global Tetrahydrofuran Market.