Succinic Acid Market Size (2024 – 2030)

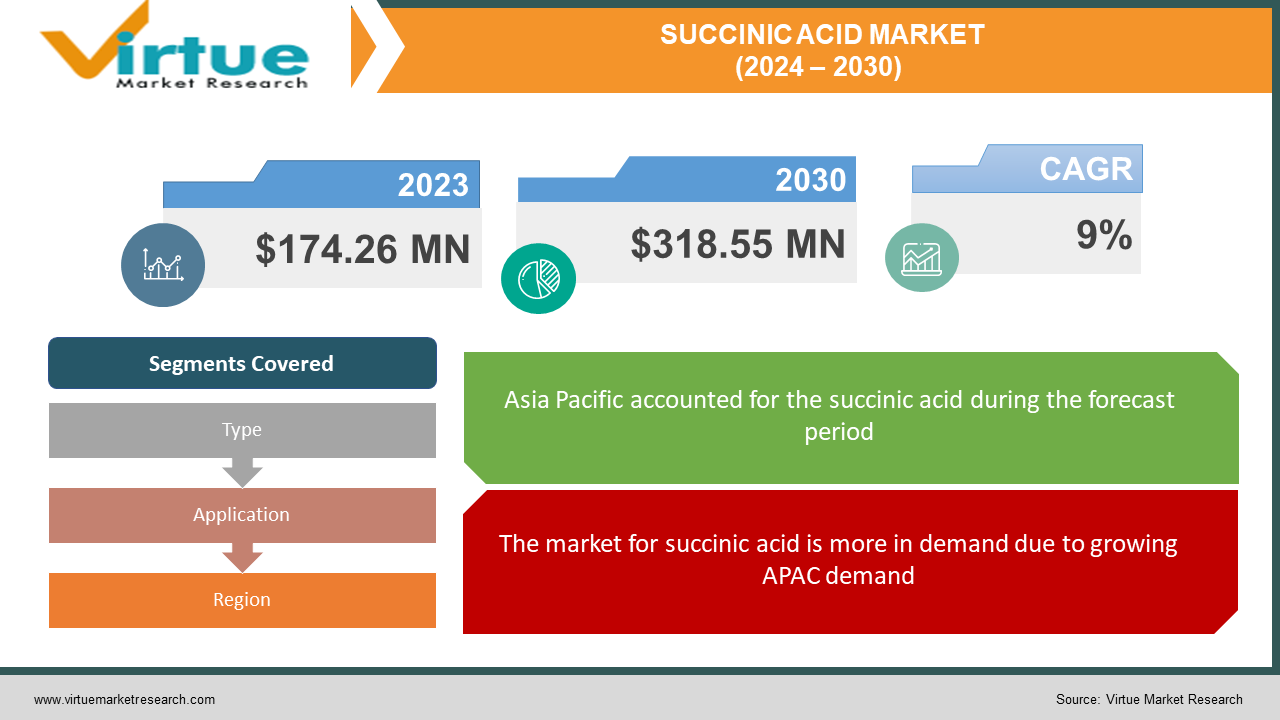

The global succinic acid market was valued at USD 174.26 million and is projected to reach a market size of USD 318.55 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 9%.

The expansion is attributed to building and infrastructure development activities as well as the growing use of succinic acid (SA) in the pharmaceutical industry. It is made from both biobased and petroleum-based materials. An increase in their choice of succinic acid over maleic anhydride derived from butane in the manufacturing of chemicals that are traditionally made from butane, such as plastics, diethylmaleate, fumaric acid, and glyoxylic acid, is expected to have a positive impact on the market's growth. Alpha, omega-dicarboxylic acid, which results from butane's methyl groups being oxidized to the appropriate carboxyl group, is petroleum-based sulfuric acid. Sugar fermentation is the procedure that yields the bio-based version. Regulators in many developed nations are quite concerned about the massive amount of CO2 emissions. As a result, consumers are now more interested in organic and bioderived goods. Because bio-succinic acid is environmentally friendly, this market is anticipated to increase in the upcoming years. The existence of several multinational firms competing for a competitive edge through a robust product portfolio, diversity, distribution network, and commercial tactics including alliances, partnerships, and capacity expansions has made the global market extremely competitive.

