Tequila Cocktails Market Size (2023 – 2030)

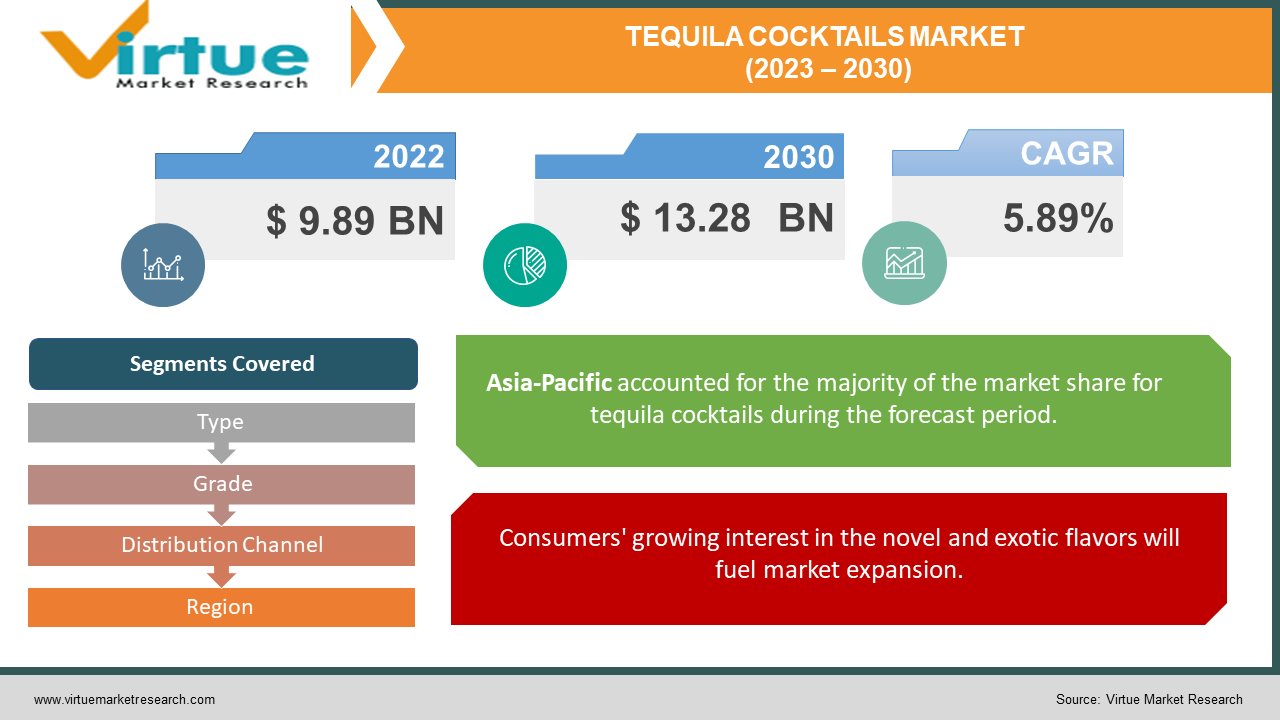

The Tequila Cocktails market was valued at USD 9.89 billion in 2022 and is projected to reach USD 13.28 billion by 2030. The market is anticipated to expand at a CAGR of 5.89% over the forecast period.

INDUSTRY OVERVIEW

The Agave Tequilana plant is used to make the distilled alcoholic beverage known as tequila. It is fermented together with extra sweets like fructose and glucose as well as synthetic flavorings. Tequila's alcohol concentration, flavor, and color typically change during the course of the maturing process. Its moderate use improves digestion by raising probiotic levels, improving calcium and magnesium absorption, and encouraging the development of beneficial bacteria in the intestines. It is extensively used as a foundation component in cocktails and is well-liked by young people all over the world.

