Switchgear Market Size (2025-2030)

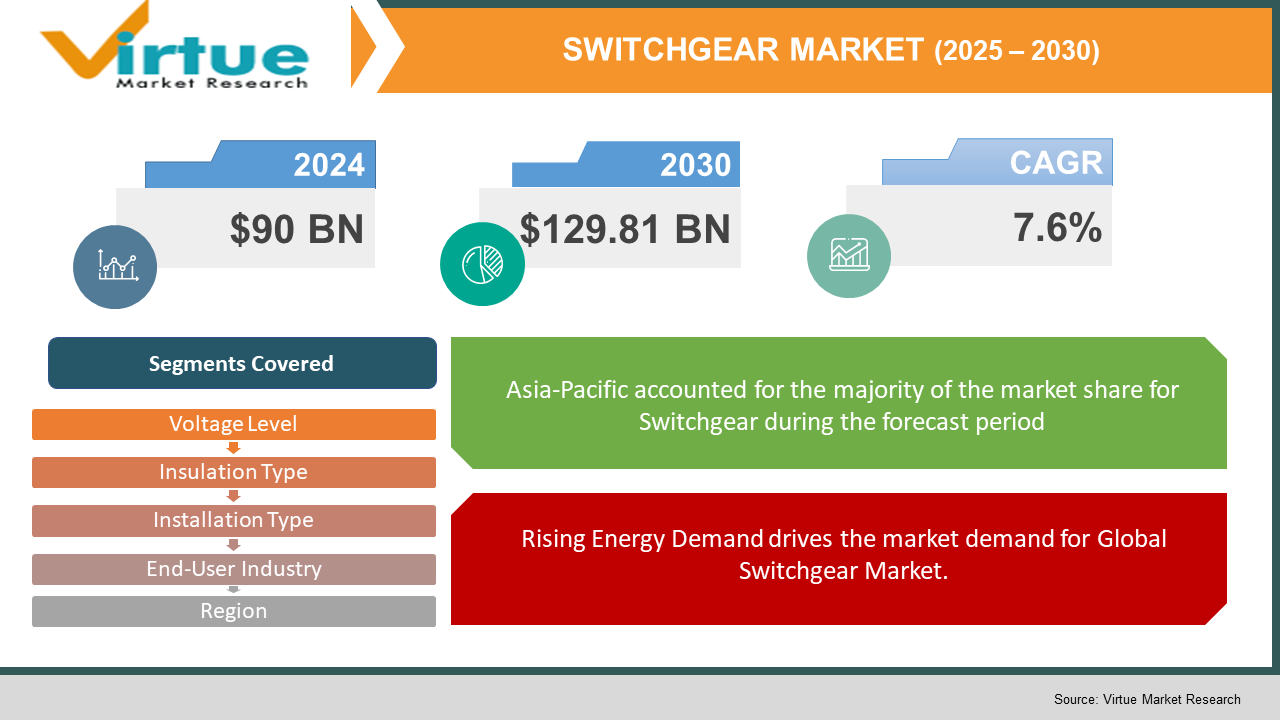

The Global Switchgear Market is valued at USD 90 Billion and is projected to reach a market size of USD 129.81 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.6%.

Switchgear is a critical component of electrical power systems, responsible for controlling, protecting, and isolating electrical circuits and equipment. It ensures the safe and efficient distribution of electricity across industrial, commercial, and residential sectors. The market is witnessing steady growth due to rising energy demand, increasing grid modernization, and the integration of renewable energy sources. Technological advancements, such as smart switchgear with IoT capabilities, are further driving industry expansion. Growing investments in power infrastructure worldwide continue to propel market growth.

Key Market Insights:

- Asia Pacific and Middle East accounts for approximately 65% of the Global Switchgear Market, driven by Rising Energy Demand, Renewable Energy Integration, Technological Advancements & Infrastructure Development and Electrification Projects.

Global Switchgear Market Drivers:

Rising Energy Demand drives the market demand for Global Switchgear Market.

With rapid urbanization and industrialization, global electricity consumption is rising significantly. Developing countries are expanding their power generation and distribution infrastructure to meet growing energy needs. Utilities and governments are investing in robust electrical grids, increasing demand for switchgear. In addition, rural electrification initiatives in emerging economies further contribute to market expansion. The shift toward high-efficiency power transmission systems necessitates the deployment of advanced switchgear to ensure grid reliability and minimize energy losses.

