Strawberry Bubble Tea Market Size (2024 – 2030)

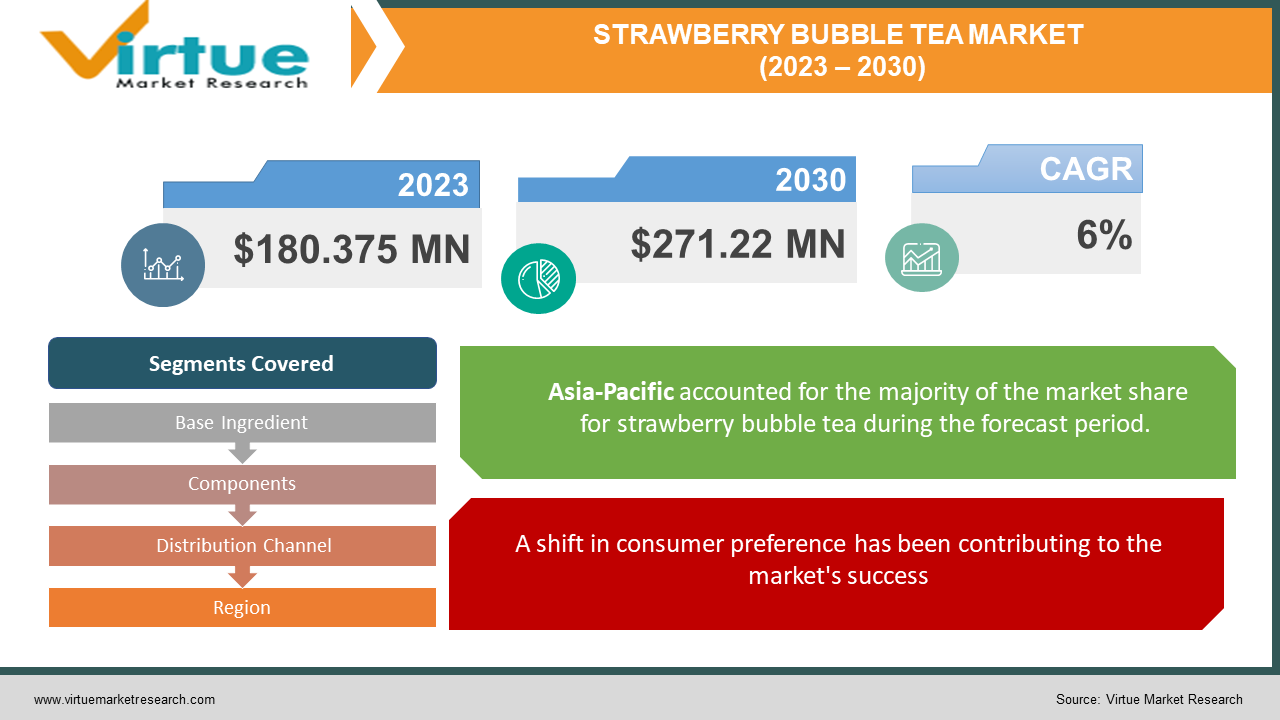

The global strawberry bubble tea market was valued at USD 180.375 million and is projected to reach a market size of USD 271.22 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 6%.

Bubble tea, often referred to as boba milk tea, is a chilled, foamy beverage created with tapioca pearls at the bottom of the glass and a tea base mixed with flavors, sweeteners, and/or milk. In the past, this market had a small presence. There weren't many innovations or awareness about these beverages. This drink was popular only in a few countries. However, it started gaining recognition by the mid-2000s. Presently, this market has seen considerable expansion owing to global operations and culinary explorations. In the future, with a growing focus on personalization, creativity, and healthier alternatives, this market is expected to witness a good boost.

Key Market Insights:

More than half of China's more than 400,000 bubble tea establishments were chain franchisees as of 2022. In China, there are more than 10 billion bubble tea transactions made each year.

According to a poll conducted in 2023, over 40% of Chinese consumers reported purchasing bubble tea three to five times each month.

