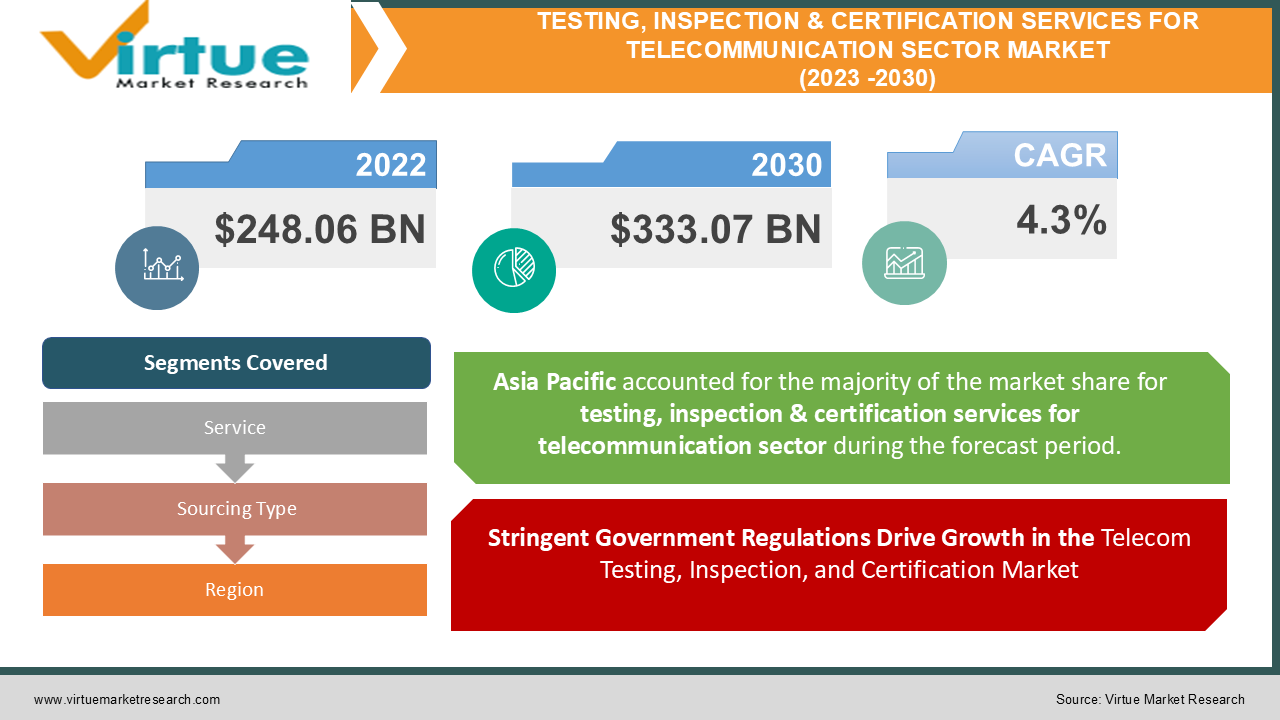

Testing, Inspection & Certification services for Telecommunication Sector Market Size (2023– 2030)

The Global Testing, Inspection & Certification services for Telecommunication Sector Market was valued at USD 248.06 billion and is projected to reach a market size of USD 333.07 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 4.3%.

INDUSTRY OVERVIEW

One of the sectors in our day with the quickest growth is the wireless and telecommunications sector. Innovative wireless technologies have enabled the launch of previously unavailable products, transforming formerly manual and disjointed business processes in a variety of industries. The development of wireless technology is best understood in light of how communication has changed over time. The need for wireless networks and connectivity in every aspect of our lives has increased as our communication methods have become more advanced. Manufacturers of wireless and telecom products are currently working even harder than before to meet the growing demand for this cutting-edge technology. The Testing, Inspection, and Certification (TIC) in the telecommunication industry is made up of conformity assessment organizations that offer services like auditing, inspection, testing, verification, quality assurance, and certification. The sector includes both internal and external services. The Testing, Inspection, and Certification (TIC) industry is made up of conformity assessment organizations that offer services like auditing, inspection, testing, verification, quality assurance, and certification. The industry includes both internal and external services. Producers may increase efficiency, adhere to international standards, and improve product and service quality with the aid of testing, inspection, and certification services. The requirement to ensure that manufactured goods comply with national and international safety and quality-related regulations has increased due to the dramatically increased demand for high-quality services and products. The market for testing, inspection, and certification in the telecommunication sector is estimated to be significantly impacted by the digital revolution of customer services. The demand for interoperability testing for connected devices and the Internet of Things is driving up the use of testing, inspection, and certification services in the telecommunication industry. The telecommunication industry's growing emphasis on enhancing customer retention by offering high-quality products is estimated to lead to an increase in the market size for testing, inspection, and certification. To evaluate and test Internet of Things (IoT)-enabled items and guarantee data and product security, the sales of testing, inspection, and certification services are expanding. Additionally, the growing market share for testing, inspection, and certification in the telecommunications industry is being driven by the increased usage of linked technologies to boost output and boost efficiency. However, on the other hand, small and medium-sized testing, inspection, and certification telecommunication service providers embrace new technologies more slowly since they need a lot of money to fund ongoing research and development. This is yet another element that could present difficulties for the market for testing, inspection, and certification.

