Technical Textile Market Size (2024 – 2030)

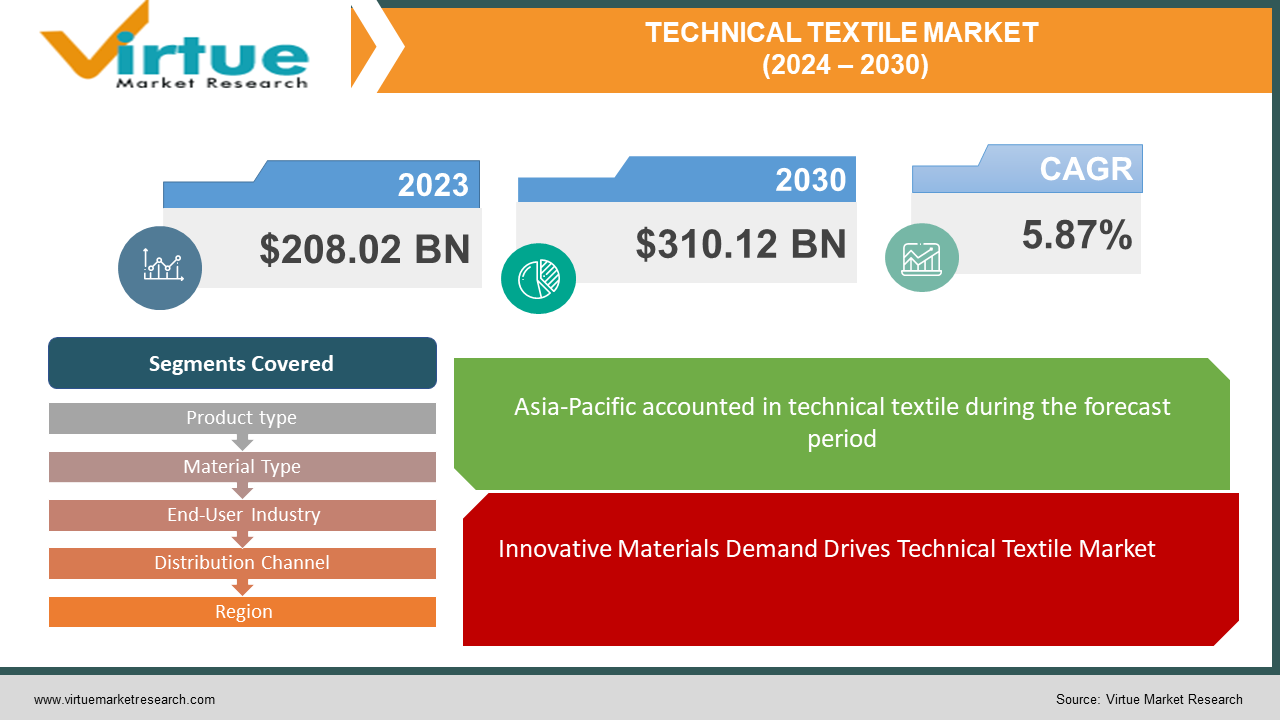

The Global Technical Textile Market was valued at USD 208.02 billion and is projected to reach a market size of USD 310.12 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.87%.

The Global Technical Textile Market stands as an energetic division inside the broader material industry, checked by textures built for particular functionalities past ordinary attire and family employments. These materials discover applications over a wide cluster of divisions, from cars and aviation to healthcare, development, and geotextiles. Not at all like conventional textures, these are specialized materials planned with specialized characteristics such as tall solidness, quality, warm resistance, and chemical inactivity, custom-fitted to meet the exacting requests of advanced businesses.

Key Market Insights:

Statistical information demonstrates that the U.S. technical textile market has seen a significant development rate of 7% every year between 2024 and 2030.One of the most recent trends within the global technical textile market is the expanding center on supportability and eco-friendliness.India rises as a key market for technical textiles, displaying noteworthy development opportunities for key players. India's Technical Textile Market is anticipated to witness a CAGR of around 8% amid the estimated period of 2024-2030, showing vigorous development potential.The direct association of India's prime minister with the Cabinet Committee on Economic Affairs (CCEA) has focused on extending the domestic market size to USD 40 to 50 billion by the year 2024.