With 93 locations as of March 2023, Bobapop led the bubble tea shop industry, followed by Tiger Sugar with 53 locations. That year, there were 364 bubble tea establishments in Vietnam.

Experts estimate that by 2032, the bubble tea industry will grow to $6.2 billion.

Unhealthy weight gain may result from regular or excessive bubble tea use without modifying daily calorie intake. Calorie counts can rise by 350–400 when tapioca, milk, and fruit syrup are combined. To address this, companies have been focusing on creating healthier alternatives and commercializing the same.

Strawberry Bubble Tea Market Drivers:

A shift in consumer preference has been contributing to the market's success.

Over the years, there have been numerous changes in diets and the standard of living. The economies of many countries have improved, providing significant employment opportunities. People have been able to live a luxurious lifestyle. Additionally, factors like the rising middle class and an increasing disposable income have been responsible as well. People can afford different types of cuisine and beverages regularly. Besides, with dual income being the new norm, people are on the lookout for options. This saves time and is convenient for them. Furthermore, global operations and online delivery services have been aiding the market.

Bubble tea is associated with health benefits, which has been helping with market expansion.

Consumers have been leaning towards beverages that are tasty and nutritious. Firstly, it is known to provide strength to the body because of the antioxidants that are present in it. Secondly, it is rich in carbohydrates, making it a rich source of energy. Thirdly, the healthy alternatives are good for heart health because of the vitamins and minerals in them. Moreover, few versions are known to enhance an individual's mood, reduce stress, and eliminate or prevent free radical damage. Furthermore, strawberries are rich in vitamin C and other antioxidants, due to which they lower the chance of developing major illnesses, including diabetes, cancer, heart disease, and stroke. They're a great source of magnesium as well.

Social media has been boosting market growth.

Social platforms like Instagram, WhatsApp, and Facebook have become very popular, with millions of users having an account. Various channels are dedicated to promoting places, dineries, and other food franchise channels that are known to give an authentic and delicious flavor. Food bloggers and other content creators share their experiences and give reviews about various food products and beverages. Additionally, few of them provide a detailed description of the health benefits, methods, and production process of the same. This encourages their fan base to try out these beverages, thereby helping in better revenue generation.

Strawberry Bubble Tea Market Restraints and Challenges:

Seasonal dependency, health concerns, and competition are the main issues that the market is currently experiencing.

The availability of strawberries is one of the biggest barriers in the market. This is a seasonal fruit that is grown during specific times of the year. Therefore, this market is subject to frequent losses. Secondly, these beverages have a high calorie and sugar content. Various surveys and statistics have revealed that nearly half of the world's population will be prone to diabetes by 2030. This has created awareness about maintaining physical and mental health. Therefore, customers prefer home-cooked and healthier options, which can cause obstacles for the market. Apart from this, regions known for their bubble tea might face severe competition from popular brands. Emerging and smaller companies can be saturated due to this.

Strawberry Bubble Tea Market Opportunities:

Product innovations and diversity have been providing the market with an infinite number of possibilities. The food and beverage industry has been keeping up with the trends. Consumers prefer healthier alternatives that have less calorie, fat, and sugar content. Therefore, all the brands have been experimenting with their options to create the desired beverage. Veganism has also gained attention. This includes the incorporation of plant-based diets. Therefore, dairy alternatives are being explored in this market. Apart from this, new strawberry blends with different herbs and flavorings are being emphasized. Furthermore, tailoring the beverages as per the needs of the customers is helping to create more profits.

