Tallow Fatty Acids Market Size (2025 – 2030)

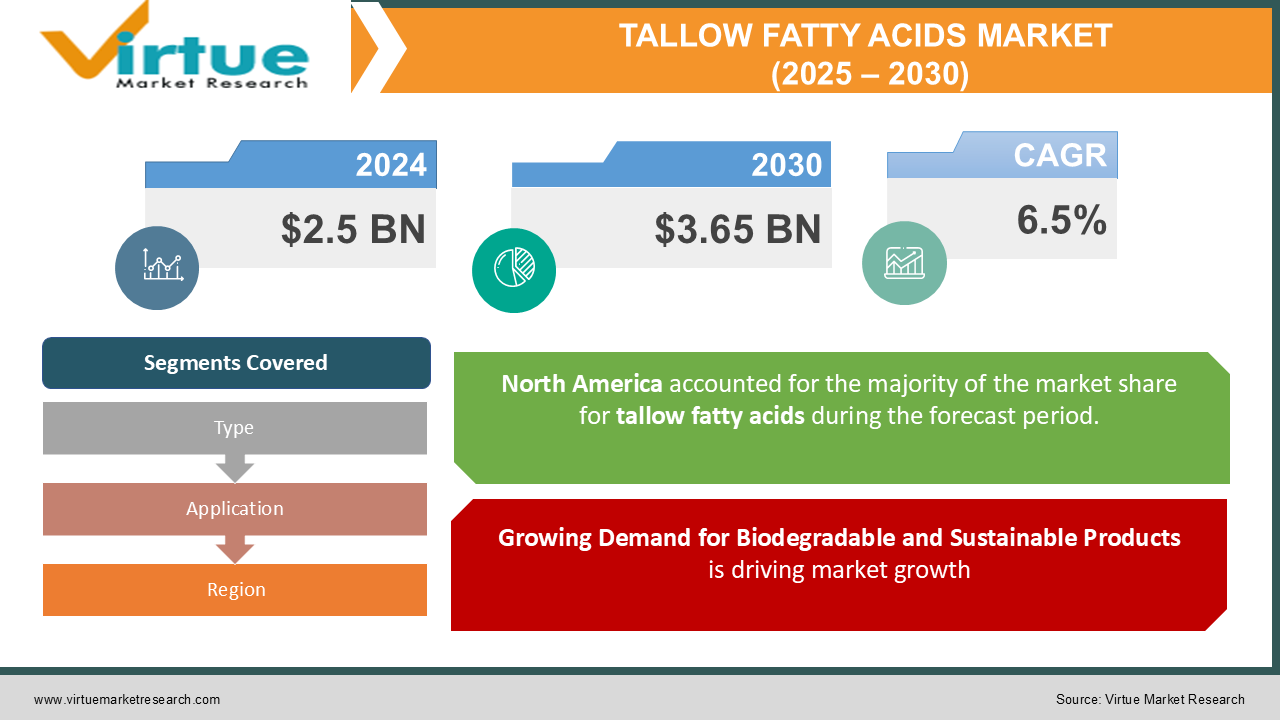

The Global Tallow Fatty Acids Market was valued at USD 2.5 billion in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. The market is expected to reach USD 3.65 billion by 2030.

Tallow fatty acids, derived from animal fats, are widely used in various industries, including soaps, cosmetics, lubricants, and rubber manufacturing. They are favored for their versatility, availability, and cost-effectiveness compared to other fatty acids. The market is driven by the rising demand for biodegradable and renewable alternatives to synthetic chemicals, coupled with growing applications in the personal care and industrial sectors.

Key Market Insights

-

Oleic acid dominates the tallow fatty acids market, accounting for nearly 40% of the revenue due to its extensive use in soaps and detergents.

-

The personal care industry contributes significantly to the demand, with an expected CAGR of 7.2%, driven by the popularity of sustainable and natural ingredients.

-

North America leads the market with a 35% share, followed by Europe, due to the established livestock industry and strong manufacturing base.

-

Increasing consumer awareness about environmental sustainability is driving the adoption of tallow fatty acids in biodegradable lubricants and cleaners. The growing automotive sector is boosting demand for tallow-based rubber and lubricants, particularly in emerging markets like Asia-Pacific. Substantial investments in research and development are yielding new applications in pharmaceuticals and bio-based materials. The shift toward plant-based alternatives poses a challenge, particularly among vegan and environmentally conscious consumers. Advances in processing technologies are improving product purity and broadening application scopes across multiple industries.

