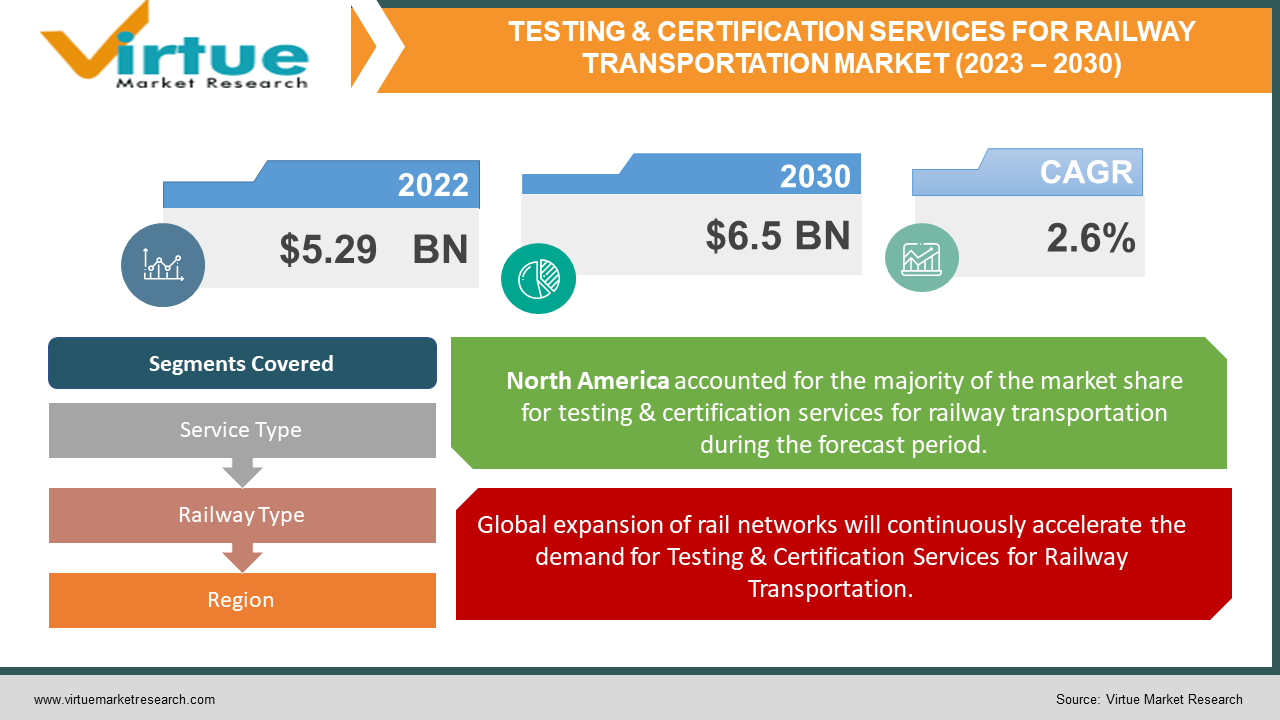

Testing & Certification Services for Railway Transportation Market size (2023 - 2030)

Testing & Certification Services for the Railway Transportation Market were estimated to be worth USD 5.29 Billion in 2022 and are projected to reach a value of USD 6.5 Billion by 2030, growing at a CAGR of 2.6% during the forecast period 2023-2030.

The Testing & Certification Services for the Railway Transportation Market consist of a wide range of essential services that are valuable for ensuring the safety, reliability, and adherence of the railway system and its components. Extensive and rigorous testing is an essential part of these services, including safety features, electromagnetic compatibility, performance parameters, and environmental durability as well. Adherence to industry-specific standards and regulations is crucial in railway transportation. As the railway industry develops and evolves with advancements in technology, testing, and certification services become more important in ensuring secure, seamless operations of the railway system and providing a safe and comfortable experience to the passengers. The demand for these services is like to continue growing with the expansion of rail networks globally.

Testing & Certification Services for Railway Transportation Market Drivers:

Global expansion of rail networks will continuously accelerate the demand for Testing & Certification Services for Railway Transportation.

Many countries are investing in expanding and innovating their rail networks to make transportation more efficient and accommodate growing populations. Growing urbanization and congestion in urban areas increase the need for efficient and sustainable transportation, fuelling the demand for rail travel. The expansion of railways drives the demand for testing and certification services to ensure the new systems meet regulatory and safety guidelines.

Stringent safety regulations and increasing focus on passenger safety are fuelling the growth of Testing & Certification Services for the Railway Transportation market.

