Surface Coating Materials Market Size (2023 – 2030)

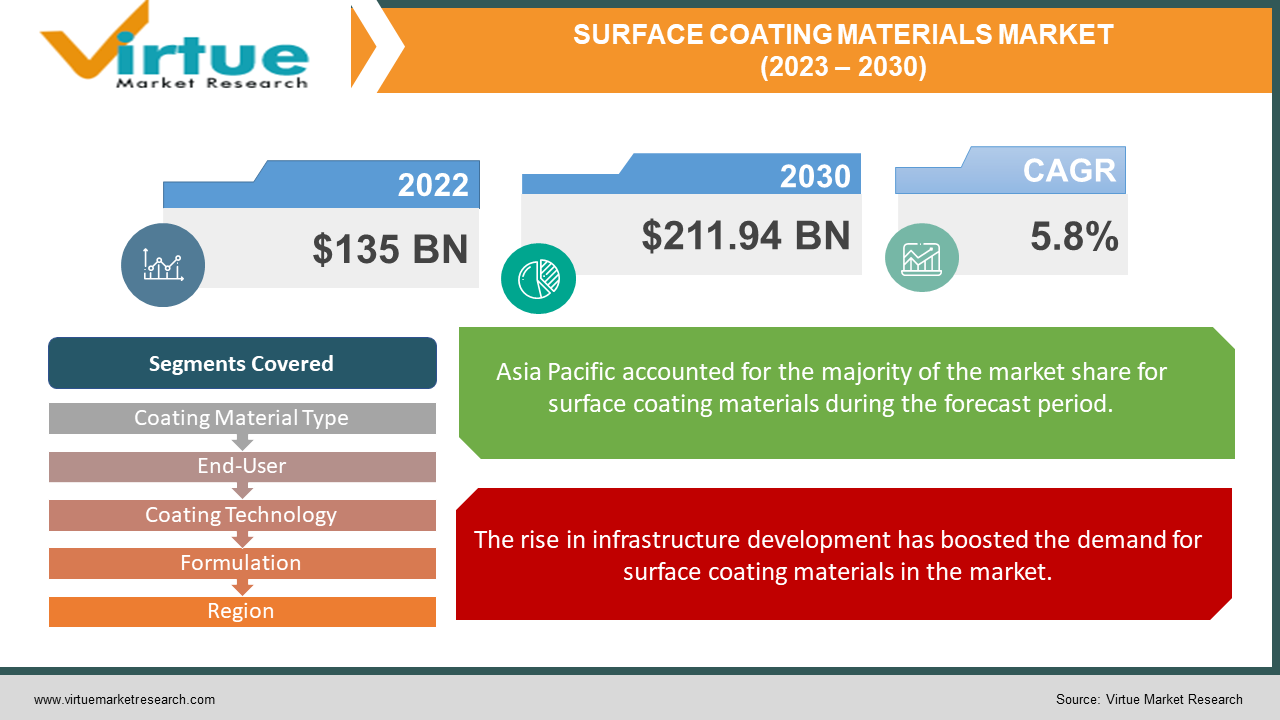

The Global Surface Coating Materials Market was valued at USD 135 billion and is projected to reach a market size of USD 211.94 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 5.8%.

Surface coating materials have been in the industry for ages and have found applications in many industries, as they protect from outside temperatures and certain chemicals, making the surface robust and resistant to various bacteria. Conventional surface coatings consist of paints, varnishes, enamels, and lacquers; and most of these coatings are solvent-based that contain VOCs. However, advancements in technology and rising demand for natural and eco-friendly surface coatings, have changed the market landscape gradually. Eco-friendly surface coatings such as waterborne coatings, cellulose and starch-based coatings, and coatings derived from vegetables and fruits are gaining traction in the present scenario due to their lower energy consumption and biodegradability. The future for the surface coatings materials market witnesses an upward trend with the rapid adoption of nanotechnology for developing nanocoating that offers stain-resistant and easy-clean properties to the consumer. Furthermore, trends in tailored surface coating materials have induced manufacturers to produce industry-specific coatings such as electronics, aerospace, automotive, healthcare, and others.

Key Market Insights:

-

According to S&P Global, about 52% of coatings are used for the decoration and protection the new and existing structures, which includes residential homes, apartments, public buildings, plants, and factories.

