Synthetic Crop Protection Chemicals Market Size (2023 - 2030)

Empower Your Agribusiness: Gaining the Competitive Edge in the Synthetic Crop Protection Chemicals Market

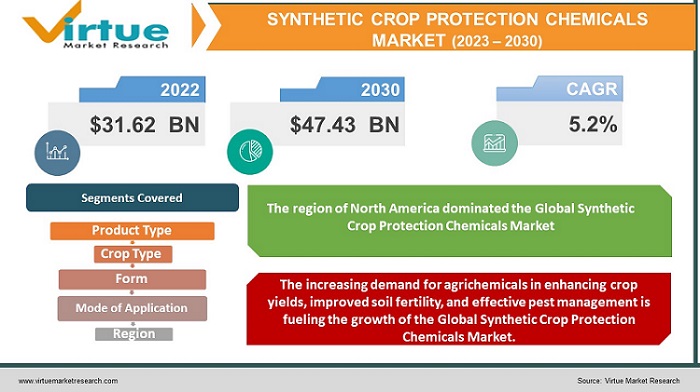

Global Synthetic Crop Protection Chemicals Market is estimated to be worth USD 31.62 Billion in 2022 and is projected to reach a value of USD 47.43 Billion by 2030, growing at a CAGR of 5.2% during the forecast period 2023-2030.

Synthetic crop protection chemicals are chemicals extensively utilized in agriculture to nurture plant growth and ensure crop protection. They are also known as agricultural chemicals, or in short agrichemicals. Initially, these chemicals were employed to augment crop cultivation, but their immoderate utilization has had detrimental repercussions on the environment. Agrichemicals can penetrate the surrounding soil and water bodies, entering the food chain and resulting in bioaccumulation. In terms of their impact on crops, the excessive application of agrichemicals leads to the accumulation of residues. These residues disrupt nutrient balance and diminish the quality of agricultural products. The consumption of such residues has been associated with various health issues. For instance, the presence of pesticide remnants in food can elevate the risk of asthma in humans.

Ancient civilizations like the Sumerians and the Chinese utilized sulfur, mercury, and arsenic compounds thousands of years ago as insecticides and lice control agents. Over time, agrichemicals, encompassing pesticides and fertilizers, were introduced to shield crops and raise yields. Chemical fertilizers, particularly during the 1960s, played a vital role in the "Green Revolution," employing intensive irrigation and mineral fertilizers like nitrogen, phosphorus, and potassium to elevate food production on limited land. However, pest adaptation led to the development of more selective agrichemicals in the following decades. Unfortunately, the escalated utilization of diverse agrichemicals had unintended environmental effects.

Global Synthetic Crop Protection Chemicals Market Drivers:

The increasing demand for agrichemicals in enhancing crop yields, improved soil fertility, and effective pest management is fueling the growth of the Global Synthetic Crop Protection Chemicals Market.

The utilization of pesticides and fertilizers in agriculture offers numerous benefits, encompassing elevated crop yields, enriched soil fertility, pest management, and crop preservation. Crops confront various biotic challenges such as weed, insect, and pest infestations, as well as abiotic stresses like declining soil fertility. To address these challenges, farmers extensively rely on the application of fertilizers and pesticides. Over the past 40 years, the utilization of these agrichemicals has led to amplified soil fertility, effective management of insects and pests, and subsequently heightened crop yields. Studies indicate a significant upsurge in fertilizer and pesticide usage in both developed and developing countries, striving to achieve maximum crop yields. Therefore, this factor propels the demand for synthetic crop protection chemicals.

The rising adoption of agrichemicals in safeguarding food processing and storage facilities from insect infestation is another factor contributing to the growth of the Global Synthetic Crop Protection Chemicals Market.

In the food processing industry, insecticides are utilized in approved quantities to safeguard raw materials and packaged food items from insect infestation during various stages of processing, manufacturing, and packaging. Insecticides and rodenticides are commonly employed in storage areas where food is kept. Additionally, insecticides, herbicides, and pesticides find application in households to suppress insects, weeds, and pests. Therefore, this factor also propels the demand for synthetic crop protection chemicals.

Global Synthetic Crop Protection Chemicals Market Challenges:

The Global Synthetic Crop Protection Chemicals Market is encountering challenges, primarily in terms of potential health risks. Synthetic crop protection chemicals pose significant apprehensions due to their persistent nature, toxicity, accumulation in the body, and detrimental effects on human health. Consumption of agrichemical-contaminated fruits and vegetables brings in these noxious chemicals into our bodies, which potentially induce cancer, birth defects, neurological disorders, endocrine disruption, and reproductive problems. The severity of agrichemicals effects depends on exposure duration and toxicity, with immediate (acute) or long-term (chronic) consequences. Glyphosate, Difenoconazole, Imidacloprid, and Bifenthrin are common agrichemicals found in market produce that may impact consumers. Thus, these challenges inhibit the growth of the Global Synthetic Crop Protection Chemicals Market.

