Synthetic Surfactants Market Size (2024-2030)

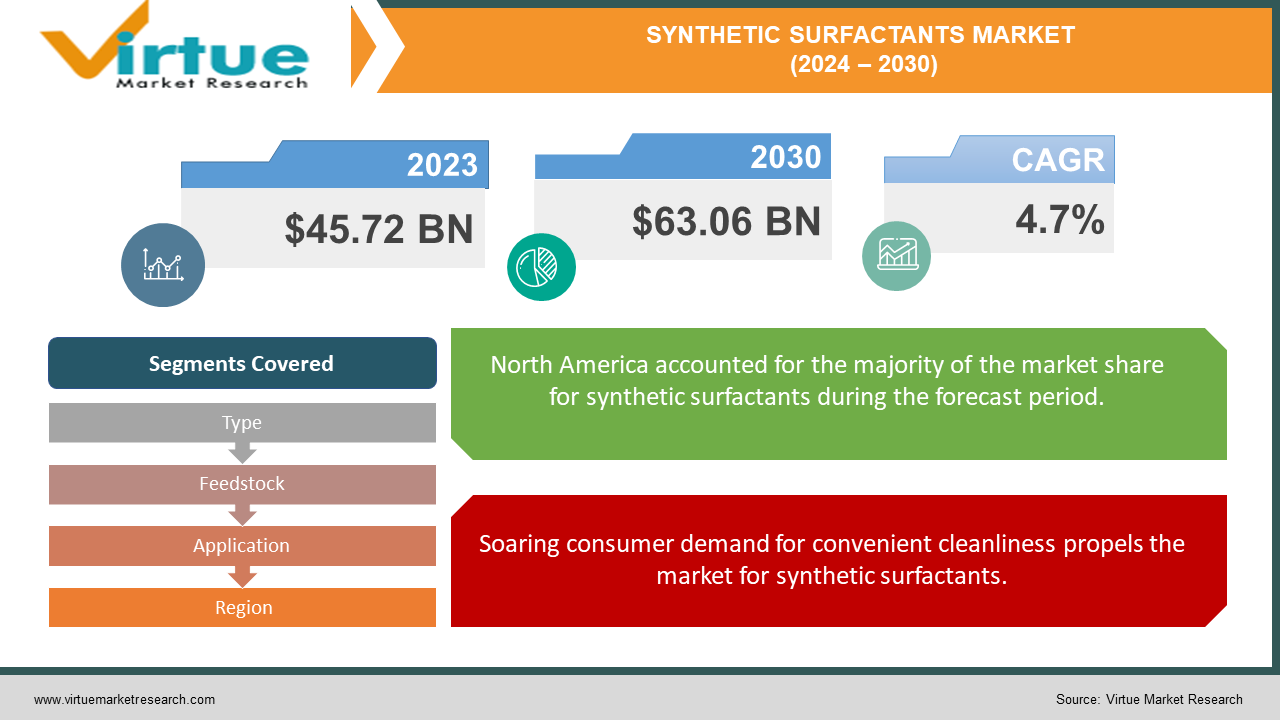

The Synthetic Surfactants Market was valued at USD 45.72 billion in 2023 and is projected to reach a market size of USD 63.06 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 4.7%.

The synthetic surfactants market is a powerhouse behind many of the cleaning and personal care products we use every day. These man-made cleaning agents find their way into laundry detergents, shampoos, and even industrial processes. The market is driven by a rising demand for hygiene and cleaning products, along with growing disposable incomes and urbanization. However, concerns about the environmental impact of some synthetic surfactants are pushing the industry towards developing more sustainable options with better biodegradability.

Key Market Insights:

Synthetic surfactants, the invisible ingredients behind many of our daily cleaning routines, are a powerful force in the global market. These man-made cleaning agents are essential components in detergents, shampoos, and even industrial processes. The market thrives due to a rising demand for cleanliness and convenience. As disposable incomes increase and urbanization accelerates, the need for effective cleaning products grows in tandem.

