Surplus Food Market Size (2025–2030)

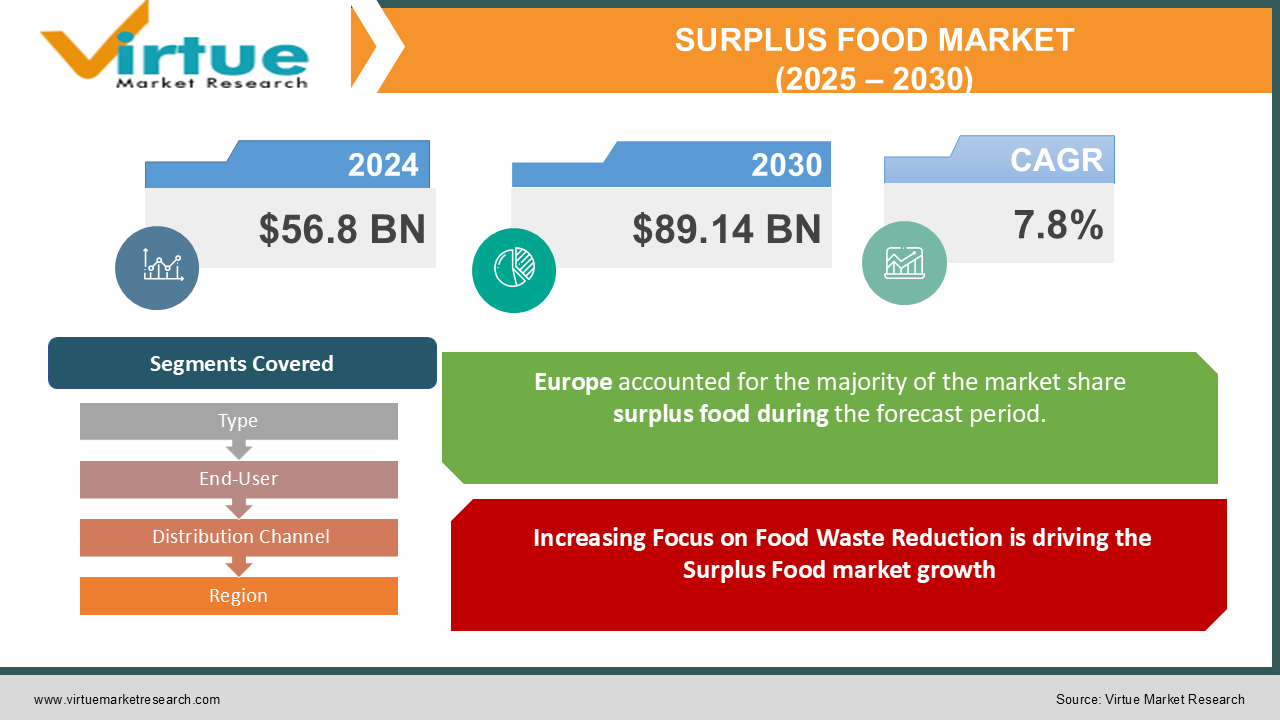

The Global Surplus Food Market was valued at USD 56.8 billion in 2024 and is expected to grow at a CAGR of 7.8% during the forecast period, reaching an estimated value of USD 89.14 billion by 2030.

The market addresses the redistribution of surplus food, which encompasses edible but unsold, unconsumed, or near-expiry food from various sources. Rising awareness about food waste reduction, sustainability initiatives, and government policies promoting food recovery have significantly driven market growth. Additionally, innovations in storage and logistics have enhanced the feasibility of redistributing surplus food, fueling demand across multiple sectors.

The surplus food market refers to the buying and selling of excess food that would otherwise go to waste. This market emerges from various sources, including unsold produce from farms, overstocked inventory from grocery stores, and surplus food from restaurants and food manufacturers. By redirecting this surplus food to those in need or innovative upcycling businesses, the market aims to reduce food waste and promote sustainability. This growing market is driven by increasing consumer awareness of food waste, technological advancements enabling efficient food redistribution, and supportive government policies. Various stakeholders, such as farmers, retailers, food banks, and social enterprises, are actively participating in this market to address food insecurity and environmental concerns.

Key Market Insights:

-

Prepared Food accounts for the largest share, driven by surplus food recovery from restaurants, catering services, and events.

-

Retailers dominate the end-user segment, contributing over 40% of the Surplus Food market share by redistributing unsold goods nearing expiry.

-

The online distribution channel is gaining traction due to the emergence of platforms facilitating surplus food donations or purchases.

-

Europe leads the global Surplus Food market, supported by stringent regulations against food waste and strong community-driven initiatives.

