Surgical Equipment Market Size (2024 – 2030)

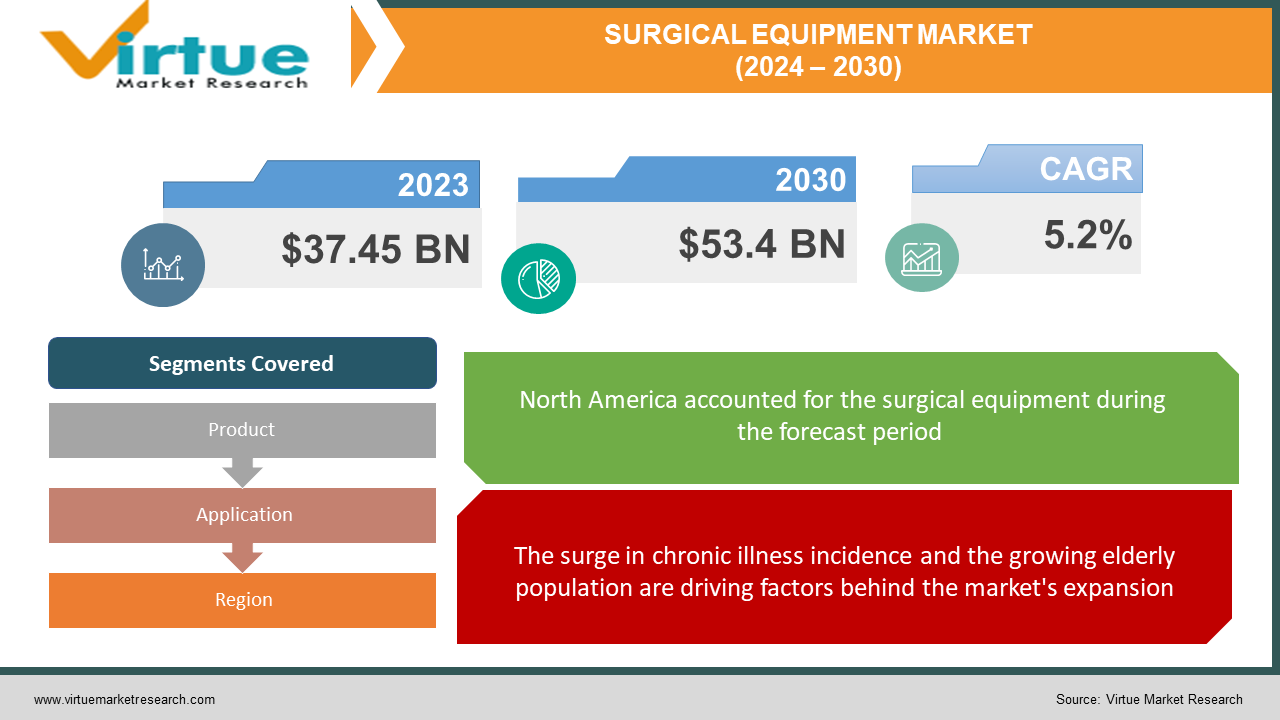

The Global Surgical Equipment Market size was exhibited at USD 37.45 billion in 2023 and is projected to hit around USD 53.4 billion by 2030, growing at a CAGR of 5.2% during the forecast period from 2024 to 2030.

Surgical instruments encompass an array of tools, instruments, and devices employed by healthcare professionals, including surgeons, nurses, and other medical personnel, in the course of surgical procedures. These implements are purposefully designed to facilitate precise, safe, and efficient execution of surgical tasks. Covering a diverse range, each item serves a distinct function within the operating room, contributing to the physical alteration of biological tissue or aiding access to the internal body. The evolution of modern electronic technologies, particularly in minimally invasive surgery equipment, plays a pivotal role in propelling the growth of the surgical equipment market.

The escalating incidence of chronic ailments such as cardiovascular diseases, cancer, and diabetes necessitates an increased number of surgical interventions for diagnosis, treatment, and management, thereby fostering market expansion. The demand for specialized surgical instruments, diagnostic tools, and monitoring devices is heightened in addressing these medical conditions. Additionally, the surge in minimally invasive surgery popularity and the growing aging population, susceptible to ocular disorders, gastric disorders, intestinal disorders, and various health conditions, contribute to the market dynamics.

