Tannin Market Size (2024-2030)

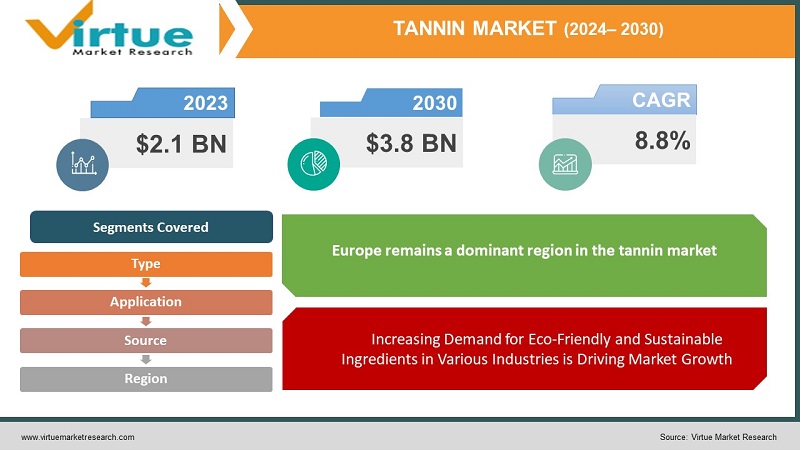

In 2023, the global tannin market was valued at USD 2.1 billion and is expected to reach USD 3.8 billion by 2030, growing at a CAGR of 8.8% during the forecast period.

The market’s expansion is driven by the rising adoption of plant-based tannins in leather processing, the increasing use of tannins in the food and beverage industry (especially in wine production), and growing applications in healthcare and pharmaceuticals due to their antioxidant and anti-inflammatory properties. Furthermore, advancements in extraction technologies and the development of innovative tannin-based products for industries such as cosmetics and adhesives are expected to drive further growth in the coming years.

Key Market Insights:

Condensed tannins, which are mainly derived from tree bark and plants, dominate the market, accounting for more than 55% of the total market share. They are widely used in the leather tanning and wine production industries.

The plant-based tannin segment is projected to witness the fastest growth due to increasing consumer preference for natural, sustainable, and eco-friendly products, especially in Europe and North America.

Leather tanning remains the largest application segment, representing more than 40% of the global market demand, as tannins are extensively used in processing leather to improve its durability and quality.

Wine production is a significant application, particularly in regions like Europe and South America, where tannins are used to enhance the taste, color, and stability of wines. The growing global demand for premium wines is contributing to the increased usage of tannins in this sector.

Asia-Pacific is expected to be the fastest-growing region, driven by the rapid expansion of industries such as leather, pharmaceuticals, and wine production in countries like China and India.

Global Tannin Market Drivers:

- Increasing Demand for Eco-Friendly and Sustainable Ingredients in Various Industries is Driving Market Growth The rising consumer preference for natural and sustainable products is one of the primary drivers of the global tannin market. With growing concerns about environmental impact, industries such as leather processing, pharmaceuticals, and cosmetics are increasingly adopting plant-based tannins as an alternative to synthetic chemicals. Tannins are biodegradable, renewable, and derived from natural sources, making them a preferred choice for manufacturers aiming to reduce their carbon footprint. The leather industry, in particular, has embraced tannins for eco-friendly tanning processes, as they eliminate the need for harmful chemicals such as chromium. Additionally, tannins are gaining popularity in the food and beverage industry, particularly in wine production, where they are used to enhance flavor profiles and stabilize wine during the fermentation process. The demand for organic and sustainably sourced wines is further boosting the market for tannins in this sector.

- Growing Applications of Tannins in Pharmaceuticals and Healthcare are Driving Market Growth Tannins possess numerous bioactive properties, including antioxidant, anti-inflammatory, and antimicrobial characteristics, which are driving their adoption in the pharmaceutical and healthcare industries. The growing awareness of the health benefits of tannins, such as their ability to neutralize free radicals, reduce inflammation, and prevent chronic diseases, has increased their application in the development of herbal medicines, dietary supplements, and functional foods. Tannins are also used in traditional medicine for treating conditions such as diarrhea, sore throat, and wound healing due to their astringent properties. The global shift towards preventive healthcare and natural remedies is expected to fuel the demand for tannin-based pharmaceutical products, particularly in regions such as North America and Europe, where consumers are increasingly adopting natural health solutions.

