Styrene Market Size (2024 – 2030)

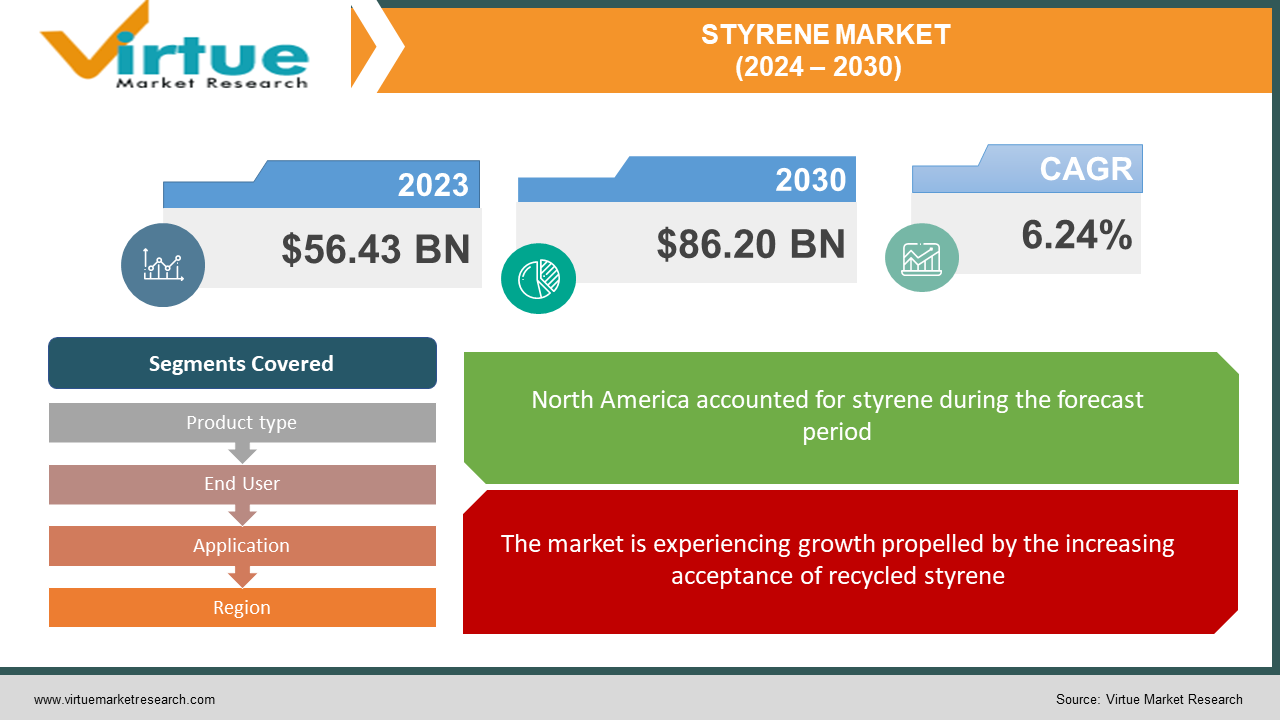

The Global Styrene Market size was exhibited at USD 56.43 billion in 2023 and is projected to hit around USD 86.20 billion by 2030, growing at a CAGR of 6.24% during the forecast period from 2024 to 2030.

Styrene, an organic and colourless compound, is employed in the production of latex, synthetic rubber, and polystyrene resins. Renowned for its unique combination of rubber and plastic characteristics, styrene exhibits high frictional force, solid electric performance, and various other attributes. The utilization of polystyrene resins is prevalent in the manufacturing of plastic packaging, primarily for food packaging such as containers, plates, and related products. The significance of the styrene market lies in the heightened demand for polystyrene, a versatile material applied in the fabrication of ovens, microwaves, freezers, and vacuum cleaners.

The advantageous attributes of Styrene Butadiene latex encompass a balanced elongation and filler acceptance. Its flexibility facilitates the creation of diverse mixtures, resulting in adhesion, high water resistance, and bonding to specific substrates. These properties find crucial applications in diverse industries, including paints & coatings, adhesives, nonwovens and textiles, packaging, paper, and construction.