Strict safety regulations and standards are involved in the railway transportation sector to ensure the safety of passengers, workers, and the public. Passenger safety remains a top priority, hence railway operators seek detailed testing and certification to ensure that the systems and components meet all the requirements and high safety standards. Testing and certification services are important to ensure compliance with these regulations.

Testing & Certification Services for Railway Transportation Market Challenges:

Complex systems and diverse infrastructure of railways might pose a significant challenge to Testing & Certification Services for the Railway Transportation market.

Railway systems consist of various interconnected components and testing these complex components requires extensive expertise and understanding which might be challenging in terms of accuracy and comprehensiveness. Along with complex components, rail networks could vary significantly with technology and infrastructure as well, and ensuring consistent testing and certification across such a complex and diverse system could be challenging.

Budget constraints could slow down the growth of Testing & Certification Services for the Railway Transportation market.

Railway operators might face budget constraints which could affect the ability to invest in comprehensive testing and inspection services. This in turn could lead to prioritization of cost-cutting measures, potentially compromising the safety and compliance efforts within the railway transportation system. So, finding a way to ensure safety while managing tight budgets is a big challenge for the railway industry.

COVID-19 Impact on the Testing & Certification Services for Railway Transportation Market:

The COVID-19 pandemic had notable repercussions on the Testing & Certification Services for the Railway Transportation Market. The lockdowns, travel restrictions, and reduced economic activity caused by the pandemic disrupted rail operations and projects. Many rail projects were delayed or put on hold due to uncertainties, impacting the demand for testing and certification services. Additionally, budget constraints arising from economic challenges led some rail operators and manufacturers to prioritize immediate financial needs over long-term safety investments, potentially affecting the extent of testing and compliance efforts. On the positive side, the pandemic highlighted the need for stringent safety measures in transportation, which could potentially lead to increased focus on testing and certification services once the industry rebounds. The pandemic underscored the sector's vulnerability to external shocks and emphasized the importance of ensuring the resilience and reliability of rail systems through thorough testing and certification practices.

Latest Industry Developments in Testing & and Certification Services for the Railway Transportation Market

-

In May 2023, Transport of Wales signed a heads of terms agreement with Global Centre of Rail Excellence (GCRE), which is a research, testing and certification facility. Transport of Wales will be getting support with its rail testing, innovation and R&D by GCRE.

-

In January 2023, Atlas Technical Consultants received a $15 Million contract from Georgia Department of Transportation (GDOT) to support its railroad safety program, in which Atlas will be responsible for delivering engineering, design and environmental services to rail crossing owned by Class 1 rail operator.

TESTING & CERTIFICATION SERVICES FOR RAILWAY TRANSPORTATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

2.6% |

|

Segments Covered |

By Service Type, Railway Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bureau Veritas SA, TÜV SÜD Group, SGS SA, DEKRA SE, Applus+, Eurofins Scientific, TV Rheinland Group, Intertek Group plc, Lloyd's Register Group Services Limited, Kiwa N.V |

Testing & Certification Services for Railway Transportation Market Segmentation: By Service Type

- Safety Testing

-

Performance Testing

-

Electromagnetic Compatibility Testing

-

Environmental Testing

-

Functional Safety Testing

-

Cybersecurity Testing

-

Certification Services

Safety testing is the largest segment in this market due to immense importance of ensuring safety of passengers, operators, and rail systems. Safety testing involves various crucial aspects like crash testing, structural integrity assessment, signalling system validation and brake performance evaluation. Safety plays a critical role in rail industry because of which this segment is the largest. The fastest growing segment is anticipated to be cybersecurity testing due to increasing digitization of rail systems and the need of protecting critical infrastructure and data from cyber threats. Environmental testing segment could also see notable growth in coming period as more focus is drawn towards reducing environmental footprints and emissions.

Testing & Certification Services for Railway Transportation Market Segmentation: By Railway Type

-

High-Speed Rail

-

Urban Rail

-

Commuter Rail

-

Freight Rail

Urban rail has the largest market share in Testing & Certification Services for Railway Transportation market, particularly in highly populated urban areas. Urban rail are significant for mass transit and play a significant role in urban transportation, and safety is of topmost priority due to large number of passengers, making testing, inspection and certification a major focus. High-Speed rail is the fastest growing segment due to increasing demand for efficient and rapid transportation between cities. High speed railways are gaining momentum in many regions. Commuter rail is a type of passenger rail service which operates between urban and suburban areas and require various safety and operational aspects which are unique to this mode of rail transportation. In freight rails, goods and cargo are transported by rail, which play an important role in global supply chain. This segment focuses on ensuring the safe and efficient movement of goods, by assessing the durability of rail infrastructure under heavy loads.