- Rising Demand for Premium Wines Boosting the Tannin Market in Wine Production Tannins play a crucial role in wine production, particularly in red wines, where they contribute to the texture, flavor, and aging potential of the wine. With the growing global demand for premium wines, especially in regions such as Europe, North America, and South America, the use of tannins in the wine industry is on the rise. Tannins are naturally present in the skins, seeds, and stems of grapes, and their concentration in wine affects the mouthfeel and complexity of the final product. The increasing consumer preference for high-quality, aged wines has led to a higher demand for tannins, which enhance the wine's ability to age well and develop richer flavors over time. Furthermore, advancements in winemaking techniques, such as the controlled addition of tannins during fermentation, are improving the consistency and quality of wines, further boosting market growth.

Global Tannin Market Challenges and Restraints:

- High Cost of Tannin Extraction and Limited Availability of Raw Materials are Restricting Market Growth One of the primary challenges facing the global tannin market is the high cost associated with the extraction process and the limited availability of raw materials. Tannins are predominantly derived from plant sources such as tree bark, wood, and leaves, and their extraction involves complex processes that require specialized equipment and technologies. Additionally, the availability of high-quality raw materials for tannin production is often dependent on environmental factors, such as forest conservation and sustainable harvesting practices. The high cost of sourcing and extracting tannins makes it difficult for small and medium-sized enterprises (SMEs) to compete in the market, particularly in regions where the availability of raw materials is limited. Furthermore, the fluctuating prices of plant-based raw materials, such as wood and bark, due to changes in environmental policies and deforestation concerns, pose a significant challenge to the market's growth.

- Stringent Regulations in the Leather Tanning Industry are Restricting Market Growth The leather tanning industry, one of the largest consumers of tannins, is subject to stringent environmental regulations aimed at reducing pollution and the use of harmful chemicals. While tannins are considered an eco-friendly alternative to synthetic chemicals in leather processing, the tanning industry still faces regulatory challenges related to waste disposal, water consumption, and emissions. In many regions, particularly in Europe and North America, leather manufacturers are required to adhere to strict environmental standards, which can increase the cost of production and limit the adoption of tannin-based tanning methods. Additionally, the increasing scrutiny of animal-derived products and the growing demand for vegan alternatives in the fashion industry may pose challenges to the traditional leather tanning sector, further impacting the tannin market.

Market Opportunities:

The Global Tannin Market presents several opportunities for growth, particularly in the cosmetics industry, the development of bio-based adhesives, and the increasing focus on sustainable packaging. The rising demand for natural and organic ingredients in skincare and cosmetic products offers significant growth potential for tannins. Tannins are known for their antioxidant and anti-aging properties, making them an ideal ingredient for anti-wrinkle creams, moisturizers, and sunscreens. The trend towards clean beauty and the avoidance of synthetic chemicals in cosmetics is expected to create new opportunities for tannin-based formulations in the global beauty industry. The development of bio-based adhesives for use in industries such as construction, automotive, and packaging presents a significant opportunity for the tannin market. Tannins can be used as natural adhesives due to their ability to form strong bonds with other materials. As industries seek to reduce their reliance on petrochemical-based adhesives and adopt more sustainable practices, tannin-based adhesives are gaining traction as a viable alternative. The increasing focus on sustainable packaging solutions in response to growing environmental concerns offers new opportunities for tannin-based products. Tannins can be used to develop biodegradable and recyclable packaging materials that reduce the environmental impact of plastic waste. The shift towards eco-friendly packaging in industries such as food and beverages, cosmetics, and consumer goods is expected to drive demand for tannin-based packaging solutions.

TANNIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.8% |

|

Segments Covered |

By Type, Application, source, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Tannin Corporation, Laffort SA, Sappi Limited, Tanac SA, Mimosa Extract Company (Pty) Ltd, Forestal Mimosa Ltd, Silvateam S.p.A, Naturex SA, W. ULRICH GmbH, Polson Ltd |

Tannin Market Segmentation:

Tannin Market Segmentation By Type:

- Hydrolyzable Tannins

- Condensed Tannins

- Phlorotannin

Condensed tannins hold the largest market share due to their widespread use in leather tanning, wine production, and adhesive manufacturing. Hydrolyzable tannins are gaining popularity in pharmaceuticals and cosmetics due to their bioactive properties, while phlorotannins, derived from brown algae, are used in niche applications such as health supplements and personal care products.

Tannin Market Segmentation By Source:

- Plant-Based Tannins

- Brown Algae-Based Tannins

Plant-based tannins dominate the market, with their extraction from sources like tree bark, leaves, and fruits being the most common. Brown algae-based tannins are emerging as a promising source, particularly in health supplements and pharmaceuticals, due to their antioxidant and anti-inflammatory properties.

Tannin Market Segmentation By Application:

- Leather Tanning

- Wine Production

- Pharmaceuticals

- Food & Beverages

- Cosmetics & Personal Care

- Others (Adhesives, Wood Preservation)

The leather tanning segment remains the largest application, driven by the continued demand for leather products in the fashion, automotive, and furniture industries. Wine production is another significant application, especially in Europe and South America, while pharmaceuticals and cosmetics are expected to be the fastest-growing segments.