One of the major forces driving the expansion of the worldwide tequila industry is the sharp increase in cocktail culture's appeal both inside and outside the home. Moreover, ultra-premium and special handcrafted tequila varieties are becoming more popular all over the world as a result of shifting lifestyles and rising income levels. In addition, the major manufacturers are expanding their product lines by adding versions made with natural components including lemon, coconut tangerine, strawberry, pineapple, mango, and pear. To boost their total sales, they are also providing easy and affordable canned tequila drinks. However, governments in several nations have enacted total lockdowns and social segregation policies to stem the spread of the coronavirus illness (COVID-19). Tequila on-premises sales have declined, but there has been an increase in the demand for alcoholic drinks through e-commerce platforms in various nations.

COVD-19 IMPACT ON THE TEQUILA COCKTAILS MARKET

The COVID-19 pandemic outbreak has brought about a global standstill in several industries, including the food and beverage, machinery, and pharmaceutical sectors. It has also hurt the economy due to the closure of several manufacturing facilities, a labor shortage, and the erratic supply of raw materials. In the early months of the viral outbreak, the industry saw a modest reduction in sales as a result of the pandemic. Several governments implemented the lockdown, which disrupted transportation and brewing operations. Due to a decrease in travel retail during the first few months of the lockdown, the major market participants saw a minor loss in their spirits sales, which eventually improved as a result of the partial reopening of the on-trade channel. For instance, organic sales are down 9.5% at Pernod Ricard S.A. The company's increased cost of products was mostly brought on by agave pricing pressure. However, once the epidemic subsided and the logistics and transportation sectors resumed operations, the sector rebounded. In addition, the manufacturers attempted to forge alliances with rival companies or businesses with complementary skills to survive the epidemic.

MARKET DRIVERS:

Consumers' growing interest in the novel and exotic flavors will fuel market expansion.

One of the key factors boosting demand for distilled spirits made from blue agave plants is the increasing acclaim that various artisanal spirits are receiving from customers all over the world. Tequila market expansion is fueled by consumers' need for excellent exotic beverages with a fresh flavor around the globe. To draw customers in and experiment with new flavors, major producers like Patron Spirits International developed flavors including flowery, black pepper, turmeric, and pumpkin. The Distilled Spirits Council of the United States (DISCUS) reports that in 2021, the spirit sector grew more quickly as restaurants reopened and sales increased to 41.3% of the country's market for alcoholic drinks. Tequila sales increased by 30.1% in 2021, which was the main factor driving this. Despite the coronavirus epidemic, the artisan spirits market did well in key consumer nations including the United States, India, and Vietnam. The firms in the sector are starting to provide new goods that appeal to clients who wish to enjoy such cocktails with their family and friends since the epidemic has increased the demand for premium spirits with distinctive flavors. For instance, the Casa Aceves brand Rock N Roll announced in July 2021 that strawberry tequila will be joining its lineup of acclaimed spirits. The distinctive taste will be the country's first premium strawberry-flavored tequila.

Premium spirits are in greater demand, supporting market growth

The tendency of premiumization has emerged in recent years as customers choose quality over quantity. Consumers' preference for sophisticated and high-end beverages, therefore, increases demand for these goods. International Wine and Spirit Research (IWSR), 2020, predicts that the demand from consumers for high-end sipping spirits and cocktails would cause the premium-and-above spirits category to expand rapidly globally, reaching a volume market share of 13% by 2024. The premiumization movement is gaining a lot of traction in European nations as customers turn their attention to artisan distilleries and regionally made beverages. Tequila, which is propelling the craft spirits sector in Europe, is one of the new tastes and propositions that these tiny craft distilleries are adding to the spirits. Their shifting choices have also been affected by rising urbanization and middle-class consumers' discretionary money. Therefore, the premium spirits category continues to be driven by new consumption patterns, which also support market expansion.

