Terpenoids Market Size (2024 - 2030)

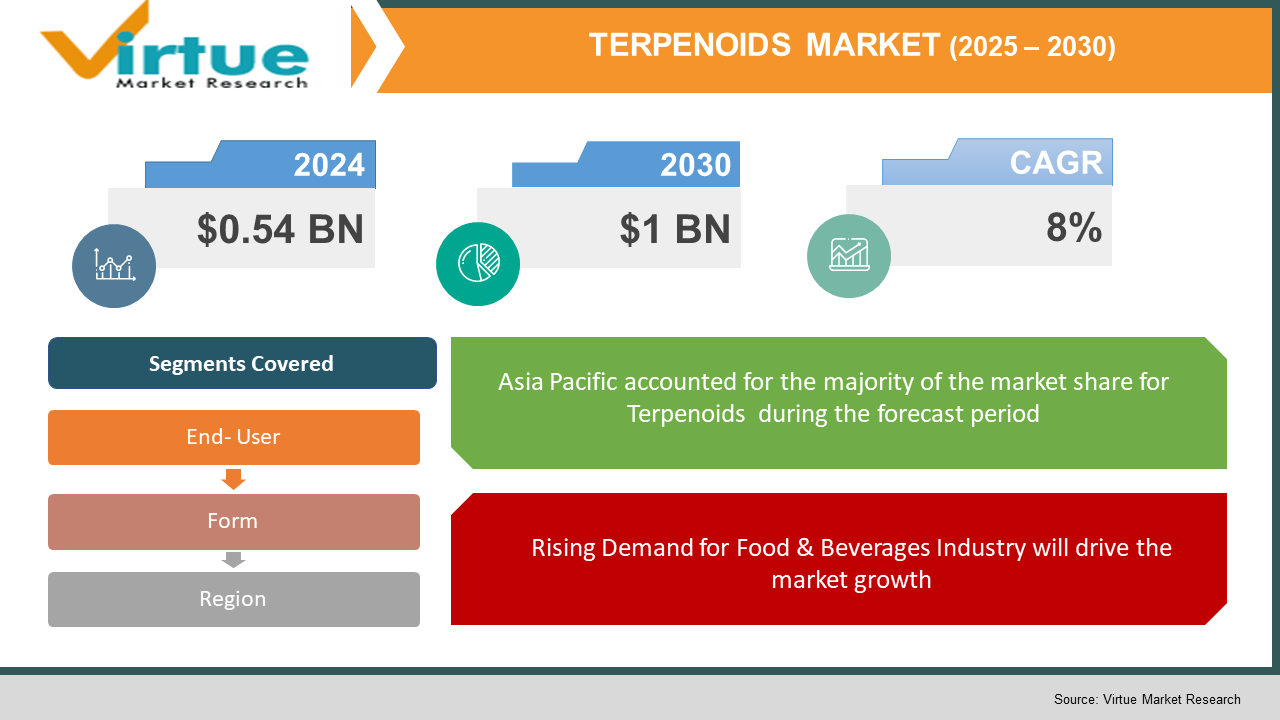

According to the report published by Virtue Market Research in Global Terpenoids Market was valued at USD 0.54 billion in 2023 and is projected to reach a market size of USD 1 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8%.

Industry Overview

Terpenes, a diverse group of aromatic compounds made up of many isoprene molecules, are a crucial component of essential oils. The synthesis of this class of chemicals has flourished as a result of an expanding body of research in plant toxicity and improvements in the fundamental chemistry of oils. The terpene industry has advanced due to hydrocarbon's utilization in a variety of materials with significant commercial value. They have been altered to create gutta-percha, which is used in dentistry, and rubber, which is utilized in a variety of different manufacturing industries. Their increasing use in consumer goods offers manufacturers and distributors in the terpene business attractive opportunities. They are a component of cannabis and are responsible for the distinctive scent and flavour, which has dramatically enlarged the marketing spectrum.

Terpene is therefore used to create medicinal meals, beverages, lotions for therapies, and vape oils. In-depth research on the possible health effects of some of the specific terpene compositions has given the terpene business a boost. Examining its potential for application in creating anti-anxiety materials is one example. The science underlying its action with cannabinoids, however, is still in its infancy, providing plenty of room for innovation in the terpene sector.

Turpentine, which is made from the resin of pine trees and contains resin acid and hydrocarbons, is where the word "terpenes" first appeared. A class of hydrocarbons known as terpenes is produced by both plants and mammals. It is also a naturally occurring substance made of isoprene molecules. Five carbon atoms are joined to eight hydrogen atoms to form the molecule isoprene. Terpenes can be divided into many categories based on the isoprene unit, including hemiterpenes, monoterpenes, diterpenes, tetraterpenes, and others.

