Stored Grain Insecticide Market Size (2024 – 2030)

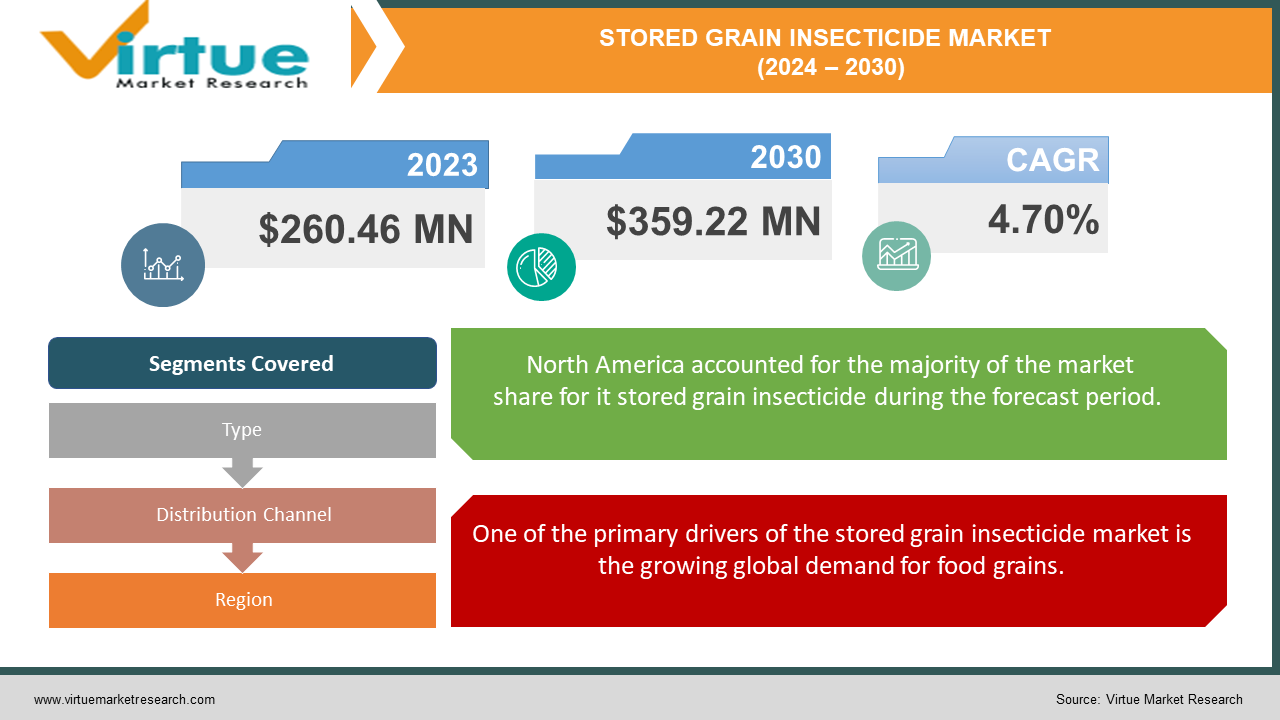

The Global Stored Grain Insecticide Market was valued at USD 260.46 Million in 2023 and is projected to reach a market size of USD 359.22 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.70%.

The global grain stockpiles' safety and quality depend heavily on the market for stored grain insecticides. Numerous pests, such as insects like beetles, weevils, and moths, can seriously harm stored grains and result in financial losses. In order to prevent infestation and spoiling of these priceless food resources, the worldwide stored grain pesticide industry is crucial. This market offers a range of pesticide kinds, application techniques, and technological innovations designed to improve the security and effectiveness of pest management strategies. Technological advancements also play a crucial role in shaping the stored grain insecticide market. Innovations in formulation and application technologies enhance the effectiveness and efficiency of insecticides. Steady-release formulations and advanced delivery systems ensure that insecticides remain active for longer periods, providing extended protection against pests. Additionally, the development of smart monitoring and management systems allows for real-time tracking of insect populations and more targeted application of insecticides.

Key Market Insights:

Effective stored grain pest control techniques may cut post-harvest losses by as much as 50%, according to studies, which would have a big influence on the world's food security.

