Surface Mount Technology (SMT) Market Size (2025 – 2030)

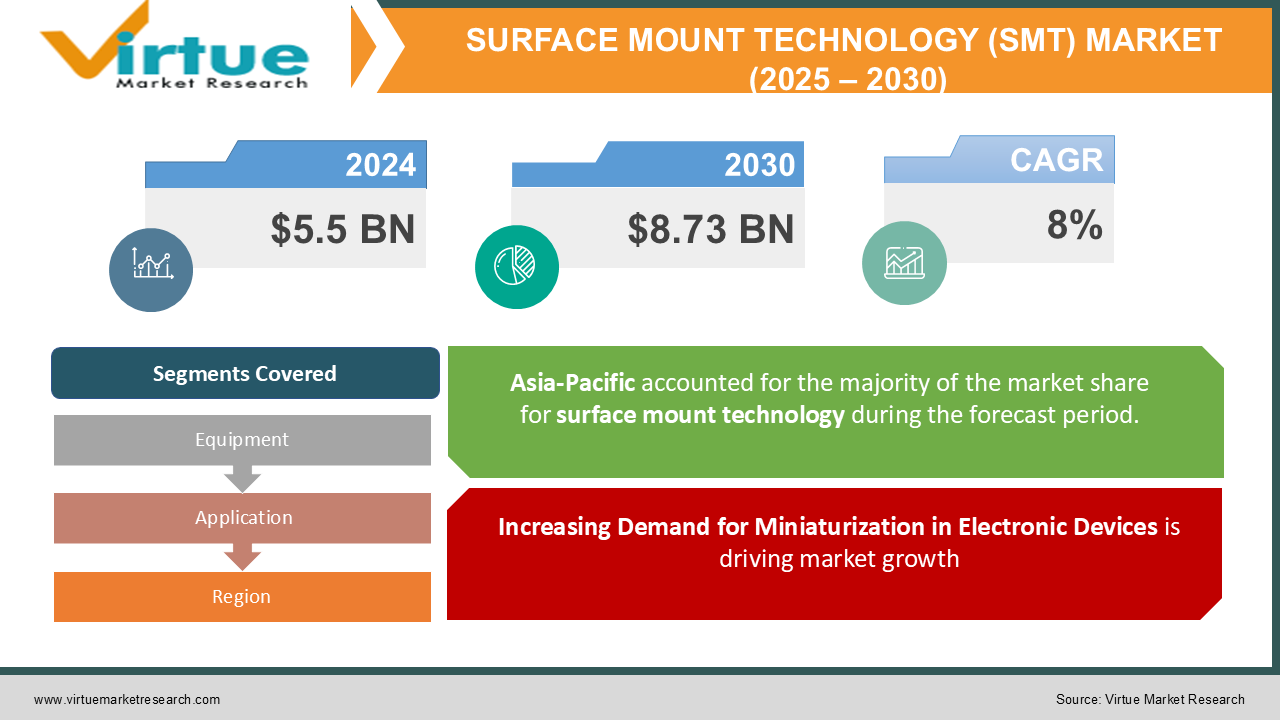

The Global Surface Mount Technology (SMT) Market was valued at USD 5.5 billion in 2024 and is projected to grow at a CAGR of 8% from 2025 to 2030. The market is expected to reach USD 8.73 billion by 2030.

Surface Mount Technology (SMT) is a method for producing electronic circuits in which the components are mounted directly onto the surface of printed circuit boards (PCBs). This technology has revolutionized the electronics manufacturing industry by offering high efficiency, reduced production costs, and the capability to support miniaturization trends in electronic devices.

The demand for SMT is primarily driven by its application in a wide range of industries, including consumer electronics, automotive, telecommunications, and healthcare. The ongoing advancements in electronics manufacturing processes, coupled with increasing demand for compact and lightweight devices, are fueling the market's growth.

Key Market Insights

-

The SMT placement equipment segment accounts for the largest share of the market, representing over 40% of the total revenue in 2024.

-

The increasing adoption of SMT in the automotive industry, particularly for advanced driver-assistance systems (ADAS) and electric vehicles (EVs), is driving growth in the sector.

-

The miniaturization of electronic devices is a significant trend, leading to increased adoption of SMT components such as resistors, capacitors, and ICs.

-

Advanced SMT technologies, such as 3D inspection systems and automated placement machines, are enhancing production efficiency and reducing defect rates.

-

The telecommunications industry is witnessing significant growth in SMT adoption due to the deployment of 5G networks and the demand for high-speed communication devices.

-

SMT assembly services are increasingly being outsourced to specialized manufacturers, enabling OEMs to focus on core competencies and product innovation.

-

Environmental regulations and the push toward lead-free soldering are influencing SMT material and process choices, fostering innovation in eco-friendly alternatives.