MARKET RESTRAINTS:

Growing preference for low-alcohol beverages to stagnate growth

The industrialized nations are anticipating a shift in consumer preference toward low- and non-alcoholic beverages since spirits use have increased recently, particularly in emerging regions. Their growing knowledge of the negative effects of alcohol consumption has caused people to resort to low- or no-alcohol drinks since they taste just like alcoholic beverages without the negative consequences. The IWSR study report states that in 2019, approximately 52% of American adults who consume alcohol are attempting to cut back. In addition, IWSR was projected for 2020. As customers switch to healthier and more enticing beverages, global alcohol sales fell by 9.4% to 24.8 billion 9-litre cases. A variety of low- and non-alcoholic drinks are being introduced by producers as they explore this market, which is likely to hurt the product's sales performance.

TEQUILA COCKTAILS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.89% |

|

Segments Covered |

By Type, Grade, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Pernod Ricard S.A, Diageo Plc, Bacardi Limited, Suntory Holdings Limited, Heaven Hill Distilleries, Inc., Campari Group, Sazerac Company Inc., Brown-Forman Corporation, Casa Aceves, Constellation Brands, Inc. |

TEQUILA COCKTAILS MARKET – BY TYPE

-

Blanco

-

Reposado

-

Anejo

-

Others

Based on the type, the Tequila Cocktails market is segmented into, Blanco, Reposado, Anejo and Others. Because of their characteristic agave flavor and earthy, semi-sweet flavor, the Blanco varieties make up a substantial portion of the tequila industry. Due to its smoother flavor and widespread availability, it is widely consumed. The wide application of Blanco varieties in several drinks, including margarita and Paloma, helps to hold the market's greatest share.

As customers become more aware of the spirit and are prepared to try new variations, reposado and Anejo variants have seen tremendous growth in recent years. Reposado and Anejo, in contrast to Blanco, are matured in oak barrels for a month to a year, giving them distinctive honey and smokey flavor.

TEQUILA COCKTAILS MARKET - BY GRADE

-

Value

-

Premium

-

High-end Premium

-

Super Premium

Based on the grade, the Tequila Cocktails market is segmented into Value, Premium, High-end Premium and Super Premium. Due to customer desire for premium craft spirits, it is projected that the premium variety would hold the highest proportion. The premium-grade spirit combines all coveted qualities, including texture, mouthfeel, and sensory appeal, which are highly regarded by customers. The market is primarily driven by young people and millennials who prefer these high-end spirit varieties. Because of shifting consumer views and their willingness to spend more money on beverages, high-end and super-premium items are among the categories with the quickest growth rates. The super-premium and high-end premium spirits expanded by volume by 6-7% every year between 2015 and 2019 according to DISCUS.

TEQUILA COCKTAILS MARKET - BY DISTRIBUTION CHANNEL

-

On-trade

-

Off-trade

Based on the grade, the Tequila Cocktails market is segmented into On-trade and Off-trade. One of the well-known ways to sell alcohol is through the on-trade sector, which is predicted to hold a greater proportion of the market. Quick servings, entertainment, and ambience are preferred by consumers in industrialized economies, which propels on-trade sales. The off-trade channel, however, is expanding rapidly since it is far more affordable to buy alcohol at supermarkets and other brick-and-mortar retailers. Alcohol may also be delivered right to your door when you order it online, which promotes the expansion of this market.

TEQUILA COCKTAILS MARKET - BY REGION

-

North America

-

Europe

-

The Asia Pacific

-

Latin America

-

The Middle East

-

Africa

By region, the Tequila Cocktails market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa. In 2021, the market in North America was estimated at USD 6.09 billion. This is because more Americans and Mexicans are becoming interested in agave-based spirits. The U.S. Distilled Spirits Council estimates that sales of agave-based spirits climbed by 30.1% on an annual basis to USD 5.2 billion in 2021. Only premixed cocktails grew faster than tequila as a category of alcohol. Tequila consumption has increased by 40% over the past five years, according to International Wine and Spirits Research (IWSR), making it one of the alcoholic beverages with the greatest growth in the U.S. The category has changed to accommodate various tastes and preferences, which has helped the spirit's popularity increase dramatically in recent years. Along with this, customers are upgrading their spirits as they become more aware of higher-quality options. They are aware of the various maturing techniques, terroir, and the locations where tequila is made. To take the experience to a new level, the producers in the area produce Blanco with clear, smooth quality and entirely natural tastes. Tequila sales in the area are also anticipated to benefit from the increased celebrity interest in the drink.