A significant worry is the emergence of insect resistance to conventional pesticides; estimates indicate that resistance rates for some bug species may reach 60%.

By 2030, the market for stored grain insecticides is expected to increase at a growth ratio of more than 7%, driven by an increasing need for environmentally friendly pest control methods.

By 2028, the use of hermetic storage systems—which provide an oxygen-depleted environment that is unfavorable for most insects—is expected to increase at a growth rate of more than 5%.

The integration of digital tools and sensor technology with stored grain management systems is expected to reach a market value of USD 1.5 billion by 2026.

Research and development efforts account for approximately 10% of the revenue generated in the stored grain insecticide market.

The average cost of insecticide application for stored grain protection can range from USD 2 to USD 10 per ton of grain, depending on the chosen method and insecticide type.

Estimates suggest that improper storage practices and inadequate pest management can lead to quality deterioration and value reduction of up to 30% in stored grains.

The implementation of Integrated Pest Management (IPM) programs in stored grain facilities can potentially reduce insecticide use by up to 50%, offering significant economic and environmental benefits.

Over 80% of global grain losses occur in developing countries, where resource limitations and lack of infrastructure can hinder effective pest control practices.

The global trade in grains valued at over USD 200 billion annually emphasizes the economic importance of minimizing post-harvest losses through effective insect control.

Approximately 10% of the money made in the stored grain pesticide sector goes toward research and development.

Depending on the technique and kind of insecticide selected, the typical cost of applying an insecticide for stored grain protection might vary from USD 2 to USD 10 per ton of grain.

Poor pest control and storage methods can cause stored grains to lose up to 30% of their value and deteriorate in quality.

Stored Grain Insecticide Market Drivers:

One of the primary drivers of the stored grain insecticide market is the growing global demand for food grains.

Sufficient food supplies are required as long as the global population grows. The efficient management of food resources, notably stored grains, and agricultural productivity are under strain due to this growing demand. Grain storage, including wheat, rice, corn, and barley, is essential to the world's food security. Millions of people rely on them as their basic diet, and they are essential components of many processed meals and animal feeds. To avoid food shortages and preserve a steady food supply chain, it is crucial to guarantee the safety and integrity of these grains while they are being stored. Insect infestations are a serious hazard to grains that are kept, resulting in severe losses in terms of quantity and quality.

Technological advancements in insecticide formulation and application technologies are another significant driver of the stored grain insecticide market.

Advancements in these domains augment the effectiveness, security, and practicality of pesticide commodities, rendering them increasingly appealing to final consumers. A noteworthy progression in the field is the creation of formulations with controlled release. The active components in these formulations are intended to be released gradually over a lengthy period of time. This sustained action minimizes the chance of insect populations developing resistance and offers ongoing protection against infestations by insects, negating the need for repeated treatments. Furthermore, developments in application technology enhance the accuracy and effectiveness of pesticide application. Aerosol and fumigation methods, for instance, make it possible to uniformly distribute pesticides throughout storage facilities, guaranteeing thorough coverage and efficient pest control.

Stored Grain Insecticide Market Restraints and Challenges:

The rising worry about the effects of chemical pesticides on the environment and human health is one of the major obstacles facing the stored grain insecticide business. The active components of many conventional pesticides have the potential to damage non-target creatures, such as people, animals, and beneficial insects. The necessity for safer and more sustainable pest management methods is fueled by the possibility of chemical residues in food items as well as the pollution of land and water sources. Chemical pesticides' effects on the environment are a serious worry, especially in areas with strict environmental laws. Chemical residues can have a negative impact on ecosystems through bioaccumulation and persistence in the environment. The development of resistance among insect populations is another significant challenge in the stored grain insecticide market. Insecticide resistance occurs when insect populations evolve to tolerate or withstand the effects of insecticides, rendering them less effective or even ineffective over time. Resistance development is a complex and multifaceted issue that can compromise the long-term sustainability of pest control strategies. Several factors contribute to the development of insecticide resistance. One primary factor is the repeated and excessive use of the same class of insecticides. This practice exerts selective pressure on insect populations, favoring the survival and reproduction of resistant individuals. Over time, the proportion of resistant individuals in the population increases, leading to reduced efficacy of the insecticide.