Terpene frequently emits a pungent smell and has a high level of resistance. As a result, it is frequently employed in many applications. For instance, it is crucial in industrial uses as an essential oil, fragrance, and flavouring agent. The market is being driven by an increase in demand for terpene in end-use sectors such as cosmetics, food & beverage, paints & coatings, rubber, and pharmaceuticals. The market isn't growing, nevertheless, because of the erratic terpene supply and expensive extraction costs.

Impact of Covid-19 on the industry

Beginning in 2021, the COVID-19 illness spread around the globe, affecting countless people in general, and major governments all over the world issued orders for work stoppages and foot restrictions. Most endeavours have been seriously impacted, except the groups that provide medical supplies and life support equipment.

Market Drivers

Surging Demand in Cosmetics and Personal Care: A Key Driver of the Terpenoids Market

The key reasons driving the Terpenoids Market are the rise in demand for the product from end-user industries including cosmetics and personal care, as well as their global expansion. Terpenes are essential flavouring and fragrance components used in much personal care and cosmetic products. Due to growing consumer awareness of the damaging environmental effects of non-biodegradable products and the rising popularity of orange terpenes because of their sustainability, the market for terpenoids is expanding more quickly. The rise in government financing and investment as well as advancements in smell and flavour technologies have an impact on the market for orange terpenes.

The International Trade Administration reports that the total cosmetic industry output in Mexico climbed to $7.15 billion in 2019 from $7.10 billion in 2018. The International Trade Administration estimates that Thailand's market for cosmetics and personal care products was worth about US$6.2 billion in 2018 and will increase to US$8.0 billion by 2022. From 2019 to 2022, the beauty and personal care industry in Thailand is anticipated to expand at a rate of 7.3% annually. The India Brand Equity Foundation (IBEF) predicts that the country's beauty, cosmetics, and grooming sector will increase from US$6.5 billion to US$20 billion by 2025.

Rising Demand for Food & Beverages Industry will drive the market growth

Terpenoids are frequently employed as organic flavouring agents in the food and beverage sector. Because there is a greater demand for natural flavourings in the food and beverage industries, the market for terpenoids is expanding more quickly. For instance, the $88 billion packaged food and beverage sector in India saw 11% of its sales in CY20 come from health-focused foods and beverages, according to the India Brand Equity Foundation. By CY26, this sum is anticipated to increase by 16%, or $30 billion. The UK's food business expanded by 49.4% between 2009 and 2019, according to the Department for Environment, Food, and Rural Affairs. The food and beverage industries are flourishing, which has resulted in a large rise in demand for terpenoids. Consequently, the expanding food and beverage industry serves as a catalyst for the terpenoids market during the forecast period.

Market Restraints

High Manufacturing Cost & Strict Government Regulation Will Challenge the Market Growth

One of the biggest issues the Terpenoids Market has to deal with is the high cost of terpenoids during manufacture. The limited availability of terpenoids such as citral, menthol, camphor, pinene, limonene, and others is another obstacle to the market expansion of active components. This is especially clear in light of the rising demand for natural and organic products, which raises the price of production. The high cost of feedstock deters ingredient manufacturers from investing in the formulations of organic cosmetics. Businesses must adhere to qualification standards, procedures, and safety inspections to meet the requirements set forth by regulatory organizations for terpenoids, which raises the cost of producing terpenoids.

Furthermore, due to the widespread use of terpenoids in cannabis and the fact that cannabis is illegal in some countries, strict government regulations have an impact on the market expansion of terpenoids. These regulations are related to industry standards related to the usage of ingredients in various industries. As a result, the price of terpenoids rises significantly. This raises manufacturing costs, lowers manufacturer profit margins, and restricts the expansion of the terpenoids' market share.

TERPENOIDS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8% |

|

Segments Covered |

By Form, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Yasuhara Chemical Co. Ltd., P.T. Naval Overseas, Himachal Terpene Products Pvt. Ltd., Interstate Commodities Corp., Foreverest Resources Ltd., BASF SE |

Global Terpenoid Market- By Form

-

Solid

-

Liquid

Due to the rising demand for liquid terpenoids over solid ones, the liquid segment had a sizable proportion of the global terpenoids market in 2021 and is anticipated to expand at a CAGR of 6.7% from 2023 - 2030. Strong cohesive force, radiation resistance, good age resistance, acid, heat, citral, menthol, camphor, and alkali resistance are only a few of the characteristics of liquid terpene resin. In addition, it is non-toxic and has excellent dielectric properties. Because of this, liquid terpene resin is in high demand in industries including pressure-sensitive tapes, paints, and printing inks, chewing gums, and rubber adhesives. The demand for liquid terpenoids is therefore increasing for use in major sectors due to their abundance and multiple advantages over solid terpenoids, which is improving the growth potential for the industry.