Global Surface Mount Technology (SMT) Market Drivers

Increasing Demand for Miniaturization in Electronic Devices is driving market growth:

The growing consumer preference for compact, lightweight, and portable electronic devices has significantly driven the adoption of SMT. Modern electronic devices, such as smartphones, wearables, and IoT devices, require highly integrated and miniature components, which can only be achieved through SMT. This technology allows manufacturers to place multiple components on both sides of a printed circuit board (PCB), optimizing space utilization and enabling higher functionality in smaller form factors. SMT also reduces the complexity of assembly and ensures reliability in high-performance applications. As industries like consumer electronics and telecommunications continue to push for advanced devices, SMT is expected to remain a critical enabler of innovation and growth.

Growing Application of SMT in the Automotive Sector is driving market growth:

The automotive industry's transition toward advanced electronics and electrification is creating significant opportunities for the SMT market. Advanced Driver Assistance Systems (ADAS), infotainment systems, and battery management systems (BMS) in electric vehicles heavily rely on SMT for efficient and compact PCB assemblies. As automotive manufacturers increasingly integrate features like lane departure warnings, automatic braking, and autonomous driving capabilities, the demand for highly reliable and miniaturized electronic components is rising. SMT's ability to deliver high-speed assembly and precision makes it indispensable for automotive electronics manufacturing. Furthermore, the rise of electric vehicles (EVs) and hybrid electric vehicles (HEVs) is expected to accelerate SMT adoption in the automotive industry.

Technological Advancements in SMT Equipment and Processes is driving market growth:

Technological innovations in SMT equipment, such as automated pick-and-place machines, 3D inspection systems, and reflow ovens, are significantly enhancing manufacturing efficiency and product quality. Automated SMT lines enable high-speed production, reduce human error, and ensure consistent output, making them highly sought-after in large-scale manufacturing. The integration of artificial intelligence (AI) and machine learning (ML) in SMT processes is further improving defect detection and optimizing equipment performance. AI-driven inspection systems can identify microscopic defects and ensure compliance with stringent quality standards. As manufacturers invest in advanced SMT equipment to stay competitive and meet growing demand, the market is poised for sustained growth.

Global Surface Mount Technology (SMT) Market Challenges and Restraints

High Initial Investment and Maintenance Costs is restricting market growth:

The adoption of SMT requires significant upfront investment in advanced machinery and equipment, such as pick-and-place machines, soldering systems, and inspection tools. These systems are expensive to purchase and maintain, posing a financial challenge for small and medium-sized enterprises (SMEs). Moreover, the rapid pace of technological advancements in SMT equipment necessitates frequent upgrades, further increasing costs. Manufacturers must also invest in skilled personnel to operate and maintain these systems effectively. While large-scale enterprises can absorb these costs, SMEs may struggle to compete, limiting market penetration in certain regions. Addressing this challenge requires the development of cost-effective and scalable solutions tailored to the needs of smaller manufacturers.

Complexity in Manufacturing Processes and Material Handling is restricting market growth:

SMT involves intricate processes that require precise control and accuracy. The miniaturization of components and high-density PCB assemblies increase the risk of defects, such as solder bridging, tombstoning, and component misalignment. These defects can lead to product failures and impact brand reputation. Handling sensitive materials, such as lead-free solder and adhesives, further complicates the manufacturing process. Environmental regulations mandating the use of lead-free materials add to the complexity, as these materials have different melting points and require specialized equipment. Manufacturers must invest in training, quality control measures, and advanced inspection systems to address these challenges, which can strain resources and affect profitability.

Market Opportunities

The evolution of 5G technology and the proliferation of IoT devices present significant growth opportunities for the SMT market. The deployment of 5G networks is driving demand for high-frequency and high-performance PCBs, which rely on SMT for precise component placement and assembly.

The increasing adoption of smart home devices, industrial automation systems, and wearable technology is further fueling the need for compact and efficient electronic assemblies. SMT's ability to support high-density integration and miniaturization makes it a preferred choice for these applications.

Additionally, the trend toward outsourcing SMT assembly services to electronics manufacturing services (EMS) providers offers opportunities for specialized players to expand their market presence. EMS providers equipped with advanced SMT capabilities can cater to the growing demand for customized and high-quality PCB assemblies. As industries continue to embrace digital transformation, the SMT market is poised to play a pivotal role in enabling next-generation technologies.

SURFACE MOUNT TECHNOLOGY (SMT) MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8% |

|

Segments Covered |

By Equipment, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ASM Assembly Systems, Fuji Corporation, Yamaha Motor Co., Ltd., Juki Corporation, Panasonic Corporation, Mycronic AB, Hanwha Precision Machinery, Nordson Corporation, Saki Corporation, Universal Instruments Corporation |

Surface Mount Technology (SMT) Market Segmentation - By Equipment

-

SMT Placement Equipment

-

SMT Inspection Equipment

-

SMT Soldering Equipment

-

Screen Printing Equipment

-

Reflow Ovens

-

Others

SMT placement equipment holds the dominant share in the market, driven by its critical role in accurately placing components on PCBs. The high speed and precision of modern placement machines contribute to their widespread adoption in high-volume production environments.

Surface Mount Technology (SMT) Market Segmentation - By Application

-

Consumer Electronics

-

Automotive

-

Telecommunications

-

Healthcare

-

Industrial Electronics

-

Others

Consumer electronics is the dominant application segment, accounting for the largest share due to the high demand for compact and multifunctional devices, such as smartphones, tablets, and wearables.