Stored Grain Insecticide Market Opportunities:

Significant potential prospects are presented by the stored grain insecticide market's rise in emerging markets. Emerging markets—especially those in Asia, Latin America, and Africa—are rapidly urbanizing, growing economically, and experiencing population expansion. In order to guarantee food security, these variables fuel the need for higher agricultural productivity and effective storage techniques. In the market for stored grain insecticides, the creation and application of integrated pest management (IPM) technologies offer a bright future. IPM is a comprehensive method of managing pest populations that uses a variety of techniques to reduce the need for chemical pesticides. To accomplish sustainable pest management, integrated pest management (IPM) stresses the combination of biological, cultural, mechanical, and chemical control approaches. A crucial element of integrated pest management (IPM) is biological control, which entails using diseases, parasitoids, and natural predators to manage insect populations. Chemical insecticides may be replaced with more ecologically friendly and efficient options through the development of biopesticides and improved biological control agents. Furthermore, cultural customs like managing temperature, washing grains, and maintaining good hygiene will lessen the likelihood of insect infestations.

STORED GRAIN INSECTICIDE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.70% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE (Germany), Bayer CropScience AG (Germany), Syngenta Group (Switzerland), Nufarm Limited (Australia), Corteva Agriscience (Formerly DowDuPont, USA), Adama Agricultural Solutions Ltd. (Israel), UPL Limited (India), Degesch America, Inc. (USA), Wilbur-Ellis Company (USA), Lach Diamond (India), Fumigation Service & Supply, Inc. (USA), Rentokil Initial PLC (UK), Anticimex (Sweden), Ecolab Inc. (USA), SGS (Switzerland) |

Stored Grain Insecticide Market Segmentation: By Type

-

Chemical insecticides

-

Biopesticides

IPM's core component is biological control, which includes using diseases, parasitoids, and natural predators to manage insect populations. Chemical insecticides may have efficient and ecologically acceptable substitutes in the form of biopesticides and improved biological control agents. Furthermore, cultural activities that maintain adequate hygiene, clean grains, and regulate temperature might help lower the incidence of insect infestations.

As customers and authorities look for more ecologically friendly and sustainable pest management options, the demand for biopesticides is rising. The goal of current research and development is to find novel biopesticide formulations and enhance their shelf life and efficacy. As more people become aware of the advantages and accessibility of biopesticides, it is anticipated that their use will rise.

Stored Grain Insecticide Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributors and Wholesalers

-

Online Sales

Direct sales are exchanges that take place between producers or distributors and final consumers, such as commercial farmers, grain storage facilities, and pest control experts. Because it enables individualized assistance and customized solutions, this channel is chosen for professional applications and large-scale projects. In addition to fostering strong client ties, direct sales allow manufacturers to offer technical assistance and training.

The fastest-growing route for distributing stored grain pesticides is through online platforms. E-commerce platforms and niche internet merchants provide a large selection of goods, thorough product details, client testimonials, and affordable prices. Online shopping is becoming more and more popular with both consumers and companies due to its ease and the availability of professional advice and product comparisons.

Stored Grain Insecticide Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

The Middle East & Africa

With almost 35% of the worldwide stored grain insecticide industry, North America has the highest proportion of the market. Leading producers and exporters of grains worldwide, the United States and Canada owe much of their dominance to their massive agricultural endeavors. The region's strict regulations and sophisticated storage facilities contribute to the increased demand for efficient pesticide solutions.

With a growth rate that exceeds other areas, the stored grain insecticide market is expanding at the quickest rate in the Asia-Pacific area. The region's expanding population, growing agricultural output, and greater awareness of food security challenges are the main drivers of this fast development. The expansion of the industry in the area has been significantly aided by nations like Australia, China, and India.

COVID-19 Impact Analysis on the Stored Grain Insecticide Market:

The worldwide supply chain saw severe interruptions during the pandemic's early phases. The transportation of commodities, particularly pesticides and their raw ingredients, was impeded by lockdowns and travel restrictions. This led to brief shortages of grain pesticides in storage in several areas, especially those that depended on imports. The pandemic also resulted in a manpower shortage in factories, which had an additional effect on distribution and output. Although there were difficulties at first, the epidemic also brought food security back into the public eye. Grain storage has been a top priority for governments and farmers as a result of worries about possible food shortages brought on by delays in agricultural output and transportation. The need for stored grain pesticides to stop spoiling and preserve grain quality grew as a result of this spike in stored grain reserves.