-

Innovations in cold chain logistics are enhancing the redistribution of perishable items, reducing wastage, and increasing recovery rates.

-

Collaboration between food recovery organizations and large corporations is creating scalable solutions for tackling food waste.

-

Rising consumer awareness about sustainability and the environment is fueling demand for surplus food among households and charities.

-

Food banks and non-profits are playing a critical role, in bridging the gap between surplus food suppliers and recipients.

Global Surplus Food Market Drivers:

1. Increasing Focus on Food Waste Reduction is driving the Surplus Food market growth

The escalating issue of global food waste has put pressure on businesses, governments, and individuals to act. Approximately 1.3 billion tons of food is wasted globally each year, representing one-third of all food produced. This is creating a significant opportunity for surplus food recovery and redistribution. Governments are imposing stricter regulations to address this, with many mandating food recovery programs in retail and food service sectors. For instance, the EU’s Farm to Fork Strategy aims to halve food waste by 2030, fostering the growth of the surplus food market. Concurrently, corporations are integrating waste reduction into their sustainability goals, and creating partnerships with recovery organizations.

2. Growth of Digital Platforms for Redistribution is driving the Surplus Food market growth

Digital platforms and mobile applications are revolutionizing how surplus food is redistributed. Companies like Too Good To Go, Olio and Food Rescue US are connecting surplus food sources with consumers and charities, enabling real-time recovery. These platforms leverage geolocation and data analytics to streamline operations, enhancing their reach and efficiency. The convenience and transparency offered by these platforms have garnered widespread adoption, particularly among millennials and Gen Z consumers who value sustainability. Furthermore, partnerships between tech firms and non-profits are driving innovation, expanding the surplus food market to underserved regions.

3. Supportive Policies and Initiatives is driving the Surplus Food market growth

Governments worldwide are introducing policies to combat food waste, encouraging surplus food recovery. For example, France mandates supermarkets to donate unsold food to charities, while Italy provides tax incentives to businesses donating surplus food. In the U.S., the Good Samaritan Food Donation Act protects donors from liability, promoting redistribution. Additionally, international organizations such as the United Nations and FAO are advocating for food waste reduction as part of their sustainability goals. These initiatives not only raise awareness but also create a supportive ecosystem for the surplus food market to thrive.

Global Surplus Food Market Challenges and Restraints:

1. Logistical and Storage Challenges is restricting the Surplus Food market growth

Efficiently redistributing surplus food, especially perishables, poses significant logistical challenges. The lack of adequate cold chain infrastructure in many regions leads to spoilage during transportation, undermining recovery efforts. High transportation costs and the need for rapid distribution further exacerbate the issue, particularly in rural and underdeveloped areas. Moreover, coordinating between multiple stakeholders—retailers, food service providers, and non-profits—requires robust systems, which are often underdeveloped. Investments in logistics and technology are essential to overcome these challenges and ensure timely redistribution.

2. Regulatory and Liability Concerns are restricting the Surplus Food market growth

While surplus food donation is encouraged, differing regulatory frameworks across countries can complicate the process. For instance, labeling requirements, liability risks, and quality standards can deter businesses from donating food. In some cases, fear of reputational damage from donating near-expiry or lower-quality food discourages participation. Although laws like the U.S. Good Samaritan Act provides legal protection, but such frameworks are not universal, leaving gaps in adoption. Addressing these regulatory and liability concerns through harmonized policies and awareness campaigns is critical to unlocking the Surplus Food market's potential.

Market Opportunities:

The surplus food market offers significant opportunities for growth, driven by advancements in technology, consumer awareness, and partnerships. Digital solutions such as blockchain are gaining momentum in the market, enabling traceability and accountability in food recovery operations. These technologies ensure that donated food meets safety standards, boosting confidence among donors and recipients. Additionally, partnerships between retailers and food banks are expanding, creating scalable redistribution models that maximize surplus food recovery. The rise of upcycled food products—where surplus food is processed into new products—represents another avenue for growth. Companies are increasingly turning to upcycling as a means to monetize surplus food while reducing waste. For example, surplus fruits can be used to produce juices or preserves, while unsold bread can be repurposed into breadcrumbs or beer. Moreover, as consumers become more eco-conscious, they are more willing to purchase surplus food at discounted rates, creating a growing market for surplus retail. Retailers and food service providers can tap into this demand by promoting the environmental benefits of surplus food consumption, aligning with consumer values, and boosting profitability.

ROBOTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.8% |

|

Segments Covered |

By Type, End-User, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Olio, Too Good To Go, FoodCloud, City Harvest, Food Rescue US, FareShare, Second Harvest, Imperfect Foods, ReFED, Copia |

Surplus Food Market Segmentation: By Type

-

Prepared Food

-

Unprepared Food

-

Packaged Food

Prepared Food holds the largest Surplus Food market share, driven by surplus recovery from restaurants and catering services. These foods are typically redirected to food banks and charities, addressing immediate food insecurity needs while reducing waste.