-

As per studies, bio-based coatings offer 100% performance and lower CO2 emissions considerably.

-

According to a forecast by the Indian Paint Association, the Indian paints & and coating industry will account for Rs,1000 billion, that is, US $ 12.34 billion in the coming five years.

-

Furthermore, as per the World Green Building Council, by 2025, sustainable architecture aims to reduce CO2 emissions by up to 84 gigatons.

-

Moreover, more than 90% of architectural paints are water-based in the USA.

Surface Coating Materials Market Drivers:

The rise in infrastructure development has boosted the demand for surface coating materials in the market.

Rapid urbanization, especially in developing economies is the key element in increasing infrastructure projects for the growth and development of a region. According to the Asian Development Bank, developing economies in Asia and the Pacific region invest US $881 billion annually in infrastructure. This has increased the demand for surface coating materials in the market. Moreover, the construction of new buildings and architectural settings are increasingly using surface coating materials for protecting physical structures from environmental factors and for aesthetic purposes. These include the use of coating materials for walls, roofs, facades, beams, and others. Further, public development projects such as roads, bridges, highways, transportation systems, and others increasingly use surface coating materials to increase the longevity of the structure, protect it from corrosion, and for visual appearance. Moreover, surface coating materials are widely used in urban transportation systems for indicating safety markings for roads and traffic safety. Furthermore, recent trends in green building have further boosted the market demand for natural and organic surface coating materials in the market.

The increasing need to maintain and renovate architectural buildings has boosted the demand for surface coating materials in the market.

Old architectural buildings such as old physical structures, monuments, aesthetic buildings, public spaces, historic structures, and others require constant protection and maintenance to ensure their integrity. However, these structures have worn out with time and require protective materials such as surface coating materials to protect the structure against corrosion, revive the architectural integrity of historic buildings, and restore roofs, particularly old commercial buildings, and others. Furthermore, many cultural structures require specific surface coating material for reviving the beauty of interior and exterior surfaces, such as anti-graffiti coatings that prevent the structure from vandalism, silicate mineral paints, anti-biological coatings for preventing moss and algae growth on the structure, and others.

Surface Coating Materials Market Restraints and Challenges:

Raw material costs and sourcing difficulties can decrease the market demand for surface coating materials. Most surface coating is made up of natural materials that are difficult to source and often require extensive and advanced processing, which can raise the production cost of companies, and hence increase the final price of the product for its consumers.

Surface Coating Materials Market Opportunities:

The Global Surface Coating Materials Market is anticipated to deliver lucrative opportunities for businesses, which include acquisitions, partnerships, collaborations, product launches, and agreements during the forecasted period. Furthermore, the demand to protect and maintain architectural buildings and shifting focus toward green coatings production is predicted to develop the market for Surface Coating Materials and enhance its future growth opportunities.

SURFACE COATING MATERIALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.8% |

|

Segments Covered |

By Coating Material Type, End-User, Coating Technology, Formulation, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF Coatings, Asian Paints, PPG, AkzoNobel, Kanasai Paint Co.Ltd, Nippon Paint Holdings, The Sherwin Williams Co., Axalta Coating Systems,Hempel A/S |

Surface Coating Materials Market Segmentation: By Coating Material Type

-

Paints

-

Specialty Coatings

-

Varnishes

-

Additives

-

Smart Coatings

-

Others

In 2022, based on market segmentation by coating material type, paints occupy the highest share of about 26% in the market. Paints are the most common type of coating material used in nearly all industries as per the requirements. Moreover, paints are particularly used for adding a protective layer to surfaces such as walls, beams, and ceilings, and are used for providing an aesthetic look to the structure, such as paints used to decorate or enhance the visual appearance of exterior components of car of cultural structures.

Specialty coatings are the fastest-growing segment during the forecast period. These coatings are designed for a specific use such as protecting the structure from corrosion, fire, chemicals, and heat, or for healing the physical structure. Anti-corrosion coating is one such example of specialty coatings that is widely used oil & and gas and construction industry for protecting metal surfaces from corrosion and increasing its longevity.