Global Synthetic Crop Protection Chemicals Market Opportunities:

Biopesticides, which are naturally occurring and made with minimal chemical usage, are gaining worldwide recognition. This spike in demand is propelled by mounting concerns about environmental impact, pollution risks, and health implications associated with traditional pesticides. Biopesticides are favored owing to their lower toxicity or non-toxic nature when contrasted with synthetic pesticides. They also provide targeted control over specific pests, unlike conventional pesticides that can be detrimental to various insects, birds, and mammals. Furthermore, biopesticides are highly effective even in small amounts, diminishing exposure risks, and they rapidly deteriorate, leaving virtually no harmful residues after application. This makes them a preferred option for sustainable and environmentally friendly pest management.

COVID-19 Impact on the Global Synthetic Crop Protection Chemicals Market:

The Global Synthetic Crop Protection Chemicals Market has been considerably influenced by the COVID-19 outbreak. As a result of rigorous lockdowns, travel restrictions, and social distancing measures, the demand for synthetic crop protection chemicals waned. Delays in the expedited production and distribution of goods and services have also been caused by the pandemic's influence on the market's supply chain, which affected the availability of synthetic crop protection chemicals. The pandemic altered consumer behavior, with disruptions in demand for non-essential crops, which affected the sales and production of synthetic crop protection chemicals. These factors negatively impacted the market's growth. Despite these challenges, the market is projected to rebound alongside the global recovery from the pandemic.

Global Synthetic Crop Protection Chemicals Market Recent Developments:

- In May 2023, Dow's Industrial Solutions business introduced DOW™ Crop Solver, an online tool devised to accelerate agricultural formulation development.

- In November 2022, Bayer AG, a prominent global crop science company, joined forces with General Aeronautics Pvt Ltd, based in Bengaluru, to offer drone services approved by the Directorate General of Civil Aviation (DGCA) for crop protection to small-scale farmers throughout India.

- In April 2022, BASF SE introduced Exponus® insecticide in India, providing farmers with an innovative solution to safeguard their crops and boost productivity.

SYNTHETIC CROP PROTECTION CHEMICALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By Product Type, CROP TYPE, Form, Mode of Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Elantas GmbH (Germany), Axalta Coating Systems (the U.S.), Von Roll Holdings AG (Switzerland), Hitachi Chemicals Company Ltd. (Japan), 3M Company (the U.S.), and Kyocera Corporation (Japan) |

Global Synthetic Crop Protection Chemicals Market Segmentation:

Global Synthetic Crop Protection Chemicals Market Segmentation: By Product Type

- Fungicides

- Herbicides

- Insecticides

- Nematicides

- Others

The Herbicides segment occupied the highest market share in the year 2022. The growth can be ascribed to the extensive utilization of herbicides in weed control practices to boost the productivity and quality of crops. Herbicides target and exterminate unwanted plant growth, hence their common name of weed killers. They effectively manage weeds by diminishing soil erosion, enriching soil fertility, and raising crop yields. Herbicide utilization can affect weed populations in agricultural areas and promote native species diversity in natural environments. These agrichemicals find application in weed waste grounds, industrial sites, railways, and railway embankments. Herbicides play a vital role in weed control for the agricultural sector and landscape turf management.

Global Synthetic Crop Protection Chemicals Market Segmentation: By Crop Type

- Cereals and Grains

- Fruits and Vegetables

- Oilseeds and Pulses

- Others

The Cereals and Grains segment occupied the highest market share in the year 2022. The growth can be ascribed to the augmenting demand for agrichemicals in the cultivation of cereals and grains using both open-field and protective methods. Cereal grains, including wheat, rice, oats, barley, and more, are classified into cereals and legumes. Cereals are grass species cultivated for their edible grain components, while grains also include legumes like chickpeas and soybeans, as well as pseudo-cereals like chia and quinoa. The significant market presence of cereals and grains in crop protection chemicals reflects their importance and extensive utilization in boosting crop productivity and ensuring food security.

Global Synthetic Crop Protection Chemicals Market Segmentation: By Form

- Dry

- Liquid

The Liquid segment occupied the highest market share in the year 2022. The growth can be ascribed to their effectiveness in foliar spray and seed treatment applications. Compared to solid formulations, liquid forms are more budget-friendly and can be easily mixed with other crop enhancers or protective products, which drives their popularity. Liquid pesticides come in various forms, encompassing suspensions, solutions, concentrates, microencapsulated suspensions, and aerosols. Suppliers and end-users prefer liquid formulations owing to their longer shelf-life, ease of handling, transportation, and application. Furthermore, liquid forms offer cost-effectiveness, environmental friendliness, and sustainability. Companies are investing in advancing liquid crop protection chemicals, which can be water-based, oil-based, polymer-based, or combinations thereof.

