Superior Quality Ceramic Abrasive Market Size (2024 – 2030)

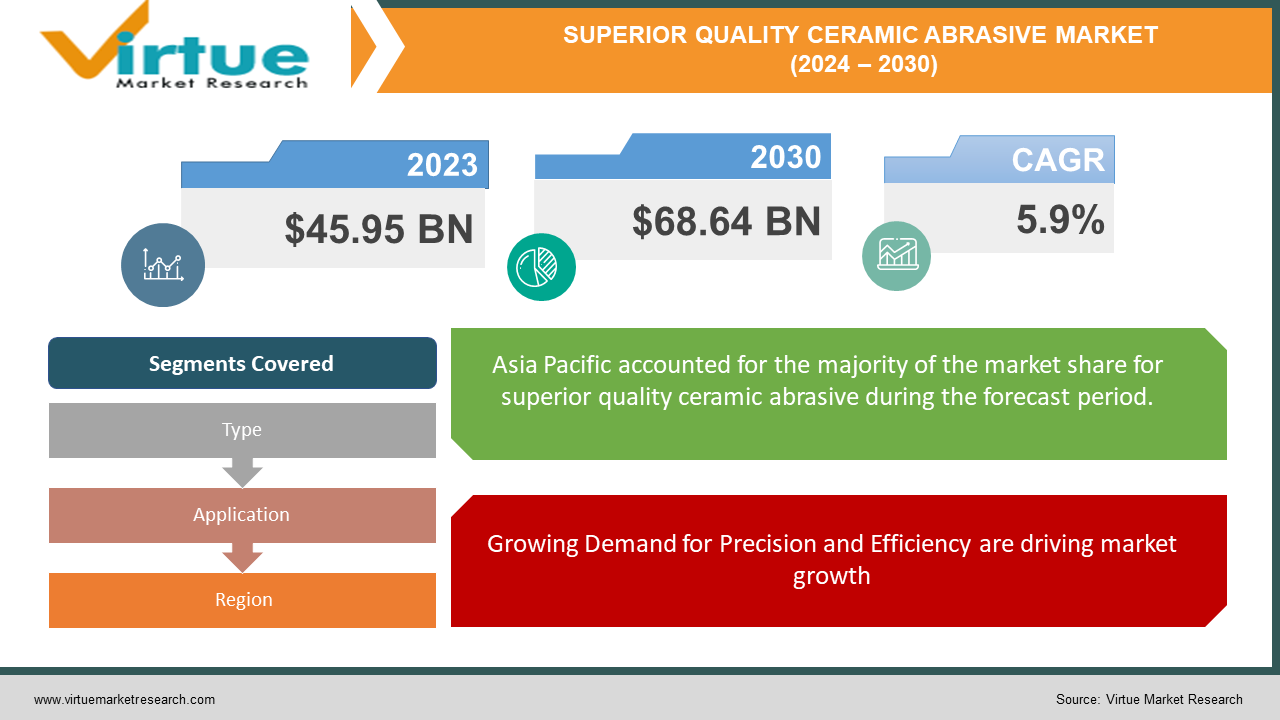

The Global Superior Quality Ceramic Abrasive Market was valued at USD 45.95 billion in 2023 and will grow at a CAGR of 5.9% from 2024 to 2030. The market is expected to reach USD 68.64 billion by 2030.

The "Superior Quality Ceramic Abrasive Market" is a specific segment within the overall abrasives market that focuses on high-performance ceramic abrasives. It's difficult to pinpoint its exact size due to the subjectivity of "superior quality," which depends on application. However, the broader abrasives market is substantial, valued at around $46 billion in 2023, and expected to grow significantly. You can find more details on the overall market and potential breakdowns by ceramic abrasives in industry reports.

Key Market Insights:

They offer superior cutting ability, wear resistance, and longer tool life compared to traditional abrasives. Applicable across various applications like grinding, polishing, and cutting in sectors like automotive, aerospace, and electronics.

The market is witnessing continuous development of new ceramic abrasive materials like cubic boron nitride (CBN) and silicon carbide (SiC). These offer even greater performance for challenging applications.

