Teleradiology Consulting Services for Neurology Market Size (2024 – 2030)

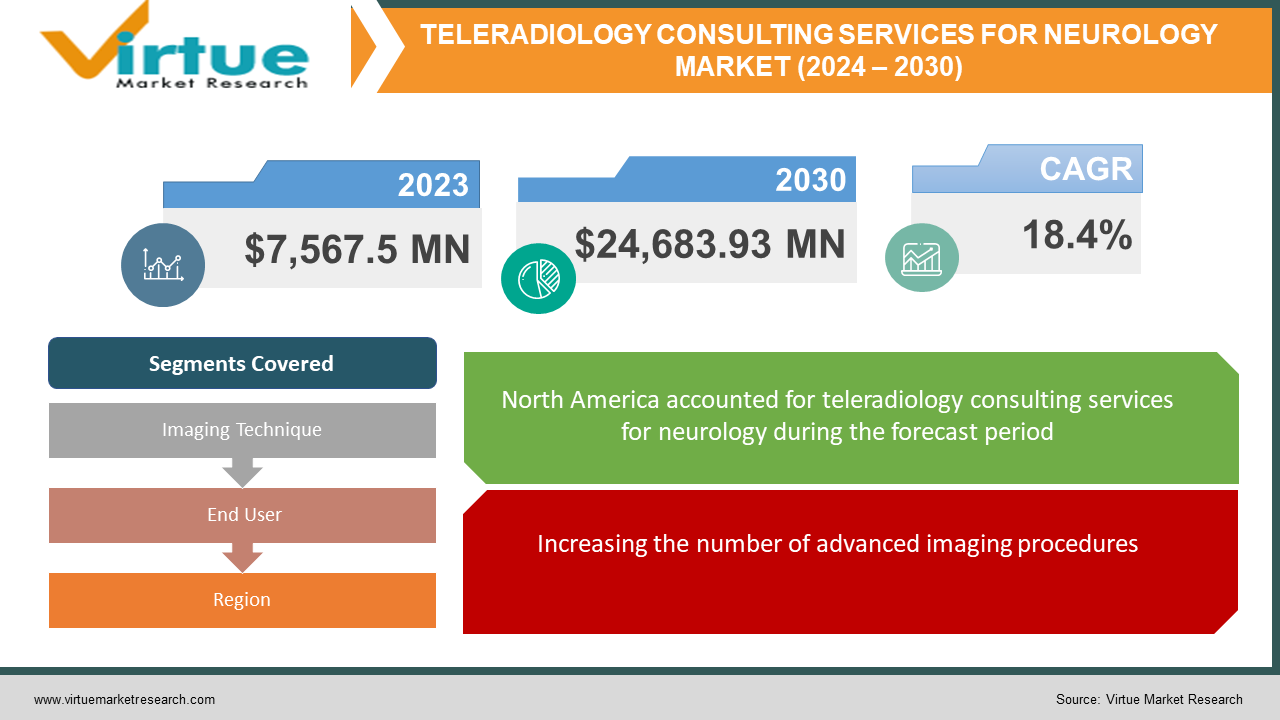

The Teleradiology Consulting Services for Neurology Market was valued at USD 7,567.5 million in 2023 and is projected to reach a market size of USD 24,683.93 million by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 18.4%.

The market development of teleradiology is significantly propelled by continuous technological advancements in imaging systems. Innovations such as higher-resolution imaging, 3D imaging, and the integration of artificial intelligence (AI) for image interpretation increase the accuracy and efficiency of diagnostic processes. These updates not only provide clearer and more detailed medical images but also enable faster transmission and analysis through teleradiology platforms. As healthcare embraces cutting-edge imaging technologies, the demand for teleradiology services develops, driven by the need for timely and precise remote diagnostics. The evolving landscape of imaging systems plays a crucial role in shaping the future trajectory of the teleradiology market forecast. However, the expected growth of the teleradiology market size is affected by the low availability of broadband networks and concerns over data security. In areas with limited broadband infrastructure, the efficiency of transmitting medical images for remote interpretation may be compromised, hindering seamless implementation.