Acrylonitrile Butadiene Styrene (ABS) stands out for its high resistance to physical impacts and corrosive chemicals. Additionally, its rapid processing in machines, coupled with a low melting temperature, simplifies its use in injection molding production processes and 3D printing on Fuel Deposition Modelling (FDM) machines. The projected surge in demand for ABS Plastic is expected to drive market growth in the foreseeable future.

Key Market Insights:

Polystyrene, known for its robust nature, emerges as the preferred material for electrical insulation and safe packaging of various products due to its moisture resistance. Colored, painted, and printable, polystyrene serves as a viable option for packaging, especially in the food industry. The adoption of disposable and reusable containers is extensive in the packaging of perishable items within the food & beverage sector, owing to their perceived hygiene compared to reused plates. Additionally, industries use various polystyrene materials to protect delicate items during transportation. Polystyrene's malleability allows it to be easily molded to fit products like glassware, electronics, and chemicals, preventing breakage.

The driving forces behind the styrene market include the escalating demand for polystyrene in the food packaging and personal care sectors. Polystyrene's widespread use in the food packaging industry, from packaging to distributing food items, is complemented by its role in crafting containers for beauty enhancement products. The growing preference for ready-to-eat, ready-to-serve, and ready-to-make food items fuels the styrene market. Additional contributing factors include the rising demand for consumer electronics and increased investments in the construction and automotive industries. However, concerns about health and the environment linked to styrene may impede its market growth.

Global Styrene Market Drivers:

The market is experiencing growth propelled by the increasing acceptance of recycled styrene.

Yearly increments in global polystyrene manufacturing and usage result from its diverse applications and widespread utility across multiple industries. The discharge of polystyrene into the environment has led environmentalists and researchers to advocate for its recycling, aiming to alleviate the substantial burden of plastics on the environment. Recycled polystyrene finds application in various products, including insulating plates, light switches, and foam packaging. The general trend reflects a heightened interest in recycling styrene. For instance, the commitment of the French industry to achieve 100% polystyrene usage by 2025, as highlighted by the French Ministry of Ecology, underscores this commitment, emphasizing the reduction of plastic's environmental impact.

The market's growth is propelled by the increasing demand for polystyrene, a versatile and extensively utilized plastic polymer.

The Compound Annual Growth Rate (CAGR) of the styrene market is influenced by the growing demand for polystyrene, a versatile and widely used plastic polymer. Polystyrene plays a pivotal role in the packaging industry, given its lightweight nature and insulating properties, making it a preferred choice for applications such as foam packaging, food containers, and disposable cutlery. The escalating demand for single-use packaging materials, particularly in the food and beverage sector and the e-commerce industry, further drives the necessity for polystyrene. Consequently, this surge in polystyrene demand contributes to an increased need for styrene as its primary precursor.

Global Styrene Market Restraints and Challenges:

The market growth faces impediments due to heightened health concerns.

Styrene consumption poses risks to human health, with trace amounts found in urban air from the consumption of food packaged in polystyrene, use of laser printers, and exposure to cigarette smoke. Additionally, the adverse effects of styrene on health are notable, with potential harm to the respiratory and central nervous systems leading to symptoms like fatigue, depression, nausea, and narcosis. Furthermore, styrene exhibits toxicity to animals, with studies indicating increased susceptibility and damage in animals exposed to styrene. The International Agency for Research on Cancer (IARC) has classified styrene as a potential carcinogen, capable of causing cancer through prolonged exposure.

The factor referred to as bio-plastic, derived from plants such as sugarcane, corn, and cellulose, introduces a constraint on market growth.

Market growth encounters challenges due to the dependence on bioplastics sourced from plants like sugarcane, corn, and cellulose. As demand rises, potential constraints surface. The cultivation of specific crops for bioplastics may lead to agricultural dilemmas, involving competition for arable land and potential disruptions in food production. Furthermore, the extraction of cellulose for these plastics requires substantial resources. Striking a balance between the eco-friendly advantages and the environmental impact of resource-intensive processes is imperative. Industry stakeholders must navigate these intricacies to ensure sustainable growth and explore alternative sources to alleviate potential market constraints.

Global Styrene Market Opportunities:

Expansion in the end-user base presents promising prospects for the styrene market.

Styrene finds diverse applications across various industries, with predominant usage in significant sectors like automotive, construction, and packaging. Its lightweight and cost-effectiveness make it particularly suitable, especially in the realm of food packaging. The current popularity of the automotive sector, coupled with the demand for innovative automotive parts, accentuates the prevalent use of styrene in manufacturing auto components. Additionally, the emerging trend toward simpler alternatives to intricate components is gaining traction across diverse industry segments.

