Sugar Substitutes Market Size (2024 – 2030)

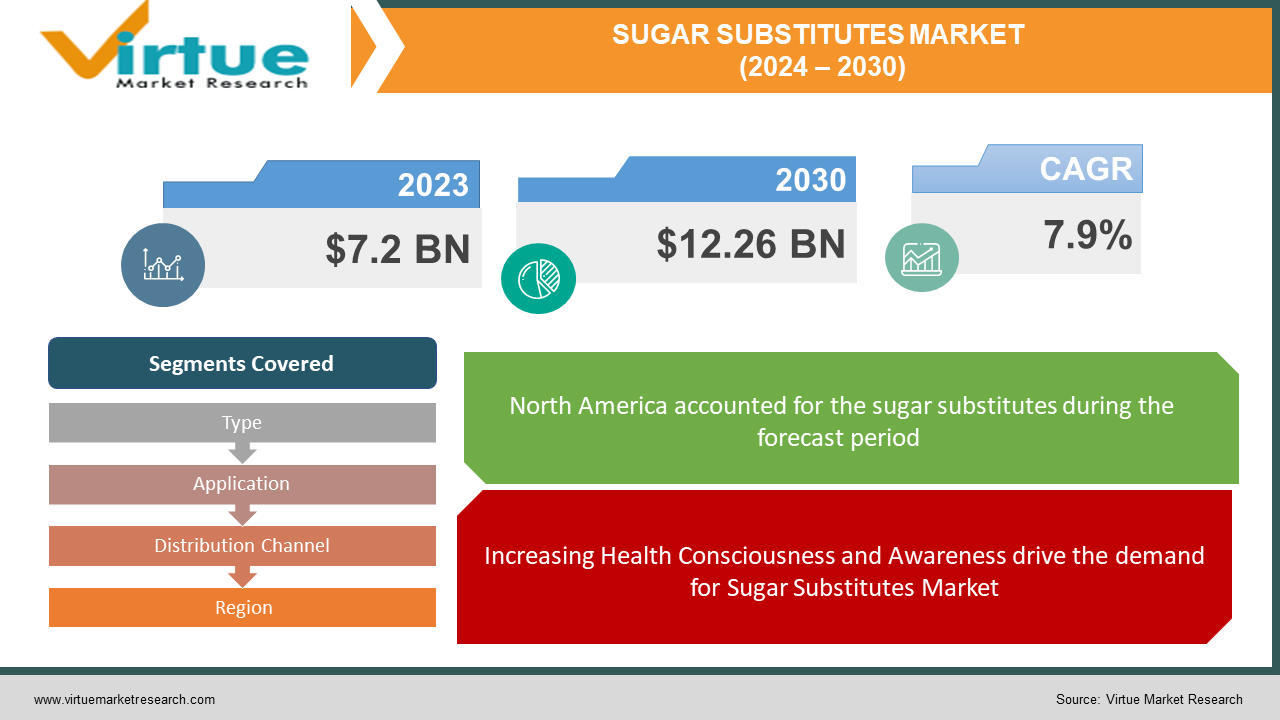

The Global Sugar Substitutes Market was valued at USD 7.2 billion and is projected to reach a market size of USD 12.26 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.9%.

Sugar substitutes are sweeteners. Sugar substitutes are widely used in various food and beverage products as alternatives to sugar. The Sugar Substitutes Market is expected to grow significantly in the coming years due to growing health consciousness and the rising prevalence of diabetes and obesity. The major well-established key players in the Sugar Substitute market are Tate & Lyle PLC, Cargill, Archer Daniels Midland Company, Ingredion Incorporated, and PureCircle Limited.

Key Market Insights:

With consumers becoming more health-conscious, there has been a shift towards Sugar substitutes. Low-calorie and sugar-free products are an ongoing trend. Sugar substitutes offer sweetness without the added calories of sugar. Health consciousness, the rising prevalence of diabetes and obesity, growing demand for low-calorie options, technological advancements in sweetener development, and expanding applications across various industries such as food and beverage, pharmaceuticals, and personal care are propelling the Sugar Substitutes Market. Sugar substitutes find applications in pharmaceuticals, personal care products, and other industries. The restraints to the sugar substitute market include taste issues along with regulatory challenges and safety concerns. North America occupies the highest share of the Sugar Substitutes Market. Asia-Pacific is the fastest-growing segment during the forecast period.