Surface Mount Technology (SMT) Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific dominates the SMT market, accounting for more than 50% of global revenue. The region's leadership is attributed to its strong manufacturing base, particularly in countries like China, Japan, and South Korea. These countries are home to major electronics manufacturers and suppliers of SMT equipment. The growing adoption of automation and the rapid expansion of the consumer electronics and automotive industries further contribute to the region's market dominance.

COVID-19 Impact Analysis on the SMT Market

The COVID-19 pandemic had a mixed impact on the Surface Mount Technology (SMT) market. In the early stages, lockdowns and disruptions to supply chains caused production halts and delayed shipments, leading to a temporary slowdown in market growth. However, the pandemic also underscored the vital role of advanced electronics in sectors such as healthcare, telecommunications, and remote work solutions. The surge in demand for medical devices like ventilators and diagnostic equipment drove the adoption of SMT for the manufacturing of high-quality printed circuit boards (PCBs). Additionally, the increased reliance on digital communication tools and home entertainment systems during lockdowns boosted the demand for SMT components in consumer electronics, further fueling the market. As the pandemic subsided, the SMT market rebounded strongly, driven by pent-up demand and a surge in investments aimed at enhancing automation and advanced manufacturing technologies. The emphasis on strengthening supply chain resilience and fostering local production has accelerated the adoption of SMT solutions across various industries. These trends point to a brighter future for the SMT market, with continued growth and innovation as industries adapt to new technologies and production strategies in the post-pandemic landscape.

Latest Trends/Developments

The Surface Mount Technology (SMT) market is undergoing rapid technological advancements and evolving trends that are reshaping its future. A significant development is the integration of artificial intelligence (AI) and machine learning (ML) into SMT processes. AI-powered inspection systems are improving defect detection and quality assurance, while ML algorithms optimize machine performance, throughput, and overall production efficiency. Another key trend is the adoption of advanced packaging technologies, such as wafer-level packaging and chip-on-board, which rely on SMT for high-density integration. These innovations are enabling more compact and efficient designs, catering to the growing demand for smaller, more powerful electronic devices. Additionally, the transition to lead-free soldering and the use of environmentally friendly materials are influencing the industry's direction, driven by stricter regulatory standards focused on sustainability and safety. The rise of Industry 4.0 and the Internet of Things (IoT) is also fueling demand for automated SMT lines and smart factories. These technologies enable real-time monitoring, predictive maintenance, and enhanced production efficiency, allowing manufacturers to stay competitive in a fast-evolving market. As industries adopt smart manufacturing solutions, SMT is becoming integral to achieving higher productivity and meeting the demands of modern electronic devices and applications. These advancements are positioning the SMT market for continued growth and innovation in the years ahead.

Key Players

-

ASM Assembly Systems

-

Fuji Corporation

-

Yamaha Motor Co., Ltd.

-

Juki Corporation

-

Panasonic Corporation

-

Mycronic AB

-

Hanwha Precision Machinery

-

Nordson Corporation

-

Saki Corporation

-

Universal Instruments Corporation

Chapter 1. Surface Mount Technology (SMT) Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Surface Mount Technology (SMT) Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Surface Mount Technology (SMT) Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Surface Mount Technology (SMT) Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Surface Mount Technology (SMT) Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Surface Mount Technology (SMT) Market – By Equipment

6.1 Introduction/Key Findings

6.2 SMT Placement Equipment

6.3 SMT Inspection Equipment

6.4 SMT Soldering Equipment

6.5 Screen Printing Equipment

6.6 Reflow Ovens

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Equipment

6.9 Absolute $ Opportunity Analysis By Equipment, 2025-2030

Chapter 7. Surface Mount Technology (SMT) Market – By Application

7.1 Introduction/Key Findings

7.2 Consumer Electronics

7.3 Automotive

7.4 Telecommunications

7.5 Healthcare

7.6 Industrial Electronics

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Surface Mount Technology (SMT) Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Equipment

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Equipment

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Equipment

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Equipment

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Equipment

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Surface Mount Technology (SMT) Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 ASM Assembly Systems

9.2 Fuji Corporation

9.3 Yamaha Motor Co., Ltd.

9.4 Juki Corporation

9.5 Panasonic Corporation

9.6 Mycronic AB

9.7 Hanwha Precision Machinery

9.8 Nordson Corporation

9.9 Saki Corporation

9.10 Universal Instruments Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Surface Mount Technology (SMT) Market was valued at USD 5.5 billion in 2024 and is projected to grow at a CAGR of 8% from 2025 to 2030. The market is expected to reach USD 8.73 billion by 2030.

Key drivers include the growing demand for miniaturized electronic devices, increasing adoption in the automotive industry, and technological advancements in SMT equipment.

The market is segmented by equipment (placement, inspection, soldering, etc.) and application (consumer electronics, automotive, telecommunications, etc.).

Asia-Pacific is the most dominant region, driven by a strong electronics manufacturing base and high demand from consumer electronics and automotive industries.

Leading players include ASM Assembly Systems, Fuji Corporation, Yamaha Motor Co., Ltd., Juki Corporation, and Panasonic Corporation.