Surface Coating Materials Market Segmentation: By End-User

-

Aerospace

-

Automotive

-

Marine

-

Oil & Gas

-

Medical & Healthcare

-

Construction & Buildings

-

Consumer Goods

-

Others

In 2022, based on market segmentation by end-users, the construction & buildings segment occupies the highest share of about 25.8% in the market. Surface coating materials find immense applications in the construction & building industry as they provide protection from various environmental factors and help in maintaining the integrity of the structure. These include the use of coatings for interior components of the building and, the use of protective coating for preventing the structure from rust and chemical exposure, such as anti-corrosion, and concrete coatings are used for bridges, steel, and pipelines. Furthermore, the rising demand for green coatings has led to the development of low or zero-VOC and bio-based coatings in the market.

The marine segment is the fastest-growing segment during the forecast period. The marine industry increasingly uses surface coating materials to protect from corrosion, and environmental hazards, and to improve the fuel efficiency of ships and boats. Anti-corrosion coatings are increasingly used to prevent ships and boats from moisture and exposure to saltwater. Further, antifouling coatings are specialty coatings that protect the hull of a ship from marine organisms such as algae and mollusks and help to improve fuel efficiency. Furthermore, underwater coatings are gaining traction in the marine coatings market, as they protect underwater structures such as submarines, pipelines, bridges, and others from corrosion and hazards.

Surface Coating Materials Market Segmentation: By Coating Technology

-

Water-Based

-

Solvent-Based

-

UV-Based

-

Green Coating

-

Nano-Coating

-

Others

In 2022, based on market segmentation by coating technology, solvent-based coatings occupy the highest share of about 24% in the market. Solvent-based coatings are widely used form of coatings that uses organic solvents to prevent structures from bad environmental conditions. They offer excellent durability, adhesion, and faster drying properties to the user.

Green coating is the fastest-growing segment during the forecast period. These coatings contain low or zero VOCs and are formulated using natural and organic compounds that reduce carbon footprint and contribute to environmental conservation. They often consist of water or powder-based coatings and contain bio-based materials. Moreover, trends in green building materials have gradually increased the adoption of green coatings in the market.

Surface Coating Materials Market Segmentation: By Formulation

-

Powder Coating

-

Liquid Coating

-

Solid Coating

In 2022, based on market segmentation by formulation, liquid coating occupies the highest share of about 23% in the market. Liquid coating is mainly composed of solvents, resins, pigments, additives, and others that allow easy application to surfaces with the help of rollers, sprayers, brushes, and other tools. Moreover, due to their easy application, resistance properties, and exact color matching with the surface, they are widely used in the automotive and construction sectors for coating vehicles and structures.

Surface Coating Materials Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, based on market segmentation, Asia Pacific occupies the highest share of about 30% in the market. The growth is attributed to increasing construction and development projects and the booming consumer goods industry. Additionally, Asia-Pacific is one of the global leaders in producing and manufacturing electronic components and electronics, which further propels the growth of surface coating materials in the region.

North America is the fastest-growing region during the forecast period. The robust aerospace and defense industry and stringent environmental regulations for low VOCs and environment-friendly materials have contributed to the growth of surface coating materials in the region.

COVID-19 Impact Analysis on the Global Surface Coating Materials Market:

The pandemic had a significant impact on the surface coating materials market. Due to the global lockdown, major surface coating materials using industries such as automotive, aerospace, electronics, and others were closed down, which declined the demand for surface coating material in the market. Further, infrastructure and construction projects witnessed a slowdown due to a shortage of labor and supply chain disruptions, which further affected the surface coating materials market. Additionally, procurement of raw materials was restricted due to geographical restrictions, which further affected the production and manufacturing of surface coating materials.

Latest Trends/ Developments:

-

The global Surface Coating Materials Market is reasonably split and fragmented with the existence of several global companies. These players are motivated to achieve higher market share by implementing different strategies, such as acquisitions, partnerships, and investments. The growing trends in sustainability have shifted the focus of both producers and consumers towards using low or zero VOCs surface coating materials that reduce air pollution and carbon footprint. This has led to the development of bio-based coatings that help in reducing carbon emissions completely, as they are formulated using biodegradable and organic compounds. Furthermore, trends in smart coatings can be witnessed in recent years, as consumers adopt smart building lifestyles. These include self-healing coatings, eco-friendly smart coating for keeping the building cool day and night, anti-microbial coatings, and others. For instance, in December 2020, British company Smart Separations launched an anti-microbial coating. This coating is aimed to destroy coronavirus and is prepared using ceramic membrane technology.