Latest Trends/ Developments:

Concerns about the environmental impact and potential development of insect resistance are driving a shift towards more selective insecticides. These target specific insect pests while minimizing harm to beneficial insects and the environment. Examples include insecticides that disrupt molting processes in targeted insects or those with specific modes of action that limit the potential for resistance development. Advancements in grain storage monitoring systems are allowing for more targeted application of insecticides. These systems utilize sensors to detect insect activity or pheromone traps to identify specific pest populations. By monitoring real-time data, farmers and storage facility managers can apply insecticides strategically, only when and where necessary, optimizing efficiency and minimizing overall insecticide use. Drones are being explored for targeted insecticide application within storage facilities. This technology allows for precise delivery to specific areas where insect infestations are detected, minimizing the amount of insecticide used and reducing exposure risks for workers. Additionally, drones can reach areas that may be difficult to access with traditional application methods.

Key Players:

-

BASF SE (Germany)

-

Bayer CropScience AG (Germany)

-

Syngenta Group (Switzerland)

-

Nufarm Limited (Australia)

-

Corteva Agriscience (Formerly DowDuPont, USA)

-

Adama Agricultural Solutions Ltd. (Israel)

-

UPL Limited (India)

-

Degesch America, Inc. (USA)

-

Wilbur-Ellis Company (USA)

-

Lach Diamond (India)

-

Fumigation Service & Supply, Inc. (USA)

-

Rentokil Initial PLC (UK)

-

Anticimex (Sweden)

-

Ecolab Inc. (USA)

-

SGS (Switzerland)

Chapter 1. Stored Grain Insecticide Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Stored Grain Insecticide Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Stored Grain Insecticide Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Stored Grain Insecticide Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Stored Grain Insecticide Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Stored Grain Insecticide Market – By Type

6.1 Introduction/Key Findings

6.2 Chemical insecticides

6.3 Biopesticides

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Stored Grain Insecticide Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Distributors and Wholesalers

7.4 Online Sales

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Stored Grain Insecticide Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Stored Grain Insecticide Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF SE (Germany)

9.2 Bayer CropScience AG (Germany)

9.3 Syngenta Group (Switzerland)

9.4 Nufarm Limited (Australia)

9.5 Corteva Agriscience (Formerly DowDuPont, USA)

9.6 Adama Agricultural Solutions Ltd. (Israel)

9.7 UPL Limited (India)

9.8 Degesch America, Inc. (USA)

9.9 Wilbur-Ellis Company (USA)

9.10 Lach Diamond (India)

9.11 Fumigation Service & Supply, Inc. (USA)

9.12 Rentokil Initial PLC (UK)

9.13 Anticimex (Sweden)

9.14 Ecolab Inc. (USA)

9.15 SGS (Switzerland)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global population is projected to reach nearly 10 billion by 2050, putting immense pressure on food production systems. Minimizing post-harvest losses due to insect infestation is crucial to ensure global food security and prevent food shortages.

As with any pest control method, insects can develop resistance to commonly used insecticides. Overreliance on broad-spectrum insecticides can accelerate this process, rendering them ineffective against resistant pest populations. This necessitates continuous research and development of new and more targeted insecticidal solutions.

BASF SE (Germany), Bayer CropScience AG (Germany)Syngenta Group (Switzerland), Nufarm Limited (Australia), Corteva Agriscience (Formerly DowDuPont, USA), Adama Agricultural Solutions Ltd. (Israel), UPL Limited (India)

Degesch America, Inc. (USA), Wilbur-Ellis Company (USA), Lach Diamond (India)

Fumigation Service & Supply, Inc. (USA), Rentokil Initial PLC (UK), Anticimex (Sweden), Ecolab Inc. (USA), SGS (Switzerland).

The Stored Grain Insecticide Market is majorly dominated in North America. Roughly 35% of the worldwide market is accounted for by this area.

With the quickest rate of growth, the Asia-Pacific region holds a 20% share of the market.