Key Market Insights:

-

The United States has a major market share and is expected to progress at a CAGR of 8.3% throughout the expected period. The healthcare infrastructure in the United States is strengthening, and imaging procedures of various kinds are performed regularly in the United States. Thus, the teleradiology market benefits and is expected to thrive in the United States.

-

The United Kingdom is one of the most promising nations in the European market. The CAGR for the United Kingdom market is expected to be 11.9% throughout the expected period. There are a high number of experts working in the radiology field in the United Kingdom. Thus, radiology equipment and scans are usual in the country. Teleradiology, too, is gaining traction in the United Kingdom.

-

Germany is another European country with major potential for market growth. The CAGR for Germany is estimated to be 11.0% from 2024 to 2030. With the growing aging population in Germany, there is an enhanced demand for medical equipment. As the number of people affected by various problems rises in Germany, so does the need for scans.

Teleradiology Consulting Services for Neurology Market Drivers:

Increasing the number of advanced imaging procedures

The growth in imaging procedures is estimated to drive the demand for advanced teleradiology solutions for reliability and efficiency. CT scanning accounts for 25% of Americans' total exposure to radiation. A high degree of technical knowledge and expertise is required to handle advanced and sophisticated diagnostic imaging systems, thus fuelling the enhancing complexity of cases with a shortage of adequate resources. The adoption of teleradiology solutions has significantly aided bridge the rural-urban disparity in many emerging economies, including India and Brazil, as well as in developed economies like the US, the UK, and Germany. These solutions are more convenient and budget-friendly, as they eliminate the need for travel and permit radiologists to work from anywhere. A dearth of qualified radiologists has further raised the demand for teleradiology services.

Teleradiology Consulting Services for Neurology Market Restraints and Challenges:

Restricted access to high-speed internet in rural areas

With teleradiology, patients and experts in villages can get high-quality imaging advice without traveling to more populated urban areas with more modernized healthcare systems. Furthermore, Radiologists working remotely require a good internet connection. However, the lack of availability of high-speed broadband connections affects expanding access to teleradiology services in rural areas. For example, according to the Broadband Deployment Report, in recent years, only 69.3% of rural areas and 64.6% of tribal areas had access to high-speed broadband internet that met the minimum standard set by the Federal Communications Commission (FCC).

Threat to privacy and cybersecurity risks

Teleradiology helps in the sharing of medical images to facilitate the delivery of care. However, Cybersecurity measures to secure patient health information are often not implemented. There are ethical and legal responsibilities for healthcare providers to preserve the privacy and confidentiality of patient information, which can contain some of the most important information about an individual. Most clinical picture archiving and communication systems (PACS) use digital imaging and communications in medicine (DICOM) as the benchmarked image format for medical images. PACS could result in major data loss, could serve as an avenue to result in disruption through a hospital’s system, or should the information be altered or misdirected, could impede on time diagnosis and treatment, thereby challenging the development of this market.

Teleradiology Consulting Services for Neurology Market Opportunities:

Growing demand coupled with technological advancements

There is a rising R&D activity in the development of advanced solutions for the efficient diagnosis, treatment, and management of several medical conditions. This mixed with the increasing demand for this technology due to several benefits associated with them is anticipated to push the market growth. Some of the advantages of this technology involve better efficiency, lower costs, and quick turnaround times. Due to the development of this technology, any modality in which the medical images can be digitalized can be paired well with teleradiology. Some of the other technological updates include improved workflow efficiency, and also the utilization of cryptocurrency and blockchain in this marketplace. The above elements combined with the growing need for efficient diagnostics are further projected to push the demand for these technologies and boost the market growth rate.

TELERADIOLOGY CONSULTING SERVICES FOR NEUROLOGY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

18.4% |

|

Segments Covered |

By Imaging Technique, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Virtual Radiologic (vRad), Agfa-Gevaert Group, ONRAD, Inc., Everlight Radiology;, 4ways Healthcare Ltd., RamSoft, Inc., USARAD Holdings, Inc., Koninklijke Philips N.V., Matrix (Teleradiology Division of Radiology Partners), Medica Group PLC |

Teleradiology Consulting Services for Neurology Market Segmentation: By Imaging Technique

-

Ultrasounds

-

Magnetic resonance imaging (MRI)

-

Nuclear imaging

-

Fluoroscopy

-

Mammography

-

Other imaging techniques

-

Computed tomography (CT)

-

X-rays

The Computed Tomography (CT) segment accounted for the biggest teleradiology market share in terms of revenue in 2023 and is expected to maintain its position during the forecast period owing to its diagnostic versatility. CT outshines in diagnosing a diverse array of conditions, encompassing trauma, cancer, and vascular diseases. Its ability to generate high-resolution three-dimensional images has positioned it as a significant technology across multiple medical specialties. The flexibility and precision provided by CT scans contribute to its continued prominence in medical diagnostics, solidifying its status as a cornerstone technology in the healthcare sector.