Renewable Energy Integration drives the market demand for Global Switchgear Market.

The global transition to renewable energy is a major driver for switchgear adoption. Wind, solar, and hydroelectric power generation require efficient distribution and safety mechanisms, making switchgear a vital component. Governments worldwide are setting ambitious renewable energy targets, accelerating demand for advanced switchgear solutions. As grids become more decentralized due to distributed energy sources, intelligent switchgear is needed to manage fluctuating power inputs. This shift enhances grid stability while supporting sustainability goals.

Technological Advancements drives the market demand for Global Switchgear Market.

The market is evolving with innovations such as smart grids, digital switchgear, and IoT-enabled monitoring systems. Smart switchgear provides real-time diagnostics, predictive maintenance, and remote operation, improving overall efficiency. Gas-insulated switchgear (GIS) is gaining popularity due to its compact size and high reliability. Additionally, advancements in insulation materials and circuit breakers enhance performance while reducing environmental impact. The continuous R&D in switchgear technology is making power distribution safer, more efficient, and cost-effective.

Infrastructure Development and Electrification Projects drives the market demand for Global Switchgear Market.

Large-scale infrastructure projects, including smart cities, metro systems, and industrial zones, are fueling switchgear demand. Governments worldwide are heavily investing in power transmission networks, modernizing aging grid infrastructure, and expanding electricity access in rural areas. The construction of data centers and telecom networks is also driving demand for reliable switchgear solutions. As electrification efforts intensify across sectors, the need for high-performance switchgear remains strong, ensuring uninterrupted power supply.

Global Switchgear Market Restraints and Challenges:

The high initial cost of advanced switchgear systems, particularly gas-insulated variants, poses a challenge for widespread adoption, especially in cost-sensitive markets. Complex installation and retrofitting of existing grid systems require significant investment, deterring some utilities from upgrading to modern switchgear. Additionally, fluctuating raw material prices, such as copper and aluminum, impact manufacturing costs, affecting profitability. Stringent regulatory compliance and environmental concerns related to SF6-based switchgear further complicate product development and adoption.

Global Switchgear Market Opportunities:

The global shift toward electric mobility is creating significant opportunities for the switchgear industry. Governments and private enterprises are investing in extensive EV charging networks, requiring efficient and safe power distribution systems. Switchgear plays a crucial role in managing electrical loads at charging stations, ensuring stability and preventing power surges. As EV adoption accelerates worldwide, switchgear manufacturers have the opportunity to develop specialized solutions for charging infrastructure.

The rise of smart grids and decentralized power generation presents lucrative growth prospects for the switchgear market. Advanced switchgear with real-time monitoring capabilities is essential for managing microgrids, distributed energy resources (DERs), and energy storage systems. With increasing reliance on localized power generation, demand for intelligent, remotely controlled switchgear is rising. Innovations in energy storage, such as battery integration with renewable energy, further drive the need for adaptable and digitalized switchgear solutions.

SWITCHGEAR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.6% |

|

Segments Covered |

By voltage level, insulation type, installation type, end user industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Siemens AG, ABB Ltd., Schneider Electric SE, General Electric Company, Eaton Corporation plc, Mitsubishi Electric Corporation, Toshiba Corporation, Hitachi Energy Ltd., Hyundai Electric & Energy Systems Co., Ltd., Fuji Electric Co., Ltd. |

Global Switchgear Market Segmentation:

Global Switchgear Market Segmentation: By Voltage Level:

- Low Voltage Switchgear

- Medium Voltage Switchgear

- High Voltage Switchgear

Medium voltage switchgear (MV) dominates the market due to its widespread application in power distribution networks, industrial facilities, and commercial buildings. It operates in the 1 kV to 36 kV range, making it an ideal choice for utilities and substations. The increasing demand for grid modernization and electrification projects worldwide, particularly in rapidly urbanizing regions, fuels its dominance. Additionally, medium voltage switchgear ensures improved operational safety, efficiency, and reliability, making it a preferred choice across multiple industries, including oil & gas, transportation, and renewable energy projects.

The high voltage (HV) switchgear segment is experiencing rapid growth due to the rising investments in high-capacity transmission networks and inter-country power grid expansions. High-voltage switchgear is essential for handling electricity in power plants, substations, and bulk power transmission. The increasing demand for renewable energy integration and smart grid technologies is also driving growth. Additionally, government initiatives in countries like China, India, and the U.S. to modernize outdated infrastructure and improve energy efficiency further accelerate the segment’s expansion.

