Telemedicine Technologies Market Size (2024 – 2030)

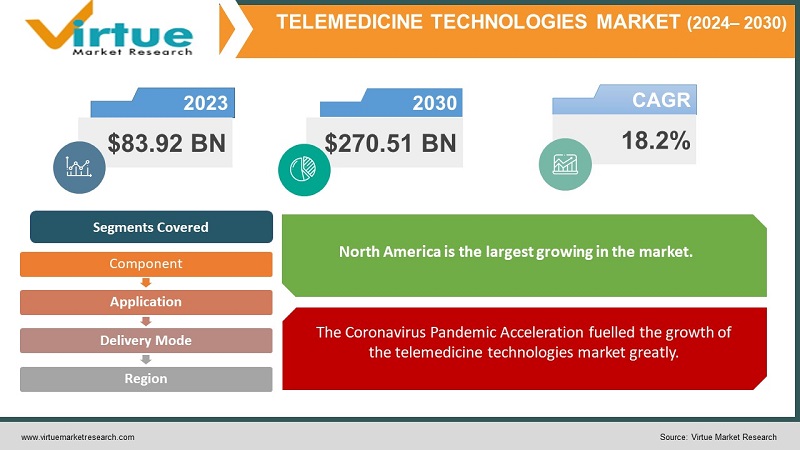

The Telemedicine Technologies Market was valued at USD 83.92 Billion and is projected to reach a market size of USD 270.51 Billion by the end of 2030, growing at a rapid CAGR of 18.2%.

The telemedicine market has experienced remarkable growth, driven by the increasing demand for accessible and cost-effective healthcare solutions. This rapidly evolving industry encompasses a wide range of services, including virtual consultations, remote monitoring, and telehealth platforms. Factors such as an aging population, the shift towards value-based care, and the impact of the COVID-19 pandemic have propelled telemedicine into the forefront of healthcare delivery. With emerging trends such as remote patient monitoring, opportunities for expanding access to underserved regions, and the integration of artificial intelligence, the telemedicine market is poised for continued expansion, promising to revolutionize healthcare delivery worldwide.

Key Market Insights:

Over the past year, telemedicine has been utilized by 37% of individuals aged 18 and above. The utilization of telemedicine increases with age among adults, starting at 29.4% for those aged 18 to 29 and reaching 43.3% for individuals aged 65 and older.

In 2021, telehealth was embraced by approximately 13% to 17% of American patients and virtual care usage has surged, being 38 times higher than pre-COVID-19 pandemic levels.

Telemedicine adoption is more pronounced among women, accounting for 42%, compared to men at 31.7%.

The prevalence of telemedicine usage increases with educational attainment, encompassing 28.7% for individuals over 18 without a high school diploma and 43.2% for those with at

Positive governmental initiatives have prompted the implementation of advanced healthcare IT infrastructure and facilities, thereby promoting the expansion of the telemedicine market.

Telemedicine Technologies Market Drivers:

A prominent driver is the shift towards Value-Based Care fostering the adoption of telemedicine technologies.

One significant driver of the telemedicine market is the healthcare industry's transition towards value-based care. Value-based care focuses on improving patient outcomes while reducing healthcare costs. Telemedicine plays a crucial role in this shift by offering continuous monitoring and timely interventions for patients. It enables healthcare providers to deliver more proactive and preventive care, reducing the need for costly hospital readmissions. This driver aligns with the broader healthcare industry's goals of improving healthcare quality and efficiency while containing costs.

The Coronavirus Pandemic Acceleration fuelled the growth of the telemedicine technologies market greatly.

As lockdowns and social distancing measures were implemented to combat the virus's spread, traditional in-person healthcare visits became challenging and risky. Telemedicine emerged as a vital solution, providing a safe way for patients to consult with healthcare professionals remotely. This sudden and widespread adoption of telehealth services during the pandemic not only met an urgent need but also introduced many individuals to the convenience and effectiveness of virtual healthcare visits. As a result, it has accelerated the growth of the telemedicine market and is expected to have a lasting impact, with many patients and healthcare providers continuing to embrace telehealth even after the pandemic subsides.