With its craftsmanship, heritage, and protected status, tequila is well-positioned to profit from the popularity of craft spirits in the region, where more drinkers are looking to "drink better" and turning to premium brands. As a result, the European market is likely to experience significant growth. The spirit registered its geographical indication (GI) in March 2019, establishing it as an EU spirit and enhancing its market worth as a protected EU product. This is anticipated to improve its performance in the area even further. Tequila demand and interest in the U.K. market are also being fueled by the expansion of cocktail culture and high-profile celebrity debuts for some brands.

Consumers in the Asia Pacific region, particularly millennials in nations like China and Australia, are becoming more aware of the spirit. The market has grown as a result of rising imports, customers who prioritize quality over quantity, and a preference for spirits produced in small quantities.

Alcohol consumption is rising in Latin American nations like Brazil and Argentina, which is probably helping the area as a whole. The premiumization and innovation trends in white spirits are being observed across the Middle East and Africa, which is fostering market expansion.

TEQUILA COCKTAILS MARKET - BY COMPANIES

Some of the major players operating in the Tequila Cocktails market include:

-

Pernod Ricard S.A

-

Diageo Plc

-

Bacardi Limited

-

Suntory Holdings Limited

-

Heaven Hill Distilleries, Inc.

-

Campari Group

-

Sazerac Company Inc.

-

Brown-Forman Corporation

-

Casa Aceves

-

Constellation Brands, Inc.

NOTABLE HAPPENING IN THE TEQUILA COCKTAILS MARKET

-

PRODUCT LAUNCH- February 2022: The Avión brand of Pernod Ricard has added Avión Reserva Cristalino Tequila to its Reserva lineup. The business has produced a product that honors each stage of its manufacturing process, from the field to the bottle, exhibiting the distinctiveness of its terroir, the personality of the agave, the purity of the distillation, and the delicate connection with wood during maturation.

-

PRODUCT LAUNCH- Aejo Cristalino, a new ultra-premium product from Suntory Holdings Limited's Tres Generaciones® Tequila, was released in February 2022. The smooth yet distinctive drink, which is crystal clear and demonstrates the dedication of the brand to quality and innovation, was made by the master distillers of Tres Generaciones at La Perseverancia Distillery in Jalisco.

Chapter 1. Tequila Cocktails Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Tequila Cocktails Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Tequila Cocktails Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Tequila Cocktails Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Tequila Cocktails Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Tequila Cocktails Market – BY TYPE

6.1. Blanco

6.2. Reposado

6.3. Anejo

6.4. Others

Chapter 7. Tequila Cocktails Market – BY GRADE

7.1. Value

7.2. Premium

7.3. High-end Premium

7.4. Super Premium

Chapter 8. Tequila Cocktails Market – BY DISTRIBUTION CHANNEL

8.1. On-trade

8.2. Off-trade

Chapter 9. Tequila Cocktails Market- By Region

9.1. North America

9.2. Europe

9.3. Asia-Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10. Tequila Cocktails Market – Key players

10.1 Pernod Ricard S.A

10.2 Diageo Plc

10.3 Bacardi Limited

10.4 Suntory Holdings Limited

10.5 Heaven Hill Distilleries, Inc.

10.6 Campari Group

10.7 Sazerac Company Inc.

10.8 Brown-Forman Corporation

10.9 Casa Aceves

10.10 Constellation Brands, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900