Tax Technology Solutions Market Size (2024 – 2030)

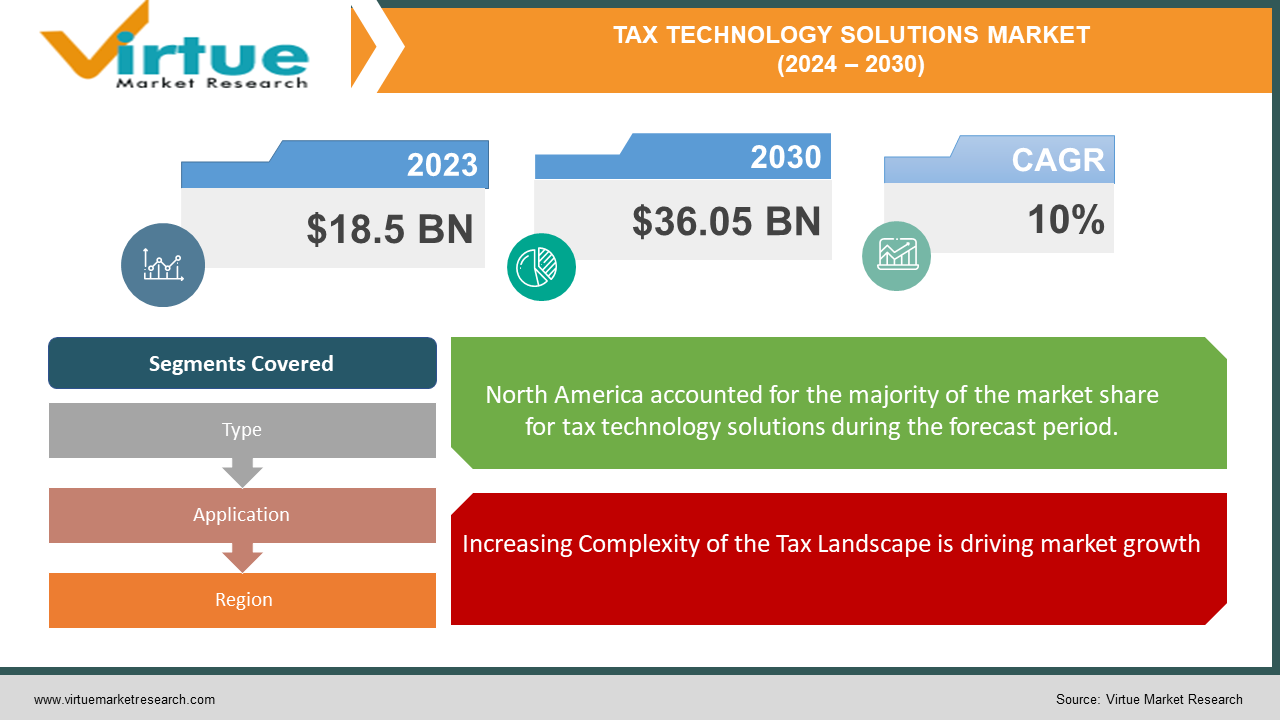

The Global Tax Technology Solutions Market was valued at USD 18.5 billion in 2023 and will grow at a CAGR of 10% from 2024 to 2030. The market is expected to reach USD 36.05 billion by 2030.

The Tax Technology Solutions Market is booming, offering software and tools that streamline tax preparation, filing, and compliance for businesses and individuals. This market is fueled by the desire to save time, reduce errors, and optimize tax strategies. With complex tax codes and growing regulations, these solutions are becoming increasingly important for navigating the ever-changing tax landscape.

Key Market Insights:

Ever-evolving tax regulations and globalization necessitate sophisticated software for compliance and optimization.Cloud-based solutions offer accessibility, scalability, and real-time data for businesses of all sizes.Automating tax tasks like data entry and calculations reduces errors, saves time, and allows accountants to focus on strategic areas.Advanced analytics empower businesses to identify tax-saving opportunities and make data-driven decisions.

