Sterile Medical Packaging Market Size (2024 – 2030)

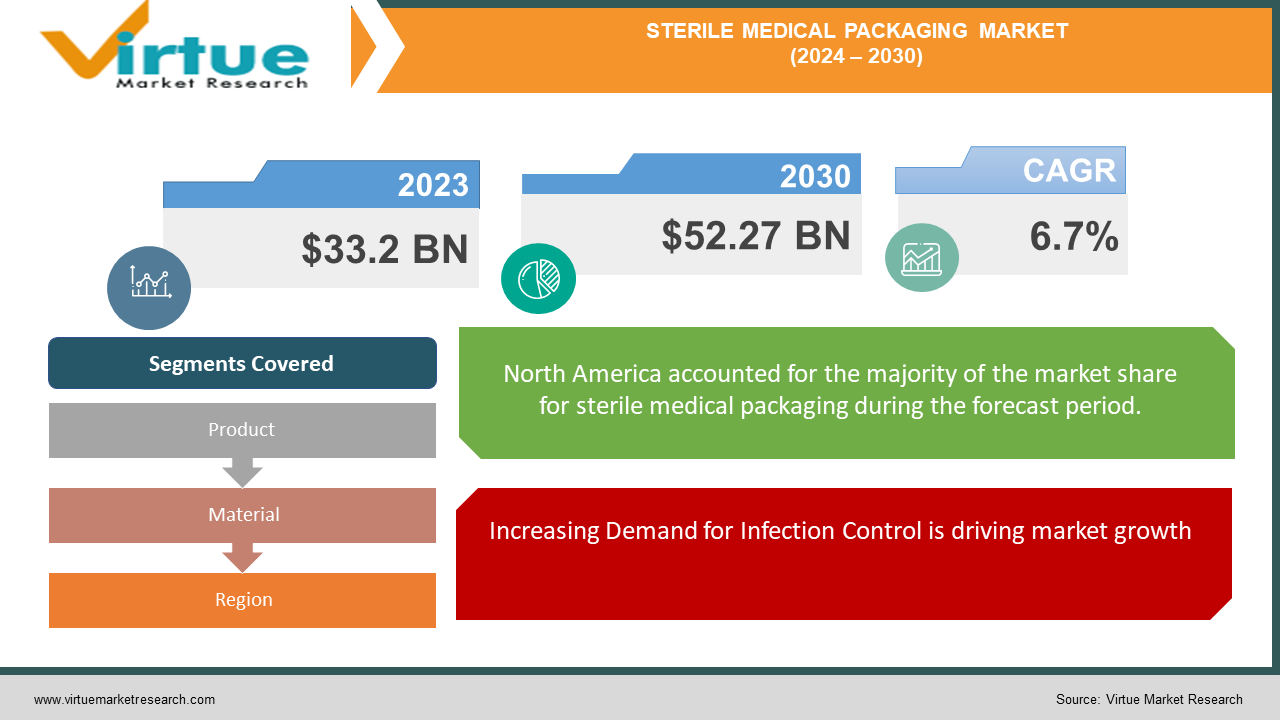

In 2023 Sterile Medical Packaging Market was valued at USD 33.2 billion and is projected to reach USD 52.27 billion by 2030, growing at a CAGR of 6.7% from 2024 to 2030.

The global sterile medical packaging market has been experiencing substantial growth, driven by the increasing demand for healthcare services and advancements in medical technology. The rise in chronic diseases, the aging population, and the need for infection control are major factors propelling the market. Moreover, stringent regulations and standards for packaging in the healthcare sector are ensuring the use of high-quality, sterile packaging materials.

Key Market Insights

Strict regulations and standards imposed by health authorities globally are ensuring the use of high-quality, sterile packaging, thus promoting market growth.

The increasing elderly population, which requires more medical care and pharmaceutical products, is significantly contributing to the demand for sterile medical packaging.

The rise of biopharmaceuticals, which require stringent packaging standards to maintain sterility and efficacy, is positively impacting the market.

The growing medical device industry, driven by technological advancements and increasing healthcare needs, is boosting the demand for sterile packaging solutions.

The trend towards sustainable packaging materials is gaining traction in the sterile medical packaging market, with manufacturers developing eco-friendly solutions to meet regulatory and consumer demands.

Global Sterile Medical Packaging Market Drivers

Increasing Demand for Infection Control is driving market growth: The global rise in hospital-acquired infections (HAIs) and the need for stringent infection control measures are pivotal drivers of the sterile medical packaging market. Hospital-acquired infections present significant risks to patient health, leading to extended hospital stays, increased medical costs, and higher mortality rates. As awareness of HAIs and their associated costs grows, healthcare providers are under pressure to adopt stringent infection control standards. Sterile packaging plays a critical role in preventing contamination of medical devices and pharmaceuticals, thereby ensuring patient safety. The enhanced focus on hygiene and infection prevention in healthcare settings is leading to an increased demand for sterile medical packaging solutions that can maintain the sterility of products from manufacturing through to end use.

