Steel Wire Rod Market Size (2024-2030)

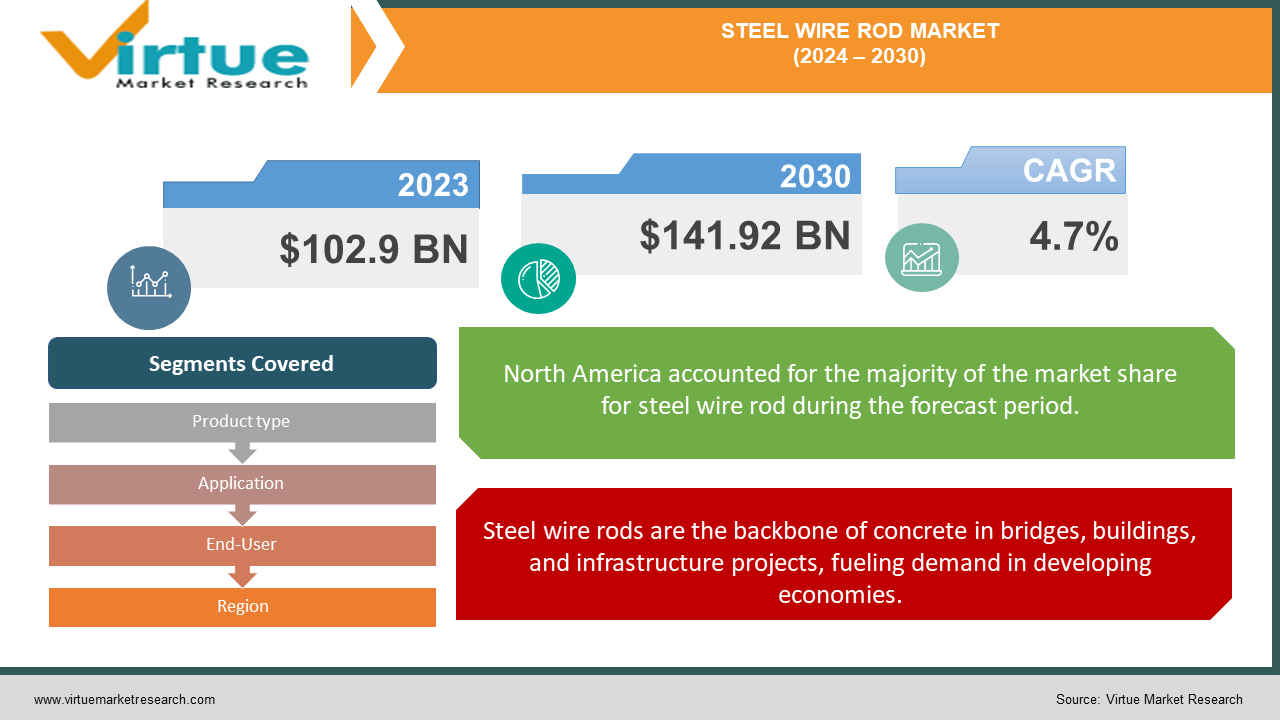

The Global Steel Wire Rod Market was valued at USD 102.9 billion in 2023 and is projected to reach a market size of USD 141.92 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 4.7%.

The steel wire rod market is on a steady growth trajectory, fueled by several key factors. The construction industry, particularly in developing economies, is a major driver. Steel wire rods are essential for reinforcing concrete in structures like buildings, bridges, and infrastructure projects. The automotive sector is another significant consumer, as wire rods are used in components like springs, tires, and suspension systems. Growth in the auto industry, especially in emerging markets, further strengthens the market.

Key Market Insights:

Steel wire rods are the lifeblood of reinforced concrete. This sector's growth translates to a projected demand for millions of tonnes of steel wire rods in the coming years.

The market is also witnessing a shift towards sustainable practices. The rise of renewable energy, particularly wind turbine manufacturing, is creating new avenues for steel wire rods. These turbines require strong and versatile wire rods, contributing to the overall market growth.