Sugar Substitutes Market Drivers:

Increasing Health Consciousness and Awareness drive the demand for Sugar Substitutes Market

Consumers are becoming more health-conscious. There is a growing awareness of the adverse health effects associated with excessive sugar. High sugar intake is responsible for various health issues, including obesity, type 2 diabetes, cardiovascular diseases, and dental problems. There is a shift in consumer preferences towards healthier dietary choices. This includes products with reduced sugar content or sugar substitutes. The health and wellness trend is particularly prevalent among demographics such as millennials and Generation Z. They prioritize health and wellness in their lifestyle choices. Health organizations, government agencies, and media outlets are educating consumers about the health risks associated with sugar consumption. Public health campaigns, dietary guidelines, and media coverage highlighting the link between sugar intake and chronic diseases increased awareness and demand for sugar substitutes.

Growing Prevalence of Diabetes and Obesity are propelling the Sugar Substitutes Market

The global prevalence of diabetes and obesity is driving the demand for sugar substitutes. This also leads to a high demand for low-calorie sweeteners. According to the World Health Organization (WHO), the number of people with diabetes is estimated to be 422 million. People living with this condition worldwide are increasing. Obesity rates are also on the rise. This is mainly due to sedentary lifestyles, unhealthy diets, and genetic predisposition. Obesity may lead to type 2 diabetes, cardiovascular diseases, and other metabolic disorders. Sugar substitutes offer a solution for individuals with diabetes by providing sweetness without impacting blood glucose levels or insulin response. Manufacturers are reformulating existing products and introducing sugar-free beverages, reduced-sugar snacks, and diabetic-friendly desserts sweetened with sugar substitutes.

Sugar Substitutes Market Restraints and Challenges

The major challenges faced by the Sugar Substitutes Market are the perception and taste issues., Some sugar substitutes still have a distinct aftertaste or perceived off-flavors compared to natural sugar. This can be the reason for consumers to stop adopting sugar substitutes. This can be challenging, especially in applications where taste is crucial, such as in baked goods or beverages. Another challenge in the Sugar Substitutes Market is the regulatory scrutiny and evolving safety standards. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA), assess the safety of sweeteners. Safety concerns regarding the long-term use of certain artificial sweeteners and conflicting research findings on their health effects lead to stricter regulations or bans on certain sweeteners by regulatory authorities.

Sugar Substitutes Market Opportunities:

The Sugar Substitutes Market has various opportunities in the market. With the increasing health consciousness and concerns about obesity and diabetes, the Sugar Substitutes Market is anticipated to witness significant growth in the coming years. Sugar substitutes offer a solution for consumers looking to adopt a healthy lifestyle and reduce their sugar intake while maintaining sweetness. This presents an opportunity for companies to promote the health benefits of sugar substitutes. Other Opportunities in the Sugar Substitutes Market include rising demand for natural sweeteners, product innovation, expanding applications, regional market expansion, sustainable sourcing, and e-commerce growth.

SUGAR SUBSTITUTES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.9% |

|

Segments Covered |

By Type, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Tate & Lyle PLC, Cargill, Incorporated, Archer Daniels Midland Company (ADM), Ingredion Incorporated, Ajinomoto Co., Inc., DuPont de Nemours, Inc., PureCircle Limited, Stevia Corp., The NutraSweet Company (Monsanto), Roquette Frères |

Sugar Substitutes Market Segmentation: By Type

-

Natural Sweeteners

-

-

Stevia

-

Monk Fruit Extracts

-

Honey

-

Maple Syrup

-

Agave Nectar

-

Others

-

-

-

Artificial Sweeteners

-

-

Aspartame

-

Sucralose

-

Saccharin

-

Neotame

-

Others

-

-

-

Sugar Alcohols

-

High-Intensity Sweeteners

In 2023, based on market segmentation by type, artificial sweeteners occupy the highest share of the Sugar Substitutes Market. This is mainly due to their widespread use in various food and beverage products. Artificial sweeteners give sweetness without the calories of sugar. These are often used in sugar-free products.