Expansion of the Pharmaceutical Industry is driving market growth: The pharmaceutical industry is a major consumer of sterile medical packaging, with its growth directly impacting market demand. The continuous development and approval of new drugs, including biologics and specialty medications, necessitate advanced packaging solutions that guarantee product integrity and sterility. As the global population rises and healthcare needs escalate, the pharmaceutical sector is expanding, driving the demand for sophisticated sterile packaging. This growth is further fueled by the increase in chronic diseases, aging populations, and the introduction of innovative therapies. Sterile packaging solutions are crucial for protecting these sensitive products, ensuring they remain uncontaminated and effective until they reach the patient.

Advancements in Sterilization Techniques is driving market growth: Innovations in sterilization methods are significantly enhancing the sterile medical packaging market. Techniques such as ethylene oxide (EtO) sterilization, gamma radiation, and electron beam sterilization are improving the effectiveness and efficiency of sterile packaging processes. These advanced methods ensure that packaging materials meet the highest standards of sterility, which is critical for maintaining the safety and efficacy of medical products. The continuous improvement in sterilization technologies is driving the adoption of more reliable and safer packaging solutions in the healthcare sector. By ensuring the highest levels of sterility, these advancements help reduce the risk of contamination and infection, thereby supporting the overall goal of improved patient safety and care.

Global Sterile Medical Packaging Market Challenges and Restraints

High Costs of Sterile Packaging is restricting market growth: The sterile medical packaging market faces significant constraints due to the high costs associated with producing these essential packaging solutions. The advanced materials required for sterile packaging, such as specialized films and barrier materials, are more expensive compared to standard packaging alternatives. Additionally, the manufacturing processes involved in creating sterile packaging are complex and involve sophisticated technology, including high-precision machinery and automated systems. These processes are designed to ensure that the packaging maintains a sterile environment and complies with stringent quality control measures. The financial burden of these advanced manufacturing processes and materials can be a considerable barrier, particularly for small and medium-sized healthcare providers and pharmaceutical companies. These entities often operate with limited budgets and may find it challenging to allocate the necessary funds for high-quality sterile packaging solutions. Consequently, the high costs can restrict their ability to adopt and implement the latest sterile packaging technologies. This limitation affects their overall operational efficiency and can impact patient safety and product quality. As a result, the market growth for sterile medical packaging is restrained, as the higher costs hinder broader adoption and innovation within the industry.

Stringent Regulatory Requirements is restricting market growth: The sterile medical packaging market is significantly impacted by stringent regulatory requirements imposed by health authorities globally. These regulations are designed to ensure that all packaging materials and processes adhere to the highest standards of safety and sterility. Compliance with these regulations necessitates rigorous monitoring, testing, and validation of packaging materials to confirm their effectiveness and reliability in maintaining sterility. For manufacturers, meeting these regulatory standards can be both challenging and time-consuming. The need for continuous compliance often requires substantial investments in quality control and assurance processes. Manufacturers must also navigate complex regulatory frameworks, which can vary by region and require frequent updates to maintain compliance. These stringent requirements can slow down production timelines and increase operational costs, further constraining the market’s growth. The additional burden of ensuring regulatory adherence can deter smaller manufacturers from entering the market or investing in advanced packaging solutions, thereby limiting overall market expansion and innovation.

Market Opportunities

The sterile medical packaging market presents numerous opportunities for growth and innovation. With the rising demand for healthcare services and advancements in medical technology, there is a growing need for more effective and efficient packaging solutions. Manufacturers can focus on developing innovative materials and technologies that enhance the safety and efficacy of sterile packaging. The increasing prevalence of chronic diseases and the aging population offer significant opportunities for the market. Additionally, the trend towards sustainable packaging materials provides an opportunity for manufacturers to develop eco-friendly solutions that meet regulatory and consumer demands. The expansion of the pharmaceutical and medical device industries, coupled with the rise of biopharmaceuticals, further enhances the growth potential of the sterile medical packaging market.

STERILE MEDICAL PACKAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.7% |

|

Segments Covered |

By Product, Material, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amcor plc,DuPont de Nemours, Inc.,West Pharmaceutical Services, Inc., 3M Company,Sonoco Products Company, Placon Corporation, Tekni-Plex, Inc., SteriPack Group, Wipak Group, Nelipak Healthcare Packaging |

Sterile Medical Packaging Market Segmentation - By Product

-

Bags and Pouches

-

Trays

-

Clamshells

-

Bottles

-

Vials and Ampoules

-

Blisters

The bags and pouches segment dominates the market due to their versatility, ease of use, and widespread application in the packaging of medical devices, pharmaceuticals, and diagnostic products. Their ability to provide a high level of sterility and protection makes them a preferred choice in the healthcare industry.