Global Tax Technology Solutions Market Drivers:

Increasing Complexity of the Tax Landscape is driving market growth:

The ever-shifting sands of global tax regulations pose a constant challenge for businesses operating across borders. New laws and policies erupt like financial geysers, demanding meticulous compliance across diverse jurisdictions. Tax technology solutions act as a sturdy raft in this churning sea. By automating tedious tasks like data entry and calculations, these solutions free up valuable time and resources for tax professionals. Furthermore, real-time updates ensure businesses stay abreast of the latest regulations, reducing the risk of costly penalties and non-compliance. This allows tax teams to shift their focus from administrative burdens to strategic planning and proactive risk management. Ultimately, tax technology solutions bridge the gap between the ever-evolving regulatory landscape and a business's need for efficient and accurate tax management.

Digitalization and Data Explosion are driving market growth:

In today's data-driven world, businesses are drowning in a sea of financial information. Manually managing this deluge for tax purposes is akin to searching for a single grain of sand on a vast beach. Time is wasted on tedious data entry, while the risk of errors lurks around every corner. Tax technology solutions emerge as a lighthouse, guiding businesses through this financial storm. By integrating seamlessly with various data sources, these solutions eliminate the need for manual entry, ensuring accuracy and saving valuable time. Automated calculations handle complex tax formulas with precision, further reducing the potential for human error. Cloud storage provides a secure and centralized repository for all tax-related data, allowing for easy access and retrieval from anywhere. This newfound efficiency allows tax professionals to transform from data wranglers into strategic partners, utilizing advanced analytics features within the tax technology solutions to identify tax-saving opportunities and make data-driven decisions that optimize the company's financial health.

Growing Demand for Automation is driving market growth:

Imagine a world where accountants and tax professionals aren't bogged down by repetitive tasks like data entry, manual calculations, and endlessly filling out forms. Tax technology solutions with automation capabilities make this dream a reality. By automating these tedious processes, tax professionals are freed from the shackles of administrative drudgery. This isn't just about saving time; it's about unlocking a new level of strategic thinking and proactive management. With repetitive tasks handled automatically and accurately, tax professionals can finally dedicate their expertise to what truly matters: tax planning and risk management. They can delve into complex tax codes, identify potential tax-saving opportunities, and develop customized strategies to optimize the company's financial health. Furthermore, automation streamlines the entire tax process, ensuring deadlines are met and errors are minimized. This newfound efficiency translates to smoother audits, reduced stress levels for the tax team, and ultimately, a significant boost to the company's bottom line. Tax technology solutions with automation capabilities are the key to unlocking a future where tax professionals can truly shine as strategic advisors.

Global Tax Technology Solutions Market challenges and restraints:

Data Security Concerns is a significant hurdle for tax technology solutions:

The cloud security conundrum is a significant hurdle for tax technology solutions. Businesses are rightfully apprehensive about entrusting their sensitive financial data, like Social Security numbers and bank account information, to cloud-based systems. This apprehension acts as a major barrier to wider adoption. To bridge this gap, tax technology providers must prioritize robust data security measures. Implementing stringent access controls, and encryption protocols, and adhering to rigorous data privacy regulations like GDPR and CCPA are crucial. Building trust requires transparency; businesses need to understand how their data is stored, accessed, and secured. By prioritizing security and fostering a culture of data privacy, tax technology solutions can unlock their full potential and empower businesses to navigate the complexities of tax with confidence.

Lack of Standardization is throwing a curveball at the tax technology solutions market:

The global tax landscape resembles a patchwork quilt, with regulations and compliance requirements differing dramatically across borders. This lack of standardization presents a significant challenge for tax technology solution providers. Imagine a single software program needing to navigate the intricacies of the Indian GST regime, Brazilian withholding taxes, and ever-changing regulations in the European Union. To conquer this challenge, tax technology providers need to develop solutions with inherent flexibility. One approach involves modularity, where core functionalities can be combined with country-specific compliance modules. This allows businesses to tailor the solution to their specific needs, ensuring adherence to local regulations. Additionally, features like built-in regulatory updates and automatic data mapping to various tax authority formats can help businesses stay ahead of the curve. By embracing flexibility and customization, tax technology providers can ensure their solutions are adaptable enough to thrive in the complex world of global tax compliance.

