Terephthalic Resins Market Size (2024 – 2030)

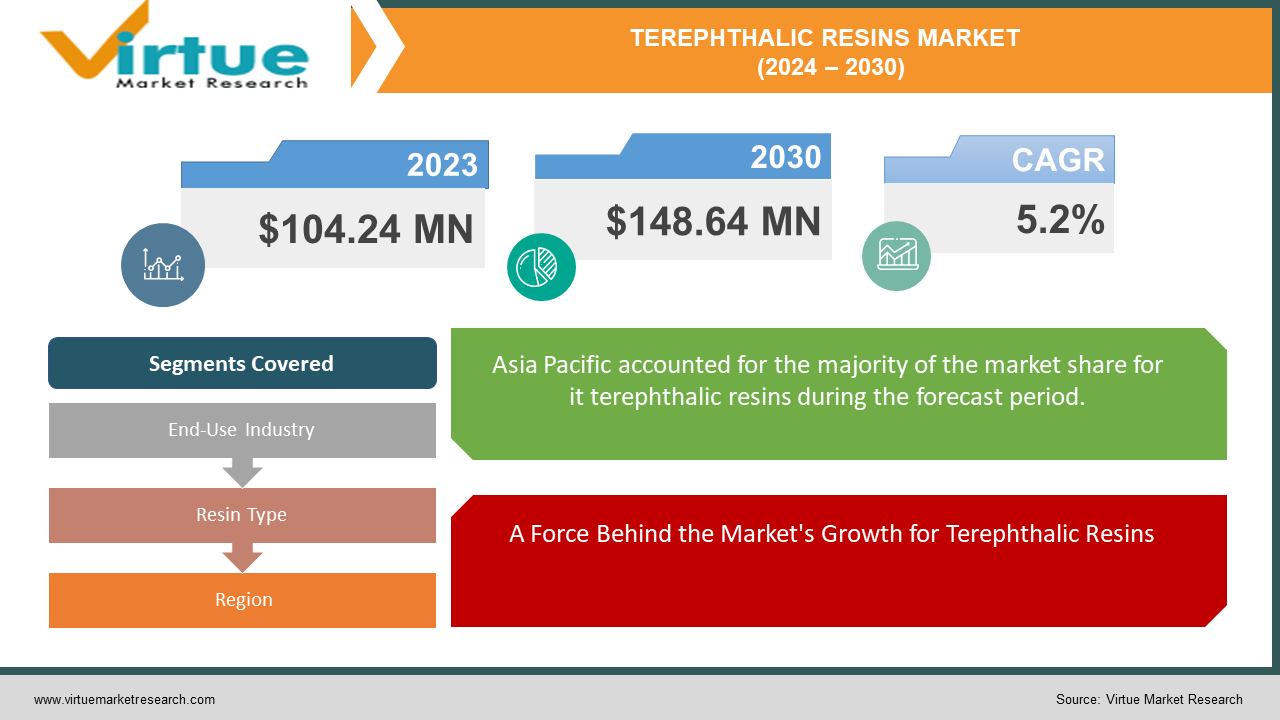

The Global Terephthalic Resins Market was valued at USD 104.24 million in 2023 and is projected to reach a market size of USD 148.64 million by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.2%.

One kind of unsaturated polyester resin (UPR) that is well-known for its strength and stiffness is terephthalic resin (high modulus). They are therefore perfect for uses requiring these characteristics. In addition, they are more affordable than isophthalic acid-based UPR resins, which are another popular kind, even though they have comparable strength. Terephthalic resins are frequently combined with fibreglass reinforcement to provide durable and adaptable fibreglass-reinforced polymers (FRP), which are used in chemical tanks, boat hulls, and construction materials, among other uses. When making cast components that require a high degree of heat and chemical resistance, they can also be utilised alone.

Key Market Insights:

With a 4.1% CAGR, the market for terephthalic acid, a crucial component of terephthalic resins, is projected to reach USD 49 million by 2026. The polyester fibre and yarn sector consumes more than 60% of PTA, which is the primary driver of this development in PET resin demand. The need for easy packaging in online food orders and the expanding e-commerce industry is predicted to drive PET bottle manufacturing to over 3 billion units.

Because of its thriving industrial sector and rising economies like China and India, the Asia Pacific area now leads the world market for terephthalic resins and is predicted to continue doing so in the years to come. Dominance is supported by variables including rapidly increasing disposable incomes and urbanisation, which promote building activity and consumer expenditure on textiles and goods made of PET.

The industry is seeing a move towards bio-based terephthalic acid made from renewable resources as environmental concerns grow. This environmentally friendly substitute provides a long-term fix and may open up new markets for environmentally conscious products. Bio-based terephthalic acid has the potential to upend the industry and meet the increasing demand for sustainable products with continued research and development.