Additionally, advancements in steel production are leading to the development of high-performance wire rods, opening doors to even more applications in the future.

Steel Wire Rod Market Drivers:

Steel wire rods are the backbone of concrete in bridges, buildings, and infrastructure projects, fueling demand in developing economies.

Steel wire rods are the invisible yet essential reinforcement within concrete, the workhorse material for bridges, buildings, and critical infrastructure projects. The burgeoning construction sector, particularly in developing economies like China and India, is experiencing exponential growth. This translates to a projected surge in demand for millions of tonnes of steel wire rods in the coming years. As these economies continue to urbanize and invest in infrastructure, the demand for steel wire rods is poised to remain strong.

From springs and tires to suspension systems, steel wire rods are essential components driving growth alongside the auto industry.

The automotive industry is a major consumer and long-standing partner of the steel wire rod market. From the crucial role they play in springs, a multi-billion-dollar market itself, to their presence in tires for enhanced strength and durability, and their contribution to the smooth handling and stability of vehicles through suspension systems, steel wire rods are woven into the very fabric of modern automobiles. As the automotive industry, particularly in emerging markets, experiences continued growth and innovation, the demand for high-quality steel wire rods is expected to rise in tandem.

The rise of wind turbine manufacturing, a key user of strong steel wire rods, creates opportunities in the renewable energy sector.

The increasing global focus on sustainable practices and renewable energy sources is creating exciting new opportunities for the steel wire rod market. Wind turbine manufacturing, a key player in the renewable energy sector, relies heavily on strong and versatile steel wire rods for its structures. This shift towards a greener future is expected to be a significant driver of demand for steel wire rods in the coming years, as wind farms and other renewable energy projects continue to be developed around the world.

Advancements in steel production led to high-performance wire rods, opening doors to new applications and a wider market reach.

Advancements in steel production technology are not only improving efficiency but also leading to the development of high-performance steel wire rods. These improved wire rods boast superior strength, better quality, and enhanced properties, opening doors to new applications across various industries. This continuous innovation in steel production is expected to further propel the steel wire rod market forward by creating new opportunities and expanding its reach into new market segments.

Steel Wire Rod Market Restraints and Challenges:

The steel wire rod market isn't without its hurdles. One key challenge is the ever-changing landscape of raw material prices. Iron ore and scrap metal, crucial ingredients in steel production, experience significant price fluctuations. These swings can squeeze profit margins for steel wire rod manufacturers. If raw material prices rise excessively, producers may be forced to raise their own prices, potentially dampening demand. Conversely, if raw material prices plummet, competition can intensify as producers engage in price wars to maintain market share. This volatility creates uncertainty for both manufacturers and consumers in the steel wire rod market.

Another obstacle lies in the broader steel industry itself. Global steel production capacity currently outstrips actual demand. This overcapacity creates fierce competition among steel producers. In this scenario, producers may resort to lowering prices to stay competitive, impacting profitability across the steel industry, including the steel wire rod market. This intense competition can hinder overall market growth and make it difficult for producers to invest in research and development for new and improved steel wire rod products.

Steel Wire Rod Market Opportunities:

The steel wire rod market offers exciting avenues for future growth. One key opportunity lies in the burgeoning electric vehicle (EV) market. High-performance steel wire rods are essential for various EV components, and as the EV market surges, the demand for these specialized rods is expected to climb. Additionally, the increasing focus on lightweight vehicles to improve fuel efficiency creates a space for high-strength, lightweight steel wire rods. Manufacturers are developing these new varieties to offer the same strength as traditional options but with a reduced weight, contributing to a greener future for the automotive industry. Furthermore, advancements in steel production technology are enabling the creation of specialty steel wire rods with unique properties. These cater to niche applications in various industries, such as aerospace, medical devices, and electronics, opening doors for market diversification and future growth. Finally, the growing emphasis on sustainable practices presents an opportunity for steel wire rod manufacturers to adopt eco-friendly production processes. This could involve utilizing recycled materials or implementing energy-efficient technologies. By demonstrating a commitment to sustainability, steel wire rod manufacturers can not only reduce their environmental impact but also gain a competitive edge in the market.