Tannin Market Segmentation Regional :

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Europe remains a dominant region in the tannin market, due to the high demand for tannins in wine production and leather processing. Countries like France, Italy, and Spain are leading in wine production, driving the demand for tannins. Rapid industrialization and the growing leather and pharmaceutical industries in countries like China, India, and Japan are propelling the growth of the tannin market in the region. The wine industry, particularly in Argentina and Chile, is fueling the demand for tannins in this region. Moderate growth is expected as industries like leather processing and pharmaceuticals adopt tannin-based products.

COVID-19 Impact Analysis on the Global Tannin Market:

The COVID-19 pandemic had a mixed impact on the global tannin market. The slowdown in industrial activities, particularly in the leather and wine industries, led to a temporary decline in demand for tannins. However, the market quickly rebounded as economies reopened and industries resumed production. In the pharmaceutical and healthcare sectors, the pandemic accelerated the adoption of tannin-based products due to their health benefits, such as immune-boosting and antioxidant properties. Post-pandemic, the market is expected to grow steadily, driven by increased demand for natural and sustainable products across various industries.

Latest Trends/Developments:

The growing focus on sustainability has led to the development of tannin-based adhesives for use in industries such as construction and automotive. New research is exploring the use of tannins in treating chronic diseases, including cancer and cardiovascular conditions, due to their antioxidant and anti-inflammatory properties. As the fashion industry moves towards cruelty-free products, vegan leather alternatives, which often use tannins in their production, are gaining popularity.

Key Players:

- Tannin Corporation

- Laffort SA

- Sappi Limited

- Tanac SA

- Mimosa Extract Company (Pty) Ltd

- Forestal Mimosa Ltd

- Silvateam S.p.A

- Naturex SA

- W. ULRICH GmbH

- Polson Ltd

Chapter 1. GLOBAL TANNIN MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL TANNIN MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL TANNIN MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL TANNIN MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL TANNIN MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL TANNIN MARKET– BY Type

6.1. Introduction/Key Findings

6.2. Hydrolyzable Tannins

6.3. Condensed Tannins

6.4. Phlorotannin

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. GLOBAL TANNIN MARKET– BY SOURCE

7.1. Introduction/Key Findings

7.2. Plant-Based Tannins

7.3. Brown Algae-Based Tannins

7.4. Y-O-Y Growth trend Analysis By SOURCE

7.5. Absolute $ Opportunity Analysis By SOURCE , 2024-2030

Chapter 8. GLOBAL TANNIN MARKET– BY Application

8.1. Introduction/Key Findings

8.2. Leather Tanning

8.3. Wine Production

8.4. Pharmaceuticals

8.5. Food & Beverages

8.6. Cosmetics & Personal Care

8.7. Others (Adhesives, Wood Preservation)

8.8. Y-O-Y Growth trend Analysis Application

8.9. Absolute $ Opportunity Analysis Application , 2024-2030

Chapter 9. GLOBAL TANNIN MARKET, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By SOURCE

9.1.3. By Application

9.1.4. By Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By SOURCE

9.2.3. By Application

9.2.4. By Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By SOURCE

9.3.3. By Application

9.3.4. By Type

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By SOURCE

9.4.3. By Application

9.4.4. By Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By SOURCE

9.5.3. By Application

9.5.4. By Type

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL TANNIN MARKET– COMPANY PROFILES – (OVERVIEW, PRODUCT PORTFOLIO, FINANCIALS, STRATEGIES & DEVELOPMENTS)

10.1 Tannin Corporation

10.2. Laffort SA

10.3. Sappi Limited

10.4. Tanac SA

10.5. Mimosa Extract Company (Pty) Ltd

10.6. Forestal Mimosa Ltd

10.7. Silvateam S.p.A

10.8. Naturex SA

10.9. W. ULRICH GmbH

10.10. Polson Ltd

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Tannin Market was valued at USD 2.1 billion in 2023 and is projected to reach USD 3.8 billion by 2030, growing at a CAGR of 8.8%.

Key drivers include the increasing demand for natural and sustainable ingredients, the growing applications of tannins in pharmaceuticals and healthcare, and the rising demand for premium wines.

The market is segmented by type (hydrolyzable, condensed, phlorotannin), source (plant, brown algae), and application (leather tanning, wine production, pharmaceuticals, others).

Europe dominates the market, driven by the high demand for tannins in wine production and leather processing.

Leading players include Tannin Corporation, Laffort SA, Sappi Limited, and Tanac SA.