Key Market Insights:

A fundamental catalyst for the growth in the surgical equipment market is the continual advancement in technology. Progress in materials, design, and manufacturing processes has yielded more precise, efficient, and minimally invasive surgical instruments. These innovations not only enhance surgical outcomes but also broaden the scope of feasible procedures.

The increasing adoption of minimally invasive surgical techniques, attributed to benefits such as smaller incisions, reduced pain, shorter hospital stays, and faster recovery times, fuels the demand for specialized surgical equipment like laparoscopic instruments and endoscopes, driving market growth.

The market is poised for growth due to factors such as improved healthcare infrastructure, escalating unmet healthcare needs, rising prevalence of chronic diseases, and increased demand for advanced surgical equipment products. The upsurge in the aging population contributes to a higher incidence of age-related health conditions and chronic diseases, necessitating surgical interventions. Additionally, there is a rising demand for elective cosmetic and reconstructive surgeries, further boosting the volume of surgical procedures and driving the demand for surgical equipment.

Furthermore, emerging markets and developing countries are experiencing substantial investments in healthcare infrastructure, leading to the establishment of new hospitals, clinics, and healthcare centers. This expansion creates a significant demand for surgical equipment, presenting an opportunity for market growth on a global scale.

Global Surgical Equipment Market Drivers:

The surge in chronic illness incidence and the growing elderly population are driving factors behind the market's expansion.

The global market for surgical instruments and equipment is witnessing growth due to the increasing incidence of chronic illnesses, a globally aging population, and a rise in road traffic accidents. In 2022, an estimated 703 million individuals aged 65 and older were living worldwide. This demographic group is undergoing a higher number of procedures due to the increased prevalence of chronic conditions such as cancer, arthritis, and cardiovascular diseases. According to the American Association of Retired Persons, older patients contribute to over 40% of inpatient procedures and 33% of outpatient surgeries. Consequently, the combination of an aging population and the uptick in chronic diseases is anticipated to propel market growth in the coming years.

As awareness about minimally invasive procedures increases, the global surgical equipment market share is expected to experience accelerated growth. Patients are becoming more informed about the financial advantages of early surgical intervention, contributing significantly to the heightened demand for such procedures.

The market is expected to receive stimulation from increasing government spending.

Growing investments by governments in healthcare infrastructure, coupled with regulations facilitating foreign direct investment (FDI) in emerging nations, are fostering the expansion of surgical equipment. The heightened occurrence of injuries, including sports-related injuries, road accidents, and cardiovascular procedures, is bolstering the demand for surgical equipment. The World Health Organization reported that cardiovascular diseases accounted for 32% of global fatalities. With the rising prevalence of cardiovascular diseases, the global surgical equipment market is witnessing growth. According to the Orthopedic Journal of Sports Medicine, Chinese athletes are more prone to injuries compared to their American counterparts, contributing to the escalating need for surgical equipment in response to the growing number of sports injuries.

Anticipated developments in surgical equipment and increased industry investments are expected to offer growth prospects in the near future. Healthcare providers are increasingly inclined to acquire state-of-the-art surgical equipment to enhance their capabilities.

Global Surgical Equipment Market Restraints and Challenges:

The impediment to market growth arises from suboptimal sterilization procedures, diminishing the reusability of surgical equipment.

Postoperative infections stand out as a common cause of mortality following surgical interventions. These infections can stem from environmental factors, medications, or inadequately sterilized surgical equipment. The sterilization of surgical instruments is a meticulous and time-consuming process conducted by trained professionals. However, due to insufficient staff and a shortage of surgical equipment, the sterilization process may be rushed, resulting in adverse consequences for human health. The diminished reusability of equipment not only increases medical waste but also leads to the inefficient utilization of surgical equipment. Consequently, inadequate sterilization procedures pose a significant hindrance to the market's growth.

The market faces an obstacle in the form of the high cost of surgical equipment.

The substantial cost associated with surgical equipment, coupled with a low adoption rate in emerging and underdeveloped nations, poses a barrier to the market's growth trajectory. This surgical equipment market report comprehensively details recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, opportunities arising from emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, and technological innovations within the market.

Global Surgical Equipment Market Opportunities:

The surge in research and development spending, propelling innovation within the industry.