STEEL WIRE ROD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.7% |

|

Segments Covered |

By Product type, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ArcelorMittal, JSW, Nippon Steel Stainless Steel Corporation, Tata Steel Limited, Van Merksteijn International, Tianjin Huayuan Metal Wire Products Co. Ltd., Henan Hengxing Science & Technology Co., Ltd., EVRAZ plc, Southwire Company, LLC, RIVA FORNI ELETTRICI S.p.A. |

Steel Wire Rod Market Segmentation: By Product Type

-

Low-carbon steel

-

High-carbon steel

-

Alloy steel

-

Stainless steel

The dominant segment in the steel wire rod market by product type is likely low-carbon steel due to its affordability, formability, and wide range of applications in construction, wires, and ropes. The fastest-growing segment is expected to be high-carbon steel driven by the increasing demand for its superior strength in applications like springs and the growth of the electric vehicle industry.

Steel Wire Rod Market Segmentation: By Application

-

Construction

-

Automotive

-

Energy

-

Agriculture

-

Others

The construction sector reigns supreme in the steel wire rod market by application, driven by the high demand for reinforced concrete in infrastructure projects. However, the energy sector is experiencing the fastest growth due to the increasing use of steel wire rods in wind turbine manufacturing for renewable energy production.

Steel Wire Rod Market Segmentation: By End-User

-

Construction

-

Automotive

-

Electrical

-

Manufacturing

-

Others

The construction sector is the most dominant consumer of steel wire rods due to its reliance on these rods for reinforcing concrete in buildings, bridges, and infrastructure projects. However, the energy sector is experiencing the fastest growth, driven by the increasing use of steel wire rods in wind turbine manufacturing for renewable energy production.

Steel Wire Rod Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The North American market for steel wire rods is expected to experience moderate growth. While the construction sector remains a significant consumer, growth may be tempered by factors like mature infrastructure and a shift towards maintenance and repair projects. However, the automotive industry, particularly in the US and Mexico, is expected to provide continued demand for wire rods in-vehicle components.

Similar to North America, the European steel wire rod market is likely to see moderate growth. The focus on infrastructure maintenance and renovation in developed European economies might limit significant demand surges. However, Eastern Europe's developing economies could offer some growth potential in the construction sector. Additionally, the presence of established automotive and manufacturing industries continues to drive demand for steel wire rods in Europe.

Asia-Pacific reigns supreme as the dominant consumer of steel wire rods. The booming construction sectors in China and India, fueled by rapid urbanization and infrastructure development projects, are key drivers. Additionally, the growing automotive industry in this region further propels the demand for steel wire rods.

COVID-19 Impact Analysis on the Steel Wire Rod Market:

The COVID-19 pandemic cast a dark cloud over the previously flourishing steel wire rod market. Stringent lockdown measures and widespread disruptions across various industries triggered a significant decline in demand. Construction projects ground to a halt, automotive production sputtered, and other sectors heavily reliant on steel wire rods experienced a downturn. This domino effect resulted in a temporary but impactful decrease in the overall market. Furthermore, travel restrictions and border closures threw global supply chains for steel wire rods and raw materials into disarray. These disruptions caused shortages, delays in deliveries, and potential price fluctuations within the market.

However, there appears to be a silver lining on the horizon. As the global economy emerges from the pandemic and restrictions ease, the steel wire rod market is experiencing a welcome resurgence in demand. Pent-up needs from various sectors are acting as a catalyst, driving a renewed interest in steel wire rods. Additionally, in some regions, governments are prioritizing infrastructure development projects as part of their economic stimulus packages. This renewed focus on infrastructure has the potential to significantly boost demand for steel wire rods in the long run. Overall, while the COVID-19 pandemic caused a temporary setback, the steel wire rod market appears to be on a path to recovery, fueled by continued growth drivers and the prospect of increased infrastructure investments.