The tire market, known for its substantial size, presents an opportunistic avenue for styrene application as a rubber component in tires. Styrene's intrinsic heat tolerance property proves fundamental in the construction sector, offering a practical substitute in various implementations. Furthermore, the escalating demand for electronics fuels the utilization of styrene and its derivatives in the electronics industry. The overall increase in electronic demand contributes to the growing opportunities for styrene in this sector.

STYRENE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.24% |

|

Segments Covered |

By Product type, End User, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Chevron Phillips Chemical Company LLC., Alpek SAB DE CV, Ineos Group AG , Nova Chemicals Corporation, Shell plc, LG Chem Ltd, Dynasol Group, Kraton Corporation, Trinseo, Elevate |

Global Styrene Market Segmentation: By Product Type

-

Polystyrene

-

Styrene Butadiene Rubber

-

Acrylonitrile Butadiene Styrene

The Acrylonitrile Butadiene Styrene (ABS) segment secured the largest market share in the global styrene market during the forecast period, attributed to the growing applications of ABS across various industries. The predominant method for polymerizing ABS copolymer is emulsion polymerization, a technique widely employed globally. ABS, a common engineering plastic, is utilized in luggage, pipe fittings, appliance housings, and interior car parts due to its strength, resilience, heat resistance, and resistance to physical impacts and corrosive substances. While a patented method known as continuous mass polymerization is also employed for ABS production, it is less prevalent.

The Polystyrene (PS) segment is expected to exhibit a consistently high market growth rate in the global styrene market, driven by the increasing use of Polystyrene (PS) owing to its thermoplastic properties. PS, derived from styrene, a liquid hydrocarbon commercially produced from petroleum, exists in foam and solid forms. In its solid form, PS is clear, stiff, brittle, and reasonably robust, while its foam form includes Extruded Polystyrene (XPS) and Expanded Polystyrene (EPS).

Global Styrene Market Segmentation: By End User

-

Packaging Industry

-

Automotive Industry

-

Constructive Industry

The Packaging Industry is anticipated to command a significantly large market share in the global styrene market, driven by the increasing use of styrene in the food packaging industry. Styrene is naturally present in various foods and is also produced during the manufacturing of foods such as cheese, wine, and beer. Additionally, styrene is used in creating PS, a substance incorporated into certain food service packaging.

The Constructive Industry is projected to register a moderately fast market growth rate, attributed to the insulation and soundproofing benefits of PS. Polystyrene, used in products like Styrofoam and disposable foam plates, is commonly employed in homes and workplaces for insulation and soundproofing purposes, capitalizing on its excellent insulating properties, extended lifespan, and high thermal and sound resistance.

Global Styrene Market Segmentation: By Application

-

Packaging

-

Construction

-

Consumer Goods

-

Automotive

-

Others

The automotive segment is poised to experience the fastest revenue growth rate in the global styrene market, driven by the increasing durability of ABS. ABS, a durable thermoplastic, finds applications in various automotive components such as dashboards, wheel covers, car body parts, covers, and linings.

The packaging segment is expected to account for the largest market share in the global styrene market, fueled by the rising demand for ABS in cosmetic packaging. ABS is a commonly used polymer in injection-molded small items like lipstick tubes, plastic eyeshadows, mascaras, and bottles, offering recyclability, affordability, and remarkable structural strength.

Global Styrene Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In North America, the well-established petrochemical industry and robust manufacturing sector, particularly in automotive, construction, and consumer goods, contribute to the region's dominance in the styrene market. The Asia-Pacific Styrene Market is expected to witness the fastest Compound Annual Growth Rate (CAGR) from 2024 to 2030, driven by rapid industrialization, significant growth in construction and infrastructure development, and increasing demand for plastics and synthetic rubber in the automotive and packaging sectors. Notably, China's Styrene market holds the largest market share, while the Indian Styrene market demonstrates the fastest-growing market in the Asia-Pacific region.

COVID-19 Impact on the Global Styrene Market:

The global styrene market encountered significant challenges due to the COVID-19 pandemic. Governments worldwide implemented regulatory guidelines for lockdowns and social distancing, resulting in the closure of airports, ports, businesses, and local shipping. These measures had a profound impact on manufacturing units and processes globally, placing a substantial burden on the economies of various countries.