However, natural sweeteners are the fastest-growing segment during the forecast period and are projected to grow at a CAGR of 15%. This is due to increasing consumer demand for healthier alternatives to sugar and artificial sweeteners. Stevia is the fastest-growing segment among natural sweeteners in the sugar substitute market. This is mainly due to its natural origin and zero-calorie content.

Sugar Substitutes Market Segmentation: By Application

-

Food and Beverages

-

-

Beverages (Soft Drinks, Juices)

-

Bakery and Confectionery

-

Dairy Products

-

Snacks

-

-

-

Healthcare and Pharmaceuticals

-

Personal Care and Cosmetics:

-

Others

In 2023, based on market segmentation by Application, the Food and Beverages segment occupies the highest share of the Sugar Substitutes Market. This is mainly due to their diverse applications. Sugar Substitutes are used in a wide range of products, including beverages (soft drinks, juices), bakery and confectionery items, dairy products, snacks, and packaged foods.

Food and Beverages are the fastest-growing segment during the forecast period. This is mainly due to the increasing health consciousness among consumers. They seek lower-calorie alternatives to traditional sugary food and beverages. The beverages segment, especially soft drinks and juices, is experiencing the fastest growth due to health and wellness trends.

Sugar Substitutes Market Segmentation: By Distribution Channel

-

Retail Stores

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Specialty Stores

-

-

Online Retail

In 2023, based on market segmentation by the Distribution Channel, the Retail Stores segment occupies the highest share of the Sugar Substitutes Market. This is mainly due to the increasing availability of sugar substitutes in these stores. Supermarkets and hypermarkets are dominant and significant distribution channels due to the wide range of sugar substitutes, including various brands and types.

However, Online Retail is the fastest-growing segment during the forecast period. This is mainly due to the increasing prevalence of e-commerce. The convenience of online shopping, a wide selection of products, competitive pricing, and home delivery attract more consumers to purchase sugar substitutes from online stores.

Sugar Substitutes Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by region, North America occupies the highest share of the Sugar Substitutes Market. It has a market share of 45%. This growth is due to the high consumer awareness of health and wellness trends, widespread adoption of low-calorie and sugar-free products, and strong regulatory frameworks supporting the use of sugar substitutes. North America is a technologically advanced region with a large food and beverage industry. The United States and Canada are dominant nations in the Sugar Substitutes Market.

However, Asia-Pacific is the fastest-growing segment during the forecast period. This is mainly due to rising disposable incomes, changing dietary habits, increasing urbanization, and growing health consciousness. Countries like China, India, Japan, and South Korea, have significant market shares due to the increasing prevalence of diabetes and obesity. Rapidly expanding food and beverage industries and a growing market for functional and health-oriented products contribute to the growth of sugar substitutes in this region.

COVID-19 Impact Analysis on the Global Sugar Substitutes Market:

The COVID-19 pandemic had a significant impact on the Sugar Substitutes Market. There were lockdowns, travel restrictions, and border closures. This disrupted global supply chains and affected the sourcing and transportation of raw materials used in sugar substitutes. This led to delays in production and distribution of sugar substitutes. During the pandemic, many consumers turned to home cooking and baking. This led to increased demand for sugar substitutes in homemade recipes. Concerns about immune health and chronic diseases like diabetes and obesity increased the demand for healthier alternatives to traditional sugar. The pandemic accelerated trends towards health and wellness. This led to increased consumer interest in the adoption of low-calorie and sugar-free products, sweetened with sugar substitutes. Thus, the pandemic accelerated certain trends in the Sugar Substitutes Market.

Latest Trends/ Developments:

One of the developments, in the Sugar substitute market is the innovation to develop new sugar substitute formulations that have the taste and texture of sugar. Ongoing research and development resulted in the introduction of newer and more effective sugar substitutes. It enhances the taste profiles of artificial sweeteners. Consumers are becoming more health-conscious, and there is a trend towards low-calorie and sugar-free products. This trend increases demand for sugar substitutes as they offer sweetness without the added calories of sugar. Sugar substitutes also find applications in pharmaceuticals, personal care products, and other industries.