Sterile Medical Packaging Market Segmentation - By Material

-

Plastic

-

Glass

-

Metal

-

Paper & Paperboard

-

Nonwoven Fabric

The plastic material type segment is the most dominant due to its cost-effectiveness, durability, and versatility. Plastics are widely used in sterile medical packaging due to their excellent barrier properties, ease of sterilization, and ability to be molded into various shapes and sizes.

Sterile Medical Packaging Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the dominant region in the global sterile medical packaging market. The region's well-established healthcare infrastructure, high healthcare expenditure, and the presence of major market players contribute to its dominance. Additionally, the stringent regulatory standards in the U.S. and Canada ensure the adoption of high-quality sterile packaging solutions, further driving the market growth in North America.

COVID-19 Impact Analysis on the Sterile Medical Packaging Market

The COVID-19 pandemic had a profound impact on the sterile medical packaging market. The initial outbreak and subsequent lockdowns disrupted supply chains, production activities, and demand across various sectors. However, the pandemic also highlighted the critical importance of hygiene and infection control in the healthcare sector, driving the demand for sterile medical packaging. The increased use of medical devices, pharmaceuticals, and diagnostic products during the pandemic necessitated the use of sterile packaging to ensure safety and efficacy. Additionally, the focus on preventing the spread of infections and maintaining sterile conditions in healthcare facilities further boosted the demand for sterile packaging solutions. The rise of telemedicine and home healthcare during the pandemic also contributed to the increased demand for sterile packaging, as patients required safe and sterile delivery of medical supplies. Overall, while the pandemic initially posed challenges, it underscored the importance of sterile medical packaging, leading to increased demand and long-term growth prospects for the market.

Latest Trends/Developments

The sterile medical packaging market is witnessing several key trends and developments that are shaping its growth trajectory. One notable trend is the increasing demand for sustainable and eco-friendly packaging solutions. Manufacturers are focusing on developing biodegradable and recyclable packaging materials to meet the growing environmental concerns and regulatory requirements. Another significant trend is the adoption of advanced sterilization technologies that enhance the safety and efficacy of sterile packaging. Innovations such as electron beam sterilization and gamma radiation are gaining traction, providing more effective sterilization methods. Additionally, the rise of personalized medicine and biologics is driving the demand for specialized sterile packaging solutions that cater to specific requirements. The trend towards smart packaging, incorporating technologies such as RFID and NFC, is also emerging, offering enhanced tracking, monitoring, and security features for sterile medical packaging. Furthermore, the increasing emphasis on patient safety and infection control is driving the adoption of tamper-evident and anti-counterfeit packaging solutions, ensuring the integrity and authenticity of medical products.

Key Players

-

Amcor plc

-

DuPont de Nemours, Inc.

-

West Pharmaceutical Services, Inc.

-

3M Company

-

Sonoco Products Company

-

Placon Corporation

-

Tekni-Plex, Inc.

-

SteriPack Group

-

Wipak Group

-

Nelipak Healthcare Packaging

Chapter 1. Sterile Medical Packaging Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Sterile Medical Packaging Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Sterile Medical Packaging Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Sterile Medical Packaging Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Sterile Medical Packaging Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Sterile Medical Packaging Market – By Product

6.1 Introduction/Key Findings

6.2 Bags and Pouches

6.3 Trays

6.4 Clamshells

6.5 Bottles

6.6 Vials and Ampoules

6.7 Blisters

6.8 Y-O-Y Growth trend Analysis By Product

6.9 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Sterile Medical Packaging Market – By Material

7.1 Introduction/Key Findings

7.2 Plastic

7.3 Glass

7.4 Metal

7.5 Paper & Paperboard

7.6 Nonwoven Fabric

7.7 Y-O-Y Growth trend Analysis By Material

7.8 Absolute $ Opportunity Analysis By Material, 2024-2030

Chapter 8. Sterile Medical Packaging Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Material

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Material

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Material

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Material

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Material

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Sterile Medical Packaging Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Amcor plc

9.2 DuPont de Nemours, Inc.

9.3 West Pharmaceutical Services, Inc.

9.4 3M Company

9.5 Sonoco Products Company

9.6 Placon Corporation

9.7 Tekni-Plex, Inc.

9.8 SteriPack Group

9.9 Wipak Group

9.10 Nelipak Healthcare Packaging

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global sterile medical packaging market was valued at USD 33.2 billion in 2023 and is projected to reach USD 52.27 billion by 2030, growing at a CAGR of 6.7% from 2024 to 2030.

Key drivers include increasing demand for infection control, expansion of the pharmaceutical industry, and advancements in sterilization techniques.

The market is segmented by product type (bags and pouches, trays, clamshells, bottles, vials and ampoules, blisters) and by material type (plastic, glass, metal, paper & paperboard, nonwoven fabric).

North America is the dominant region due to its well-established healthcare infrastructure, high healthcare expenditure, and stringent regulatory standards.

Leading players include Amcor plc, DuPont de Nemours, Inc., West Pharmaceutical Services, Inc., 3M Company, Placon Corporation, Tekni-Plex, Inc, SteriPack Group, Wipak Group, Nelipak Healthcare Packaging.