Global Technical Textile Market Drivers:

Innovative Materials Demand Drives Technical Textile Market

The persistent interest in development powers the motor of worldwide specialized material advertising. Businesses extending from healthcare to aviation are clamoring for materials that can withstand extraordinary conditions, give predominant quality, and offer upgraded functionalities. This intense journey for cutting-edge materials pushes inquiries about and advancement to unused statures, as companies race to provide materials with properties once regarded as incomprehensible. The request for materials that can stand up to the fire, repulse water, conduct power, or offer progressed filtration capabilities proceeds to surge, moving the advertisement forward in a direction of advancement.

Expanding Applications across Industries drives the Technical Textile Market

The embroidered artwork of applications for specialized materials is quickly growing, weaving its way into an ever-increasing cluster of businesses. From development and cars to sports and relaxation, specialized materials are getting to be crucial over the board. The development segment looks for materials for geotextiles, fortifying materials, and structural layers, whereas the car industry requests high-performance materials for car contribute, airbags, and tire fortifications. Therapeutic progressions, as well, are interlaced with specialized materials, with applications extending from implantable textures to wound care items. As these assorted divisions recognize the unparalleled preferences specialized materials offer, their appropriation proceeds to surge, driving the showcase to scale modern statures.

Global Technical Textile Market Restraints and Challenges:

The Global Technical Textile Market experiences the imposing challenge of exploring a maze of administrative necessities and advancing benchmarks. Governments around the world are forcing rigid controls concerning the utilization of certain materials, forms, and end-products. Compliance with these standards requires noteworthy ventures in inquiring about, testing, and certification, putting a profound burden on producers. Moreover, the differences in administrative systems over locales require a fragile adjusting act to guarantee items meet changed details without compromising quality or bringing about extreme costs.

Global Technical Textile Market Opportunities:

One eminent opportunity inside the Global Technical Textile Market is the domain of savvy materials, where advancement meets usefulness. The integration of shrewd innovation into textures offers a bunch of applications, from healthcare to sports and aviation. Picture textures inserted with sensors that screen patients' crucial signs or athletic wear that tracks real-time execution measurements. The request for these brilliant materials is quickly developing, giving a ripe ground for companies to carve out their specialty in this burgeoning advertisement.

TECHNICAL TEXTILE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.87% |

|

Segments Covered |

By Product type, Material Type, End-User Industry, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DuPont (Now part of Koch Industries), Berry Global Group, Freudenberg Group, Kimberly-Clark Corporation, Asahi Kasei Corporation, Ahlstrom-Munksjö, Low & Bonar (Now Bonar Natpet), SGL Carbon, Toyobo Co., Ltd., Milliken & Company |

Technical Textile Market Segmentation: By Product Type

-

Nonwovens

-

Woven Textiles

-

Knitted Textiles

-

Composites

-

Coated Textiles

-

3D Fabrics

-

Others

The highest market share within the Global Technical Textile Market is commanded by nonwovens, capturing a critical parcel of roughly 35%. At the same time, the fastest-growing fragment inside this perplexing embroidered artwork of materials is the domain of composites, taking off at an amazing 8% every year. These cutting-edge materials, mixing strands with tars or ceramics, discover their specialty in aviation, car, and development applications. Eminent for their flexibility over filtration, restorative, and car divisions, nonwovens stand as a foundation of this energetic industry. This juxtaposition of built-up unwavering quality with cutting-edge progressions paints a striking picture of the worldwide specialized material advertise, a scene always advancing to meet the differing needs of present-day businesses. As nonwovens proceed with their unfaltering development direction, expected at around 5% every year, composites surge forward, underscoring the market's drive towards development and high-performance arrangements.

Technical Textile Market Segmentation: By Material Type

-

Polymer

-

Mineral

-

Natural

-

Metal

Polymer-based technical textiles developed as the evident pioneer within the Global Technical Textile Market, bragging the most elevated advertise share owing to their broad utilization in car, development, and healthcare segments. Inside this fragment, polyethylene-based materials stand out as the quickest developing, moved by their lightweight properties and eco-friendly nature, perfect for progressed composites and geotextiles. Whereas polymer materials rule incomparable, mineral-based materials with their fire resistance and warm separator properties, natural-based materials emphasizing supportability, and metal-based materials for specialized applications, collectively make a different and energetic scene in this ever-evolving industry.

