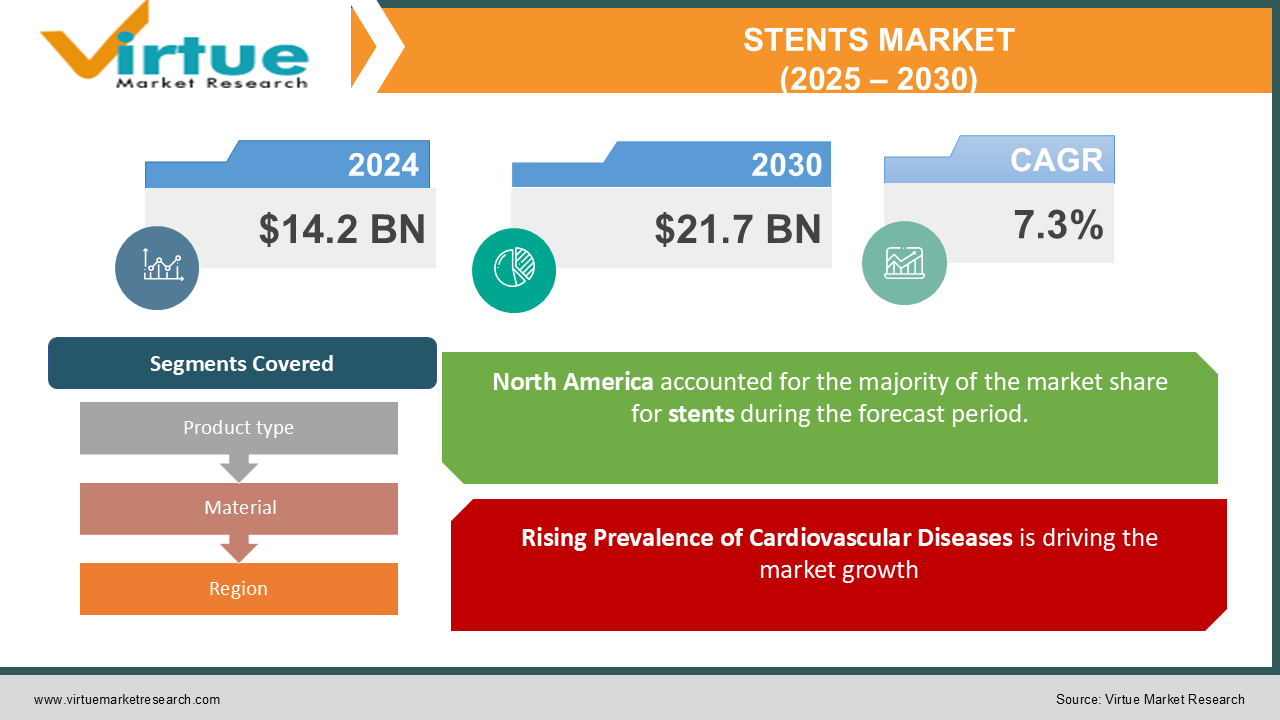

Stents Market Size (2025 – 2030)

The Global Stents Market was valued at USD 14.2 billion in 2024 and is projected to reach USD 21.7 billion by 2030, expanding at a CAGR of 7.3% from 2025 to 2030.

Stents are medical devices used to open blocked or narrowed blood vessels, ureters, or other tubular structures in the body. They are commonly employed in the treatment of cardiovascular diseases, urological conditions, and other ailments requiring intervention.

The market is witnessing growth due to the rising prevalence of chronic conditions such as cardiovascular diseases, advancements in stent technologies, and an increase in minimally invasive procedures. The development of bioresorbable and drug-eluting stents has further revolutionized the sector by improving patient outcomes and reducing complication risks.

Key Market Insights

-

Coronary stents dominate the product segment, holding more than 55% of the market share in 2024, driven by the rising incidence of cardiovascular diseases globally.

-

Drug-eluting stents (DES) are the leading subcategory in terms of material and technology, offering reduced restenosis rates and superior clinical outcomes.

-

The hospital end-user segment accounted for the largest share, exceeding 60% in 2024, owing to the high number of procedures performed in this setting.

-

North America leads the market, driven by advanced healthcare infrastructure and a high prevalence of coronary artery disease.

-

Emerging markets in Asia-Pacific are experiencing robust growth due to rising healthcare expenditures and increasing awareness of advanced treatment options.

-

The demand for bioabsorbable stents is increasing, supported by their ability to eliminate long-term complications associated with permanent stents.

Global Stents Market Drivers

1. Rising Prevalence of Cardiovascular Diseases is driving the market growth

The global burden of cardiovascular diseases (CVDs) is a major driver of the stents market. According to the World Health Organization (WHO), CVDs account for nearly 17.9 million deaths annually, representing 32% of all global deaths. Lifestyle changes, unhealthy diets, and sedentary habits are contributing to this rise, especially in emerging economies.

Stents, particularly coronary stents, are crucial in treating conditions like atherosclerosis and coronary artery disease. The increasing adoption of minimally invasive procedures for treating CVDs is further propelling market growth.