However, the Nuclear Imaging segment is anticipated to exhibit the fastest CAGR during the forecast period due to ongoing technological advancements in nuclear medicine, marked by the generation of new radiotracers and substantial investments in upgrading diagnostic imaging centers. These developments widen the capabilities of nuclear imaging, encouraging its increased adoption and contributing to its rapid development within the broader diagnostic imaging market.

Teleradiology Consulting Services for Neurology Market Segmentation: By End User

-

Hospitals

-

Diagnostic centers

-

Others

The Hospital segment accounted for the biggest share in terms of revenue in 2023 and is anticipated to maintain its lead during the forecast period. The growing necessity for prompt and precise diagnostic imaging, integrated with the efficiency and accessibility advantages provided by the teleradiology industry, establishes hospitals as major contributors to the market's overall revenue. The increased dependency on teleradiology services within hospital settings underscores the technology's pivotal role in modern healthcare, offering seamless access to expert interpretations and contributing to enhanced diagnostic capabilities within hospital environments. However, the Diagnostic centers segment is anticipated to exhibit the fastest CAGR during the forecast period. Diagnostic centers play an integral role in providing a diverse array of medical tests and imaging services, encompassing radiology, pathology, and various diagnostic procedures.

Teleradiology Consulting Services for Neurology Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America held the biggest market share of 38.91% in 2023 and is anticipated to maintain its dominance over the forecast period. The rising target population base, increasing prevalence of chronic disorders, and presence of key market players in the region are the major factors adding to the market growth. Additionally, developed infrastructure, supportive government initiatives, and growing demand for efficient radiology solutions are likely to widen the regional market further.

Asia Pacific is estimated to experience the fastest CAGR over the forecast period. This can be related to the large unmet healthcare needs coupled with the rapidly expanding healthcare infrastructure in the region. In developing countries such as India and China, a major proportion of the population resides in rural areas where they have restricted access to healthcare, as most of the advanced care facilities are being implemented in urban areas. Hence, hospitals and organizations are looking to tap this unexploited market considering the benefit at the bottom of the pyrami

COVID-19 Impact Analysis on the Teleradiology Consulting Services for Neurology Market:

In the COVID-19 pandemic situation, teleradiology systems are adopted even more to share observations and details information collected during the treatment of COVID-19 patients. For example, in March 2020, USARAD Holdings Inc. (US) partnered with Nanox Imaging (Israel) to facilitate fetching Nanox’s mobile imaging system to high-risk areas, encouraging preventative COVID-19 screening efforts in these locations. It has assisted in preventing the exchange of hard copies of imaging results and avoids face-to-face personal contact. Moreover, many international teleradiology alliances of radiologists are estimated to propel the speed of trials and studies on preventive measures. In addition, initially due to the lockdown and hold on elective imaging services, there was a fall in teleradiology services being observed.

Latest Trends:

Penetration of artificial intelligence in teleradiology

Artificial intelligence is one of the most trustworthy breakthroughs in the field of teleradiology. In the past 10 years, it is expected that the number of publications on AI in radiology will increase from an average of 100–150 research publications per year to 700–800 per year. Of all the key imaging modalities, the adoption of AI is wider in CT and MRI systems; likewise, based on applications, AI is heavily utilized in neuroradiology. Several players in this market have increased their product and service portfolios in the field of AI. For example, at the 2018 Radiology Society of North America (RSNA) annual conference, about 104 companies represented AI-based technologies in the medical imaging space, of which 25 were first-time exhibitors. AI can help in the development of an in-built system that prioritizes cases based on protocol requirements. For instance, cases of trauma and stroke can be prioritized and allocated to the radiologist’s work lists, thereby saving many lives.