Key Market Insights:

Succinic acid, often referred to as butanedioic acid, is found in nature in a variety of forms as its esters or in its initial state in the tissues of plants and animals. The global market for succinic acid has shown significant expansion due to the swift progress made in the science of fermentation and procedures. The market for succinic acid is propelled by the enormous potential for growth associated with converting succinic acid into a variety of industrial compounds with robust demand dynamics. However, creating biobased succinic acid is a costly and time-consuming procedure. For the sustainable manufacture of succinic acid, the selection of supplies and a high level of expertise for purifying processes are still essential.

The major players in the worldwide succinic acid market are stepping up their manufacturing efforts. The market for bio-based succinic acid is anticipated to grow significantly as a result of microorganisms being a dependable supply of succinic acid. The value-added and derivative products made from succinic acid provide businesses with yet another profitable market. Succinic acid's role as a precursor to numerous consumer goods and industrial chemicals is helping to propel the market's overall expansion.

Succinic Acid Market Drivers:

The market for succinic acid is more in demand due to growing APAC demand.

The market in the region is expanding quickly as a result of the strengthening economy and rising consumer awareness. By 2023, it is also anticipated that this region will control the majority of the global succinic acid market due to the expanding polyurethane, pharmaceutical, 1, 4-BDO, food and beverage, and industrial bases, as well as the accessibility of inexpensive labor and low manufacturing costs. Moreover, the APAC succinic acid market has expanded as a result of China's increasing demand for succinic acid derivatives. Due to advancements in downstream industries and succinic acid production technology, the Chinese market for the product has grown steadily over the past ten years. Succinic acid is widely utilized in China to make several derivatives, including 1,4-BDO and dimethyl succinate (DMS), which are then employed in the chemical industry as surfactants and soldering fluxes. While succinic acid is utilized in the food and beverage sector to produce disodium succinate, which enhances food flavor, in the pharmaceutical industry it serves as a raw material for ferrous succinate, succinimide, and N-bromo succinimide (NBS). Consequently, China's need for succinic acid is rising as a result of the industry's use of the substance to produce a variety of derivatives.

Growing Consumer Demand for Organic Cosmetics to Increase Consumption of Bio-Succinic Acid

Revenues for succinic acid in North America are predicted to be led by the United States. The nation's consumption of cosmetic and personal care items has been positively impacted by high consumer spending power. In the US personal care market in the coming years, this factor will be the main driver of succinic acid demand. Due to rising health consciousness in the nation, succinic acid pills and supplements should experience consistent growth in consumption throughout the projected period. The need for succinic acid in the United States will be further supported by growing consumer demand for organic products and growing knowledge of the negative consequences of products based on chemicals.

Succinic acid suppliers are likely to discover attractive opportunities due to low production costs.

Given its strong manufacturing credentials, China is anticipated to offer lucrative prospects for the succinic acid industry. The expansion of the succinic acid market in China is anticipated to be supported by favorable government initiatives and low labor costs. Throughout the projection period, growth in the production of succinic acid food additives, supplements, and tablets is anticipated throughout the country. At present, 45.2% of the Asia Pacific succinic acid industry is held by the China succinic acid market.

Global Succinic Acid Market Restraints and Challenges:

One of the main obstacles to using succinic acid more often as a building component is the creation of inexpensive fermentation processes. The development of an economical sugar fermentation process is necessary to guarantee the competitiveness of bio-based succinic acid compared to petroleum-based products. Additionally, there is a need to optimize the fermentation process in terms of ultimate titer, pH concerns, productivity, and nutritional requirements. The market for bio-based succinic acid is closed to producers due to the poor performance of other biochemical production projects. Since bio-based processes need a lot of land and water to develop their feedstock, their environmental credentials are frequently questioned. Furthermore, there is limited application of succinic acid as a chemical element due to the complexity of the procedure utilized to produce bio-based succinic acid. The industrialization of succinic acid made from renewable feedstock is hampered by these main problems. Previously, several succinic acid producers were working to create commercially viable capabilities for bio-based succinic acid. However, there have been few documented successes in the bio-production of succinic acid, save for a few initiations made by the major players. Utilizing renewable feedstock to produce bio-based succinic acid led to a highly expensive separation method and a low yield. As a result, there was less of a market for bio-based succinic acid, which ultimately caused large operations to close.