However, the synthetic surfactants market faces challenges. Environmental concerns regarding the biodegradability of some surfactants are pushing the industry towards developing more sustainable options. This focus on eco-friendly solutions is a key trend shaping the future of the market. Manufacturers are constantly innovating to create surfactants with a lower environmental footprint.

The Synthetic Surfactants Market Drivers:

Soaring consumer demand for convenient cleanliness propels the market for synthetic surfactants.

As global disposable incomes rise, consumer spending on products that enhance convenience and cleanliness is on the upswing. This translates to a significant surge in demand for effective cleaning solutions across households and institutions. Synthetic surfactants become a crucial driver in this scenario, as they are essential ingredients in detergents, dishwashing liquids, and surface cleaners. Their ability to effectively remove dirt, grime, and bacteria makes them a popular choice for maintaining a clean and hygienic environment, contributing to the market's growth.

Rapid urbanization and the need for hygiene in densely populated areas drive the use of synthetic surfactants in cleaning products.

Rapid urbanization across the globe signifies denser living conditions, which in turn necessitates a heightened focus on maintaining cleanliness and hygiene to prevent the spread of diseases. Synthetic surfactants play a vital role in this aspect. They are extensively used in various cleaning products that promote sanitation and personal hygiene. From disinfecting surfaces in hospitals and public spaces to keeping homes and workplaces clean, synthetic surfactants contribute significantly to public health and well-being in densely populated areas, driving market demand.

Synthetic surfactants' versatility extends beyond households, playing a vital role in various industries.

The influence of synthetic surfactants extends far beyond household applications. Their remarkable versatility makes them valuable across numerous industries, contributing significantly to various production processes. In the food processing industry, synthetic surfactants act as emulsifiers, dispersants, and wetting agents, ensuring proper mixing, and processing of food products. Within the textile industry, they are essential for processing textiles, aiding in dyeing, scouring, and finishing fabrics to achieve desired qualities.

Cost-effectiveness and consistent performance make synthetic surfactants a reliable choice for manufacturers across applications.

Compared to some natural alternatives, synthetic surfactants offer a cost-effective solution for manufacturers. This affordability factor makes them readily accessible to a wider range of producers. Additionally, synthetic surfactants deliver consistent performance and possess desired cleaning properties. Their ability to effectively remove dirt and grime while remaining stable under various conditions makes them a reliable choice for various applications. This balance between cost-effectiveness and consistent performance remains a key driver in the synthetic surfactants market.

The Synthetic Surfactants Market Restraints and Challenges:

While the synthetic surfactants market enjoys a positive outlook, it's not without hurdles. A major concern is their environmental impact. Some surfactants break down slowly, potentially polluting waterways and harming aquatic life. This has led to a rise in consumer demand for eco-friendly alternatives. Natural and organic options are gaining significant traction, perceived to have a lower environmental footprint. Governments are also playing a role, implementing stricter regulations on specific chemicals used in surfactants. These regulations can restrict the use of certain surfactants or require manufacturers to find safer alternatives.

The market must adapt to this evolving landscape. Increased competition from natural options and stricter regulations are pushing for innovation. Manufacturers need to constantly develop new and improved surfactants that are eco-friendlier and more compliant with regulations. This competitive pressure can squeeze profit margins and necessitate significant investments in research and development. However, this focus on sustainable solutions is crucial for the long-term success of the synthetic surfactants market. By developing and promoting eco-friendly alternatives, manufacturers can navigate these challenges and ensure the continued growth of this vital industry.

