Surgical Staplers Market Size (2024 – 2030)

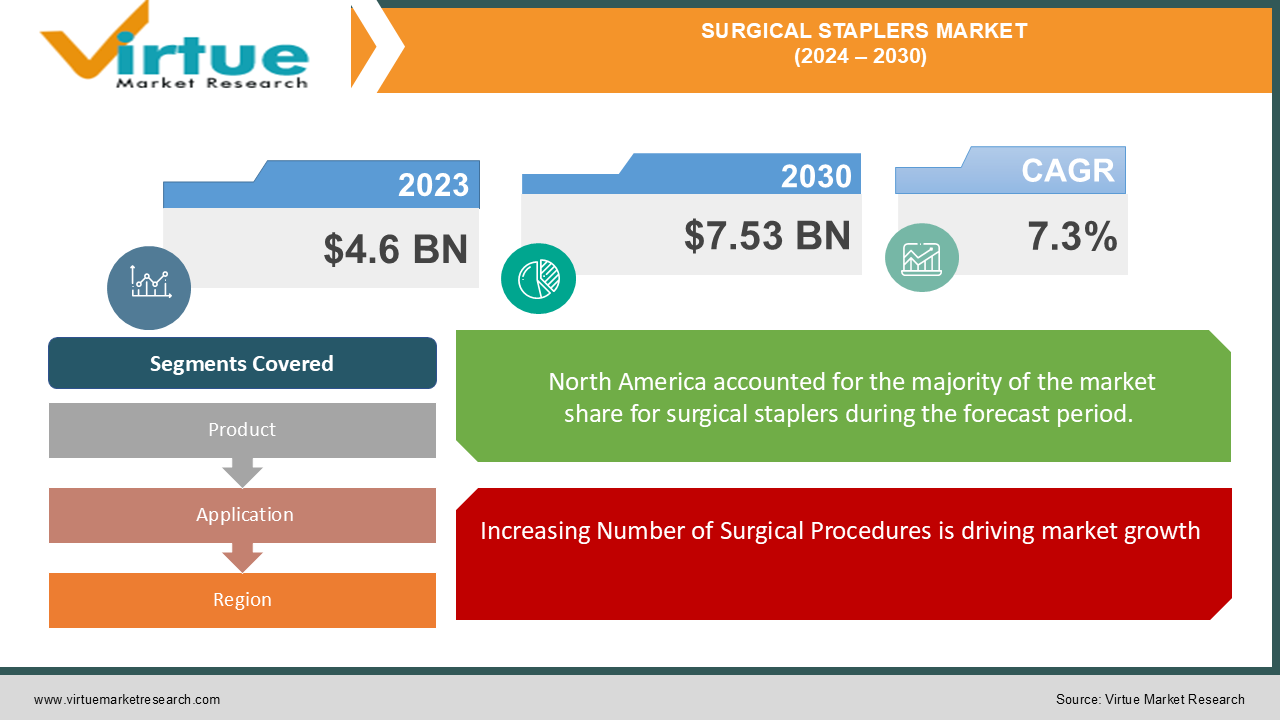

The global Surgical Staplers Market is experiencing rapid growth, driven by increasing surgical procedures and technological advancements in the medical field. The market was valued at approximately USD 4.6 billion in 2023 and is expected to grow at a CAGR of 7.3% from 2024 to 2030. By 2030, the market is projected to reach USD 7.53 billion.

Surgical staplers are increasingly being preferred over sutures for wound closure due to their precision, reduced surgery time, and decreased chances of infection. The rise in bariatric surgeries, along with a growing aging population, is also contributing significantly to the market's expansion.

Key Market Insights

The disposable surgical staplers segment dominates the market, accounting for over 65% of the total market share in 2023, due to their cost-effectiveness and reduced risk of infection.

North America holds the largest market share, with the U.S. contributing significantly due to the high adoption rate of advanced surgical tools and a large number of surgical procedures performed annually.

The Asia-Pacific region is expected to witness the highest growth rate during the forecast period, driven by increasing healthcare investments, a growing number of hospitals, and rising awareness about advanced surgical tools.

The rising prevalence of chronic diseases, including obesity, cardiovascular diseases, and cancer, is fueling the demand for surgical staplers, as these conditions often require surgical intervention.

The market faces challenges due to the high cost of advanced surgical staplers and the potential for postoperative complications, which could hinder market growth.

Increasing research and development activities focused on improving the safety and efficiency of surgical staplers are likely to create new growth opportunities in the market.