COVID-19 IMPACT ON THE TESTING, INSPECTION & CERTIFICATION SERVICES FOR THE TELECOMMUNICATION SECTOR MARKET

Governments around the world implemented stringent measures to stop the transmission of the virus after the WHO declared COVID-19 a global epidemic in early 2020. These included restrictions on movement, shelter-in-place orders, and limitations on business operations by allowing only a small number of employees to work at any facility. Due to the restrictions on travel, there were few workers present in the various manufacturing sectors across the world. The production levels have been directly impacted, which has increased total expenses in 2020, including unabsorbed overhead and logistical costs.

The mandatory certifications across industries like healthcare, consumer electronics, aerospace, and marine, as well as the rise in acceptance and usage of Internet of Things-enabled devices that must be assessed and inspected for their quality and durability, have all contributed to the significant growth of the testing, inspection, and certification market in the various sectors including the telecom sector over the past few years. However, it's anticipated that the COVID-19 epidemic has slowed the demand for testing, inspection, and certification, particularly between 2020 and 2021. This is due to the supply chain's interruption, which left a large number of items in production facilities because all services had already shut down. The COVID-19 pandemic epidemic resulted in the complete or partial closure of industries, warehouses, enterprises, and institutions all across the world. Additional lockdown measures were put into place in addition to this, such as rigorous social distancing rules, travel restrictions, and restricted access to industrial facilities, electronic enterprises, and warehouses. Operations in the supply chain and services connected to logistics have been disrupted throughout the majority of sectors globally. The growth of the testing, inspection, and certification market has been hampered by the lack of demand for testing, inspection, and certification services during the pandemic, lockdown measures, limited consumer and industrial spending, and lower manufacturing rates caused by supply chain disruptions. Governments all across the world have been forced to concentrate on and increase expenditure on the healthcare industry as a result of the epidemic.

MARKET DRIVERS:

Stringent Government Regulations Drive Growth in the Telecom Testing, Inspection, and Certification Market

With the emergence of globalization and liberalism, consumers' top worry has been safety. Increased danger to life is a significant worry, making customers aware of the need of putting safety first. Organizations are concentrating on developing safety by the established regulations to solve these safety problems. The major concern associated with the telecom sector is the harmful radiation emitted by the towers which needs to be properly checked and maintained timely. These standards give safety and minimizing environmental effects top attention. The significant recovery and expansion of the TIC market are anticipated to be supported by positive government actions to strengthen the many industries affected by COVID-19. Growing digitization is also likely to create a trend that will promote market growth

MARKET RESTRAINTS:

Regulations and standards that vary between countries and regions to limit market expansion

Regional laws and standards may make it harder for items to be acknowledged internationally when trade and industry become more multinational. The discrepancy between local and international norms may impede the market's future growth. Disparities in tax rates brought on by differences in regulatory policies and benchmark criteria by various governments across various nations would have an influence on market development in the following years. Additionally, the market growth for Testing and Safety Inspection Services in the telecom sector in the upcoming years may be hampered by the longer lead time required for total qualifying tests.

TESTING, INSPECTION & CERTIFICATION SERVICES FOR TELECOMMUNICATION SECTOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

4.3% |

|

Segments Covered |

By SERVICE, SOURCING TYPE, and REGION |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

SGS SA, BUREAU VERITAS, DEKRA CERTIFICATION B.V. , INTERTEK GROUP PLC , TUV SUD AG, APPLUS+, ALS LIMITED, EUROFINS SCIENTIFIC SE , DNV GL, SOCOTEC GROUP |

This research report on the Testing, Inspection & Certification services for Telecommunication Sector Market has been segmented and sub-segmented based on Service, By Sourcing Type and By Region.

TESTING, INSPECTION & CERTIFICATION SERVICES FOR THE TELECOMMUNICATION SECTOR MARKET – BY SERVICE

- Testing

- Inspection

- Certification

Based on the service outlook, the Testing, Inspection & Certification services for Telecommunication Sector Market are segmented into Testing, Inspection and Certification. In 2021, the testing segment's revenue share was above 70.0 % of the total. Product testing in the real world helps businesses maintain high standards and satisfy client demands. This is encouraging businesses from a variety of sectors to invest more in operating expenses for testing equipment, which is fostering market expansion. The industry is anticipated to have considerable growth possibilities in the inspection sector. This may be ascribed to the increase in supply chain activities in nations like Switzerland, Japan, Germany, and Norway, which made inspection procedures possible to implement. Additionally, the consumer products industry helps the inspection section expand. These businesses have been able to implement an efficient inspection ecosystem thanks to the strict regulations set by national governments and international organizations regarding the caliber of the hardware and equipment used and also monitoring the harmful radiations emitted from the communication towers.