Key Players:

-

Virtual Radiologic (vRad)

-

Agfa-Gevaert Group

-

ONRAD, Inc.

-

Everlight Radiology;

-

4ways Healthcare Ltd.

-

RamSoft, Inc.

-

USARAD Holdings, Inc.

-

Koninklijke Philips N.V.

-

Matrix (Teleradiology Division of Radiology Partners)

-

Medica Group PLC

Recent Developments

-

In May 2023, IMEXHS and deepc announced the introduction of their new solution offering, “IMEX AI Powered by deepc. The collaboration between IMEXHS and Deep combines their expertise, providing a one-stop destination for medical imaging necessities. With deepc’s advanced platform and AI solutions and IMEXHS’s cloud-based enterprise imaging platform, healthcare providers will have approachability to cutting-edge technology that is scalable, adaptable, accessible, and can offer seamless interoperability while maintaining data integrity.

-

In October 2023, IMAGE Information Systems and Aycan Medical Systems launched a new version of the iQ-ROUTER. The product, combinedly made by the two companies, has a new 5.0 version, facilitating smooth data transmission along international lines.

-

Also in October 2023, Egyptian company Rology’s AI-assisted teleradiology platform received permission from the US Food and Drug Administration (FDA).

Chapter 1. TELERADIOLOGY CONSULTING SERVICES FOR NEUROLOGY MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. TELERADIOLOGY CONSULTING SERVICES FOR NEUROLOGY MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. TELERADIOLOGY CONSULTING SERVICES FOR NEUROLOGY MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. TELERADIOLOGY CONSULTING SERVICES FOR NEUROLOGY MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. TELERADIOLOGY CONSULTING SERVICES FOR NEUROLOGY MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. TELERADIOLOGY CONSULTING SERVICES FOR NEUROLOGY MARKET – By Imaging Technique

6.1 Introduction/Key Findings

6.2 Ultrasounds

6.3 Magnetic resonance imaging (MRI)

6.4 Nuclear imaging

6.5 Fluoroscopy

6.6 Mammography

6.7 Other imaging techniques

6.8 Computed tomography (CT)

6.9 X-rays

6.10 Y-O-Y Growth trend Analysis By Imaging Technique

6.11 Absolute $ Opportunity Analysis By Imaging Technique, 2024-2030

Chapter 7. TELERADIOLOGY CONSULTING SERVICES FOR NEUROLOGY MARKET – By End User

7.1 Introduction/Key Findings

7.2 Hospitals

7.3 Diagnostic centers

7.4 Others

7.5 Y-O-Y Growth trend Analysis By End User

7.6 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. TELERADIOLOGY CONSULTING SERVICES FOR NEUROLOGY MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By By Imaging Technique

8.1.3 By End User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By By Imaging Technique

8.2.3 By End User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By By Imaging Technique

8.3.3 By End User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By By Imaging Technique

8.4.3 By End User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By End User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. TELERADIOLOGY CONSULTING SERVICES FOR NEUROLOGY MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Virtual Radiologic (vRad)

9.2 Agfa-Gevaert Group

9.3 ONRAD, Inc.

9.4 Everlight Radiology;

9.5 4ways Healthcare Ltd.

9.6 RamSoft, Inc.

9.7 USARAD Holdings, Inc.

9.8 Koninklijke Philips N.V.

9.9 Matrix (Teleradiology Division of Radiology Partners)

9.10 Medica Group PLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Teleradiology Consulting Services for Neurology Market was valued at USD 7,567.5 million in 2023 and is projected to reach a market size of USD 24,683.93 million by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 18.4%.

The increased number of advanced imaging procedures is propelling the Teleradiology Consulting Services for Neurology Market.

Teleradiology Consulting Services for Neurology Market is segmented based on Imaging Technique, End User, and Region.

North America is the most dominant region for Teleradiology Consulting Services for the Neurology Market.

Virtual Radiologic (vRad), Agfa-Gevaert Group, ONRAD, Inc., Everlight Radiology, 4ways Healthcare Ltd, and RamSoft, Inc. are a few of the key players operating in the Teleradiology Consulting Services for the Neurology Market.