STRAWBERRY BUBBLE TEA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Base Ingredient, Components, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Chatime, Gong Cha, Kung Fu Tea, Coco Fresh Tea & Juice, Boba Guys, Ten Ren's Tea, Happy Lemon, Tiger Sugar, CoCo Fresh Tea & Juice, ShareTea |

Strawberry Bubble Tea Market Segmentation: By Base Ingredient

-

Black Tea

-

Green Tea

-

Oolong Tea

-

White Tea

Based on base ingredients, the black tea segment is the largest segment in the market, accounting for more than 40% of the share in 2023. Because black tea has a stronger flavor than coffee and less caffeine, it is utilized in bubble tea. It also helps with digestion, bloating, and an upset stomach, among other health advantages. Secondly, the flavones included in black tea can reduce blood cholesterol. Flavonoids, which can lower the risk of heart disease, are also included in it. Thirdly, lung protein oxidation can be stopped by drinking black tea. Moreover, it offers a slightly bitter taste, complementing the sweet taste of strawberries. The green tea segment is the fastest-growing category. Due to its numerous health advantages, green tea is a widely preferred flavor of bubble tea. Antioxidants included in green tea, such as polyphenols and catechins, can strengthen the immune system. Polyphenols, which are also found in green tea, may have antiviral and anti-inflammatory properties.

Strawberry Bubble Tea Market Segmentation: By Components

-

Flavor

-

Creamer

-

Sweetener

-

Liquid

-

Tapioca Pearls

-

Others

Based on components, tapioca pearls are the largest segment. Boba, or tapioca pearls, are a common component in bubble tea. They give the beverage a distinct texture and sweetness. Furthermore, innovations and creativity have led to growth. The flavor segment is the fastest-growing. This includes the addition of exotic fruits, herbs, and other infusions. They help impart a rich taste to the beverage. Furthermore, they make the drink more appealing, helping with the expansion.

Strawberry Bubble Tea Market Segmentation: By Distribution Channel

-

Supermarkets and Hypermarkets

-

Convenience Stores

-

Online Retail

-

Others

Online retail is both the largest and fastest-growing distribution channel in this market. The primary reason for this is convenience. Customers can order beverages from the comfort of their homes. Besides, they will be able to access a wider range of flavors, including local and international. Additionally, online apps offer benefits to consumers, which can include discounts, subscription boxes, free delivery, promotions, etc. Moreover, the rising trend of digitalization has been helping the market to grow.

Strawberry Bubble Tea Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Based on region, Asia-Pacific is the largest market, holding a rough share of 35% in 2023. Countries like Taiwan, China, and Vietnam are at the forefront. The primary reason for this is because of its cultural significance. This beverage was popularly consumed in Asian countries. The revenue from this drink helped strengthen the economy. These regions are known for their bulk manufacturing, resulting in a higher number of imports and exports. Apart from this, globalization has been helping to commercialize the beverage in more countries, thereby increasing sales. North America is the fastest-growing region, with the United States as the top country. This region holds a share of around 29%. This is because of the rising number of companies involved in the manufacturing and production processes of this tea. Secondly, people have increased their consumption of this tea owing to its taste. This has resulted in greater demand. Apart from this, organizations in this region have been focusing on culinary exploration, which includes vegan options and healthier alternatives, to attract a broader consumer base.

COVID-19 Impact Analysis on the Global Strawberry Bubble Tea Market:

The outbreak of the virus hurt the market. The new norm was lockdowns, movement restrictions, and social isolation. This caused disruptions in the supply chain, transportation, and logistics. Import-export trade activities were affected due to this. Most of the food outlets and manufacturing units were closed. Besides, there was a delay in product launches and collaborations because of the tight financial budgets. There was a lot of uncertainty, and people lost their jobs. Most of the funding was shifted towards healthcare applications and research activities. Furthermore, there was a shift in consumer preference. People cut down on their junk food intake and leaned towards home-cooked meals. According to an article by AP News, since the start of the epidemic, boba shipments have become more expensive by around 10%. However, post-pandemic, the market has slowly started to pick up because of the uplift in lockdowns and guidelines. Digitalization has been facilitating the growth. Vendors and merchants are working towards having an online presence to increase sales.

Latest Trends/ Developments:

The companies in this market are motivated to achieve a higher market share by implementing different strategies, such as acquisitions, partnerships, and investments. Companies are also spending heavily to improve existing formulations while maintaining competitive pricing. This has further resulted in increased enlargement.