Global Tallow Fatty Acids Market Drivers

Growing Demand for Biodegradable and Sustainable Products is driving market growth:

The increasing global focus on environmental sustainability is driving the demand for tallow fatty acids as an alternative to synthetic chemicals. Tallow fatty acids are biodegradable, renewable, and derived from animal by-products, making them a sustainable choice for various industries. In personal care, the demand for natural ingredients has surged due to consumer preferences for eco-friendly products. Similarly, the industrial sector benefits from the use of tallow fatty acids in lubricants, cleaners, and soaps, as they pose minimal environmental impact compared to petroleum-based alternatives.

Expanding Applications Across End-Use Industries is driving market growth:

Tallow fatty acids are highly versatile and find applications in a diverse range of industries, including personal care, rubber, plastics, and food additives. The automotive sector, in particular, is contributing to the growing demand for tallow-based products such as vulcanizing agents and lubricants, which improve the performance and longevity of vehicles. Additionally, the food industry uses tallow fatty acids in emulsifiers and stabilizers, benefiting from their compatibility with various food processing systems. This wide range of applications ensures consistent demand across regions and industries.

Technological Advancements in Processing and Purification is driving market growth:

Innovations in processing technologies have enhanced the quality and purity of tallow fatty acids, expanding their application potential. Manufacturers are adopting advanced techniques like fractionation and hydrogenation to produce specific grades of fatty acids tailored to niche applications. For instance, purified tallow fatty acids are increasingly used in pharmaceutical formulations and high-end cosmetics. These technological advancements are also enabling manufacturers to meet stringent regulatory requirements and consumer expectations for safety and quality.

Global Tallow Fatty Acids Market Challenges and Restraints

Ethical and Environmental Concerns is restricting market growth:

The use of animal-derived products in the tallow fatty acids market faces criticism from vegan and environmentally conscious consumers. Ethical concerns surrounding animal welfare and the carbon footprint associated with livestock farming pose challenges to market growth. Additionally, the availability of plant-based alternatives, such as palm oil and coconut oil fatty acids, further intensifies competition. These challenges compel manufacturers to invest in marketing strategies that highlight sustainability and responsible sourcing practices to address consumer concerns.

Volatility in Raw Material Prices is restricting market growth:

The production of tallow fatty acids is heavily dependent on the availability and cost of animal fat, which is influenced by fluctuations in the livestock industry. Factors such as feed costs, disease outbreaks, and changing consumer preferences for meat consumption can impact the supply of raw materials. Furthermore, competition from biodiesel production, which also relies on animal fat, adds pressure on supply chains. Manufacturers must navigate these price volatilities to maintain profitability and ensure consistent supply.

Market Opportunities

The growing demand for bio-based and sustainable raw materials across the industrial and personal care sectors presents significant opportunities for the tallow fatty acids market. In the cosmetics industry, there is an increasing preference for natural and organic products, which is driving the adoption of tallow-derived ingredients. These ingredients are valued for their emollient and moisturizing properties, making them ideal for use in skin care products. As consumers seek more eco-friendly and sustainable beauty solutions, tallow fatty acids are becoming a preferred choice in formulation. Emerging markets in Asia-Pacific, Latin America, and Africa represent untapped potential for the tallow fatty acids market. Rising urbanization and increasing disposable incomes in these regions are contributing to the growing demand for consumer goods that incorporate tallow fatty acids. As more people gain access to personal care products and industrial goods, the market for bio-based ingredients like tallow is expected to expand significantly. Furthermore, the development of advanced processing technologies, including enzymatic synthesis and green chemistry methods, provides new opportunities for creating high-purity tallow fatty acids. These innovations cater to specialized applications that require superior product quality, positioning manufacturers to meet evolving consumer and industry needs. Collaborations with local suppliers and investments in sustainable sourcing practices are essential for strengthening market presence in these regions. By ensuring that sourcing practices align with sustainability goals, companies can not only capture new market opportunities but also contribute to the broader trend of environmental responsibility.

TALLOW FATTY ACIDS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Twin Rivers Technologies, Vantage Specialty Chemicals, Emery Oleochemicals, Akzo Nobel N.V., aerlocher GmbH,H Foster & Co. Ltd., Godrej Industries Limited, LG Household & Health Care Ltd., Eastman Chemical Company |

Tallow Fatty Acids Market Segmentation - By Type

-

Oleic Acid

-

Stearic Acid

-

Palmitic Acid

-

Others

Oleic acid dominates the market due to its extensive use in the production of soaps, detergents, and personal care products. Its versatility and affordability make it the preferred choice for manufacturers in these sectors.

Tallow Fatty Acids Market Segmentation - By Application

-

Soaps and Detergents

-

Personal Care Products

-

Rubber and Plastics

-

Lubricants

-

Food Additives

-

Others

Soaps and detergents hold the largest share in the application segment, driven by the consistent demand for cleaning products globally. Personal care products are rapidly gaining traction, especially with the growing preference for natural and sustainable ingredients.