Telemedicine Technologies Market Restraints and Challenges:

Regulatory and Licensing Hurdles limit the growth of the telemedicine technologies market.

One of the primary challenges in the telemedicine market is navigating the complex regulatory landscape. Telemedicine services often cross state or international borders, and healthcare regulations can vary significantly from one jurisdiction to another. Ensuring compliance with licensing requirements, privacy laws, and reimbursement policies in different regions can be a daunting task for telemedicine providers. Additionally, regulations may evolve, further complicating the regulatory landscape. Navigating these legal and regulatory hurdles is essential for telemedicine companies to operate effectively and expand their services while remaining in compliance with the law.

Connectivity and Infrastructure Barriers pose a hindrance to the adoption of telemedicine technology, especially in rural areas.

While telemedicine holds great promise for expanding healthcare access, it relies heavily on technology and infrastructure. In many regions, especially rural or underserved areas, access to reliable internet connectivity and suitable devices can be limited. Patients and healthcare providers may face challenges in accessing telemedicine services due to these connectivity issues. Furthermore, not all patients are tech-savvy, and some may struggle with the technology required for virtual consultations. Bridging the digital divide and ensuring that telemedicine services are accessible to all demographics is an ongoing challenge for the industry. Additionally, maintaining the security and privacy of patient data in the digital realm is crucial and presents another layer of complexity.

Telemedicine Technologies Market Opportunities:

The telemedicine technologies market presents significant opportunities, with the potential to expand access to healthcare in underserved regions, enhance patient engagement, and improve healthcare outcomes. As telemedicine continues to evolve, opportunities for innovative solutions in remote patient monitoring, telehealth platform development, and AI-driven diagnostic tools are on the rise. Additionally, the growing acceptance of telemedicine as a mainstream healthcare delivery method, coupled with increased investment in telehealth infrastructure, offers a fertile ground for businesses to thrive in this rapidly expanding market.

TELEMEDICINE TECHNOLOGIES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

18.2% |

|

Segments Covered |

By Component, Application, Delivery Mode, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

MDlive, Inc. (Evernorth), American Well Corp.,Twilio, Inc.,Teladoc Health, Inc., Doctor On Demand, Inc., SOC Telemed, Inc., NXGN Management, LLC, Plantronics, Inc., Practo, VSee |

Telemedicine Technologies Market Segmentation: By Component

-

Hardware

-

Software

-

Service

The service segment is the largest having 52% of the market share. The service segment encompasses a wide range of offerings, including telehealth consultations, remote monitoring, technical support, and training services. Service providers play a pivotal role in implementing and maintaining telemedicine solutions, which often require ongoing support and customization to meet the specific needs of healthcare providers and institutions. As a result, the service segment is typically larger due to the recurring nature of service contracts and the demand for comprehensive telehealth solutions.

The software segment is experiencing the fastest growth with a CAGR of 19.6% due to continuous technological advancements in the telemedicine industry. The software is at the heart of telehealth platforms, enabling secure and user-friendly interactions between patients and healthcare providers. Innovations in telehealth software include improved user interfaces, enhanced data analytics, integration with electronic health records (EHRs), and the incorporation of artificial intelligence (AI) for more accurate diagnoses and treatment recommendations. These advancements drive increased demand for telemedicine software solutions, making it the fastest-growing segment in the market.

Telemedicine Technologies Market Segmentation: By Application

-

Teleradiology

-

Telepsychiatry

-

Telepathology

-

Teledermatology

-

Telecardiology

-

Others

Teleradiology, as the largest segment in telemedicine technologies having a 24% revenue share, has gained prominence due to its critical role in delivering timely and accurate diagnostic services. Radiology images such as X-rays, CT scans, and MRIs are essential in medical decision-making, and teleradiology allows these images to be remotely interpreted by specialized radiologists. This capability has proven invaluable for healthcare facilities, especially in remote or underserved areas, where access to on-site radiologists may be limited. Teleradiology not only expedites diagnosis and treatment planning but also helps reduce the cost and time associated with transferring physical films, making it a cornerstone of telemedicine.