The growing demand for surgical procedures acts as a catalyst for innovation, prompting improvements in surgical equipment regarding functionality, efficiency, and life cycle. The integration of robotics in the medical domain has resulted in the creation of automated, minimally invasive, and efficient surgical equipment that can be operated externally for intricate surgeries. Additionally, novel technologies are being introduced to streamline the sterilization process of surgical equipment, ensuring enhanced safety, sanitation, and reduced downtime. Similarly, the incorporation of RFID tags into surgical equipment facilitates position tracking, minimizing the occurrence of surgical instruments being unintentionally left inside the patient's body. Therefore, the escalating investment in research and development, driving innovation within the industry, presents lucrative opportunities for the growth of the global surgical equipment market in the forecast period.

SURGICAL EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

B. Braun Melsungen Ag, Smith & Nephew plc, Zimmer Biomet Holdings Inc., Stryker Corporation, Alcon Laboratories Inc., Aspen Surgical Products, Inc., Medtronic Inc., Ethicon Inc., Becton, Dickinson and Company |

Global Surgical Equipment Market Segmentation: By Product

-

Surgical Sutures & Staplers

-

Handheld Surgical Devices

-

Forceps & Spatulas

-

Retractors

-

Dilators

-

Graspers

-

Auxiliary Instruments

-

Cutter Instruments

-

Others

-

Electrosurgical Devices

The market was led by the surgical sutures and staplers segment, accounting for a revenue share exceeding 45.0% in 2023. This dominance is attributed to the widespread adoption of sutures and staplers, particularly in wound closure procedures. The staplers segment is poised to emerge prominently, given the advantages it offers over sutures, including rapid wound healing and a lower risk of infection. The market categorization by product encompasses surgical sutures and staplers, handheld surgical devices, and electrosurgical devices.

In 2022, the handheld surgical devices segment held a substantial revenue share and is expected to experience robust growth throughout the projection period. Within this segment, subcategories include forceps and spatulas, retractors, dilators, graspers, auxiliary instruments, cutter instruments, and others. A noteworthy trend in this segment is the shift towards disposable instruments, driven by factors such as cost-effectiveness and a reduced risk of cross-contamination.

Global Surgical Equipment Market Segmentation: By Application

-

Neurosurgery

-

Plastic & Reconstructive Surgery

-

Wound Closure

-

Obstetrics & Gynecology

-

Cardiovascular

-

Orthopedic

-

Others

The "others" segment secured the largest revenue share, surpassing 27.9% in 2023. The obstetrics and gynecology segment followed closely, driven by the global increase in childbirths and the surge in female reproductive organ disorders necessitating gynecological surgeries. Notably, an estimated 1,148,692 cesarean surgeries were performed in the U.S. The application-based segmentation includes neurosurgery, plastic and reconstructive surgery, wound closure, obstetrics and gynecology, cardiovascular, orthopedic, and others.

The plastic and reconstructive surgery segment is anticipated to exhibit the swiftest growth during the forecast period. Factors such as rising disposable income, technological advancements, and an increasing demand for enhanced aesthetic appeal are expected to fuel segmental growth. The growth is further propelled by individuals in the entertainment industry focusing on their appearance.

Global Surgical Equipment Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America commanded the largest revenue share, exceeding 39.5% in 2023. This is attributed to factors such as high healthcare expenditure, the presence of well-established hospitals, and major players operating in the U.S. Additionally, technological advancements and a growing demand for minimally invasive surgeries are expected to drive regional market growth over the forecast period.

Asia-Pacific is poised to be the fastest-growing regional market during the forecast period. Increasing disposable income in countries like India and China is expected to boost the plastic and reconstructive surgeries segment, contributing to overall regional market growth. The rising geriatric population in the region is anticipated to lead to an increase in orthopedic and cardiovascular procedure volumes.

COVID-19 Impact on the Global Surgical Equipment Market:

The global surgical equipment market experienced a substantial adverse impact due to the COVID-19 pandemic. The market witnessed a sharp decline in the sales of surgical equipment as a consequence of the disruptions caused by the government-imposed lockdowns and restrictions, leading to a significant disturbance in the supply chain. Simultaneously, a shift in healthcare priorities and precautionary measures to curb the virus's spread resulted in the postponement of numerous surgeries and procedures, creating a substantial backlog in the overall number of surgical interventions and adversely affecting the market.