Tallow Fatty Acids Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America leads the global tallow fatty acids market with a 35% share, primarily due to the region’s well-established livestock industry and robust demand from the personal care and industrial sectors. The region’s strong focus on sustainability and the availability of advanced processing technologies further bolster its dominance. Additionally, stringent regulations promoting the use of biodegradable materials have encouraged the adoption of tallow fatty acids in various applications.

COVID-19 Impact Analysis on the Tallow Fatty Acids Market

The COVID-19 pandemic had a mixed impact on the tallow fatty acids market. Initially, disruptions in supply chains and manufacturing activities slowed market growth, creating challenges for production and distribution. However, the pandemic also led to an increased demand for soaps, detergents, and personal care products, which provided a significant boost to the market. The heightened emphasis on hygiene and cleanliness during this time drove a surge in demand for cleaning agents, many of which rely on tallow fatty acids as key ingredients. Despite this boost in the hygiene-related sectors, the industrial sector, particularly automotive and construction industries, experienced a slowdown due to reduced activity and economic uncertainty. This decline in industrial demand temporarily dampened overall growth in the tallow fatty acids market. As the world moves into the post-pandemic era, the market is expected to recover steadily. The continued focus on sustainability, coupled with rising demand for environmentally-friendly products, is likely to drive growth in the coming years. Additionally, the ongoing emphasis on hygiene, especially in personal care and cleaning products, will continue to support the market. As industries adapt to new economic realities, the tallow fatty acids market is positioned for gradual recovery, with an emphasis on sustainable sourcing and eco-friendly production processes.

Latest Trends/Developments

The cosmetics industry is increasingly adopting tallow fatty acids in products such as moisturizers, creams, and soaps, driven by the growing demand for natural and sustainable beauty solutions. This shift reflects consumers' preferences for environmentally friendly ingredients in their personal care products. Manufacturers are also exploring advanced processing techniques, such as enzymatic reactions, to enhance the quality and purity of tallow fatty acids, ensuring that these products meet higher standards of performance and safety. In addition, the rise of the circular economy is encouraging the use of animal by-products like tallow in high-value applications, reducing waste and promoting sustainability across various industries. This approach not only contributes to environmental conservation but also adds economic value to these by-products. Partnerships between manufacturers and retailers are further expanding the availability of tallow-based products, particularly in emerging markets, where demand for sustainable solutions is on the rise. Furthermore, the development of bio-lubricants and bio-based rubber additives using tallow fatty acids is gaining traction as industries increasingly shift toward environmentally friendly alternatives. This trend aligns with the global push for sustainable practices in manufacturing, as businesses seek to reduce their environmental impact while maintaining product performance.

Key Players

-

BASF SE

-

Twin Rivers Technologies

-

Vantage Specialty Chemicals

-

Emery Oleochemicals

-

Akzo Nobel N.V.

-

Baerlocher GmbH

-

H Foster & Co. Ltd.

-

Godrej Industries Limited

-

LG Household & Health Care Ltd.

-

Eastman Chemical Company

Chapter 1. Tallow Fatty Acids Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Tallow Fatty Acids Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Tallow Fatty Acids Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Tallow Fatty Acids Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Tallow Fatty Acids Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Tallow Fatty Acids Market – By Type

6.1 Introduction/Key Findings

6.2 Oleic Acid

6.3 Stearic Acid

6.4 Palmitic Acid

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Tallow Fatty Acids Market – By Application

7.1 Introduction/Key Findings

7.2 Soaps and Detergents

7.3 Personal Care Products

7.4 Rubber and Plastics

7.5 Lubricants

7.6 Food Additives

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Tallow Fatty Acids Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Tallow Fatty Acids Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 Twin Rivers Technologies

9.3 Vantage Specialty Chemicals

9.4 Emery Oleochemicals

9.5 Akzo Nobel N.V.

9.6 Baerlocher GmbH

9.7 H Foster & Co. Ltd.

9.8 Godrej Industries Limited

9.9 LG Household & Health Care Ltd.

9.10 Eastman Chemical Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Tallow Fatty Acids Market was valued at USD 2.5 billion in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. The market is expected to reach USD 3.65 billion by 2030.

Key drivers include the growing demand for biodegradable and sustainable products, expanding applications across industries, and technological advancements in processing and purification.

The market is segmented by product (oleic acid, stearic acid, palmitic acid, and others) and by application (soaps and detergents, personal care products, rubber and plastics, lubricants, food additives, and others).

North America is the dominant region, contributing 35% of the global market share, driven by its strong livestock industry and advanced manufacturing capabilities.

Leading players include BASF SE, Twin Rivers Technologies, Vantage Specialty Chemicals, Emery Oleochemicals, and Akzo Nobel N.V.