Technical Textile Market Segmentation: By End-User Industry

-

Agriculture

-

Construction

-

Healthcare & Medical

-

Automotive

-

Aerospace

-

Sports & Leisure

-

Packaging

-

Others

The highest market share within the Global Technical Textile Market is held by the Construction division, which depends broadly on geotextiles for infrastructure advancement. At the same time, the fastest-growing fragment, Agrotextiles, is anticipated to witness critical development with a promising CAGR. This sector's vigorous nearness underscores the significant part of technical textiles in advanced development hones, advertising arrangements in geotextiles, platform nets, and concrete fortification. This surge is fueled by the expanding request for arrangements to improve edit assurance, irrigation, and soil administration within the rural division. The market's direction is characterized by a range of applications, guaranteeing an energetic and promising future for this flexible division. These patterns reflect the different and extending scene of specialized materials, where advancement meets the squeezing needs of businesses, from upgrading security in-car applications to revolutionizing healthcare with progressed therapeutic materials.

Technical Textile Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributors

-

E-commerce

-

Others

Direct Sales stands as the bedrock of the Global Technical Textile Market, commanding the most noteworthy showcase share with its custom-fitted client intelligent and brand-centric approach. In the meantime, the market's fastest-growing fragment, E-commerce, is reshaping the industry scene with its unparalleled comfort and broad reach. This dissemination channel, characterized by producers specifically locking in with end-users, guarantees consistent communication, productive problem-solving, and unflinching brand devotion. The exponential development of online stages advertising specialized materials is driven by components such as upgraded web availability, user-friendly interfacing, and doorstep conveyance administrations. As shoppers float towards the ease of browsing, comparing, and acquiring specialized materials online, E-commerce proceeds to surge ahead, changing the way businesses interface with their target markets. These two columns, Coordinate Deals, and E-commerce emphasize the energetic advancement and flexibility of worldwide specialized material advertising, catering to different client inclinations and industry requests.

Technical Textile Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region develops as the highest market share holder, around 40% in 2023, and the fastest-growing fragment inside the Global Technical Textile Market, exhibiting its energetic scene of fast industrialization and taking off requests. Commanding a significant 40% advertise share. Its energetic development is moved by a juncture of variables such as strong industrialization, a burgeoning populace, and an expanding center on mechanical progressions inside the material division. Taking after closely behind is North America, holding a critical 25% advertising share, driven by a developed however imaginative advertising scene. Europe keeps up a strong 20% share, tied down by its convention of high-quality specialized material generation and solid mechanical foundation. South America and the Center East Africa locale each contribute 10% and 5% to the advertising share, individually, appearing promising signs of development in the midst of advancing financial scenes. This differing territorial dispersion reflects the worldwide offer and versatility of specialized materials over different businesses and applications. This assorted territorial examination paints a striking picture of the worldwide specialized material advertising, encouraging industry partners to capitalize on these territorial qualities and produce vital organizations together for supported development and advertising administration.

COVID-19 Impact Analysis on the Global Technical Textile Market:

The COVID-19 widespread quickly disturbed the Global Technical Textile Market, uncovering vulnerabilities in supply chains and causing disparate request designs over segments. Whereas the healthcare industry has seen a surge in requests for specialized materials like PPE, the car and aviation divisions experienced a striking decrease due to stopped generation and stifled shopper movement. In any case, amid these challenges, the industry showcased flexibility by quickly adjusting, with producers turning generation lines to meet the pressing needs of the healthcare division. This period of misfortune moreover impelled advanced change, as e-commerce stages rose as imperative channels for obtainment. Looking ahead, the industry faces vulnerabilities, however, it is secured by a recharged center on maintainability, development, and strength, directing its way toward a brighter, more associated future.

Latest Trends/ Developments:

In reaction to heightening calls for maintainability, the global technical textile market is seeing a significant move towards eco-friendly arrangements. Keen materials, prepared with sensors and microelectronics, are driving the charge in healthcare, sports, and car divisions. This center on maintainability not as it were addresses natural concerns but also drives advancement, introducing an unused period of mindful material generation.