Global Synthetic Crop Protection Chemicals Market Segmentation: By Mode of Application

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Others

The Foliar Spray segment occupied the highest market share in the year 2022. The growth can be ascribed to the utilization of foliar spray as the most common method for applying synthetic crop protection chemicals. Foliar spray is employed for diverse purposes, encompassing herbicides, insecticides, and fungicides. Its primary application is for spraying herbicides and insecticides, propelled by the scarcity of labor for manual weed removal and the need to combat insect infestations on crops. Foliar spray, also known as foliar feeding, involves directly applying liquid crop protection chemicals to the leaves of plants. This method has demonstrated striking potency in eliminating undesired grasses, herbs, and shrubs.

Global Synthetic Crop Protection Chemicals Market Segmentation: By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

The region of North America dominated the Global Synthetic Crop Protection Chemicals Market in the year 2022. The augmenting global demand for agricultural productivity, the adoption of cutting-edge technologies and modern agricultural practices, the rising importance of food security, and the growing exports of agricultural commodities are some of the pivotal factors propelling the region's growth. Furthermore, North America is home to several prominent market players, including Dow Inc., DuPont de Nemours, Inc., Corteva, Inc., Marrone Bio Innovations Inc., and FMC Corporation.

The region of Asia-Pacific is anticipated to expand at the quickest rate over the forecast period 2023-2030 owing to the significant agricultural foundation, extensive farmland, the rising awareness of pesticide usage, advancements in agricultural technology, the rising demand for crops and their cultivation across the region, and the strong presence of significant market players, including Nufarm Ltd., UPL Limited, and Nissan Chemical Corporation.

Global Synthetic Crop Protection Chemicals Market Key Players:

- BASF SE (Germany)

- Bayer AG (Germany)

- Dow Inc. (United States)

- DuPont de Nemours, Inc., (United States)

- Corteva, Inc. (United States)

- FMC Corporation (United States)

- Nufarm Ltd. (Australia)

- UPL Limited (India)

- Syngenta AG (Switzerland)

- Nissan Chemical Corporation (Japan)

Chapter 1. SYNTHETIC CROP PROTECTION CHEMICALS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. SYNTHETIC CROP PROTECTION CHEMICALS MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. SYNTHETIC CROP PROTECTION CHEMICALS MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. SYNTHETIC CROP PROTECTION CHEMICALS MARK ET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. SYNTHETIC CROP PROTECTION CHEMICALS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. SYNTHETIC CROP PROTECTION CHEMICALS MARKET – By Product Type

6.1 Fungicides

6.2. Herbicides

6.3. Insecticides

6.4. Nematicides

6.5. Others

Chapter 7. SYNTHETIC CROP PROTECTION CHEMICALS MARKET – By Crop Type

7.1. Cereals and Grains

7.2. Fruits and Vegetables

7.3. Oilseeds and Pulses

7.4. Others

Chapter 8. SYNTHETIC CROP PROTECTION CHEMICALS MARKET – By Form

8.1 Dry

8.2. Liquid

Chapter 9. SYNTHETIC CROP PROTECTION CHEMICALS MARKET –By Mode of Application

9.1 Foliar Spray

9.2. Seed Treatment

9.3. Soil Treatment

9.4. Others

Chapter 10. SYNTHETIC CROP PROTECTION CHEMICALS MARKET – By Region

10.1. North America

10.2. Europe

10.3.The Asia Pacific

10.4.Latin America

10.5. Middle-East and Africa

Chapter 11. SYNTHETIC CROP PROTECTION CHEMICALS MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

11.1. BASF SE (Germany)

11.2. Bayer AG (Germany)

11.3. Dow Inc. (United States)

11.4. DuPont de Nemours, Inc., (United States)

11.5. Corteva, Inc. (United States)

11.6. FMC Corporation (United States)

11.7. Nufarm Ltd. (Australia)

11.8. UPL Limited (India)

11.9. Syngenta AG (Switzerland)

11.10. Nissan Chemical Corporation (Japan)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Synthetic Crop Protection Chemicals Market is estimated to be worth USD 31.62 Billion in 2022 and is projected to reach a value of USD 47.43 Billion by 2030, growing at a CAGR of 5.2% during the forecast period 2023-2030

The Global Synthetic Crop Protection Chemicals Market Drivers are the Increasing Demand for Agrichemicals in Enhancing Crop Yields, Improved Soil Fertility, and Effective Pest Management and the Rising Adoption of Agrichemicals in Safeguarding Food Processing and Storage Facilities from Insect Infestation

Based on the Product Type, the Global Synthetic Crop Protection Chemicals Market is segmented into Fungicides, Herbicides, Insecticides, Nematicides, and Others.

The United States is the most dominating country in the region of North America for the Global Synthetic Crop Protection Chemicals Market

BASF SE, Bayer AG, and Dow Inc. are the leading players in the Global Synthetic Crop Protection Chemicals Market