Surfboard Market Size (2024 – 2030)

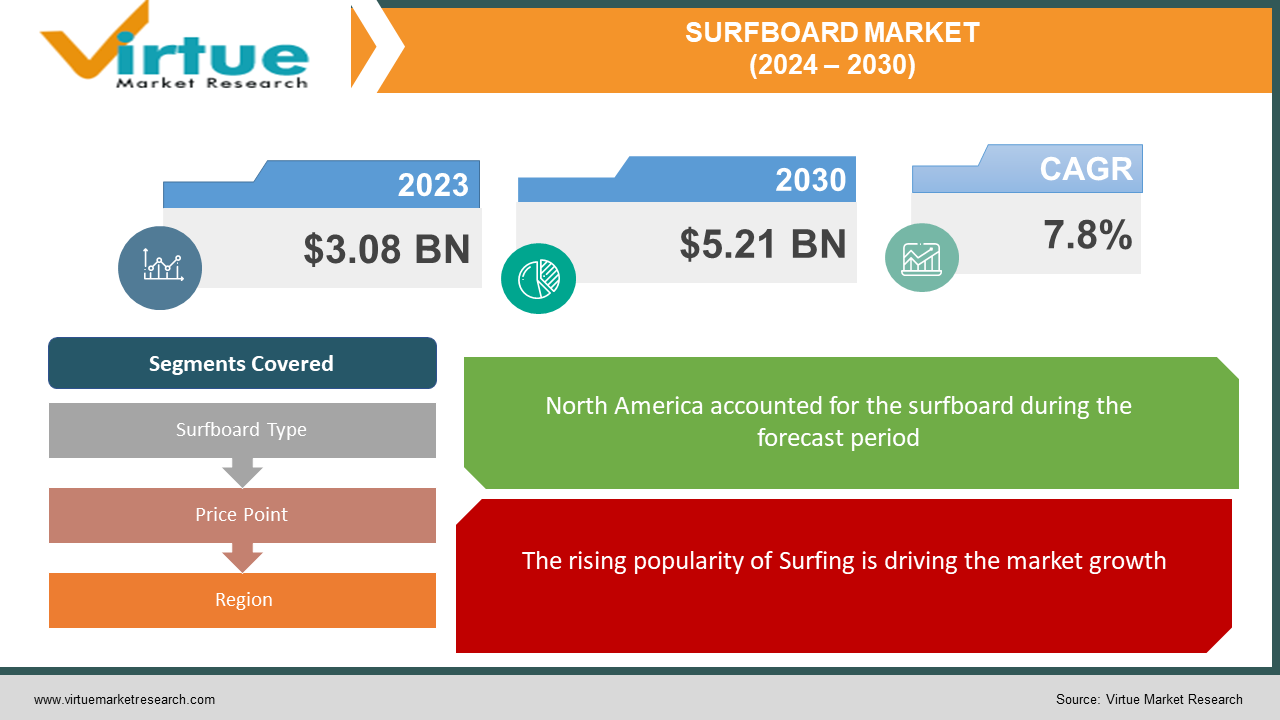

The Global Surfboard Market was valued at USD 3.08 billion in 2023 and will grow at a CAGR of 7.8% from 2024 to 2030. The market is expected to reach USD 5.21 billion by 2030.

Key Market Insights:

The surfboard market rides two waves: performance and accessibility. Established brands cater to experienced surfers with high-performance, lightweight designs using advanced materials like carbon fiber. This segment prioritizes responsiveness and wave-specific customization but can be expensive. On the other hand, a growing trend sees eco-conscious consumers demanding sustainable materials like cork and bamboo. Additionally, beginner and recreational surfers are driving demand for rental programs, soft-top learning boards, and inflatable options that are easier to transport and store. This affordability focus opens the door for new entrants, particularly in regions with growing surf tourism. Overall, the market thrives on innovation, with a focus on lighter, stronger, and more sustainable materials, while remaining mindful of price points to attract new participants and cater to the evolving needs of existing surfers.

Global Surfboard Market Drivers:

The rising popularity of Surfing is driving the market growth

Surfing is experiencing a surge in popularity as a recreational activity. More and more people are drawn to the challenge and exhilaration of catching waves. This rise in participation translates directly to a growing demand for surfboards. Whether it's the desire to emulate surfing superstars from televised competitions or simply a yearning for an adventurous connection with the ocean, the increasing interest in surfing is creating a wave (pun intended) of new surfers who need boards to ride. This presents a significant opportunity for the surfboard market, with manufacturers catering to this influx of enthusiastic beginners and experienced riders alike.

Growth in Surfing Competitions and Events which is driving the market growth

High-profile surfing competitions like the World Surf League (WSL) Championships act as a global stage for the sport, turning professional surfers into celebrities and surfing into a spectator sport. The aerial maneuvers, wipeouts, and close finishes of these events provide a thrilling spectacle that is broadcast around the world. This exposure not only ignites a passion for surfing in those watching but also fuels the desire to emulate their surfing heroes. Witnessing the athleticism and skill required to compete at the professional level inspires beginners to take their first tentative steps on a surfboard, while also motivating experienced surfers to hone their skills and push their limits. This newfound interest translates into a surge in demand for surfboards, as people around the world seek to experience the thrill of riding waves for themselves. Surfboard manufacturers capitalize on this wave of enthusiasm by strategically placing their products in the hands of competition surfers and using their victories to endorse and promote their latest surfboard models to aspiring surfers.