Global Superior Quality Ceramic Abrasive Market Drivers:

Growing Demand for Precision and Efficiency are driving market growth:

The relentless pursuit of precision and efficiency in industries like aerospace, automotive, and electronics fuels the demand for superior ceramic abrasives. Traditional abrasives often struggle to meet the ever-tightening tolerances and high-quality finishes required in these sectors. Here's where superior ceramic abrasives shine. Their superior cutting ability translates to cleaner cuts and faster material removal, minimizing rework and production time. This translates to significant cost savings – not just in terms of reduced rework, but also in extended tool life. Unlike traditional abrasives that wear down quickly, superior ceramic abrasives last longer, requiring fewer replacements and minimizing downtime associated with tool changes. This translates to smoother production cycles and increased overall efficiency. In essence, superior ceramic abrasives become a force multiplier, enabling these industries to achieve the high-precision finishes and tight tolerances demanded by today's cutting-edge technologies.

Stricter Regulations are driving market growth:

The environmental impact of traditional abrasives is a growing concern, particularly in industries like automotive and aerospace with stringent regulations. These abrasives often generate significant amounts of hazardous dust during grinding processes. This dust poses health risks to workers and can be difficult and expensive to manage through proper ventilation and disposal. Here's where superior ceramic abrasives offer a significant advantage. Their unique properties enable cooler grinding processes. This translates to two key benefits for the environment. Firstly, cooler grinding reduces the overall amount of dust generated. Less dust translates to a safer work environment and minimizes the need for expensive dust collection systems. Secondly, the cooler temperatures associated with superior ceramic abrasives often lead to a reduction in the formation of harmful byproducts like hazardous fumes. This not only improves worker safety but also ensures compliance with stricter environmental regulations, allowing manufacturers to operate more sustainably. By minimizing dust generation and promoting cleaner grinding processes, superior ceramic abrasives play a crucial role in creating a more eco-friendly manufacturing landscape.

Increased Automation and Robotics are driving market growth:

As the automation revolution takes hold, robots are increasingly tasked with delicate grinding and finishing processes. Unlike human workers who can adapt to slight variations in tool performance, robots rely on consistent and predictable behavior from their abrasive tools. Traditional abrasives, with their uneven wear patterns, can throw a wrench into these automated workflows. Inconsistent wear can lead to fluctuating cutting depths and uneven finishes, ultimately compromising product quality. Here's where superior ceramic abrasives come to the rescue. These advanced abrasives boast consistent wear characteristics. They wear down at a predictable rate, ensuring robots maintain consistent cutting depths and deliver uniform finishes throughout their operation. This predictability is crucial for smooth and reliable performance in automated environments. With superior ceramic abrasives, robots can operate with minimal downtime and intervention, leading to increased production efficiency and consistent product quality – essential ingredients for a successful robotic integration strategy.

Global Superior Quality Ceramic Abrasive Market challenges and restraints:

Higher Upfront Cost is a significant hurdle for Superior Quality Ceramic Abrasive:

A significant hurdle for superior ceramic abrasives is their upfront cost. While traditional abrasives might seem like a more budget-friendly option at first glance, this perception can be misleading. For cost-conscious manufacturers, particularly in industries with razor-thin margins, the higher price tag of superior ceramic abrasives can be a major deterrent. However, a deeper look reveals a potential hidden cost advantage. Traditional abrasives wear down quickly, requiring frequent replacements and leading to downtime for tool changes. This translates to lost production time and additional labor costs. Superior ceramic abrasives, on the other hand, boast a significantly longer lifespan. While the initial investment might be higher, these advanced abrasives minimize replacement needs and downtime, leading to overall cost savings in the long run. Savvy manufacturers are increasingly recognizing this lifecycle cost advantage, making superior ceramic abrasives a more attractive proposition despite the initial price tag.

Limited Awareness is throwing a curveball at Superior superior-quality ceramic Abrasive market:

Superior ceramic abrasives offer a game-changing performance edge, but a surprising hurdle to wider adoption is a lack of awareness. Manufacturers accustomed to traditional abrasives might not be fully apprised of the substantial benefits these advanced options offer. This knowledge gap can significantly hinder market penetration. Consider the scenario in an automotive manufacturing setting. Traditional abrasives might be the norm for grinding engine components. However, superior ceramic abrasives could deliver a much faster cutting rate, leading to quicker turnaround times. Additionally, their superior wear resistance could translate to fewer tool changes, minimizing downtime and maximizing production efficiency. Unfortunately, if the manufacturer remains unaware of these potential benefits, they might continue relying on traditional methods, simply because they're the familiar choice. Bridging this awareness gap is crucial for wider adoption. Educational initiatives by industry leaders and abrasive manufacturers can play a key role in highlighting the performance gains and cost savings associated with superior ceramic abrasives, ultimately propelling them to become the preferred choice across various manufacturing sectors.