Global Succinic Acid Market Opportunity:

Amber acid, sometimes referred to as succinic acid, is an essential component of several secondary compounds that find use in a variety of sectors, including polyurethane, food and beverage, pharmaceuticals, and solvents and lubricants. Significant prospects for succinic acid are provided by PBS, 1, 4-BDO, and food applications.

A biopolymer known as polybutylene succinate (PBS) is created when succinic acid and 1, 4-BDO polymerize. PBS, or crystalline polyester, has a melting point that is higher than 212°F (100°C), which is crucial for applications that require high temperatures. PBS is used in a variety of applications, such as compostable bags, agricultural mulching films, and single-use food service equipment (such as cutlery, cups, and lids). PBS may additionally be utilized to create composites by adding different materials to the fibers to improve the substance's material qualities and increase its range of possible uses. PBS is utilized in the agricultural sector to create mulching films and materials with the delayed release of fertilizer and pesticides. PBS is utilized in the agricultural sector to create mulching films and materials with the delayed release of fertilizer and pesticides. PBS is being researched for usage in medical implants in addition to its use in biodegradable medication encapsulating systems in the medical field. Therefore, it is anticipated that the growing potential uses of PBS across many industries will fuel the need for succinic acid in PBS production.

SUCCINIC ACID MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Mitsubishi Chemical Corporation, The Chemical Company, Kawasaki Kasei Chemicals Ltd, Parchem, Dow Chemicals, Myriant Corporation, BioAmber, Ernesto Ventos S.A., BASF SE |

Global Succinic Acid Market Segmentation: By Type

-

Petro-based

-

Bio-based

The petro-based category has the largest market, with a rough share of 50% in 2023. This is explained by the fact that succinic acid derived from petroleum is used in place of adipic acid throughout the polyurethane synthesis process. The methyl groups in butane are oxidized to the appropriate carboxy group to create the petro-based version. It is used in many different processes, including the creation of plasticizers and flavor enhancers for packaged foods. The expansion of this category is anticipated to be fueled by the growing demand from the food and beverage, personal care, and industrial sectors. The bio-based industry is the fastest-growing segment. The growing concern over consumer health and the focus of the government on environmental issues have made it difficult for the petro-based goods sector to grow. Growing demand for succinic acid over butane-based maleic anhydride in the production of chemicals that are traditionally made from butane, such as fumaric acid, succinic anhydride, plastics, diethylmaleate, polymers, and glyoxylic acid, is also anticipated to have a positive effect on the demand for a bio-based product.

Global Succinic Acid Market Segmentation: By Application

-

Food and Beverages

-

Pharmaceuticals

-

Industrial

The industrial segment holds the largest market share, at around 39% in 2023. This sizeable portion of the market may be ascribed to the growing usage of goods like tetrahydrofuran, polyurethane, and 1,4-butanediol (BDO) across a variety of sectors where succinic acid is the main raw material. Tetrahydrofuran, which is produced using BDO, is a crucial raw ingredient for the creation of spandex and is also utilized as a form of solvent in the chemical sector. Spandex is incredibly strong and elastic. In turn, an increasing need for this material is anticipated to support the segment's expansion. Due to growing demand from the automotive and construction industries, the coatings industry had a significant percentage. Succinic acid gives coatings durability, a fast cure ratio, and a glossy finish, which makes it a popular raw material. The food and beverage industry is the fastest-growing application. Natural acid succinic acid is used as a flavoring, preservative, and acidity regulator in the food and beverage sector. Additionally, various food packaging materials and food additives are made with it. It is anticipated that rising government investment in infrastructure in nations like China, India, and the United States will enhance demand. Growing urbanization and increased building activity are also anticipated to fuel demand.