2. Technological Advancements in Stents is driving the market growth

Technological innovations in stent design and material have significantly enhanced their safety and efficacy. The development of drug-eluting stents (DES) has reduced restenosis rates compared to traditional bare-metal stents, improving patient outcomes.

Additionally, the advent of bioresorbable stents represents a breakthrough in stent technology. These stents dissolve over time, reducing the risk of long-term complications. Ongoing research and development activities are expected to drive the adoption of advanced stents, fostering market growth.

3. Growing Demand for Minimally Invasive Procedures is driving the market growth

Minimally invasive surgeries are gaining traction globally due to their advantages, such as shorter recovery times, reduced pain, and lower complication rates. Stenting procedures, particularly percutaneous coronary intervention (PCI), are widely preferred for treating vascular blockages.

The rising preference for these procedures is supported by advancements in imaging technologies and catheter-based systems, which have improved the precision and safety of stent placements. This trend is expected to continue, boosting the demand for stents.

Global Stents Market Challenges and Restraints

1. High Costs of Stent Procedures and Devices is restricting the market growth

The high cost of stents, particularly advanced variants like drug-eluting and bioresorbable stents, poses a significant challenge to market growth. In developing and underdeveloped regions, the affordability of stenting procedures remains a concern due to limited healthcare coverage and low-income levels.

Efforts to reduce stent prices through government initiatives and local manufacturing are underway. However, cost-related barriers could still hinder the widespread adoption of stents in economically weaker regions.

2. Risk of Complications and Device Failures is restricting the market growth

Although stents have revolutionized the treatment of vascular diseases, they are not without risks. Potential complications include stent thrombosis, restenosis, and infections. Device malfunctions, though rare, can lead to severe consequences, necessitating additional interventions.

Manufacturers are focusing on improving the biocompatibility and design of stents to address these issues. Despite these advancements, concerns over safety and efficacy may impact patient and physician confidence, affecting market growth.

Market Opportunities

The stents market offers significant growth opportunities, particularly in emerging economies where healthcare infrastructure is improving rapidly. Governments and private organizations are investing in expanding access to advanced medical technologies, driving the adoption of stents.

Additionally, the increasing focus on value-based healthcare is creating opportunities for cost-effective stent solutions. Manufacturers introducing affordable stents without compromising on quality are well-positioned to capture market share in price-sensitive regions.

The development of personalized stents, tailored to the specific anatomical and clinical needs of patients, represents another growth avenue. These innovations, coupled with advancements in imaging and deployment technologies, are expected to transform the stents market in the coming years.

STENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.3% |

|

Segments Covered |

By Product type, Material, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Abbott Laboratories, Boston Scientific Corporation, Medtronic plc, B. Braun Melsungen AG, Terumo Corporation, Cook Medical, Biotronik SE & Co. KG, C. R. Bard, Inc. (a BD Company), MicroPort Scientific Corporation, Meril Life Sciences Pvt. Ltd. |

Stents Market Segmentation - By Product Type

-

Coronary Stents

-

Bare-Metal Stents

-

Drug-Eluting Stents (DES)

-

Bioresorbable Stents

-

-

Peripheral Stents

-

Ureteral Stents

-

Others

Coronary stents represent the largest product segment within the stent market, driven by the high prevalence of coronary artery disease (CAD) and the widespread adoption of drug-eluting stents (DES). CAD, a condition characterized by the buildup of plaque in the coronary arteries, remains a leading cause of morbidity and mortality worldwide. Percutaneous coronary intervention (PCI), a minimally invasive procedure involving the deployment of a stent to open blocked or narrowed coronary arteries, has become a standard treatment for CAD. Drug-eluting stents have revolutionized the field of interventional cardiology by delivering a therapeutic dose of medication to the arterial wall, inhibiting cell proliferation and reducing the risk of restenosis. These devices offer superior clinical outcomes compared to bare-metal stents, making them the preferred choice for most patients undergoing PCI. The increasing availability of advanced DES with improved drug delivery systems and biocompatibility has further fueled the growth of this segment. As the global population ages and the prevalence of cardiovascular risk factors continues to rise, the demand for coronary stents is expected to remain strong, driving significant growth in the overall stent market.

Stents Market Segmentation - By Material

-

Metallic

-

Polymer

-

Hybrid

Metallic stents dominate the material segment due to their durability and affordability. However, polymer-based stents are gaining popularity, supported by advancements in biodegradable materials.

Stents Market Segmentation - By End-User

-

Hospitals

-

Ambulatory Surgical Centers

-

Specialty Clinics

Hospitals are the primary end-users of stents, dominating the market due to their specialized infrastructure, skilled personnel, and comprehensive treatment capabilities. These institutions are equipped with advanced catheterization laboratories and experienced interventional cardiologists who perform complex percutaneous coronary interventions (PCIs) to treat coronary artery disease. Hospitals often have dedicated cardiac units to monitor and care for patients post-procedure, ensuring optimal recovery and minimizing complications. The rising prevalence of cardiovascular diseases, such as coronary artery disease and peripheral arterial disease, has significantly contributed to the demand for stenting procedures in hospitals. These institutions are well-positioned to handle the complex needs of patients with these conditions, offering a range of diagnostic and therapeutic services, including angiography, angioplasty, and stent implantation

Stents Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America holds the largest share of the global stents market, with the United States being the primary contributor. Factors such as advanced healthcare infrastructure, high adoption of innovative technologies, and favorable reimbursement policies are driving market growth in the region.