Global Surgical Staplers Market Drivers:

Increasing Number of Surgical Procedures is driving market growth: The global rise in the number of surgeries, including minimally invasive procedures, is a key driver for the surgical staplers market. The growing prevalence of chronic diseases such as cancer, cardiovascular diseases, and obesity has led to a surge in surgical interventions. Additionally, the increasing number of cesarean deliveries is contributing to the demand for surgical staplers. These staplers offer quicker wound closure, reduced operation time, and decreased chances of infection, making them a preferred choice in modern surgical practices.

Technological Advancements in Surgical Staplers is driving market growth: Technological innovations in surgical staplers, such as the development of powered staplers and those with integrated imaging technologies, are driving market growth. Powered surgical staplers, which require less manual force, offer better control, precision, and consistency during surgeries. The integration of imaging technologies allows for real-time visualization, ensuring accurate placement of staples. These advancements are particularly beneficial in complex surgeries, where precision is critical, and are expected to further boost the adoption of surgical staplers.

Growing Preference for Minimally Invasive Surgeries is driving market growth: There is a growing trend towards minimally invasive surgeries (MIS), which require smaller incisions, leading to quicker recovery times and reduced postoperative complications. Surgical staplers are extensively used in MIS procedures for tasks such as tissue resection, anastomosis, and wound closure. The benefits of MIS, including shorter hospital stays and reduced pain, are leading to an increased adoption of surgical staplers in these procedures, thereby driving market growth.

Global Surgical Staplers Market Challenges and Restraints:

High Cost of Surgical Staplers is restricting market growth: One of the primary challenges facing the surgical staplers market is the high cost associated with advanced stapling devices. While manual staplers are relatively affordable, powered staplers and those with advanced features are significantly more expensive. This cost factor can be a barrier to adoption, particularly in emerging markets where healthcare budgets are limited. Additionally, the cost of disposable staplers, which are used only once and then discarded, can add up, making it an expensive option for hospitals and surgical centers.

Risk of Postoperative Complications is restricting market growth: Despite the advantages of surgical staplers, there are concerns regarding potential postoperative complications, such as staple line leakage, bleeding, and infections. In some cases, improper stapler use or device malfunction can lead to severe complications, including anastomotic leaks or tissue damage. These risks have led to recalls of certain stapler models in the past and have raised concerns about the safety of these devices. As a result, some surgeons remain cautious about using staplers, preferring traditional suturing methods in specific scenarios.

Market Opportunities:

The surgical staplers market is poised for significant growth, driven by several key advancements and trends. One of the most promising areas of development is the innovation of bioabsorbable and biodegradable staplers. These cutting-edge staplers eliminate the need for post-surgery staple removal, which can enhance patient comfort and improve overall outcomes by minimizing complications. Another major opportunity lies in the increasing adoption of robotic-assisted surgeries. This trend is creating demand for advanced surgical staplers designed to integrate seamlessly with robotic systems. Such staplers provide enhanced precision and control, making them ideal for complex procedures where accuracy is crucial. Additionally, the expanding focus on improving healthcare infrastructure in emerging markets presents a substantial growth opportunity. As these regions invest more in healthcare and see rising healthcare expenditures, there is a growing demand for advanced surgical tools, including sophisticated stapling devices. This shift offers market players a chance to establish and expand their presence in these developing areas. Overall, the development of bioabsorbable staplers, the integration of stapling devices with robotic systems, and the expanding healthcare markets in emerging regions are all driving factors that present substantial opportunities for growth in the surgical staplers market.

SURGICAL STAPLERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.3% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ethicon Inc. (Johnson & Johnson), Medtronic Plc, CONMED Corporation, Smith & Nephew Plc, 3M Company, B. Braun Melsungen AG, Intuitive Surgical Inc., Purple Surgical Holdings Limited, Grena Ltd., Frankenman International Ltd. |

Surgical Staplers Market Segmentation: By Product

-

Manual Surgical Staplers

-

Powered Surgical Staplers

In the product category, powered surgical staplers are expected to dominate the market due to their advanced features and growing adoption in complex surgeries.

Surgical Staplers Market Segmentation: By Application

-

General Surgery

-

Orthopedic Surgery

-

Cardiovascular Surgery

In the application category, general surgery remains the most dominant segment, driven by the high number of procedures and the widespread use of staplers in these surgeries.