Testing & Certification Services for Railway Transportation Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America has well-established urban rail systems which are crucial for daily commuting and require safety testing and certification services, vital to ensure the safety of passengers. Europe is the largest segment in this market due to presence of extensive and well-developed railway networks along with focus on sustainable transportation, interconnectivity and safety regulations which has ultimately expanded the market of testing and certification services in the region. Asia Pacific region is the fastest-growing region with a significant growth in railway infrastructure development, especially in countries like India, China, Japan and South Korea. South America has a vital railway system with more presence of commuter railway which are essential for reducing traffic in major cities, making safety testing and certification key. In Middle East & Africa region, urban rail segment is growing due to the growth of metro systems in cities like Dubai, Riyadh, and Johannesburg, emphasizing the significance of testing and certification services.

Testing & Certification Services for Railway Transportation Market Key Players:

-

Bureau Veritas SA

-

TÜV SÜD Group

-

SGS SA

-

DEKRA SE

-

Applus+

-

Eurofins Scientific

-

TV Rheinland Group

-

Intertek Group plc

-

Lloyd's Register Group Services Limited

-

Kiwa N.V

Chapter 1. Testing & Certification Services for Railway Transportation Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Testing & Certification Services for Railway Transportation Market– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Testing & Certification Services for Railway Transportation Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Testing & Certification Services for Railway Transportation Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Testing & Certification Services for Railway Transportation Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Testing & Certification Services for Railway Transportation Market– By Service Type

6.1. Introduction/Key Findings

6.2 Safety Testing

6.3 Performance Testing

6.4 Electromagnetic Compatibility Testing

6.5 Environmental Testing

6.6 Functional Safety Testing

6.7 Cybersecurity Testing

6.8 Certification Service

6.9 Y-O-Y Growth trend Analysis By Service Type

6.10 Absolute $ Opportunity Analysis By Service Type, 2023-2030

Chapter 7. Testing & Certification Services for Railway Transportation Market– By Railway Type

7.1. Introduction/Key Findings

7.2 High-Speed Rail

7.3 Urban Rail

7.4 Commuter Rail

7.5 Freight Rail Y-O-Y Growth trend Analysis By Railway Type

7.6 Absolute $ Opportunity Analysis By Railway Type, 2023-2030

Chapter 8. Testing & Certification Services for Railway Transportation Market , By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2 By Service Type

8.1.3 By Railway Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1. U.K.

8.2.2. Germany

8.2.3. France

8.2.4. Italy

8.2.5. Spain

8.2.6. Rest of Europe

8.2.2 By Service Type

8.2.3 By Railway Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. Rest of Asia-Pacific

8.3.2 By Service Type

8.3.3. By Railway Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.3.4. South America

8.4.1. By Country

8.4.1. Brazil

8.4.2. Argentina

8.4.3. Colombia

8.4.4. Chile

8.4.5. Rest of South America

8.4.2 By Service Type

8.4.3. By Railway Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.4.5. Middle East & Africa

8.5.1. By Country

8.5.1. United Arab Emirates (UAE)

8.5.2. Saudi Arabia

8.5.3. Qatar

8.5.4. Israel

8.5.5. South Africa

8.5.6. Nigeria

8.5.7. Kenya

8.5.8. Egypt

8.5.9. Rest of MEA

8.5.2. By Service Type

8.5.3. By Railway Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Testing & Certification Services for Railway Transportation Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Bureau Veritas SA

9.2 TÜV SÜD Group

9.3 SGS SA

9.4 DEKRA SE

9.5 Applus+

9.6 Eurofins Scientific

9.7 TV Rheinland Group

9.8 Intertek Group plc

9.9 Lloyd's Register Group Services Limited

9.10 Kiwa N.V

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Testing & Certification Services for Railway Transportation Market was estimated to be worth USD 5.29 Billion in 2022 and is projected to reach a value of USD 6.5 Billion by 2030, growing at a CAGR of 2.6% during the forecast period 2023-2030.

The Testing & Certification Services for Railway Transportation Market Drivers are the Global expansion of rail networks, stringent safety regulations and increasing focus on passenger safety.

Based on the railway type, the Testing & Certification Services for Railway Transportation Market is segmented into High-Speed Rail, Urban Rail, Commuter Rail, and Freight Rail.

Europe is the most dominating in the Testing & Certification Services for Railway Transportation Market.

Bureau Veritas SA, TÜV SÜD Group, SGS SA, DEKRA SE are few of the leading players in the Testing & Certification Services for Railway Transportation Market.