-

In May 2023, AkzoNobel launched a powder coating product for architects and designers in India. The coating is a super durable Interpol D powder coating that aims to enhance the visual appearance of buildings and protect and increase the longevity of structures. Moreover, the product is free from VOCs and is backed by an Environmental Product Declaration certificate.

-

In March 2023, PPG launched PPG SIGMAGLIDE 2390 marine coating for shipowners. The product aims to lower power consumption, reduce carbon emissions, and offer high performance with no impact on the marine environment.

Key Players:

-

BASF Coatings

-

Asian Paints

-

PPG

-

AkzoNobel

-

Kanasai Paint Co.Ltd

-

Nippon Paint Holdings

-

The Sherwin Williams Co.

-

Axalta Coating Systems

-

Hempel A/S

Chapter 1. Surface Coating Materials Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Surface Coating Materials Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Surface Coating Materials Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Surface Coating Materials Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Surface Coating Materials Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Surface Coating Materials Market – By Coating Material Type

6.1 Introduction/Key Findings

6.2 Paints

6.3 Specialty Coatings

6.4 Varnishes

6.5 Additives

6.6 Smart Coatings

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Coating Material Type

6.9 Absolute $ Opportunity Analysis By Coating Material Type, 2023-2030

Chapter 7. Surface Coating Materials Market – By End-User

7.1 Introduction/Key Findings

7.2 Aerospace

7.3 Automotive

7.4 Marine

7.5 Oil & Gas

7.6 Medical & Healthcare

7.7 Construction & Buildings

7.8 Consumer Goods

7.9 Others

7.10 Y-O-Y Growth trend Analysis By End-User

7.11 Absolute $ Opportunity Analysis By End-User, 2023-2030

Chapter 8. Surface Coating Materials Market – By Coating Technology

8.1 Introduction/Key Findings

8.2 Water-Based

8.3 Solvent-Based

8.4 UV-Based

8.5 Green Coating

8.6 Nano-Coating

8.7 Others

8.8 Y-O-Y Growth trend Analysis Coating Technology

8.9 Absolute $ Opportunity Analysis Coating Technology, 2023-2030

Chapter 9. Surface Coating Materials Market – By Formulation

9.1 Introduction/Key Findings

9.2 Powder Coating

9.3 Liquid Coating

9.4 Solid Coating

9.5 Y-O-Y Growth trend Analysis Formulation

9.6 Absolute $ Opportunity Analysis Formulation, 2023-2030

Chapter 10. Surface Coating Materials Market , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Coating Material Type

10.1.3 By End-User

10.1.4 By Coating Technology

10.1.5 By Formulation

10.1.6 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Coating Material Type

10.2.3 By End-User

10.2.4 By Coating Technology

10.2.5 By Formulation

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Coating Material Type

10.3.3 By End-User

10.3.4 By Coating Technology

10.3.5 By Formulation

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Coating Material Type

10.4.3 By End-User

10.4.4 By Coating Technology

10.4.5 By Formulation

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Coating Material Type

10.5.3 By End-User

10.5.4 By Coating Technology

10.5.5 By Formulation

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Surface Coating Materials Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 BASF Coatings

11.2 Asian Paints

11.3 PPG

11.4 AkzoNobel

11.5 Kanasai Paint Co.Ltd

11.6 Nippon Paint Holdings

11.7 The Sherwin Williams Co.

11.8 Axalta Coating Systems

11.9 Hempel A/S

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Surface Coating Materials Market was valued at USD 135 billion and is projected to reach a market size of USD 211.94 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 5.8%.

The rise in infrastructure development and the increasing need to maintain and renovate architectural buildings are the market drivers of the Global Surface Coating Materials Market.

Paints, Specialty Coatings, Varnishes, Additives, Smart Coatings, and Others are the segments under the Global Surface Coating Materials Market by coating material type.

Asia-Pacific is the most dominant region for the Global Surface Coating Materials Market.

North America is the fastest-growing region in the Global Surface Coating Materials Market.