TESTING, INSPECTION & CERTIFICATION SERVICES FOR THE TELECOMMUNICATION SECTOR MARKET - BY SOURCING TYPE

- In-house

- Outsourced

Based on the sourcing type, the Testing, Inspection & Certification services for Telecommunication Sector Market are segmented into In-house and Outsourced. In 2021, the in-house type had the highest revenue share—more than 55.0 %. Companies can conduct realistic TIC operations thanks to the adoption of in-house testing and inspection techniques since they may engage people on-site and set up specialized procedures for their specific needs. Deploying internal TIC teams also enables better control and a deeper comprehension of company procedures, which might be advantageous from an organizational standpoint. Market expansion potential is anticipated to be strong in the outsourced sector. The sector is anticipated to have the greatest CAGR throughout the projection period. Companies will exercise cost-effectiveness and concentrate on short-term commitments, according to the outsourcing segment. The efficiency of the system is increased by helping businesses implement TIC practices utilizing several engagement models, such as the hourly model, the time and materials model, and the dedicated team model. In addition, growing urbanization and globalization have complicated the supply chains for TIC services used in the telecom industry, which has, in turn, led to the privatization of labs, raised the bar for efficiency, and increased demand for outsourced telecom TIC services.

TESTING, INSPECTION & CERTIFICATION SERVICES FOR THE TELECOMMUNICATION SECTOR MARKET - BY REGION

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East

- Africa

By region, the Enhanced water market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa. The region with the greatest CAGR throughout the anticipated period is the Asia Pacific. With a revenue share of more than 30.0 % in 2021, Asia Pacific led the worldwide market. Rising economic development in nations like China, India, Japan, and South Korea is to be attributed to the large income share. This has increased the region's manufacturing and industrial activities, providing the telecom sector TIC industry with development potential. Additionally, Singapore's quickly growing AI technology ecosystem supports software and program in a way that makes it possible for testing and inspection services to expand. In growing nations like China, Japan, India, and others, end-user investments in the manufacturing, electronics, and automobile industries have surged. Asia is seeing an increase in the number of production facilities operated by General Electric Company, Toshiba Corporation, HTC Corporation, and other electronics manufacturing companies. According to projections, this increase will create a variety of possibilities for TIC service providers. The Department for Promotion of Industry and Internal Trade (DPIIT) in India estimates that from April 2000 to June 2021, investments in the manufacturing industry in India totaled USD 100.35 billion which is consequently going to positively influence the testing, inspection and certification industry in the telecom sector.

TESTING, INSPECTION & CERTIFICATION SERVICES FOR THE TELECOMMUNICATION SECTOR MARKET - BY COMPANIES

Some of the major players operating in the market include:

- SGS SA

- BUREAU VERITAS

- DEKRA CERTIFICATION B.V.

- INTERTEK GROUP PLC

- TUV SUD AG

- APPLUS+

- ALS LIMITED

- EUROFINS SCIENTIFIC SE

- DNV GL

- SOCOTEC GROUP

NOTABLE HAPPENING IN THE TESTING, INSPECTION & CERTIFICATION SERVICES FOR THE TELECOMMUNICATION SECTOR MARKET

- COLLABORATION- SGS announced their collaboration with Microsoft in January 2022. The new partnership will provide the business with the ability to create and evolve TIC services based on data, IoT, and AI that are sustainable, inclusive, and can help its clients reach their full potential.

- ACQUISITION- A well-known North American provider of product certification services, Lightship Security, Inc., was acquired by Applus+, global testing, inspection, and certification organization, in February 2022. The strategic goal of Applus+ Laboratories is to strengthen its position in key technologies and competencies to support customers during the worldwide technological change brought on by electrification, energy transition, and connectivity.

Chapter 1. Testing, Inspection & Certification services for Telecommunication Sector Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Testing, Inspection & Certification services for Telecommunication Sector Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Testing, Inspection & Certification services for Telecommunication Sector Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Testing, Inspection & Certification services for Telecommunication Sector Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Testing, Inspection & Certification services for Telecommunication Sector Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Testing, Inspection & Certification services for Telecommunication Sector Market – By Service

6.1. Testing

6.2. Inspection

6.3. Certification

Chapter 7. Testing, Inspection & Certification services for Telecommunication Sector Market – By Sourcing Type

7.1. In-house

7.2. Outsourced

Chapter 8. Testing, Inspection & Certification services for Telecommunication Sector Market- By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Testing, Inspection & Certification services for Telecommunication Sector Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. SGS SA

9.2. BUREAU VERITAS

9.4. INTERTEK GROUP PLC

9.5. TUV SUD AG

9.6. APPLUS+

9.7. ALS LIMITED

9.9. DNV GL

9.10. SOCOTEC GROUP

Download Sample

Choose License Type

2500

4250

5250

6900