Technological developments in terephthalic resin recycling provide a transformative prospect. Reducing reliance on virgin resources can result in a more sustainable value chain by establishing a closed-loop system. Using recycled materials, not only minimises waste for the environment but also provides producers with financial savings. Future developments in recycling technology will allow terephthalic resins to become more sustainable.

Global Terephthalic Resins Market Drivers:

A Force Behind the Market's Growth for Terephthalic Resins

The expansion of end-use industries is a major factor driving the global market for terephthalic resins. This tendency can be attributed to several sources. First, growing disposable incomes cause consumers to spend more, especially in developing nations like China and India. This translates into increased demand for a range of goods made with terephthalic resins, including home furnishings, polyester apparel, and beverage bottles made of PET. Second, the demand for infrastructure development and building is fueled by the world's rising urbanisation. Because terephthalic resins are strong and reasonably priced, they are used in pipes, building materials, and other construction components. The demand for terephthalic resins is further bolstered by the growth in infrastructure initiatives in emerging nations.

The Exceptional Blend that Drives Terephthalic Resins' Market Domination

Because of its unique mix of three essential characteristics high strength, stiffness, and affordability—terephthalic resins stand out in the market, compared to other materials, they are a highly sought option for a variety of applications because of this special trifecta. Because of its great strength, terephthalic resins can support heavy weights without cracking or deforming. This makes them perfect for pipelines, car parts and structural elements in building supplies. Because of their high modulus, they are rigid and do not bend or flex when under pressure. For applications needing dimensional stability, such as bottles and containers that must keep their form, this feature is essential. The most attractive feature of terephthalic resins is their low cost. In comparison to other materials that possess comparable strength and stiffness, terephthalic resins are frequently a more economical choice.

Global Terephthalic Resins Market Restraints and Challenges:

There are a few challenges facing the worldwide terephthalic resins industry. The primary offender is the price volatility of raw materials, especially paraxylene, which is produced from petrol and oil. The expenses associated with producing terephthalic resins are unpredictable due to this volatility. A further difficulty is the overcapacity problem in the region, particularly in China, which puts resin producers under intense competition and reduces their profit margins. Concerns about the environment are also growing since terephthalic resin manufacture and disposal might have unfavourable effects. Lastly, recycled PET, a more environmentally friendly alternative that gets more affordable with continuous improvements in recycling technology, is becoming a more formidable competitor in the market. These are the main obstacles and difficulties that the worldwide market for terephthalic resins must overcome to expand.

Global Terephthalic Resins Market Opportunities:

The worldwide terephthalic resins market has a lot of room to develop in the future. The demand for consumer products, building materials, and infrastructure is rising due to the expansion of developing economies in Asia Pacific and Latin America. In these markets, terephthalic resins excel because of their low cost and high adaptability. Another important factor is sustainability. Environmentally aware consumers are drawn to bio-based terephthalic acid that is made from renewable resources since it provides a sustainable substitute for petroleum-based alternatives. Technological developments in recycling can further improve sustainability by cutting prices, reducing dependency on virgin resources, and developing a closed-loop system for terephthalic resins. Another possibility is presented by the aerospace and automobile sectors' tendency towards lightweight. When paired with composites, terephthalic resins have the potential to revolutionise the creation of stronger, lighter components that increase fuel economy in various industries.

TEREPHTHALIC RESINS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By End-Use Industry, Resin Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BP plc (UK), Eastman Chemical Company (US), Formosa Plastics (Taiwan), Havana Company Limited (China), Hengli Petrochemical Co., Ltd. (China), Indian Oil Corp. (India), Indorama Ventures Public Company (Thailand), LyondellBasell (US), Mitsubishi Chemicals Corporation (Japan), PKN Orlen S.A. (Poland), Reliance Industries Limited (India), SABIC (Saudi Arabia), Siam Mitsui PTA (Thailand), Sinopec Group (China), Taekwang Industrial Co., Ltd. (South Korea) |

Global Terephthalic Resins Market Segmentation: By End-Use Industry

-

Textiles

-

PET Bottles and Packaging

-

Construction Materials

-

Other Applications

PET bottles and packaging are now the market category with the quickest rate of growth, despite textiles traditionally being the main consumer of terephthalic resins. The growth of e-commerce and our growing desire for practical packaging solutions are the main drivers of this upsurge.

Global Terephthalic Resins Market Segmentation: By Resin Type

-

Saturated Terephthalic Resins

-

Unsaturated Terephthalic Resins

Due to a lack of data, it is difficult to pinpoint the precise leader in terephthalic resin types by size and growth. Because they are used so extensively in automotive and construction parts, unsaturated resins, or UTRs, are probably the larger players. Even though they may make up a lesser market, saturated resins (STRs) may be expanding more quickly due to applications where heat and chemical resistance are required. More accurate segmentation information may be obtained through additional studies using purchased market studies from reputable companies.

Global Terephthalic Resins Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In terms of both present market share and anticipated growth, Asia Pacific leads the world market for terephthalic resins. This dominance is the result of the region's quickly urbanising terrain with considerable infrastructural development, as well as the burgeoning textile and packing sectors, which are driven by rising disposable incomes.