At the same time, the integration of innovation into textiles is revolutionizing businesses around the world. Producers are grasping biodegradable strands and reused materials, adjusting with both customer inclinations and administrative necessities. From checking understanding vitals to improving competitor execution, these clever textures are reshaping usefulness, consolation, and security benchmarks over differing applications.

Key Players:

-

DuPont (Now part of Koch Industries)

-

Berry Global Group

-

Freudenberg Group

-

Kimberly-Clark Corporation

-

Asahi Kasei Corporation

-

Ahlstrom-Munksjö

-

Low & Bonar (Now Bonar Natpet)

-

SGL Carbon

-

Toyobo Co., Ltd.

-

Milliken & Company

-

In 2022, SKAPS Industries, a leading manufacturer of geosynthetic products, announced the acquisition of Henderson Sewing Machine Co., a company specializing in the production of industrial sewing machines for textiles.

Chapter 1. Technical Textile Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Technical Textile Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Technical Textile Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Technical Textile Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Technical Textile Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Technical Textile Market – By Product Type

6.1 Introduction/Key Findings

6.2 Nonwovens

6.3 Woven Textiles

6.4 Knitted Textiles

6.5 Composites

6.6 Coated Textiles

6.7 3D Fabrics

6.8 Others

6.9 Y-O-Y Growth trend Analysis By Product Type

6.10 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Technical Textile Market – By Material Type

7.1 Introduction/Key Findings

7.2 Polymer

7.3 Mineral

7.4 Natural

7.5 Metal

7.6 Y-O-Y Growth trend Analysis By Material Type

7.7 Absolute $ Opportunity Analysis By Material Type, 2024-2030

Chapter 8. Technical Textile Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Direct Sales

8.3 Distributors

8.4 E-commerce

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Distribution Channel

8.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Technical Textile Market – By End-User

9.1 Introduction/Key Findings

9.2 Agriculture

9.3 Construction

9.4 Healthcare & Medical

9.5 Automotive

9.6 Aerospace

9.7 Sports & Leisure

9.8 Packaging

9.9 Others

9.10 Y-O-Y Growth trend Analysis By End-User

9.11 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 10. Technical Textile Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Product Type

10.1.3 By Material Type

10.1.4 By Distribution Channel

10.1.5 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Product Type

10.2.3 By Material Type

10.2.4 By Distribution Channel

10.2.5 By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Product Type

10.3.3 By Material Type

10.3.4 By Distribution Channel

10.3.5 By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Product Type

10.4.3 By Material Type

10.4.4 By Distribution Channel

10.4.5 By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Product Type

10.5.3 By Material Type

10.5.4 By Distribution Channel

10.5.5 By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Technical Textile Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 DuPont (Now part of Koch Industries)

11.2 Berry Global Group

11.3 Freudenberg Group

11.4 Kimberly-Clark Corporation

11.5 Asahi Kasei Corporation

11.6 Ahlstrom-Munksjö

11.7 Low & Bonar (Now Bonar Natpet)

11.8 SGL Carbon

11.9 Toyobo Co., Ltd.

11.10 Milliken & Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Technical Textile Market was valued at USD 208.02 billion and is projected to reach a market size of USD 310.12 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.87%.

Innovative Materials Demand and Expanding Applications across Industries.

Based on Product, the Global Technical Textile Market is segmented into Nonwovens, Woven Textiles, Knitted Textiles, Composites, Coated Textiles,3D Fabrics, and Others.

Asia-Pacific is the most dominant region for the Global Technical Textile Market.

DuPont (Now part of Koch Industries), Berry Global Group, Freudenberg Group, Kimberly-Clark Corporation, Asahi Kasei Corporation, Ahlstrom-Munksjö, Low & Bonar (Now Bonar Natpet), SGL Carbon, Toyobo Co., Ltd., Milliken & Company, Huesker Group, TenCate Geosynthetics (Now part of Royal TenCate), Saint-Gobain Performance Plastics, Lydall Performance Materials, Glen Raven, Inc. (Owner of Sunbrella).