Latest Trends/ Developments:

The steel wire rod market is experiencing a surge of innovation, transforming the way these essential materials are produced and utilized. Manufacturers are increasingly developing high-performance and sustainable wire rods. These advanced rods boast superior strength, lighter weight, and improved corrosion resistance, catering to the growing demand for efficiency and environmental consciousness in construction, automotive, and other industries. For instance, the development of lightweight, high-strength wire rods is contributing to the automotive industry's trend toward fuel-efficient vehicles.

Furthermore, the industry is embracing automation through technologies like robotic handling and automated inspection systems. This focus on automation goes beyond just improving production efficiency. It also enhances consistency in the quality of wire rods and prioritizes safety for workers in steel wire rod manufacturing facilities.

The digital revolution is also reaching the steel wire rod market, with online platforms for ordering and tracking steel wire rods gaining traction. This trend offers greater transparency and convenience for buyers, allowing them to access real-time information and streamline their purchasing processes. Additionally, data analytics is being employed to optimize production processes and predict market demands, ensuring that manufacturers can adapt to meet evolving industry needs.

By focusing on innovation, automation, and digitalization, the steel wire rod market is well-positioned for continued growth and adaptation in the years to come. These advancements not only enhance the performance and sustainability of wire rods but also improve efficiency and transparency throughout the entire supply chain.

Key Players:

-

ArcelorMittal

-

JSW

-

Nippon Steel Stainless Steel Corporation

-

Tata Steel Limited

-

Van Merksteijn International

-

Tianjin Huayuan Metal Wire Products Co. Ltd.

-

Henan Hengxing Science & Technology Co., Ltd.

-

EVRAZ plc

-

Southwire Company, LLC

-

RIVA FORNI ELETTRICI S.p.A.

Chapter 1. Steel Wire Rod Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Steel Wire Rod Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Steel Wire Rod Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Steel Wire Rod Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Steel Wire Rod Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Steel Wire Rod Market – By Product Type

6.1 Introduction/Key Findings

6.2 Low-carbon steel

6.3 High-carbon steel

6.4 Alloy steel

6.5 Stainless steel

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Steel Wire Rod Market – By Application

7.1 Introduction/Key Findings

7.2 Construction

7.3 Automotive

7.4 Energy

7.5 Agriculture

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Steel Wire Rod Market – By End-Use Industry

8.1 Introduction/Key Findings

8.2 Construction

8.3 Automotive

8.4 Electrical

8.5 Manufacturing

8.6 Others

8.7 Y-O-Y Growth trend Analysis By End-Use Industry

8.8 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 9. Steel Wire Rod Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Application

9.1.4 By End-Use Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Application

9.2.4 By End-Use Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Application

9.3.4 By End-Use Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Application

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Application

9.5.4 By End-Use Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Steel Wire Rod Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 ArcelorMittal

10.2 JSW

10.3 Nippon Steel Stainless Steel Corporation

10.4 Tata Steel Limited

10.5 Van Merksteijn International

10.6 Tianjin Huayuan Metal Wire Products Co. Ltd.

10.7 Henan Hengxing Science & Technology Co., Ltd.

10.8 EVRAZ plc

10.9 Southwire Company, LLC

10.10 RIVA FORNI ELETTRICI S.p.A.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Steel Wire Rod Market was valued at USD 102.9 billion in 2023 and is projected to reach a market size of USD 141.92 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 4.7%.

Construction Boom in Developing Economies, Automotive Industry Reliance, Renewable Energy Revolution, Innovation Breeds Opportunity.

Construction, Automotive, Energy, Agriculture, Others.

The Asia-Pacific region reigns supreme in the Steel Wire Rod Market, driven by its booming construction and automotive sectors.

ArcelorMittal, JSW, Nippon Steel Stainless Steel Corporation, Tata Steel Limited, Van Merksteijn International, Tianjin Huayuan Metal Wire Products Co. Ltd., Henan Hengxing Science & Technology Co., Ltd., EVRAZ plc, Southwire Company, LLC, RIVA FORNI ELETTRICI S.p.A.