Surfing Education and Accessibility which is driving the market growth

In the past, learning to surf might have felt like an exclusive club you needed special connections to enter. But thanks to the rise of surf schools and educational programs, catching waves is becoming increasingly accessible to beginners of all ages and backgrounds. These programs break down the barriers to entry by providing professional instruction, high-quality equipment rentals, and a safe learning environment. Gone are the days of struggling to figure out surfboard etiquette or paddling techniques on your own. Surf schools offer a structured approach that builds confidence and competence, allowing beginners to experience the joy of surfing much quicker. This wider net cast by surf schools expands the potential customer base for surfboards exponentially. Instead of a niche group of experienced surfers, the market now includes a growing wave of enthusiastic newcomers who, having discovered the thrill of riding waves, are eager to invest in their surfboard. This not only translates to more sales for surfboard companies but also fosters a lifelong connection to the sport, ensuring a future generation of passionate surfers.

Global Surfboard Market challenges and restraints:

Traditional surfboard construction with materials like fiberglass and resin raises environmental concerns

Surfboard mainstays, fiberglass, and resin, come with a hidden environmental cost. Fiberglass production is energy-intensive and can release harmful chemicals. Resin curing often involves volatile organic compounds (VOCs) that pollute the air. Additionally, disposal of these materials after a board's lifespan is tricky. Landfills aren't ideal, and incineration releases toxins. Shapers are looking for eco-alternatives, but these might be pricier or require sacrificing some performance.

Fluctuating raw material costs restricting market growth

Fluctuating raw material costs are a constant wave of uncertainty for surfboard shapers. Polyurethane foam, the core of most surfboards, is susceptible to price swings based on the petroleum industry. When oil prices rise, foam manufacturers pass on those costs, squeezing surfboard profits. Resin, another key player, experiences similar volatility. Global supply chain disruptions can also cause shortages and price spikes. This unpredictability makes it difficult for shapers to set stable prices for their boards. If they raise prices to offset material cost increases, they risk losing customers to cheaper (but potentially lower quality) alternatives. Conversely, absorbing those costs can eat into profits and hinder their ability to invest in innovation or higher-quality materials. To navigate this challenge, some shapers are looking for alternative materials like bio-based resins or recycled foam cores. However, these options might be pricier or have slightly different performance characteristics. Ultimately, surfboard shapers have to find a delicate balance between managing costs, maintaining quality, and staying competitive in a market where price is a major wave to catch.

Market Opportunities:

The surging popularity of surfing presents a multitude of market opportunities. Fueled by the growing desire to experience the thrill of riding waves, the demand for surfboards is poised for significant growth. High-profile competitions like the WSL Championships act as a global stage, igniting a passion for surfing in viewers and inspiring them to emulate their surfing heroes. This translates into a surge in surfboard sales, with manufacturers strategically partnering with competition surfers to endorse their latest models. Furthermore, the rise of surf schools and educational programs is democratizing surfing, making it more accessible to beginners of all ages and backgrounds. These programs not only cultivate a new generation of surfers but also convert them into potential surfboard customers. Additionally, the focus on eco-friendly materials caters to a growing environmentally conscious consumer base, opening doors for surfboard manufacturers who utilize sustainable practices. By capitalizing on these trends, surfboard companies have the opportunity to expand their customer base, develop innovative board designs, and solidify their position within this thriving market.

SURFBOARD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.8% |

|

Segments Covered |

By Surfboard Type, Price Point, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Channel Islands Surfboards, Firewire Surfboards, HaydenShapes Surfboards, Lost Surfboards, Mayhem Surfboards, Morningstar Surfboards, O'Neill, Quiksilver, Rip Curl, Sector 9 Surfboards, Shapers, Starling Surfboards |

Surfboard Market Segmentation - by Surfboard Type

-

Shortboards

-

Funshapes

-

Longboards

-

Stand Up Paddleboards

Longboards (8' and above) are inherently popular due to their stability and ease of use, making them perfect for those new to surfing and that is why they have the largest segment. Funshapes and Fish (6' - 8' length) also cater to this growing group, offering a comfortable middle ground between paddling ease and maneuverability as surfers develop their skills. Shortboards (5' - 7' length), while coveted for their performance, are the domain of experienced surfers in powerful waves and likely represent a smaller market segment in terms of overall sales. Stand-up paddle (SUP) boards are a separate category, used for paddling on flat water or gentle waves, and their sales figures wouldn't be directly comparable to traditional surfboards.