Integration Issues are a growing nightmare for the tax technology solutions market:

The smooth operation of tax technology solutions hinges on seamless integration with a company's existing enterprise resource planning (ERP) and accounting systems. However, this can be a tangled web. Data formats may vary between systems, leading to compatibility issues and frustrating errors. Imagine a scenario where tax software expects data in a specific format, but the accounting system outputs it differently. This data mismatch can disrupt the entire workflow and cause delays. To overcome this integration hurdle, tax technology providers need to prioritize open architecture and robust application programming interfaces (APIs). Open architecture allows for smooth communication between different software systems, while strong APIs act as the bridge, facilitating data exchange in a standardized format. Additionally, pre-built connectors for popular ERP and accounting systems can further streamline the integration process. By prioritizing seamless integration, tax technology solutions can become a unified front within a company's financial ecosystem, eliminating data silos and ensuring a smooth flow of information for accurate tax calculations and reporting.

Market Opportunities:

The Tax Technology Solutions Market presents a plethora of opportunities for innovative companies looking to capitalize on the growing need for efficient and accurate tax management. Firstly, the ever-evolving global tax landscape, with its constantly changing regulations, creates a prime opportunity for solutions that offer real-time updates and automated compliance checks. Secondly, the massive amounts of financial data businesses generate can be harnessed by tax technology solutions with advanced data integration, automated calculations, and cloud storage capabilities. This frees up valuable time for tax professionals and empowers them to focus on strategic tax planning and risk management. Furthermore, the increasing adoption of cloud computing opens doors for cost-effective solutions that are scalable and accessible to businesses of all sizes. Governments around the world pushing for digitalization and e-filing further fuel market growth as businesses seek solutions that seamlessly integrate with e-filing systems. Additionally, a growing number of small and medium-sized enterprises (SMEs) represent an untapped market for user-friendly and affordable tax technology solutions. Finally, advancements in artificial intelligence (AI) and blockchain hold immense potential for the future of tax technology. AI-powered solutions can automate complex tasks like anomaly detection and risk assessment, while blockchain technology can enhance data security and streamline tax reporting processes. By addressing challenges like data security concerns and a lack of standardization, tax technology providers can unlock the full potential of this rapidly growing market and empower businesses to navigate the complexities of tax with greater efficiency and confidence.

TAX TECHNOLOGY SOLUTIONS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Avalara, Vertex, Inc., Thomson Reuters, Wolters Kluwer N.V., SAP SE, Sovos Compliance, LLC, Intuit Inc., H&R Block, Xero Limited, Drake Software |

Tax Technology Solutions Market Segmentation: By Type

-

Tax Preparation Software

-

Enterprise Tax Management Software

Tax Preparation Software reigns supreme in the Tax Technology Solutions Market. This software caters to individuals and small businesses, offering user-friendly interfaces and guidance to navigate tax filing. Its affordability and ease of use make it a widespread solution for a vast majority of taxpayers. Enterprise Tax Management Software, while crucial for large corporations with complex tax structures, serves a much smaller niche market and requires significant investment in both software and expertise.

Tax Technology Solutions Market Segmentation: By Application

-

Tax Compliance and Reporting

-

Tax Planning and Optimization

Tax Compliance and Reporting holds the bigger market share in Tax Technology Solutions compared to Tax Planning and Optimization. While both are crucial aspects of tax management, compliance is mandatory. Tax Compliance and Reporting software ensures accurate tax calculations, filing, and adherence to regulations, avoiding penalties and interest. This makes it essential for all businesses and individuals. Tax Planning and Optimization software, although valuable for minimizing tax burdens, caters more towards a strategic approach and serves a specific market segment.