Global Switchgear Market Segmentation: By Insulation Type:

- Air-Insulated Switchgear (AIS)

- Gas-Insulated Switchgear (GIS)

- Oil-Insulated Switchgear

- Vacuum-Insulated Switchgear

Air-insulated switchgear is the most widely used due to its cost-effectiveness, ease of maintenance, and simple design. It is commonly deployed in utilities, commercial buildings, and industrial plants, making it the dominant insulation type. AIS provides reliable performance at medium voltage levels, making it ideal for power distribution applications. Additionally, its environmentally friendly properties, compared to SF6 gas-insulated alternatives, contribute to its widespread adoption, particularly in regions emphasizing sustainability and lower carbon emissions.

Gas-insulated switchgear (GIS) is growing at an accelerated pace due to its compact size, higher efficiency, and minimal maintenance requirements. Unlike AIS, GIS is suitable for space-constrained urban environments and high-voltage applications in power plants and industrial facilities. The push for smart grids, renewable energy integration, and automation is driving GIS demand. Additionally, countries in Asia-Pacific and the Middle East are investing heavily in GIS-based substations due to their ability to operate in harsh environments with minimal external impact.

Global Switchgear Market Segmentation: By Installation Type:

- Indoor Switchgear

- Outdoor Switchgear

Outdoor switchgear is the largest segment due to its widespread use in high-voltage transmission and distribution networks. It is designed to withstand harsh environmental conditions, making it a preferred choice for substations, industrial plants, and large-scale power transmission systems. Governments and utility providers are increasing investments in grid expansion and electrification projects, further solidifying outdoor switchgear as the dominant sub-segment.

Indoor switchgear is growing rapidly due to the rising adoption of smart grids and urban infrastructure development. The increasing demand for safe, space-efficient, and low-maintenance power distribution systems in commercial buildings, data centers, and metro rail projects is driving its growth. Additionally, digitalization and automation trends in industries are further accelerating the demand for compact, intelligent indoor switchgear solutions.

Global Switchgear Market Segmentation: By End-User Industry:

- Residential Sector

- Commercial & Industrial Sector

- Utilities & Power Generation

- Transportation (Railways, Airports, Metro Systems)

- Oil & Gas Industry

- Data Centers & IT Infrastructure

The utilities and power generation sector dominates the switchgear market as electricity transmission and distribution remain the primary applications of switchgear. Governments and private players are heavily investing in grid modernization, rural electrification, and smart metering projects, ensuring continuous demand for switchgear in power plants, substations, and distribution networks. Additionally, the transition to renewable energy sources like wind and solar power is reinforcing the importance of efficient switchgear solutions.

With the global surge in cloud computing, AI, and digital transformation, the demand for high-performance power distribution systems in data centers is rising. Switchgear plays a vital role in ensuring uninterrupted power supply, voltage stability, and fault protection in critical IT infrastructure. The expansion of hyperscale data centers and increasing energy consumption in IT operations are driving the demand for advanced, intelligent, and modular switchgear solutions.

Global Switchgear Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Asia-Pacific leads the switchgear market due to rapid urbanization, industrialization, and large-scale electrification initiatives. Countries like China, India, and Japan are investing heavily in smart grid projects, power distribution networks, and renewable energy integration, driving the demand for advanced switchgear solutions. Additionally, expanding manufacturing hubs and infrastructure projects are further propelling market dominance in this region.

The Middle East & Africa region is witnessing rapid switchgear market growth, driven by massive energy infrastructure projects, renewable energy investments, and urban expansion. Countries like Saudi Arabia and the UAE are focusing on smart city projects, solar farms, and oil & gas developments, leading to increasing adoption of high-voltage and gas-insulated switchgear solutions. Additionally, electrification efforts in Africa’s rural and emerging economies are further fueling market expansion.

COVID-19 Impact Analysis on Global Switchgear Market:

The COVID-19 pandemic initially disrupted the switchgear industry due to supply chain constraints, project delays, and reduced infrastructure investments. However, the post-pandemic recovery has accelerated smart grid deployments and digital transformation in the power sector. Governments have increased funding for power resilience projects, boosting demand for modern switchgear solutions. The need for remote monitoring and automation has also grown, leading to a shift toward IoT-enabled and AI-powered switchgear systems.