The disruptions caused by the pandemic included challenges in the supply chain, reduced industrial activities, and a decline in the demand for consumer goods and automotive products, contributing to a contraction in the styrene market. Lockdowns and restrictions hindered production and logistics, affecting both upstream and downstream sectors. However, with gradual economic recovery and ongoing vaccination efforts, the styrene market is anticipated to experience a rebound. The heightened emphasis on hygiene and healthcare-related products may drive increased demand, fostering market growth. Industry stakeholders must adapt to evolving consumer trends and prioritize supply chain resilience in navigating the post-pandemic landscape.

Recent Trends and Advancements in the Global Styrene Market:

In May 2023, a collaboration between Sinopec and SABIC was unveiled, with the joint objective of developing and commercializing novel styrene-based polymers. This partnership is geared towards the creation of innovative materials for diverse applications.

April 2023 witnessed INEOS's strategic acquisition of the polystyrene assets of TotalEnergies, encompassing three production sites situated in France, Spain, and Germany. This acquisition solidified INEOS's position as the foremost global producer of polystyrene.

In February 2023, Huntsman Chemical successfully acquired the styrene monomer business of Ashland Holdings for a sum of $1.2 billion. This strategic move not only augmented Huntsman's styrene monomer production capacity but also broadened its geographical footprint.

In January 2022, INEOS Styrolution initiated a significant milestone by commencing a 50,000-ton ABS production facility in France, concurrently enhancing INEOS's product portfolio.

The collaborative efforts of Technip Energies and Agilyx materialized in August 2022 with the introduction of the TruStyrenyx brand, dedicated to the chemical recycling of polystyrene. This initiative represents a noteworthy stride in advancing sustainable practices within the styrene market.

Key Players:

-

Chevron Phillips Chemical Company LLC.

-

Alpek SAB DE CV

-

Ineos Group AG

-

Nova Chemicals Corporation

-

Shell plc

-

LG Chem Ltd

-

Dynasol Group

-

Kraton Corporation

-

Trinseo

-

Elevate

Chapter 1. Styrene Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Styrene Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Styrene Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Styrene Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Styrene Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Styrene Market – By Product Type

6.1 Introduction/Key Findings

6.2 Polystyrene

6.3 Styrene Butadiene Rubber

6.4 Acrylonitrile Butadiene Styrene

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Styrene Market – By End User

7.1 Introduction/Key Findings

7.2 Packaging Industry

7.3 Automotive Industry

7.4 Constructive Industry

7.5 Y-O-Y Growth trend Analysis By End User

7.6 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. Styrene Market – By Application

8.1 Introduction/Key Findings

8.2 Packaging

8.3 Construction

8.4 Consumer Goods

8.5 Automotive

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Application

8.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Styrene Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By End User

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By End User

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By End User

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By End User

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By End User

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Styrene Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Chevron Phillips Chemical Company LLC.

10.2 Alpek SAB DE CV

10.3 Ineos Group AG

10.4 Nova Chemicals Corporation

10.5 Shell plc

10.6 LG Chem Ltd

10.7 Dynasol Group

10.8 Kraton Corporation

10.9 Trinseo

10.10 Elevate

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Styrene Market size is valued at USD 56.43 billion in 2023.

The worldwide Global Styrene Market growth is estimated to be 6.24% from 2024 to 2030.

The Global Styrene Market is segmented By Product Type (Polystyrene, Styrene Butadiene Rubber, and Acrylonitrile Butadiene Styrene), By Application (Packaging, Construction, Consumer Goods, Automotive, and Others), By End User (Packaging Industry, Automotive Industry, and Constructive Industry).

Future trends and opportunities for the Global Styrene Market include the rise of sustainable practices, increased demand in healthcare and packaging sectors, innovations in styrene-based polymers, and strategic collaborations. Adapting to evolving consumer needs, enhancing recycling initiatives, and exploring diverse applications are key avenues for market growth.

The COVID-19 pandemic significantly impacted the Global Styrene Market, leading to disruptions in the supply chain, reduced industrial activities, and decreased demand for consumer goods and automotive products. Lockdowns and restrictions hampered production and logistics, causing a contraction, but recovery is expected with increased focus on hygiene-related products.