Global Terpenoid Market- By End-User

-

Personal Care & Cosmetic

-

Body Care

-

Face Care

-

Nail Care

-

Fragrance

-

Other

-

-

Food & Beverages

-

Pharmaceutical

-

Others

The Pharmaceutical sector, which accounted for a sizeable portion of the Terpenoids Market in 2021, is anticipated to expand at a CAGR of 7.2% from 2023 - 2030. Terpenoids are in high demand in the pharmaceutical business for use in a variety of products including personal care, cosmetics, paint and printing inks, rubber, and others. Terpenoids are frequently used in the pharmaceutical end-use business because they have many medical benefits, including antibacterial, antiseptic, and possibly anti-carcinogenic characteristics. The significant demand for terpenoids, which is driving the market for terpenoids, is driving the rapid expansion of the pharmaceutical industry. Revenue from the production of veterinary drugs in Australia reached $852 million in 2020–21, growing 5.4% annually since, claims the Department of Industry, Science, Energy, and Resources.

Global Terpenoid Market- By Geography & Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

In 2021, the Asia-Pacific region accounted for up to 41% of the global terpenoids market. Terpenoids are in high demand in this region due to the booming pharmaceutical, personal care & cosmetic, and other significant industries, as well as the booming manufacturing activity across APAC. The increased demand for terpenoids, which is driving the growth of the terpenoids market, is driving the pharmaceutical industry in Asia-Pacific to expand swiftly. For instance, the domestic pharmaceutical market in India is estimated to be valued at US$42 billion in 2021 and US$65 billion in 2024 by the India Brand Equity Foundation.

The demand for terpenoids will increase due to the increase in pharmaceutical manufacturing and thriving manufacturer demand in APAC, according to the Ministry of Health, Labour and Welfare's (MHLW) Annual Pharmaceutical Production Statistics. This is estimated to increase the size of the terpenoids market in the Asia-Pacific region over the forecast year.

Global Terpenoid Market- By Companies

-

Yasuhara Chemical Co. Ltd.

-

P.T. Naval Overseas

-

Himachal Terpene Products Pvt. Ltd.

-

Interstate Commodities Corp.

-

Foreverest Resources Ltd.

-

BASF SE

NOTABLE HAPPENINGS IN THE GLOBAL TERPENOIDS MARKET IN THE RECENT PAST:

-

Business Partnership: - In 2022, To increase the availability of its beverages with cannabis terpenes, Diesel Beverages launched an equity crowdfunding campaign in partnership with Wefunder.

-

Business Collaboration: - In 2021, Old Pal, Creed n C, and Lemon Tree are the three new brand collaborations that Eybna has revealed. By generating their distinctive aroma and delivering the desired effects, Eybna's unique, data-driven terpene compositions are used in the brands' goods to maximize the cannabis sensory experience.

-

Research & Development: - In 2021, AmplifiTM, the first terpene-enhanced dry cannabis flower brand, is presented by Vireo Health.

Chapter 1. Terpenoids Market Industry Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Terpenoids Market Industry Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Terpenoids Market Industry Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Terpenoids Market Industry Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Terpenoids Market Industry Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Terpenoids Market Industry Market – By Form

6.1 Introduction/Key Findings

6.2 Solid

6.3 Liquid

6.4 Y-O-Y Growth trend Analysis By Form

6.5 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 7. Terpenoids Market Industry Market – By End-User

7.1 Introduction/Key Findings

7.2 Personal Care & Cosmetic

7.3 Body Care

7.4 Face Care

7.5 Nail Care

7.6 Fragrance

7.7 Other

7.8 Food & Beverages

7.9 Pharmaceutical

7.10 Others

7.11 Y-O-Y Growth trend Analysis By End-User

7.12 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 8. Terpenoids Market Industry Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Form

8.1.3 By End-User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Form

8.2.3 By End-User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Form

8.3.3 By End-User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Form

8.4.3 By End-User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Form

8.5.3 By End-User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Terpenoids Market Industry Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Yasuhara Chemical Co. Ltd.

9.2 P.T. Naval Overseas

9.3 Himachal Terpene Products Pvt. Ltd.

9.4 Interstate Commodities Corp.

9.5 Foreverest Resources Ltd.

9.6 BASF SE

Download Sample

Choose License Type

2500

4250

5250

6900