Latest Trends/ Developments:

The switchgear market is witnessing the rise of SF6-free, environmentally friendly gas-insulated switchgear, reducing greenhouse gas emissions. Hybrid switchgear solutions combining different insulation technologies are gaining popularity. Companies are increasingly focusing on modular switchgear designs, providing greater flexibility and cost-effectiveness. Strategic collaborations between power utilities and technology firms are driving innovations in AI-driven switchgear diagnostics. The integration of blockchain-based energy trading within smart grids is also expected to influence future switchgear applications.

Key Players:

- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- General Electric Company

- Eaton Corporation plc

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Hitachi Energy Ltd.

- Hyundai Electric & Energy Systems Co., Ltd.

- Fuji Electric Co., Ltd.

Chapter 1. Switchgear Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. Global Switchgear Market– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Switchgear Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Switchgear Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Switchgear Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Switchgear Market– By Voltage Level

6.1 Introduction/Key Findings

6.2 Low Voltage Switchgear

6.3 Medium Voltage Switchgear

6.4 High Voltage Switchgear

6.5 Y-O-Y Growth trend Analysis By Voltage Level

6.6 Absolute $ Opportunity Analysis By Voltage Level , 2025-2030

Chapter 7. Global Switchgear Market– By Insulation Type

7.1 Introduction/Key Findings

7.2 Air-Insulated Switchgear (AIS)

7.3 Gas-Insulated Switchgear (GIS)

7.4 Oil-Insulated Switchgear

7.5 Vacuum-Insulated Switchgear

7.6 Y-O-Y Growth trend Analysis By Insulation Type

7.7 Absolute $ Opportunity Analysis By Insulation Type , 2025-2030

Chapter 8. Global Switchgear Market– By Installation Type

8.1 Introduction/Key Findings

8.2 Indoor Switchgear

8.3 Outdoor Switchgear

8.4 Y-O-Y Growth trend Analysis Installation Type

8.5 Absolute $ Opportunity Analysis Installation Type , 2025-2030

Chapter 9. Global Switchgear Market– By End-User Industry

9.1 Introduction/Key Findings

9.2 Residential Sector

9.3 Commercial & Industrial Sector

9.4 Utilities & Power Generation

9.5 Transportation (Railways, Airports, Metro Systems)

9.6 Oil & Gas Industry

9.7 Data Centers & IT Infrastructure

9.8 Y-O-Y Growth trend Analysis End-User Industry

9.9 Absolute $ Opportunity Analysis End-User Industry , 2025-2030

Chapter 10. Switchgear Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Voltage Level

10.1.3. By Installation Type

10.1.4. By Insulation Type

10.1.5. End-User Industry

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Voltage Level

10.2.3. By Installation Type

10.2.4. By Insulation Type

10.2.5. End-User Industry

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Voltage Level

10.3.3. By End-User Industry

10.3.4. By Insulation Type

10.3.5. Installation Type

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By End-User Industry

10.4.3. By Insulation Type

10.4.4. By Voltage Level

10.4.5. Installation Type

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Installation Type

10.5.3. By End-User Industry

10.5.4. By Insulation Type

10.5.5. Voltage Level

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Switchgear Market– Company Profiles – (Overview, Service Voltage Level Portfolio, Financials, Strategies & Developments)

11.1 Siemens AG

11.2 ABB Ltd.

11.3 Schneider Electric SE

11.4 General Electric Company

11.5 Eaton Corporation plc

11.6 Mitsubishi Electric Corporation

11.7 Toshiba Corporation

11.8 Hitachi Energy Ltd.

11.9 Hyundai Electric & Energy Systems Co., Ltd.

11.10 Fuji Electric Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Switchgear Market is valued at USD 90 Billion and is projected to reach a market size of USD 129.81 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.6%.

Rising Energy Demand, Renewable Energy Integration, Technological Advancements & Infrastructure Development and Electrification Projects are the major drivers of Global Switchgear Market

Hypertension Management, Atrial Fibrillation Monitoring, Coronary Artery Disease (CAD) Therapy, Heart Failure Management & Stroke Prevention are the segments under the Global Switchgear Market by Application

Asia Pacific is the most dominant region for the Global Switchgear Market.

Middle East & Africa is the fastest-growing region in the Global Switchgear Market.