Technical Expertise is a growing nightmare for Superior Quality Ceramic Abrasive:

While superior ceramic abrasives promise superior results, unlocking their full potential can pose a challenge for smaller companies. Unlike traditional abrasives that are more forgiving of slight variations in technique, superior ceramic abrasives demand a certain finesse for optimal performance. To achieve the promised benefits of consistent wear and precise cuts, grinding processes might need adjustments. This could involve tweaking parameters like grinding speed, pressure, and coolant application. Additionally, operators accustomed to traditional methods might require training to adapt to the specific characteristics of superior ceramic abrasives. For smaller companies with limited technical expertise, these adjustments and training needs can be a significant hurdle. The lack of in-house resources to optimize grinding processes or train operators effectively can lead to subpar results, potentially negating the advantages of superior ceramic abrasives. To overcome this challenge, collaboration with abrasive suppliers offering technical support and training programs can be crucial for smaller companies to bridge the knowledge gap and successfully integrate superior ceramic abrasives into their workflows.

Market Opportunities:

The Superior Quality Ceramic Abrasive market presents exciting opportunities driven by the relentless pursuit of efficiency and precision in advanced manufacturing sectors like aerospace, automotive, and electronics. These industries demand high-quality finishes and tight tolerances, which traditional abrasives often struggle to deliver. Here's where superior ceramic abrasives shine. Their superior cutting ability and longer tool life translate to faster production times, minimized rework, and significant cost savings. Additionally, stricter environmental regulations are pushing manufacturers towards cleaner technologies. Superior ceramic abrasives, with their cooler grinding processes and reduced dust generation, offer a sustainable solution compared to traditional abrasives. Furthermore, the rise of automation necessitates consistent and predictable performance from abrasives. Superior ceramic abrasives, boasting consistent wear characteristics, ensure robots maintain consistent cutting depths and deliver uniform finishes, maximizing production efficiency. However, challenges exist. The higher upfront cost can be a deterrent, particularly for cost-conscious manufacturers. A lack of awareness about the long-term cost savings and performance benefits can also hinder market growth. Additionally, smaller companies might struggle with the technical expertise needed to optimize grinding processes and train operators for superior ceramic abrasives. Despite these challenges, the market holds immense potential. As manufacturers become more aware of the lifecycle cost benefits and superior performance, coupled with advancements in technology and wider adoption, superior-quality ceramic abrasives are poised to revolutionize precision grinding and finishing across a multitude of industries.

SUPERIOR QUALITY CERAMIC ABRASIVE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Saint-Gobain (France), 3M Company (USA), Robert Bosch GmbH (Germany), Honeywell International Inc. (USA), Norton Abrasives (USA), Tyrolit Group (Austria), Asahi Diamond Industrial Co., Ltd. (Japan), Diamant Boart (Belgium), Weiler Abrasives Group (Germany), China National Abrasives Group Co., Ltd. (China) |

Superior Quality Ceramic Abrasive Market Segmentation - By Type

-

Ceramic Material

-

Product Form

It's difficult to definitively say which segment, Ceramic Material or Product Form, is most prominent in the superior quality ceramic abrasive market. Both ceramic Material and Product Form likely play significant roles in the superior quality ceramic abrasive market, with their prominence depending on the specific application and performance needs.

Superior Quality Ceramic Abrasive Market Segmentation - By Application

-

Metalworking

-

Electronics

While both metalworking and electronics industries benefit from superior quality ceramic abrasives, metalworking is likely the more prominent sector due to its sheer size and diverse applications. The electronics industry shouldn't be underestimated. As miniaturization and component complexity increase, the demand for high-precision abrasives in electronics will continue to rise. Ultimately, both sectors represent significant opportunities for superior-quality ceramic abrasives, with metalworking holding the current lead due to its broader scope.

Superior Quality Ceramic Abrasive Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia Pacific region (including China, India, and Japan) is expected to be the most dominant market for superior-quality ceramic abrasives. While North America and Europe also have established manufacturing bases, Asia's booming industrial sector and focus on technological advancements position it as the leader in the superior quality ceramic abrasive market.