Telepsychiatry is the fastest growing and its rapid growth can be attributed to several factors. The increasing awareness of mental health issues has led to greater demand for psychiatric services. Telepsychiatry addresses the shortage of mental health professionals by enabling patients to access mental health care from the comfort and privacy of their homes. The convenience and accessibility of telepsychiatry have been particularly beneficial during the COVID-19 pandemic, where social distancing measures limited in-person consultations.

Telemedicine Technologies Market Segmentation: By Delivery Mode

-

Real-time Telemedicine

-

Store-and-Forward Telemedicine

-

Remote Patient Monitoring

-

Mobile Health (mHealth)

-

Web-based Telemedicine

-

Point-of-Care Testing

-

Kiosks and Self-service Terminals

-

Others

Real-time Telemedicine which enables live, synchronous interactions between healthcare providers and patients, holds the largest market share of 23%, due to its versatility and wide range of applications. It allows for immediate diagnosis, consultation, and treatment, making it an essential mode for urgent care, emergency consultations, and specialist consultations. The real-time approach provides a sense of immediacy and assurance to both patients and healthcare professionals, making it a preferred choice for many healthcare scenarios. Additionally, the COVID-19 pandemic accelerated the adoption of real-time telemedicine, further solidifying its dominant position in the market.

Mobile Health (mHealth) on the other hand, is the fastest-growing segment in the telemedicine market. This growth is attributed to the proliferation of smartphones and wearable devices, which have become an integral part of people's daily lives. mHealth leverages these devices to deliver healthcare services, allowing patients to monitor their health, access medical information, and communicate with healthcare providers conveniently from their mobile devices. The increasing awareness of personal health and wellness, coupled with the desire for on-the-go healthcare solutions, has driven the rapid expansion of the mHealth segment.

Telemedicine Technologies Market Segmentation: Regional Analysis

-

North America

-

Asia- Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the largest segment in the telemedicine technologies market holding over 33.7% market share. The region boasts advanced healthcare infrastructure and a high level of technological adoption, making it receptive to telemedicine innovations. Additionally, a well-established regulatory framework and reimbursement policies in North America have provided a conducive environment for telemedicine to flourish. The regions large and aging population, coupled with the growing demand for accessible healthcare services, has driven significant investments in telemedicine. Moreover, the COVID-19 pandemic played a pivotal role in accelerating telemedicine adoption across North America, as it became a crucial tool for maintaining healthcare access while minimizing exposure to the virus.

Asia Pacific, on the other hand, is the fastest-growing segment with a CAGR of 15.6% in the telemedicine technologies market primarily due to its vast population and rapidly evolving healthcare landscape. Several factors contribute to this growth, including the increasing prevalence of chronic diseases, rising healthcare costs, and the need to improve healthcare access in remote and underserved areas. The region's mobile-first approach to technology, combined with the proliferation of smartphones, has made mHealth and telemedicine services particularly popular and accessible.

COVID-19 Impact Analysis on the Global Telemedicine Technologies Market:

The COVID-19 pandemic had a profound and transformative impact on the global telemedicine technologies market, catapulting it into accelerated growth. As the virus spread, social distancing measures and lockdowns created an urgent need for remote healthcare solutions, driving a surge in telehealth adoption. Patients and healthcare providers embraced virtual consultations, remote patient monitoring, and telemedicine platforms to ensure continued access to care while minimizing exposure to the virus. This unprecedented demand led to the expansion of telemedicine services across various healthcare specialties and demographics. Moreover, governments and healthcare systems worldwide recognized the value of telemedicine in the pandemic response and have since invested in infrastructure, regulatory changes, and reimbursement policies to support its long-term integration, solidifying telemedicine's position as a pivotal component of modern healthcare delivery.