Surgical Staplers Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America holds the dominant position in the surgical staplers market, accounting for the largest share in 2023. The region's dominance is attributed to the high adoption of advanced surgical technologies, a large number of surgical procedures performed annually, and the presence of major market players. The U.S., in particular, contributes significantly to the market, driven by its well-established healthcare infrastructure and the growing demand for minimally invasive surgeries.

COVID-19 Impact Analysis on the Surgical Staplers Market:

The COVID-19 pandemic had a mixed impact on the surgical staplers market. In the initial months of the pandemic, elective surgeries were postponed or canceled to prioritize COVID-19 patients and reduce the risk of virus transmission. This led to a temporary decline in the demand for surgical staplers. However, as healthcare systems adapted to the new normal, the market began to recover. The increasing need for surgeries related to COVID-19 complications, such as tracheostomies and emergency procedures, provided some support to the market during this period. Additionally, the pandemic accelerated the adoption of minimally invasive surgeries, which require fewer resources and offer faster recovery times, further driving the demand for surgical staplers. As healthcare systems continue to recover and elective surgeries resume, the market is expected to regain its growth trajectory.

Latest Trends/Developments:

The surgical staplers market is evolving with several key trends that are influencing its future growth. One prominent trend is the increasing use of robotic-assisted surgeries, which necessitate advanced stapling devices that are compatible with robotic systems. These robotic-compatible staplers offer enhanced precision and control, making them particularly suited for complex and delicate procedures. Another significant trend is the development of bioabsorbable and biodegradable staplers. These innovative devices eliminate the need for staple removal after surgery, thus minimizing post-operative complications and improving patient recovery. The focus on these types of staplers reflects a broader commitment to reducing invasive procedures and enhancing patient outcomes. The integration of imaging technologies with stapling devices is also gaining traction. This advancement allows surgeons to visualize tissue layers in real-time, ensuring more accurate staple placement and improving the overall precision of surgical interventions. By providing immediate feedback, these technologies help in achieving better surgical results. Additionally, there is a growing emphasis on ergonomically designed powered staplers. Manufacturers are investing in these designs to address surgeon fatigue, which can impact performance and outcomes. Powered staplers with ergonomic features are designed to enhance comfort and efficiency, leading to improved surgical results and reduced physical strain on surgeons. These trends—robotic assistance, bioabsorbable materials, imaging integration, and ergonomic designs—are driving the expansion of the surgical staplers market. As these technologies continue to advance, they are expected to further enhance the capabilities of surgical staplers, leading to improved surgical precision, patient outcomes, and overall market growth in the coming years.

Key Players:

-

Ethicon Inc. (Johnson & Johnson)

-

Medtronic Plc

-

CONMED Corporation

-

Smith & Nephew Plc

-

3M Company

-

B. Braun Melsungen AG

-

Intuitive Surgical Inc.

-

Purple Surgical Holdings Limited

-

Grena Ltd.

-

Frankenman International Ltd.

Chapter 1. Surgical Staplers Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Surgical Staplers Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Surgical Staplers Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Surgical Staplers Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Surgical Staplers Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Surgical Staplers Market – By Product Type

6.1 Introduction/Key Findings

6.2 Manual Surgical Staplers

6.3 Powered Surgical Staplers

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Surgical Staplers Market – By Application

7.1 Introduction/Key Findings

7.2 General Surgery

7.3 Orthopedic Surgery

7.4 Cardiovascular Surgery

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Surgical Staplers Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Surgical Staplers Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Ethicon Inc. (Johnson & Johnson)

9.2 Medtronic Plc

9.3 CONMED Corporation

9.4 Smith & Nephew Plc

9.5 3M Company

9.6 B. Braun Melsungen AG

9.7 Intuitive Surgical Inc.

9.8 Purple Surgical Holdings Limited

9.9 Grena Ltd.

9.10 Frankenman International Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Surgical Staplers Market was valued at approximately USD 4.6 billion in 2023 and is projected to reach USD 7.53 billion by 2030, growing at a CAGR of 7.3% during the forecast period from 2024 to 2030.

The key drivers of the Global Surgical Staplers Market include the increasing number of surgical procedures, advancements in surgical stapler technology, and the growing preference for minimally invasive surgeries.

The market is segmented based on product type (manual and powered surgical staplers) and application (general surgery, orthopedic surgery, and cardiovascular surgery).

North America is the most dominant region in the Surgical Staplers Market, driven by the high adoption of advanced surgical technologies and the large number of surgical procedures performed annually.

The leading players in the Global Surgical Staplers Market include Ethicon Inc. (Johnson & Johnson), Medtronic Plc, CONMED Corporation, Smith & Nephew Plc, and 3M Company.