The Synthetic Surfactants Market Opportunities:

The synthetic surfactants market isn't all about overcoming challenges. There are exciting opportunities for growth as well. A key area lies in developing sustainable surfactants. By creating new, biodegradable options, manufacturers can address environmental concerns and attract eco-conscious consumers. Additionally, there's a growing need for high-performance, specialty surfactants. These could be formulated for harsh environments, have minimal foaming, or work synergistically with specific cleaning agents. Developing economies present another significant opportunity. As disposable incomes rise and urbanization accelerates, the demand for effective cleaning products will surge in these regions. Manufacturers can tailor their offerings to meet the specific needs of these emerging markets. The future might even see synthetic surfactants playing a role in new technologies, from advanced materials to biofuels, or even medical applications. Research and development in these areas could open entirely new avenues for market growth. Finally, collaboration between surfactant manufacturers, research institutions, and environmental groups can accelerate the development of sustainable and innovative solutions. Strategic partnerships can help overcome technical hurdles and bring new products to market faster. By capitalizing on these opportunities for sustainability, innovation, and exploration, the synthetic surfactants market can ensure its continued success in the years to come.

SYNTHETIC SURFACTANTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.7% |

|

Segments Covered |

By Type, Application, Feedstock, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, The Dow Chemical Company, Huntsman Corporation, Stepan Company, Evonik Industries, AkzoNobel, Clariant, Kao Corporation, Croda International, Solvay, Ashland |

Synthetic Surfactants Market Segmentation: By Type

-

Anionic Surfactants

-

Cationic Surfactants

-

Non-ionic Surfactants

-

Amphoteric Surfactants

By type, anionic surfactants hold the dominant position in the synthetic surfactants market due to their strong cleaning and foaming abilities, making them ideal for detergents, shampoos, and soaps. However, the fastest-growing segment is bio-based surfactants. Driven by environmental concerns, these surfactants derived from renewable resources like plant oils are gaining significant traction as a more sustainable alternative.

Synthetic Surfactants Market Segmentation: By Application

-

Household Care

-

Personal Care

-

Industrial & Institutional Cleaning

-

Textiles

-

Food & Beverage

-

Other Applications

The household detergents segment reigns supreme in the synthetic surfactants market by application, with its essential cleaning agents in laundry detergents, dishwashing liquids, and surface cleaners. However, the Asia Pacific region is the fastest-growing application sector, driven by a surge in disposable incomes, rapid urbanization, and a consequent rise in demand for effective cleaning products across households and institutions.

Synthetic Surfactants Market Segmentation: By Feedstock

-

Synthetic surfactants

-

Bio-based surfactants

The synthetic surfactants market is segmented by feedstock, with synthetic surfactants, derived from petroleum-based chemicals, being the dominant segment due to their established production methods and cost-effectiveness. However, bio-based surfactants, made from renewable resources, are the fastest-growing segment. This growth is driven by rising environmental concerns and increasing consumer preference for sustainable products.

Synthetic Surfactants Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America region represents a mature market with a high and established demand for cleaning products. Consumers here have a strong focus on convenience and effectiveness, driving the use of synthetic surfactants in detergents, dishwashing liquids, and personal care products. However, there's a growing awareness of environmental concerns, prompting a shift towards more sustainable surfactant options.

Asia Pacific region boasts the fastest growth in the synthetic surfactants market due to several factors. Rising disposable incomes in developing countries like China and India are fuelling the demand for cleaning products and personal care items. Additionally, rapid urbanization creates a need for effective cleaning solutions to maintain hygiene in densely populated areas. However, balancing this growth with environmental concerns will be crucial for the long-term sustainability of the market in Asia Pacific.

COVID-19 Impact Analysis on the Synthetic Surfactants Market:

The COVID-19 pandemic left its mark on the synthetic surfactants market, presenting both challenges and opportunities. On the positive side, the heightened focus on hygiene during the pandemic led to a surge in demand for cleaning and personal care products like hand sanitizers, disinfectants, and detergents. This naturally translated to an increased need for synthetic surfactants, a key ingredient in these products. However, the pandemic also brought about disruptions in global supply chains due to lockdowns and travel restrictions. This caused shortages of raw materials needed for surfactant production, leading to delays and increased costs for manufacturers. Additionally, demand fluctuated – a spike in panic buying at the beginning gave way to a period of reduced demand as people adjusted to the new normal.