COVID-19 Impact Analysis on the Global Terephthalic Resins Market:

Initially, the market for terephthalic resins wasn't spared by the COVID-19 outbreak. Lockdowns put a stop to demand, especially in textiles where the fashion sector halted, and clothes outlets closed. The problems were exacerbated by disrupted supply chains, which made it challenging to obtain terephthalic resins where they were required. Nonetheless, the market has shown incredible tenacity. Online shopping gave rise to a surge in e-commerce, which in turn increased demand for PET bottles and other packaging required for necessities. In addition, when lockdowns loosened, building activity increased, taking up some of the slack left by the faltering textile industry. Ultimately, the impact of COVID-19 was just a temporary roadblock; the market for terephthalic resins has recovered and is poised for further expansion.

Recent Trends and Developments in the Global Terephthalic Resins Market:

The terephthalic resins market is changing on a worldwide scale. Sustainability is a major motivator, as new bio-based products come on the scene and recycling technologies enable closed-loop systems. Asia Pacific continues to dominate in PET bottle demand, which is surging primarily to e-commerce, with growth anticipated in developing nations. The automotive and aerospace sectors benefit from advancements in lightweight composites, but unstable raw material pricing continues to be a problem. The terephthalic resins market may steer towards a prosperous and sustainable future by adopting these trends.

Key Players:

-

BP plc (UK)

-

Eastman Chemical Company (US)

-

Formosa Plastics (Taiwan)

-

Havana Company Limited (China)

-

Hengli Petrochemical Co., Ltd. (China)

-

Indian Oil Corp. (India)

-

Indorama Ventures Public Company (Thailand)

-

LyondellBasell (US)

-

Mitsubishi Chemicals Corporation (Japan)

-

PKN Orlen S.A. (Poland)

-

Reliance Industries Limited (India)

-

SABIC (Saudi Arabia)

-

Siam Mitsui PTA (Thailand)

-

Sinopec Group (China)

-

Taekwang Industrial Co., Ltd. (South Korea)

Chapter 1. Terephthalic Resins Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Terephthalic Resins Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Terephthalic Resins Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Terephthalic Resins Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Terephthalic Resins Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Terephthalic Resins Market – By End-Use Industry

6.1 Introduction/Key Findings

6.2 Textiles

6.3 PET Bottles and Packaging

6.4 Construction Materials

6.5 Other Applications

6.6 Y-O-Y Growth trend Analysis By End-Use Industry

6.7 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 7. Terephthalic Resins Market – By Resin Type

7.1 Introduction/Key Findings

7.2 Saturated Terephthalic Resins

7.3 Unsaturated Terephthalic Resins

7.4 Y-O-Y Growth trend Analysis By Resin Type

7.5 Absolute $ Opportunity Analysis By Resin Type, 2024-2030

Chapter 8. Terephthalic Resins Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By End-Use Industry

8.1.3 By Resin Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By End-Use Industry

8.2.3 By Resin Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By End-Use Industry

8.3.3 By Resin Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By End-Use Industry

8.4.3 By Resin Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By End-Use Industry

8.5.3 By Resin Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Terephthalic Resins Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BP plc (UK)

9.2 Eastman Chemical Company (US)

9.3 Formosa Plastics (Taiwan)

9.4 Havana Company Limited (China)

9.5 Hengli Petrochemical Co., Ltd. (China)

9.6 Indian Oil Corp. (India)

9.7 Indorama Ventures Public Company (Thailand)

9.8 LyondellBasell (US)

9.9 Mitsubishi Chemicals Corporation (Japan)

9.10 PKN Orlen S.A. (Poland)

9.11 Reliance Industries Limited (India)

9.12 SABIC (Saudi Arabia)

9.13 Siam Mitsui PTA (Thailand)

9.14 Sinopec Group (China)

9.15 Taekwang Industrial Co., Ltd. (South Korea)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Terephthalic Resins Market size is valued at USD 104.24 million in 2023.

The worldwide Global Terephthalic Resins Market growth is estimated to be 5.2% from 2024 to 2030.

The Global Terephthalic Resins Market is segmented By End-Use Industry (Textiles, PET Bottles and Packaging, Construction Materials, Other Applications); By Resin Type (Saturated Terephthalic Resins, Unsaturated Terephthalic Resins) and by region.

Growing demand for sustainable and bio-based terephthalic resins is anticipated in response to environmental issues. Technological developments in recycling will establish a closed-loop system that lowers manufacturing costs and waste. Furthermore, terephthalic resins in conjunction with composites present a potential due to the transportation sectors' emphasis on lightweight materials.

The market for terephthalic resins was first affected by the COVID-19 pandemic because of lockdowns and a decline in demand for packaging and textiles. Nonetheless, the industry recovered because of a rise in building activity, e-commerce, and packaging for necessities.