Latest Trends/ Developments:

Many companies in the telemedicine market are incorporating AI and ML technologies into their platforms. This trend involves using AI algorithms to analyze patient data, offer diagnostic assistance, and predict health outcomes. AI-driven telehealth solutions can provide more accurate and timely recommendations, enhancing the quality of care and improving patient outcomes. Machine learning algorithms can also help personalize treatment plans and predict disease progression, making telemedicine more efficient and effective. Companies adopting AI and ML are staying at the forefront of innovation and attracting healthcare providers seeking advanced solutions.

Another prevalent trend is the expansion of telemedicine ecosystems. Companies are broadening their service offerings to create comprehensive platforms that cater to various aspects of healthcare delivery. This includes integrating services like remote patient monitoring, electronic health records systems, pharmacy services, and even wearable devices into their telemedicine platforms. By offering a holistic approach to healthcare, these companies aim to provide a seamless and comprehensive patient experience, making it easier for healthcare providers to manage patient care and for patients to access a wide range of healthcare services through a single platform. This trend aligns to make telemedicine a central hub for healthcare needs, enhancing its convenience and effectiveness.

Key Players:

-

MDlive, Inc. (Evernorth)

-

American Well Corp.

-

Twilio, Inc.

-

Teladoc Health, Inc.

-

Doctor On Demand, Inc.

-

SOC Telemed, Inc.

-

NXGN Management, LLC

-

Plantronics, Inc.

-

Practo

-

VSee

Chapter 1. Telemedicine Technologies Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Telemedicine Technologies Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Telemedicine Technologies Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Telemedicine Technologies Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Telemedicine Technologies Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Telemedicine Technologies Market – By Component

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Software

6.4 Service

6.5 Y-O-Y Growth trend Analysis By Component

6.6 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Telemedicine Technologies Market – By Application

7.1 Introduction/Key Findings

7.2 Teleradiology

7.3 Telepsychiatry

7.4 Telepathology

7.5 Teledermatology

7.6 Telecardiology

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Telemedicine Technologies Market – By Delivery Mode

8.1 Introduction/Key Findings

8.2 Real-time Telemedicine

8.3 Store-and-Forward Telemedicine

8.4 Remote Patient Monitoring

8.5 Mobile Health (mHealth)

8.6 Web-based Telemedicine

8.7 Point-of-Care Testing

8.8 Kiosks and Self-service Terminals

8.9 Others

8.10 Y-O-Y Growth trend Analysis By Delivery Mode

8.11 Absolute $ Opportunity Analysis By Delivery Mode, 2024-2030

Chapter 9. Telemedicine Technologies Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Component

9.1.3 By Application

9.1.4 By Delivery Mode

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Component

9.2.3 By Application

9.2.4 By Delivery Mode

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Component

9.3.3 By Application

9.3.4 By Delivery Mode

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Component

9.4.3 By Application

9.4.4 By Delivery Mode

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Component

9.5.3 By Application

9.5.4 By Delivery Mode

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Telemedicine Technologies Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 MDlive, Inc. (Evernorth)

10.2 American Well Corp.

10.3 Twilio, Inc.

10.4 Teladoc Health, Inc.

10.5 Doctor On Demand, Inc.

10.6 SOC Telemed, Inc.

10.7 NXGN Management, LLC

10.8 Plantronics, Inc.

10.9 Practo

10.10 VSee

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Telemedicine Technologies Market was valued at USD 83.92 Billion and is projected to reach a market size of USD 270.51 Billion by the end of 2030, growing at a rapid CAGR of 18.2%.

The shift towards Value-Based Care fostering the adoption of telemedicine technologies, and the COVID-19 Pandemic Acceleration are drivers of the telemedicine technologies market.

Based on component type, the Global Telemedicine Technologies Market is segmented into hardware, software, and services.

North America is the most dominant region for the Global Telemedicine Technologies Market.

MDlive, Inc. (Evernorth), American Well Corp., Twilio, Inc., Teladoc Health, Inc., and Doctor On Demand, Inc. are a few of the key players operating in the Global Telemedicine Technologies Market.