Looking at the bigger picture, the overall impact on the synthetic surfactants market was positive. The pandemic's emphasis on hygiene and sanitation is likely to have a lasting effect, with a continued demand for cleaning products that rely on synthetic surfactants. Emerging trends in this market include a focus on developing more sustainable surfactant options, driven by heightened consumer awareness of environmental issues. Additionally, the significant shift towards online shopping for cleaning products during the pandemic is expected to continue, creating new opportunities for manufacturers to reach consumers directly. As the market recovers and maintains steady growth in the post-pandemic era, manufacturers who can adapt to these evolving trends and leverage e-commerce opportunities are poised to succeed.

Latest Trends/ Developments:

The synthetic surfactants market is buzzing with innovation as it strives to meet the demands of environmentally conscious consumers and address growing concerns about sustainability. A key trend is the rise of bio-based surfactants. These eco-friendly alternatives are derived from renewable resources like plant oils, offering a welcome change from traditional petroleum-based options that can have a larger environmental footprint.

Innovation is further driving the development of specialty surfactants that cater to specific cleaning needs. Imagine high-performance surfactants designed to tackle harsh environments like industrial settings, or those with minimal foaming ideal for automatic dishwashers. Additionally, researchers are exploring the power of synergy by combining enzymes with synthetic surfactants.

Key Players:

-

BASF SE

-

The Dow Chemical Company

-

Huntsman Corporation

-

Stepan Company

-

Evonik Industries

-

AkzoNobel

-

Clariant

-

Kao Corporation

-

Croda International

-

Solvay

-

Ashland

Chapter 1. Synthetic Surfactants Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Synthetic Surfactants Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Synthetic Surfactants Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Synthetic Surfactants Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Synthetic Surfactants Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Synthetic Surfactants Market – By Type

6.1 Introduction/Key Findings

6.2 Anionic Surfactants

6.3 Cationic Surfactants

6.4 Non-ionic Surfactants

6.5 Amphoteric Surfactants

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Synthetic Surfactants Market – By Feedstock

7.1 Introduction/Key Findings

7.2 Synthetic surfactants

7.3 Bio-based surfactants

7.4 Y-O-Y Growth trend Analysis By Feedstock

7.5 Absolute $ Opportunity Analysis By Feedstock, 2024-2030

Chapter 8. Synthetic Surfactants Market – By Application

8.1 Introduction/Key Findings

8.2 Household Care

8.3 Personal Care

8.4 Industrial & Institutional Cleaning

8.5 Textiles

8.6 Food & Beverage

8.7 Other Applications

8.8 Y-O-Y Growth trend Analysis By Application

8.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Synthetic Surfactants Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Feedstock

9.1.4 By By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Feedstock

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Feedstock

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Feedstock

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Feedstock

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Synthetic Surfactants Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 BASF SE

10.2 The Dow Chemical Company

10.3 Huntsman Corporation

10.4 Stepan Company

10.5 Evonik Industries

10.6 AkzoNobel

10.7 Clariant

10.8 Kao Corporation

10.9 Croda International

10.10 Solvay

10.11 Ashland

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Synthetic Surfactants Market was valued at USD 45.72 billion in 2023 and is projected to reach a market size of USD 63.06 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 4.7%.

Soaring Demand for Cleanliness and Convenience, Urbanization and Heightened Focus on Hygiene, Versatility Across Diverse Industries, Cost-Effectiveness, and Consistent Performance.

Household Care, Personal Care, Industrial & Institutional Cleaning, Textiles, Food & Beverage, Other Applications.

The most dominant region for the Synthetic Surfactants Market is currently Asia Pacific, driven by rising disposable incomes and rapid urbanization.

BASF SE, The Dow Chemical Company, Huntsman Corporation, Stepan Company, Evonik Industries, AkzoNobel, Clariant, Kao Corporation, Croda International, Solvay, Ashland.