Global Succinic Acid Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the largest growing market, with a share of around 34% in 2023. China, India, and other Southeast Asian countries are responsible for this expansion. Urbanization is one of the major success factors. With a rising middle class and an increasing disposable income, the economies of many countries have seen significant development. This region has a lot of well-established key players who are involved in bulk manufacturing. These companies have a global presence. Besides, the extensive use and applications in the cosmetic, pharmaceutical, and industrial sectors have been driving growth. Europe is the fastest-growing region. The region's expanding healthcare and agriculture sectors are to blame for this expansion. The preference of consumers for bio-based products as a drop-in substitute is projected to cause stagnation in European product demand. The personal care and cosmetics business in Europe uses a lot of succinic acid. Numerous cosmetic brands, like P&G and Unilever, are based in Europe, which is a major driver in the expansion of this regional market. The aerospace industry has expanded as a result of the significant presence of aircraft manufacturers in certain regions of Germany and the United Kingdom. North America also contributes a good share of the global market. This is explained by the numerous opportunities in the area to construct and expand new production facilities. In this age of scarce petroleum, the microbial conversion of renewable feedstock to succinic acid has generated interest in North America to accomplish sustainable development.

COVID-19 Impact Analysis on the Global Succinic Acid Market:

The pandemic caused by COVID-19 impacted all key industries. Lockdowns and travel restrictions were necessary for the majority of countries around the world to stop the virus's spread. All of the big countries' economies were negatively impacted by this. Every industry saw production facility closures, which caused supply chain disruptions. France, Italy, Spain, India, and the United Kingdom were among the important nations whose product demand was negatively impacted. Nonetheless, a steady increase in the demand for succinic acid on the international market will result from the progressive reopening of numerous sectors.

Latest Trends/ Developments:

The market is highly competitive as a result of the presence of numerous international businesses. To increase their revenue, these businesses are eager to expand into unexplored markets. To obtain an edge over rivals, they are implementing several business plans to build a robust customer base, an extensive dealer network, and a range of products. Businesses are attempting to adjust to novel production methods with the aid of technological breakthroughs to maximize profit while requiring the least amount of input and investment.

Key Players:

-

Mitsubishi Chemical Corporation

-

The Chemical Company

-

Kawasaki Kasei Chemicals Ltd

-

Parchem

-

Dow Chemicals

-

Myriant Corporation

-

BioAmber

-

Ernesto Ventos S.A.

-

BASF SE

Chapter 1. Succinic Acid Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Succinic Acid Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Succinic Acid Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Succinic Acid Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Succinic Acid Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Succinic Acid Market – By Type

6.1 Introduction/Key Findings

6.2 Petro-based

6.3 Bio-based

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Succinic Acid Market – By Application

7.1 Introduction/Key Findings

7.2 Food and Beverages

7.3 Pharmaceuticals

7.4 Industrial

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Succinic Acid Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Succinic Acid Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Mitsubishi Chemical Corporation

9.2 The Chemical Company

9.3 Kawasaki Kasei Chemicals Ltd.

9.4 Parchem

9.5 Dow Chemicals

9.6 Myriant Corporation

9.7 BioAmber

9.8 Ernesto Ventos S.A.

9.9 BASF SE

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The key players are Mitsubishi Chemical Corporation, The Chemical Company, Kawasaki Kasei Chemicals Ltd., Parchem, Dow Chemicals, Myriant Corporation, BioAmber, Ernesto Ventos S.A., and BASF SE.

The global succinic acid market was valued at USD 174.26 million and is projected to reach a market size of USD 318.55 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 9%.

Asia-Pacific has the largest global succinic acid market.

Succinic acid is an essential component of several secondary compounds that find use in a variety of sectors, including polyurethane, food and beverage, pharmaceuticals, solvents, and lubricants. Significant prospects for succinic acid are provided by PBS, 1, 4-BDO, and food applications.

Petro-based has a significant impact on the global succinic acid market.