Surplus Food Market Segmentation: By End-User

-

Foodservice Providers

-

Retailers

-

Households

Retailers dominate this segment, contributing over 40% of the Surplus Food market share. Unsold items nearing expiry or imperfect goods are redistributed through food recovery programs, helping retailers align with sustainability goals and reduce waste management costs.

Surplus Food Market Segmentation: By Distribution Channel

-

Online

-

Offline

The online distribution channel is witnessing rapid growth due to the rise of mobile apps and platforms facilitating real-time surplus food recovery. These platforms provide convenience and transparency, enabling wider adoption among both donors and recipients.

Surplus Food Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East & Africa

Europe leads the global surplus food market, accounting for approximately 38% of the market share in 2024. The region’s strong regulatory framework, including bans on food waste in countries like France and Italy, drives market growth. Non-profit organizations and community initiatives play a pivotal role in redistributing surplus food, supported by government incentives. Europe’s advanced infrastructure and high consumer awareness further bolster the region's dominance.

COVID-19 Impact Analysis:

The COVID-19 pandemic had a profound impact on the surplus food market, both positively and negatively. During the initial phases of the pandemic, disruptions in the food supply chain and the closure of food service providers led to an increase in surplus food. However, the redistribution process was hampered by logistical challenges and reduced workforce availability. As the pandemic progressed, food recovery organizations adapted by leveraging digital platforms and contactless distribution methods, enabling continued operations. The crisis underscored the importance of food security and waste reduction, leading to increased investment in surplus food recovery initiatives post-pandemic. Governments and non-profits also ramped up efforts to address rising food insecurity, boosting the demand for surplus food redistribution.

Latest Trends/Developments:

The food industry is undergoing a sustainability revolution, driven by a growing awareness of food waste and a desire for eco-conscious choices. Companies are at the forefront of this movement, innovating by upcycling surplus food into new and delicious products. This not only reduces waste but also caters to the increasing demand from consumers who prioritize sustainability. To ensure transparency and accountability in the food redistribution process, blockchain technology is being integrated. This cutting-edge technology enables traceability of food items from source to consumer, fostering trust and confidence. Additionally, the rise of food recovery apps has streamlined the process of connecting surplus food sources with recipients, making it more efficient than ever before. Corporate partnerships between retailers and food banks are further amplifying the impact of food recovery efforts, creating scalable models to address the issue on a larger scale. By educating consumers about the benefits of consuming surplus food and promoting awareness campaigns, the industry is encouraging wider adoption of sustainable food practices. These collective efforts are shaping a future where food waste is minimized, resources are optimized, and a more sustainable food system is realized.

Key Players:

-

Olio

-

Too Good To Go

-

FoodCloud

-

City Harvest

-

Food Rescue US

-

FareShare

-

Second Harvest

-

Imperfect Foods

-

ReFED

-

Copia

Chapter 1. Surplus Food Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Surplus Food Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Surplus Food Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Surplus Food Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Surplus Food Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Surplus Food Market – By Type

6.1 Introduction/Key Findings

6.2 Prepared Food

6.3 Unprepared Food

6.4 Packaged Food

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Surplus Food Market – By End-User

7.1 Introduction/Key Findings

7.2 Foodservice Providers

7.3 Retailers

7.4 Households

7.5 Y-O-Y Growth trend Analysis By End-User

7.6 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 8. Surplus Food Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Online

8.3 Offline

8.4 Y-O-Y Growth trend Analysis By Distribution Channel

8.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Surplus Food Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By End-User

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By End-User

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By End-User

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By End-User

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By End-User

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Surplus Food Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Olio

10.2 Too Good To Go

10.3 FoodCloud

10.4 City Harvest

10.5 Food Rescue US

10.6 FareShare

10.7 Second Harvest

10.8 Imperfect Foods

10.9 ReFED

10.10 Copia

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Surplus Food market was valued at USD 56.8 billion in 2024 and is projected to reach USD 89.14 billion by 2030, growing at a CAGR of 6.7%.

Key drivers include the focus on food waste reduction, the growth of digital platforms, and supportive government policies.

- Segments include:

- By Type: Prepared Food, Unprepared Food, Packaged Food

- By End-User: Foodservice Providers, Retailers, Households

- By Distribution Channel: Online, Offline

Europe dominates the Surplus Food market, accounting for 38% of the share, due to strong regulations and high consumer awareness.

Leading players include Olio, Too Good To Go, FoodCloud, City Harvest, and FareShare.