Sustainable initiatives are being prioritized. With increasing environmental concerns, manufacturing units are looking out for eco-friendly and recyclable packaging products instead of using traditional materials like plastic. This move has facilitated the creation of a broader consumer base.

Key Players:

-

Chatime

-

Gong Cha

-

Kung Fu Tea

-

Coco Fresh Tea & Juice

-

Boba Guys

-

Ten Ren's Tea

-

Happy Lemon

-

Tiger Sugar

-

CoCo Fresh Tea & Juice

-

ShareTea

In November 2023, the parent company of the well-known regional bubble tea brand Tealive, Loob Holding, made a significant upstream investment of RM10 million in a state-of-the-art tapioca pearl facility in Malaysia. This program demonstrates Loob's unwavering dedication to innovation, quality, and change in the Malaysian and global beverage industries.

In September 2023, to introduce beverages based on the two best-selling flavors of the lollipop brand—grape and strawberry & cream—Chupa Chups teamed up with the boba chain Chatime. With a lighthearted campaign, the partnership hopes to highlight the company's dedication to innovation and invigorate the lively breweries.

In August 2022, Jamba launched two Boba Offerings, bringing a flavorful and fun burst. Jamba is introducing two all-new boba options that will enhance the taste, excitement, and personalization of its whole menu, which also includes the company's well-liked smoothies, bowls, and iced drinks. The Just Gotta Jamba brand marketing campaign is being incorporated into the brand's first product announcement with the debut of the boba.

Chapter 1. Strawberry Bubble Tea Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Strawberry Bubble Tea Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Strawberry Bubble Tea Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Strawberry Bubble Tea Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Strawberry Bubble Tea Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Strawberry Bubble Tea Market – By Base Ingredient

6.1 Introduction/Key Findings

6.2 Black Tea

6.3 Green Tea

6.4 Oolong Tea

6.5 White Tea

6.6 Y-O-Y Growth trend Analysis By Base Ingredient

6.7 Absolute $ Opportunity Analysis By Base Ingredient, 2024-2030

Chapter 7. Strawberry Bubble Tea Market – By Components

7.1 Introduction/Key Findings

7.2 Flavor

7.3 Creamer

7.4 Sweetener

7.5 Liquid

7.6 Tapioca Pearls

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Components

7.9 Absolute $ Opportunity Analysis By Components, 2024-2030

Chapter 8. Strawberry Bubble Tea Market – By Distribution Channels

8.1 Introduction/Key Findings

8.2 Supermarkets and Hypermarkets

8.3 Convenience Stores

8.4 Online Retail

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Distribution Channels

8.7 Absolute $ Opportunity Analysis By Distribution Channels, 2024-2030

Chapter 9. Strawberry Bubble Tea Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Base Ingredient

9.1.3 By Components

9.1.4 By By Distribution Channels

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Base Ingredient

9.2.3 By Components

9.2.4 By Distribution Channels

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Base Ingredient

9.3.3 By Components

9.3.4 By Distribution Channels

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Base Ingredient

9.4.3 By Components

9.4.4 By Distribution Channels

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Base Ingredient

9.5.3 By Components

9.5.4 By Distribution Channels

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Strawberry Bubble Tea Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Chatime

10.2 Gong Cha

10.3 Kung Fu Tea

10.4 Coco Fresh Tea & Juice

10.5 Boba Guys

10.6 Ten Ren's Tea

10.7 Happy Lemon

10.8 Tiger Sugar

10.9 CoCo Fresh Tea & Juice

10.10 ShareTea

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Strawberry Bubble Tea Market was valued at USD 180.375 million and is projected to reach a market size of USD 271.22 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6%.

A shift in consumer preference, associated health benefits, and social media are the main factors propelling the Global Strawberry Bubble Tea Market.

Based on Components, the Global Strawberry Bubble Tea Market is segmented into Flavor, Creamer, Sweetener, Liquid, Tapioca Pearls, and Others.

Asia-Pacific is the most dominant region for the Global Strawberry Bubble Tea Market.

Chatime, Gong Cha, and Kung Fu Tea are the key players operating in the Global Strawberry Bubble Tea Market.