The financial losses incurred during the pandemic compelled the closure of several ambulatory surgical centers. However, with the introduction of vaccines and increased governmental focus on strategic plans for potential outbreaks, the market has exhibited signs of recovery in the past year. Additionally, efforts are being made to address the backlogs that emerged during the pandemic, contributing to the positive outlook for the market's growth in the foreseeable future.

Recent Trends and Innovations in the Global Surgical Equipment Market:

In June 2022, Johnson & Johnson MedTech's Ethicon division announced the introduction of the ECHELON 3000 Stapler in the U.S. This digitally enabled device offers surgeons a straightforward, one-handed powered articulation to address the distinct requirements of their patients.

In April 2022, Ethicon, a part of Johnson & Johnson MedTech, unveiled the ENSEAL X1 Straight Jaw Tissue Sealer. This advanced bipolar energy device not only cuts and transects but also enables more robust sealing, capturing a greater amount of tissue per bite.

In December 2022, Solvay collaborated with the French start-up Ostium to facilitate the mechanical recycling of end-of-life single-use surgical equipment incorporating glass fiber. This collaboration exemplifies the compatibility of high-performance polymers, such as Solvay's Ixef PARA in single-use surgical instruments, with the imperative for enhanced sustainability and resource efficiency in healthcare. This pioneering initiative marks the first instance of valuable polymers being recycled and upcycled from used healthcare devices. The collaboration enabled the development of a specialized mechanical process for cleaning the collected material and supplying high-quality polymer feedstock, thereby supporting the creation of new polymers.

Key Players:

-

B. Braun Melsungen Ag

-

Smith & Nephew plc

-

Zimmer Biomet Holdings Inc.

-

Stryker Corporation

-

Alcon Laboratories Inc.

-

Aspen Surgical Products, Inc.

-

Medtronic Inc.

-

Ethicon Inc.

-

Becton, Dickinson and Company

Chapter 1. Surgical Equipment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Surgical Equipment Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Surgical Equipment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Surgical Equipment Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Surgical Equipment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Surgical Equipment Market – By Product

6.1 Introduction/Key Findings

6.2 Surgical Sutures & Staplers

6.3 Handheld Surgical Devices

6.4 Forceps & Spatulas

6.5 Retractors

6.6 Dilators

6.7 Graspers

6.8 Auxiliary Instruments

6.9 Cutter Instruments

6.10 Others

6.11 Electrosurgical Devices

6.12 Y-O-Y Growth trend Analysis By Product

6.13 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Surgical Equipment Market – By Application

7.1 Introduction/Key Findings

7.2 Neurosurgery

7.3 Plastic & Reconstructive Surgery

7.4 Wound Closure

7.5 Obstetrics & Gynecology

7.6 Cardiovascular

7.7 Orthopedic

7.8 Others

7.9 Y-O-Y Growth trend Analysis By Application

7.10 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Surgical Equipment Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Surgical Equipment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 B. Braun Melsungen Ag

9.2 Smith & Nephew plc

9.3 Zimmer Biomet Holdings Inc.

9.4 Stryker Corporation

9.5 Alcon Laboratories Inc.

9.6 Aspen Surgical Products, Inc.

9.7 Medtronic Inc.

9.8 Ethicon Inc.

9.9 Becton, Dickinson and Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Surgical Equipment Market size is valued at USD 37.45 billion in 2023.

The worldwide Global Surgical Equipment Market growth is estimated to be 5.2% from 2024 to 2030.

The Global Surgical Equipment Market is segmented By Product (Surgical Sutures & Staplers, Handheld Surgical Devices, Electrosurgical Devices), By Application (Neurosurgery, Plastic & Reconstructive Surgery, Wound Closure, Obstetrics & Gynecology, Cardiovascular, Orthopedic, Others).

The Global Surgical Equipment Market is poised for transformative growth, driven by advancements in minimally invasive procedures, robotic-assisted surgeries, and increasing demand for precision instruments. Opportunities lie in expanding healthcare infrastructure, rising geriatric population, and technological innovations, fostering a dynamic landscape for industry players.

The COVID-19 pandemic has reshaped the Global Surgical Equipment Market, with disruptions in elective procedures, supply chain challenges, and heightened focus on infection control measures. Telemedicine integration, accelerated digitalization, and renewed emphasis on resilient healthcare systems emerge as pivotal trends amid this transformative period.