COVID-19 Impact Analysis on the Global Superior Quality Ceramic Abrasive Market

The COVID-19 pandemic caused a temporary setback for the superior-quality ceramic abrasive market. Lockdowns disrupted supply chains, stalling production and hindering the availability of these advanced abrasives. Additionally, the overall decline in industrial activity across sectors like automotive and aerospace due to pandemic restrictions led to a decrease in demand. However, the impact wasn't uniform. Some manufacturers, particularly in essential industries like medical devices, continued operations and relied on superior ceramic abrasives for high-precision finishing of critical components. As economies reopened and industrial activity resumed, the market witnessed a rebound. Pent-up demand, coupled with the ongoing need for precision and efficiency in advanced manufacturing, fueled the recovery. Moreover, the growing adoption of automation necessitates consistent performance from abrasives, which is a key strength of superior ceramic options. Looking ahead, the long-term outlook for this market remains positive. As awareness about the performance and lifecycle cost benefits of superior ceramic abrasives increases, and technological advancements lead to even better options, these advanced abrasives are poised to play a major role in shaping the future of precision grinding and finishing across the globe.

Latest trends/Developments

The Superior Quality Ceramic Abrasive market is witnessing exciting developments driven by the relentless pursuit of performance and sustainability in manufacturing. A key trend is the development of next-generation ceramic materials like cubic boron nitride (CBN) and silicon carbide (SiC) with even greater hardness and wear resistance. These advancements cater to the growing need for grinding ever-tougher materials used in aerospace components and electric vehicle parts. Another trend is the focus on environmentally friendly abrasives. Superior ceramic abrasives often generate less dust and require cooler grinding processes compared to traditional options. Manufacturers are increasingly looking for solutions that comply with stricter environmental regulations and promote sustainable manufacturing practices. Additionally, the rise of automation is driving the demand for consistent and predictable abrasives. Superior ceramic abrasives, with their uniform wear characteristics, ensure robots maintain consistent cuts and finishes, maximizing production efficiency in automated environments. Furthermore, there's a growing emphasis on research and development to create application-specific abrasives. Manufacturers are tailoring ceramic abrasive properties like grain size and bond type to optimize performance for specific grinding and finishing tasks in industries like electronics and medical devices. Overall, the Superior Quality Ceramic Abrasive market is evolving rapidly, with a focus on advanced materials, sustainability, automation compatibility, and application-specific solutions, paving the way for a future of high-precision and eco-conscious manufacturing.

Key Players:

-

Saint-Gobain (France)

-

3M Company (USA)

-

Robert Bosch GmbH (Germany)

-

Honeywell International Inc. (USA)

-

Norton Abrasives (USA)

-

Tyrolit Group (Austria)

-

Asahi Diamond Industrial Co., Ltd. (Japan)

-

Diamant Boart (Belgium)

-

Weiler Abrasives Group (Germany)

-

China National Abrasives Group Co., Ltd. (China)

Chapter 1. Superior Quality Ceramic Abrasive Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Superior Quality Ceramic Abrasive Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Superior Quality Ceramic Abrasive Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Superior Quality Ceramic Abrasive Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Superior Quality Ceramic Abrasive Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Superior Quality Ceramic Abrasive Market – By Type

6.1 Introduction/Key Findings

6.2 Ceramic Material

6.3 Product Form

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Superior Quality Ceramic Abrasive Market – By Application

7.1 Introduction/Key Findings

7.2 Metalworking

7.3 Electronics

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Superior Quality Ceramic Abrasive Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Superior Quality Ceramic Abrasive Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Saint-Gobain (France)

9.2 3M Company (USA)

9.3 Robert Bosch GmbH (Germany)

9.4 Honeywell International Inc. (USA)

9.5 Norton Abrasives (USA)

9.6 Tyrolit Group (Austria)

9.7 Asahi Diamond Industrial Co., Ltd. (Japan)

9.8 Diamant Boart (Belgium)

9.9 Weiler Abrasives Group (Germany)

9.10 China National Abrasives Group Co., Ltd. (China)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Superior Quality Ceramic Abrasive Market was valued at USD 45.95 billion in 2023 and will grow at a CAGR of 5.9% from 2024 to 2030. The market is expected to reach USD 68.64 billion by 2030.

Growing Demand for Precision and Efficiency, Stringent Environmental Regulations, and Increased Automation and Robotics are the reasons that are driving the market.

Based on Application it is divided into two segments – Metalworking and electronics.

Asia is the most dominant region for the luxury vehicle Market.

Saint-Gobain (France), 3M Company (USA), Robert Bosch GmbH (Germany), Honeywell International Inc. (USA), Norton Abrasives (USA).