Surfboard Market Segmentation - By Price Point

-

Mid-Range

-

Premium

-

Custom-Made

The dominance between mid-range and premium surfboards likely leans towards mid-range. While high-performance, premium boards cater to the aspirations of experienced surfers, the larger pool of intermediate surfers seeking to improve their skills creates a wider market for mid-range surfboards. These boards offer a balance of performance and affordability, making them a more accessible and attractive option for the developing surfer. This doesn't negate the importance of premium boards, but the sheer volume of intermediate surfers compared to the niche market of advanced surfers suggests that mid-range takes the lead in overall sales.

Surfboard Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America likely holds the largest market share due to established brands like Channel Islands and Rip Curl, along with a long history of surfing culture. However, the fastest growth is expected in the Asia-Pacific region. China's expanding middle class with a newfound interest in surfing, coupled with the existing manufacturing strength of countries like Brazil, is creating fertile ground for regional surfboard brands to take root and flourish.

COVID-19 Impact Analysis on the Global Surfboard Market

COVID-19 caused a wipeout for the surfboard market in 2020. Travel restrictions and beach closures slammed the brakes on tourism and surfing activities, leading to a drop in demand for new boards. Supply chains were also disrupted as factories shut down and international trade slowed. However, this wasn't a complete wipeout. The industry showed surprising resilience. As lockdowns eased and people sought outdoor activities, a surge in local surfing participation was observed. This growth, particularly among beginners, fueled demand for rental programs, soft-top learning boards, and inflatable options. Additionally, with more time at home, some surfers invested in upgrading their existing quiver. The online retail sector also emerged as a lifeline for surfboard sales, allowing surfers to browse and purchase boards while physical stores were restricted. Overall, after the initial shock, the surfboard market adapted and recovered. While pre-pandemic growth rates might have been dented, the focus on local surfing and online sales channels steered the industry toward a rebound. The long-term impact of COVID might be a renewed interest in accessible and budget-friendly surf products, with a growing focus on sustainability as surfers become more environmentally conscious.

Latest trends/Developments

The surfboard market is riding a wave of innovation with a focus on sustainability and performance. Eco-conscious shapers are driving the use of alternative materials like cork, bamboo, and bio-based resins to minimize environmental impact. These materials might be slightly pricier, but surfers are increasingly willing to pay a premium for a greener ride. Technology is also making a splash. Surfboards with built-in sensors are being developed to track performance metrics and provide real-time feedback to surfers. Additionally, advancements in 3D printing are opening doors for custom board design and on-demand manufacturing, allowing surfers to tailor shapes and features to their specific needs. However, the market acknowledges that accessibility is key. To attract new surfers and cater to budget-conscious buyers, there's a growing focus on high-quality, yet affordable options. This includes soft-top learning boards, inflatable surfboards for easier travel and storage, and innovative rental programs.

Key Players:

-

Channel Islands Surfboards

-

Firewire Surfboards

-

HaydenShapes Surfboards

-

Lost Surfboards

-

Mayhem Surfboards

-

Morningstar Surfboards

-

O'Neill

-

Quiksilver

-

Rip Curl

-

Sector 9 Surfboards

-

Shapers

-

Starling Surfboards

Chapter 1. SURFBOARD MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. SURFBOARD MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. SURFBOARD MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. SURFBOARD MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. SURFBOARD MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. SURFBOARD MARKET – By Surfboard Type

6.1 Introduction/Key Findings

6.2 Shortboards

6.3 Funshapes

6.4 Longboards

6.5 Stand Up Paddleboards

6.6 Y-O-Y Growth trend Analysis By Surfboard Type

6.7 Absolute $ Opportunity Analysis By Surfboard Type, 2024-2030

Chapter 7. SURFBOARD MARKET – By Price Point

7.1 Introduction/Key Findings

7.2 Mid-Range

7.3 Premium

7.4 Custom-Made

7.5 Y-O-Y Growth trend Analysis By Price Point

7.6 Absolute $ Opportunity Analysis By Price Point, 2024-2030

Chapter 8. SURFBOARD MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Surfboard Type

8.1.3 By Price Point

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Surfboard Type

8.2.3 By Price Point

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Surfboard Type

8.3.3 By Price Point

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Surfboard Type

8.4.3 By Price Point

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Surfboard Type

8.5.3 By Price Point

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. SURFBOARD MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Channel Islands Surfboards

9.2 Firewire Surfboards

9.3 HaydenShapes Surfboards

9.4 Lost Surfboards

9.5 Mayhem Surfboards

9.6 Morningstar Surfboards

9.7 O'Neill

9.8 Quiksilver

9.9 Rip Curl

9.10 Sector 9 Surfboards

9.11 Shapers

9.12 Starling Surfboards

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Surfboard Market was valued at USD 3.08 billion in 2023 and will grow at a CAGR of 7.8% from 2024 to 2030. The market is expected to reach USD 5.21 billion by 2030.

Growth in Surfing Competitions and Events, Surfing Education and Accessibility, and Rising Popularity of Surfing are the reasons which is driving the market.

Based on surfboard type it is divided into four segments – Shortboards, Funshapes, Longboards, Stand Up Paddleboards

North America is the most dominant region for the Surfboard Market.

Channel Islands Surfboards, Firewire Surfboards, HaydenShapes Surfboards, Lost Surfboards