Key Players:

-

Tate & Lyle PLC

-

Cargill, Incorporated

-

Archer Daniels Midland Company (ADM)

-

Ingredion Incorporated

-

Ajinomoto Co., Inc.

-

DuPont de Nemours, Inc.

-

PureCircle Limited

-

Stevia Corp.

-

The NutraSweet Company (Monsanto)

-

Roquette Frères

Market News:

-

In 2023, SweetLeaf launched two new product lines of natural sugar substitutes. The Indulge Line features zero-calorie sweeteners and sugars with a 50% calorie reduction. It offers healthier alternatives for satisfying sweet cravings. SweetLeaf's commitment to natural ingredients and reduced sugar aligns with the growing demand for healthier food choices. The introduction of these products contributes to the evolution of the sugar substitute industry.

-

In 2023, the United States Food and Drug Administration (FDA) officially approved allulose as a novel food additive, thereby expanding the options within the realm of sugar substitutes. Allulose, a naturally occurring low-calorie sweetener found in foods like figs, raisins, and maple syrup, boasts a taste profile akin to regular sugar but with notably fewer calories. This regulatory approval unlocks promising opportunities for developing healthier food products that maintain sweetness without sacrificing nutritional goals.

Chapter 1. Sugar Substitutes Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Sugar Substitutes Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Sugar Substitutes Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Sugar Substitutes Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Sugar Substitutes Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Sugar Substitutes Market – By Application

6.1 Introduction/Key Findings

6.2 Food and Beverages

6.3 Beverages (Soft Drinks, Juices)

6.4 Bakery and Confectionery

6.5 Dairy Products

6.6 Snacks

6.7 Healthcare and Pharmaceuticals

6.8 Personal Care and Cosmetics:

6.9 Others

6.10 Y-O-Y Growth trend Analysis By Application

6.11 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Sugar Substitutes Market – By Type

7.1 Introduction/Key Findings

7.2 Natural Sweeteners

7.3 Stevia

7.4 Monk Fruit Extracts

7.5 Honey

7.6 Maple Syrup

7.7 Agave Nectar

7.8 Others

7.9 Artificial Sweeteners

7.10 Aspartame

7.11 Sucralose

7.12 Saccharin

7.13 Neotame

7.14 Others

7.15 Sugar Alcohols

7.16 High-Intensity Sweeteners

7.17 Y-O-Y Growth trend Analysis By Type

7.18 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Sugar Substitutes Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Retail Stores

8.3 Supermarkets/Hypermarkets

8.4 Convenience Stores

8.5 Specialty Stores

8.6 Online Retail

8.7 Y-O-Y Growth trend Analysis By Distribution Channel

8.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Sugar Substitutes Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By Type

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By Type

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By Type

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By Type

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By Type

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Sugar Substitutes Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Tate & Lyle PLC

10.2 Cargill, Incorporated

10.3 Archer Daniels Midland Company (ADM)

10.4 Ingredion Incorporated

10.5 Ajinomoto Co., Inc.

10.6 DuPont de Nemours, Inc.

10.7 PureCircle Limited

10.8 Stevia Corp.

10.9 The NutraSweet Company (Monsanto)

10.10 Roquette Frères

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global was valued at USD 7.2 billion and is projected to reach a market size of USD 12.26 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.9 %.

Health consciousness, the rising prevalence of diabetes and obesity, growing demand for low-calorie options, technological advancements in sweetener development, and expanding applications across various industries such as food and beverage, pharmaceuticals, and personal care are the market drivers of the Global Sugar Substitutes Market.

Retail Stores (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores) and online Retail are the segments under the Global Sugar Substitutes Market by Distribution Channel.

North America is the most dominant region for the Global Sugar Substitutes Market.

Tate & Lyle PLC, Cargill, Archer Daniels Midland Company, Ingredion Incorporated, PureCircle Limited are the key players in the Global Sugar Substitutes Market .