Tax Technology Solutions Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia

-

South America

-

Middle East and Africa

North America currently leads the Tax Technology Solutions Market due to its established tax infrastructure, complex regulations, and tech adoption. However, Asia Pacific is the fastest-growing region driven by rising incomes, increasing regulations, and a tech-savvy population. Europe remains a major player, while South America, and Middle East & Africa have room for significant growth as their economies and technology mature.

COVID-19 Impact Analysis on the Global Tax Technology Solutions Market

The COVID-19 pandemic's impact on the Tax Technology Solutions Market was a mixed bag. Initial uncertainty and economic downturn led to a temporary dip in demand, particularly from SMEs facing cash flow constraints. However, the pandemic also accelerated digital transformation across industries. This, coupled with government support for e-filing and tax relief measures, spurred the adoption of tax technology solutions. Businesses increasingly sought solutions for remote work, automated filing, and managing complex tax regulations during a period of rapid change. Tax professionals, overwhelmed by the complexities of pandemic-related tax breaks and stimulus programs, turned to technology for efficient processing and compliance. The growing need for data-driven insights to optimize finances further fueled market growth. Overall, while the pandemic caused a temporary setback, it ultimately highlighted the value proposition of tax technology solutions, positioning the market for a strong rebound and continued growth in the post-pandemic era.

Latest trends/Developments

The Tax Technology Solutions Market is buzzing with innovation as it races to keep pace with the ever-evolving tax landscape. Artificial intelligence (AI) is emerging as a game-changer, automating complex tasks like anomaly detection in tax data and streamlining risk assessments. Blockchain technology is gaining traction for its potential to enhance data security and transparency in tax reporting processes. Cloud-based solutions are becoming the norm, offering businesses scalability, accessibility, and real-time data collaboration. Integration with existing ERP and accounting systems is a top priority, with advancements in open architecture and APIs fostering seamless data exchange. The focus is shifting from simple compliance to strategic tax planning, with solutions leveraging advanced analytics to identify tax-saving opportunities and generate insightful reports. As governments worldwide push for digitalization and e-filing, tax technology providers are developing solutions that seamlessly integrate with e-filing systems, ensuring efficient and compliant tax management. This constant stream of advancements promises to empower businesses of all sizes to navigate the complexities of tax with greater efficiency and confidence.

Key Players:

-

Avalara

-

Vertex, Inc.

-

Thomson Reuters

-

Wolters Kluwer N.V.

-

SAP SE

-

Sovos Compliance, LLC

-

Intuit Inc.

-

H&R Block

-

Xero Limited

-

Drake Software

Chapter 1. Tax Technology Solutions Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Tax Technology Solutions Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Tax Technology Solutions Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Tax Technology Solutions Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Tax Technology Solutions Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Tax Technology Solutions Market – By Application

6.1 Introduction/Key Findings

6.2 Tax Compliance and Reporting

6.3 Tax Planning and Optimization

6.4 Y-O-Y Growth trend Analysis By Application

6.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Tax Technology Solutions Market – By Type

7.1 Introduction/Key Findings

7.2 Tax Preparation Software

7.3 Enterprise Tax Management Software

7.4 Y-O-Y Growth trend Analysis By Type

7.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Tax Technology Solutions Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Tax Technology Solutions Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Avalara

9.2 Vertex, Inc.

9.3 Thomson Reuters

9.4 Wolters Kluwer N.V.

9.5 SAP SE

9.6 Sovos Compliance, LLC

9.7 Intuit Inc.

9.8 H&R Block

9.9 Xero Limited

9.10 Drake Software

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Tax Technology Solutions Market was valued at USD 18.5 billion in 2023 and will grow at a CAGR of 10% from 2024 to 2030. The market is expected to reach USD 36.05 billion by 2030.

The increasing Complexity of the Tax Landscape, Digitalization, Data Explosion, and Growing Demand for Automation are the reasons that are driving the market.

Based on Application it is divided into two segments – Tax Compliance and Reporting, Tax Planning and Optimization.

North America is the most dominant region for the luxury vehicle Market.

Avalara, Vertex, Inc., Thomson Reuters, Wolters Kluwer N.V., SAP SE.