Asia-Pacific, on the other hand, is the fastest-growing region, supported by increasing healthcare investments, rising awareness of minimally invasive treatments, and the growing prevalence of cardiovascular diseases. Countries like China and India are emerging as lucrative markets due to their large patient populations and improving access to advanced medical care.

COVID-19 Impact Analysis

The COVID-19 pandemic had a mixed impact on the global stents market. While elective procedures, including non-urgent stenting, were delayed during the initial phase of the pandemic, the demand for stents rebounded as healthcare systems adapted to the new normal. The pandemic underscored the importance of efficient healthcare delivery, accelerating investments in minimally invasive procedures and advanced medical devices. Moreover, the increased focus on improving healthcare infrastructure in response to the pandemic is expected to have a positive long-term impact on the stents market.

Latest Trends/Developments

Advances in Bioresorbable Stents: The development of stents that dissolve after restoring blood flow is gaining momentum, reducing the risk of long-term complications such as restenosis and thrombosis. These innovative devices offer significant advantages over traditional metallic stents, as they eliminate the need for permanent implants and minimize the potential for late adverse events. As bioresorbable polymers continue to evolve, these stents are becoming increasingly effective and safe, paving the way for a new era of minimally invasive cardiovascular interventions. Combining metallic and polymer materials is improving the biocompatibility and flexibility of stents, enhancing their performance in complex cases. These hybrid stents offer a balance between the strength and durability of metal and the flexibility and biocompatibility of polymers. By strategically incorporating metallic components into polymer-based stents, manufacturers can optimize device performance, reduce the risk of complications, and improve long-term outcomes for patients. Real-time imaging systems, such as intravascular ultrasound (IVUS) and optical coherence tomography (OCT), are being used to optimize stent placement, improving procedural success rates. These advanced imaging modalities provide detailed visualization of the coronary arteries, enabling precise stent deployment and ensuring optimal blood flow restoration. By integrating imaging technologies with stent delivery systems, physicians can minimize the risk of complications and achieve superior clinical results. Manufacturers are expanding their presence in developing regions to cater to the growing demand for affordable stents. As healthcare systems in these countries continue to improve, there is a rising need for effective and cost-effective cardiovascular interventions. By offering innovative stent technologies at competitive prices, manufacturers can help address the unmet needs of patients in emerging markets and contribute to the global fight against cardiovascular disease.

Key Players

-

Abbott Laboratories

-

Boston Scientific Corporation

-

Medtronic plc

-

B. Braun Melsungen AG

-

Terumo Corporation

-

Cook Medical

-

Biotronik SE & Co. KG

-

C. R. Bard, Inc. (a BD Company)

-

MicroPort Scientific Corporation

-

Meril Life Sciences Pvt. Ltd.

Chapter 1. Stents Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Stents Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Stents Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Stents Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Stents Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Stents Market – By Product

6.1 Introduction/Key Findings

6.2 Coronary Stents

6.3 Bare-Metal Stents

6.4 Drug-Eluting Stents (DES)

6.5 Bioresorbable Stents

6.6 Peripheral Stents

6.7 Ureteral Stents

6.8 Others

6.9 Y-O-Y Growth trend Analysis By Product

6.10 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Stents Market – By Material

7.1 Introduction/Key Findings

7.2 Metallic

7.3 Polymer

7.4 Hybrid

7.5 Y-O-Y Growth trend Analysis By Material

7.6 Absolute $ Opportunity Analysis By Material, 2024-2030

Chapter 8. Stents Market – By End-User

8.1 Introduction/Key Findings

8.2 Hospitals

8.3 Ambulatory Surgical Centers

8.4 Specialty Clinics

8.5 Y-O-Y Growth trend Analysis By End-User

8.6 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Stents Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By Material

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By Material

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By Material

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By Material

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By Material

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Stents Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Abbott Laboratories

10.2 Boston Scientific Corporation

10.3 Medtronic plc

10.4 B. Braun Melsungen AG

10.5 Terumo Corporation

10.6 Cook Medical

10.7 Biotronik SE & Co. KG

10.8 C. R. Bard, Inc. (a BD Company)

10.9 MicroPort Scientific Corporation

10.10 Meril Life Sciences Pvt. Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 14.2 billion in 2024 and is projected to reach USD 21.7 billion by 2030, growing at a CAGR of 7.3%.

Key drivers include the rising prevalence of cardiovascular diseases, advancements in stent technologies, and the growing demand for minimally invasive procedures

Segments include Product Type (Coronary Stents, Peripheral Stents, Ureteral Stents, Others), Material (Metallic, Polymer, Hybrid), and End-User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics).

North America dominates with over 40% of the market share, driven by advanced healthcare infrastructure and high adoption of innovative technologies.

Leading players include Abbott Laboratories, Boston Scientific Corporation, Medtronic plc, and others.